A comprehensive guide to the January 17 individual entry form

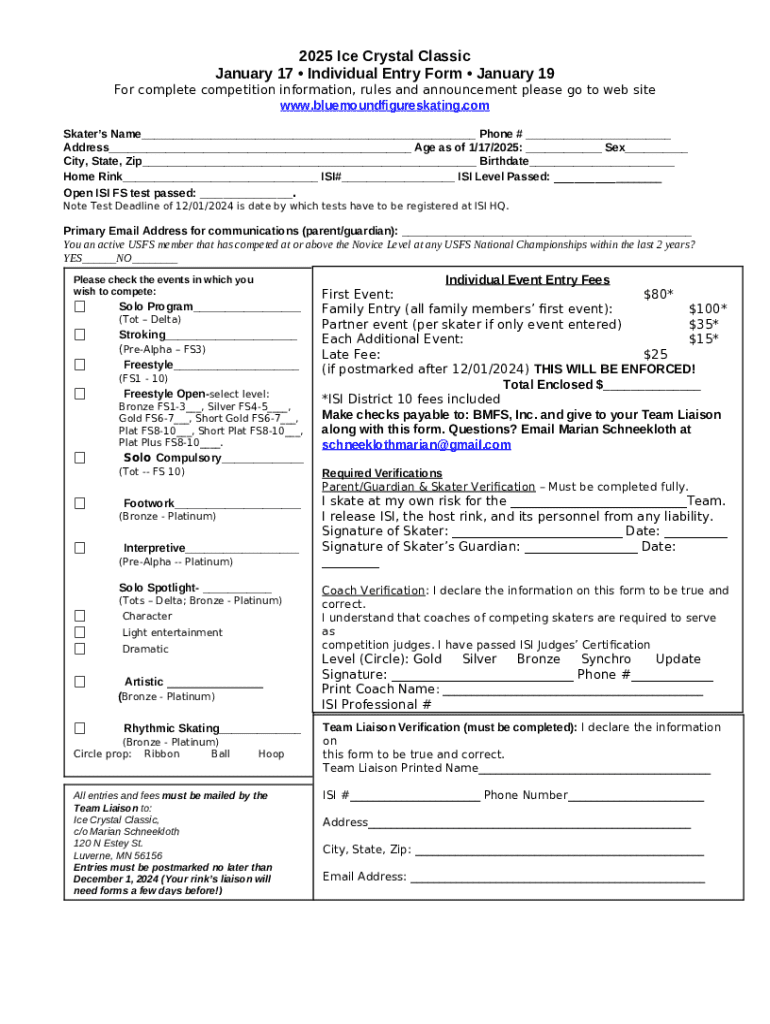

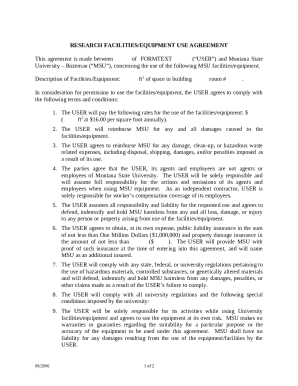

Overview of the January 17 individual entry form

The January 17 individual entry form is an essential document used by individuals to report their financial information accurately. This form allows taxpayers to submit relevant income details and deductible expenses to ensure compliance with tax responsibilities. Its significance revolves around providing a structured method for individuals to declare earnings and deductions while also ensuring that their tax returns are filed promptly, helping to avoid potential penalties.

Use cases for the January 17 individual entry form typically include submission during tax filing seasons and as a part of financial reporting for freelance workers, contractors, and small business owners among others. It stands as a key component in maintaining financial integrity for both individuals and teams.

Pre-filling considerations

To effectively fill out the January 17 individual entry form, certain pre-filling considerations must be taken into account. The first step involves determining eligibility criteria. It's crucial that anyone who has earned income in the previous year and has specific deductible expenses related to their business or personal finances needs to complete this form.

Furthermore, it is important to gather required documentation that supports the entries made in the form. This may include:

1099 forms for freelance or contracted work

Receipts and records of deductible expenses

Bank statements and other relevant financial documents

Having this documentation organized and available ensures a smoother filling and verification process.

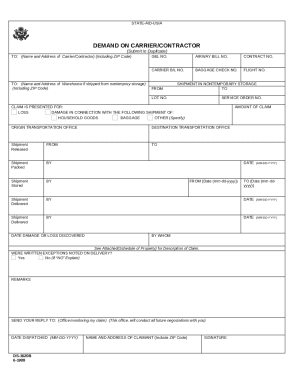

Step-by-step guide to filling out the form

The completion of the January 17 individual entry form can be broken down into several detailed sections to guide users through the process. First, the personal information section involves filling in areas such as name, address, Social Security number, and date of birth. Accuracy is vital here; typos could lead to issues with your submission.

In the second section, income details must be provided. Users should break down their total earnings into categories, including wages, freelance income, interest, and dividends. It’s essential to report these various sources accurately, as discrepancies could trigger audits or delays.

Next, the deductible expenses section allows the claimant to list expenses that can be deducted from taxable income. Familiarize yourself with which expenses qualify for deduction, such as business-related travel or educational costs. Gather all necessary documentation to substantiate these claims before filling in this section.

Finally, a signature is required to validate the form. Depending on your preference, choose between an e-signature or a traditional pen and ink signature. Be mindful to check all entries before signing as errors at this stage can cause complications in processing your form.

Editing and customizing the form

When using pdfFiller, customizing the January 17 individual entry form is straightforward. First, access the form in the pdfFiller interface, where you can take advantage of various built-in editing tools to tailor the document to your needs. These tools allow for easy addition or removal of fields, ensuring you can adapt the form to suit specific situations.

Adjusting the layout and format can significantly enhance clarity and readability. Consider the following tips for effective customization:

Use clear headings and subheadings to separate sections

Adjust font sizes for emphasis on important information

Incorporate color coding for different categories to streamline reading

Using these strategies can make the January 17 individual entry form not only functional but also visually appealing.

eSigning the form

The benefits of eSigning the January 17 individual entry form cannot be overstated. It not only expedites the signing process but also enhances the security of the document. Using pdfFiller for eSigning provides users with reassurance of the authenticity and integrity of their signature.

To eSign through pdfFiller, follow these steps:

Open the form in the pdfFiller interface.

Select the eSignature tool.

Follow the prompts to create and place your electronic signature.

Finalize and save the document.

If you encounter common issues, such as failed signature uploads or forms not saving, consult pdfFiller's help section for troubleshooting tips to keep the process seamless.

Collaborative features and sharing options

Another highlight of pdfFiller is its robust collaborative features. You can invite team members to review and contribute to the January 17 individual entry form, allowing for a more thorough examination of the document before submission. Real-time tracking of changes and comments significantly enhances teamwork in document preparation.

Additionally, securely sharing completed forms with stakeholders is straightforward. Utilize pdfFiller's sharing functionalities to ensure that sensitive information remains protected while enabling necessary parties to access or review the form without compromising security.

Managing submitted forms

Once the January 17 individual entry form has been submitted, managing these documents is crucial for proper organization and future reference. pdfFiller offers features to store and access submitted forms with ease. Best practices for document management include categorizing forms by date, purpose, or client to facilitate quick retrieval.

Furthermore, consider utilizing archiving options to secure personal data. Implementing a consistent naming convention for archived documents can aid in efficient future access, ensuring that you have everything at your fingertips when needed.

Frequently asked questions (FAQs)

To address potential confusion surrounding the January 17 individual entry form, we’ve compiled some frequently asked questions. Many users are often unclear about who exactly needs to fill out this form. If you earned income that needs reporting, preparation is vital. Moreover, concerns about the type of documentation required can often arise, making clarity essential prior to the submission.

Additionally, if you encounter technical issues with pdfFiller or have questions about the filling process, support is available through the platform’s help section, which offers guidance tailored for common challenges faced by users.

Conclusion

The January 17 individual entry form plays a vital role in ensuring tax compliance and smooth financial reporting. Navigating through the complexities of this document doesn't have to be daunting, especially when utilizing pdfFiller for editing, eSigning, and managing the entire process seamlessly.

Users are encouraged to leverage pdfFiller's tools to simplify their document needs while ensuring that their submissions are accurate and timely. Taking the plunge into efficient document management will result in a more organized and less stressful experience.

Additional interactive tools

pdfFiller enhances the experience surrounding the January 17 individual entry form beyond basic filling and signing. Explore calculators and other interactive tools that can assist in planning your finances more effectively.

Moreover, a variety of related templates are readily available on pdfFiller, allowing users to delve into other necessary documents that may accompany their submissions. These resources bolster one’s overall document management journey, ensuring nothing is overlooked during tax preparation.