Get the free Knox County, Tennessee, et al. v. Delinquent Taxpayers, et ...

Get, Create, Make and Sign knox county tennessee et

How to edit knox county tennessee et online

Uncompromising security for your PDF editing and eSignature needs

How to fill out knox county tennessee et

How to fill out knox county tennessee et

Who needs knox county tennessee et?

Comprehensive Guide to Knox County Tennessee ET Form

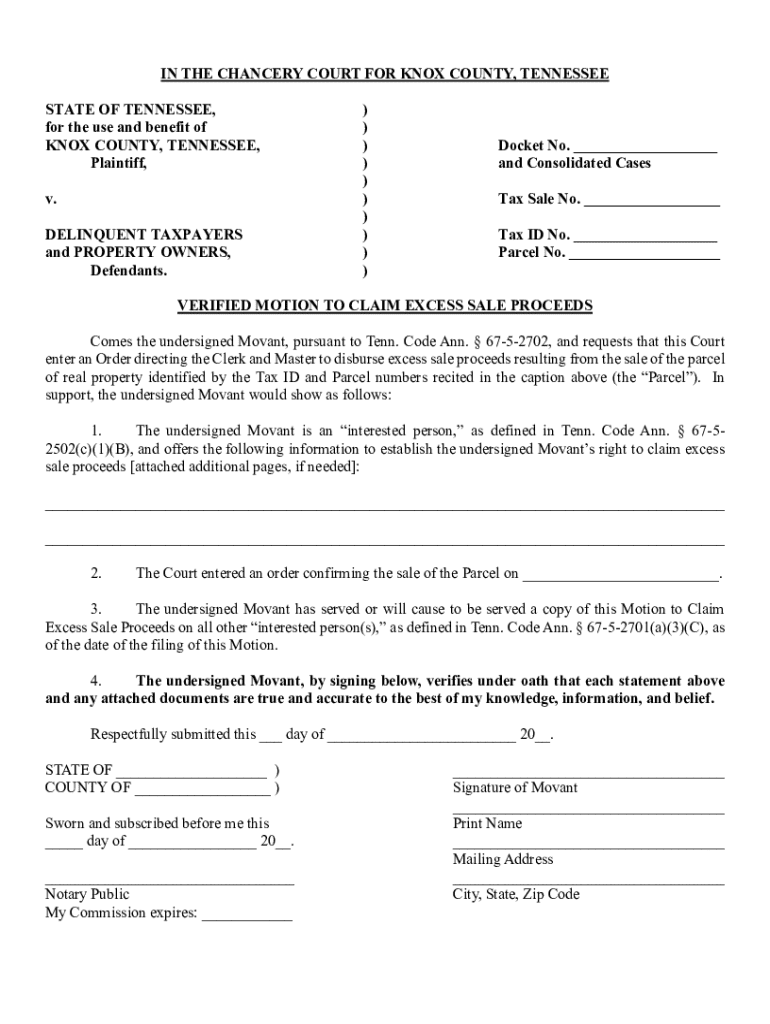

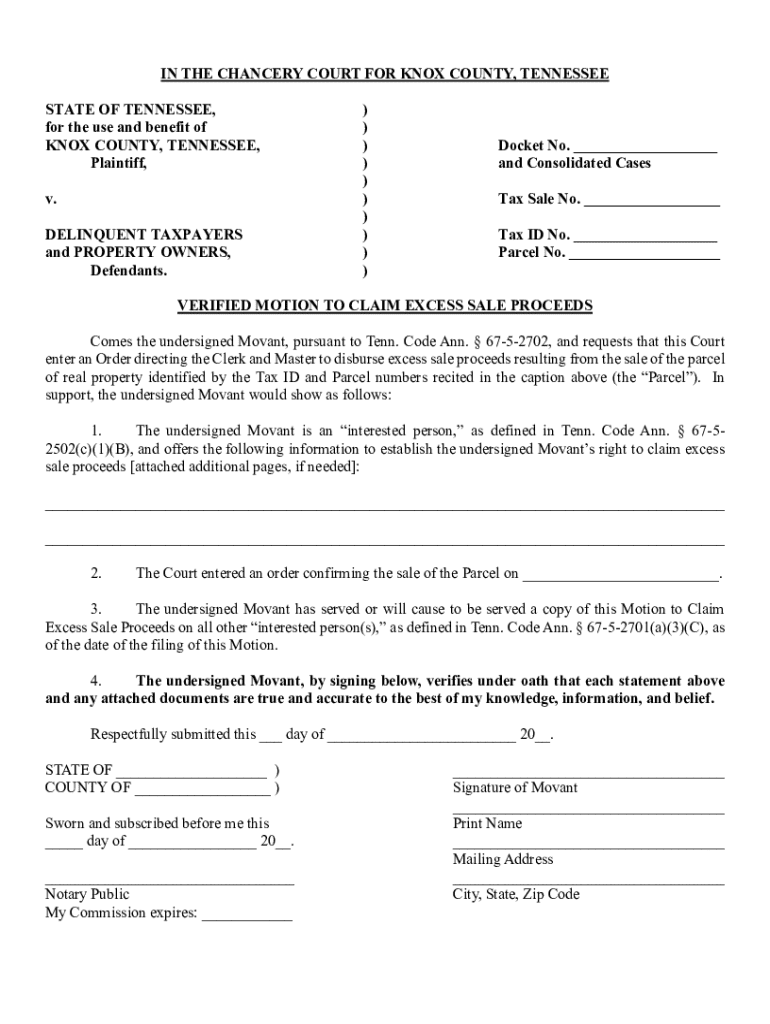

Understanding the Knox County ET Form

The Knox County ET Form, also known as the Excise Tax Form, is a crucial document used within the local government framework to facilitate various tax processes and business permits in Knox County, Tennessee. This form acts as a declaration of intent for those looking to engage in specific economic activities that require taxation compliance. Completing the Knox County ET Form is essential for both individuals and businesses as it ensures record-keeping and legal compliance within municipal regulations.

The significance of the ET Form goes beyond basic compliance; it plays a key role in various applications, including property tax assessments, business licenses, and personal financial disclosures. Moreover, the proper documentation can help mitigate legal issues and provide clarity for future tax assessments, making it a vital tool for proper financial and business planning.

Who needs to complete the Knox County ET Form?

Eligibility to complete the Knox County ET Form generally revolves around activities that fall under local taxation regulations. This includes individuals who may have financial assets subject to tax, as well as business owners engaged in operations within Knox County. The form is particularly targeted towards new business owners, individuals claiming deductions for taxation purposes, and representatives handling the legal and financial matters of estates.

Common scenarios for utilizing the Knox County ET Form include starting a new business venture, reporting financial changes that could affect tax statuses, and ensuring that estate settlements comply with local taxation laws.

Step-by-step guide to filling out the Knox County ET Form

Before diving into the specifics of filling out the Knox County ET Form, it’s essential to gather all necessary documents and information that will inform the fields you'll need to fill. This includes your identification details, financial records, and any relevant tax documents that support your application. By preparing ahead of time, you can streamline the process and avoid unnecessary delays.

Understanding the required fields is equally important. The form will generally include sections such as personal information, financial details, and necessary signatures. Each part must be completed accurately to ensure compliance and avoid complications during the processing of your form.

Editing and managing the Knox County ET Form

After filling out the Knox County ET Form, you may find yourself needing to make edits or amendments. Utilizing tools like pdfFiller allows users to easily modify PDF documents without extensive hassle. With pdfFiller, users can fill in the form, amend information as necessary, and maintain the document's integrity.

In the instance that changes are required after submission, pdfFiller offers intuitive options to adjust the details directly on the form, ensuring that you stay compliant with the latest information. It’s also advisable to organize and save copies of your forms for future reference, which can be easily achieved through cloud-based storage solutions.

eSigning the Knox County ET Form

eSigning the Knox County ET Form adds a layer of convenience and security to your submission process. With electronic signatures gaining significant traction, businesses and individuals can save time and reduce paperwork effectively by opting for eSignatures via pdfFiller. One of the primary benefits of eSigning documents is the ability to complete your forms from any location, at any time, streamlining the workflow for both parties involved.

To use pdfFiller’s eSignature feature, simply follow the prompts to add your signature electronically. Verification features help ensure the authenticity of your signature while maintaining robust security measures, offering peace of mind that your document is both valid and confidential.

Common errors to avoid when completing the Knox County ET Form

When filling out the Knox County ET Form, common mistakes can lead to processing delays or rejection of the form. Misreading or misunderstanding the required fields is a frequent issue, as well as simple errors like misspelled names or incorrect identification numbers. It's critical to meticulously review your form before submission to catch these errors early.

In addition to careful attention while filling out the form, familiarize yourself with Knox County's specific requirements to ensure compliance. This includes keeping abreast of any changes in local laws or tax regulations that could affect the information you provide.

Submitting your Knox County ET Form

Once the Knox County ET Form is complete and reviewed, the next significant step is submission. You have multiple options for how to submit your completed form: online, via mail, or in-person delivery. Each method has its own benefits, and the choice will depend on what you find most convenient.

Be mindful of submission deadlines, which can vary depending on the purpose of your filing. Familiarizing yourself with these timelines is crucial to ensure you meet the required deadlines and avoid any late penalties. Once submitted, you can typically expect to receive confirmation either electronically or via mail, confirming that your ET Form has been received and is being processed.

Frequently asked questions about the Knox County ET Form

Many individuals and businesses have common questions regarding the Knox County ET Form, particularly regarding where to find support and resources. For assistance, individuals can visit the Knox County government's official website or contact the local finance department directly for guidance on completing their forms.

Additionally, frequently asked questions often revolve around eligibility, submission methods, and deadlines. It’s beneficial to review these questions, as the information can alleviate confusion and facilitate a smoother filing experience.

Related forms and resources in Knox County, TN

The Knox County ET Form is often associated with a variety of other forms required for comprehensive tax compliance in the area. For example, property tax forms or business licensing applications may be closely linked with the ET Form. Understanding and having access to these related forms can simplify the completion of all necessary documentation.

Links to downloadable and printable versions of these forms are often available through the Knox County official website, ensuring easy access to essential documents. Additionally, exploring other Knox County services dedicated to document management can enhance your understanding of tax responsibilities and streamline your administrative tasks.

Getting help for completing the Knox County ET Form

Completing the Knox County ET Form doesn’t have to be a daunting task. With resources like pdfFiller, assistance is just a few clicks away. The online platform provides a wealth of tools to help users efficiently fill out, edit, and manage their documents, making the entire process easier.

For those who prefer a more guided experience, pdfFiller also offers customer support for any form-related inquiries. Additionally, workshops or webinars related to form completion are often available to provide hands-on assistance and tips for ensuring your documentation is completed correctly.

Real-life case studies

While understanding the technicalities of the Knox County ET Form is important, hearing personal success stories can further highlight the benefits of using pdfFiller. For instance, local business owners have reported dramatically reducing their filing time by using pdfFiller’s intuitive editing tools, enabling them to reallocate their time to other aspects of their business operations.

Testimonials from users emphasize the straightforward process of eSigning through pdfFiller. Many noted that uploading their forms saved valuable time, and the solid security measures put in place gave them peace of mind. Overall, managing the Knox County ET Form with such innovative solutions can substantially improve compliance and efficiency for both individuals and local businesses.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify knox county tennessee et without leaving Google Drive?

How do I complete knox county tennessee et online?

How can I edit knox county tennessee et on a smartphone?

What is knox county tennessee et?

Who is required to file knox county tennessee et?

How to fill out knox county tennessee et?

What is the purpose of knox county tennessee et?

What information must be reported on knox county tennessee et?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.