Get the free Energy Loan Application and Program Guidelines

Get, Create, Make and Sign energy loan application and

Editing energy loan application and online

Uncompromising security for your PDF editing and eSignature needs

How to fill out energy loan application and

How to fill out energy loan application and

Who needs energy loan application and?

Your Complete Guide to Energy Loan Application and Form

Understanding energy loans

Energy loans are specifically designed to help homeowners finance upgrades and improvements that enhance energy efficiency in their properties. These loans serve a dual purpose: they assist in funding the cost of energy-efficient renovations while contributing to a reduction in energy consumption, ultimately benefiting the environment.

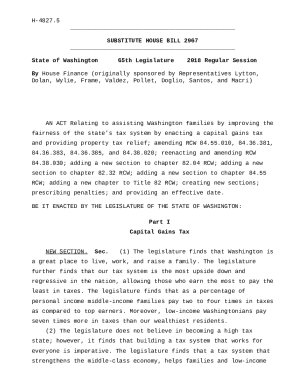

Common types of energy loans include secured loans, where the property acts as collateral, and unsecured loans, which do not require collateral but may have higher interest rates. Additionally, some government programs offer low-interest loans or grants for specific energy improvement projects.

Getting started with your energy loan application

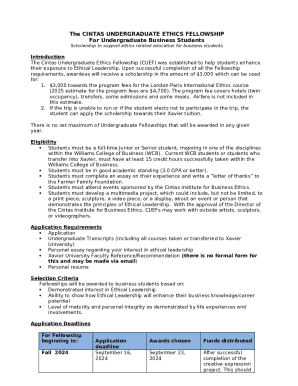

Before embarking on your energy loan application, it’s crucial to understand the eligibility criteria. Homeowners typically qualify if they operate a primary residence, have a stable income, and maintain a reasonable credit score. However, specific programs may also require you to demonstrate that your project aligns with energy-saving guidelines.

Key factors affecting eligibility include credit history, debt-to-income ratio, and the type of project being financed. Additionally, some lenders may assess the potential energy savings of your proposed upgrades.

Gathering the necessary documentation can streamline your application process. Common documents required include income verification, proof of property ownership, details about the energy-efficient upgrades you plan to make, and any previous energy bills for reference.

The energy loan application process

The application process for an energy loan can be manageable if you adhere to a structured approach. Start by assessing your energy needs to determine which upgrades are most impactful for your home. You can often find interactive tools and calculators online to help evaluate your energy consumption.

Once your needs are clear, select the appropriate loan type that matches your project goals. After choosing, you can fill out the application form, which may include details like the loan amount needed, project plans, and personal information.

Utilizing advanced form-filling tools can enhance your application experience. For instance, pdfFiller offers interactive filling capabilities where users can collaborate in real-time to ensure accuracy and completeness of the application.

Completing the energy loan application form

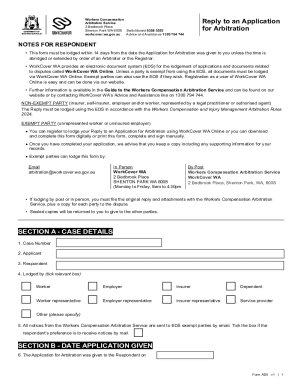

When filling out the energy loan application form, attention to detail is crucial. Each section of the form typically covers personal information, project details, financials, and planned energy-saving improvements. Understanding what each section requires can prevent delays in your application process.

Common mistakes include inadequate project descriptions or incorrect financial figures. It’s essential to provide detailed information to validate your financing request effectively.

Best practices for completing the form include reviewing your answers before submission, utilizing pdfFiller’s eSign tools for a seamless signing process, and saving your progress to avoid losing any critical data.

Special considerations

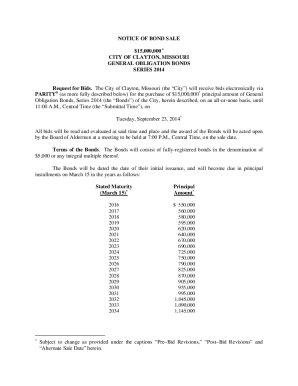

Understanding the parameters surrounding loan limits and terms is vital for any applicant. Depending on the type of project and lender, maximum loan amounts can vary. Generally, smaller projects may receive funding ranging from $1,000 to $15,000, while larger retrofitting may require more extensive financing.

Loan terms also significantly impact your repayment plan; therefore, be sure to compare interest rates, repayment duration, and any potential fees. Additionally, some applicants may wish to explore options for community grants, which can supplement their loans to reduce their overall financial burden.

Support and resources for loan applicants

As you progress through your energy loan application journey, specialized support is available to help clarify and guide you through the financial process. Many lenders offer dedicated customer support through multiple channels, including phone, email, and live chat to address any queries you may have.

Moreover, it is advisable to utilize available online resources such as webinars, FAQs, and forums where past applicants share insights and strategies that have worked for them.

Frequently asked questions (FAQs)

In this section, we tackle common inquiries related to the energy loan application process. Many applicants wonder about eligibility, especially regarding income levels and how credit scores impact approval chances. Others may seek clarity on specific documentation required for various loan types.

By addressing these FAQs, potential applicants can gain confidence in their understanding of the process, ensuring they are well-prepared to submit an application that meets the required standards.

Monitoring and reporting

After your energy loan application is approved, it's essential to keep track of your loan's progress. Many lenders provide online dashboards or mobile apps that allow you to monitor your loan status, repayment schedules, and remaining balance. This digital engagement ensures you stay informed and empowered throughout the life of your loan.

Understanding the reporting requirements for funded projects is equally vital. Knowing what documentation you need to submit post-approval can alleviate any concerns that arise as you undertake your energy improvement projects.

Continuous engagement and follow-up

Maintaining communication with your lender after obtaining an energy loan is beneficial for both managing repayments and understanding any future funding opportunities. Signing up for newsletters focused on energy efficiency and financing can provide valuable insights into new grants or programs that may be available.

Additionally, staying engaged with the community through forums or social media can enhance your knowledge base and open avenues for sharing experiences with others who are also in the process of improving their energy efficiency.

Additional insights and resources

Staying ahead in the field of energy financing requires keeping up with current trends and insights. Regularly reviewing media coverage, industry reports, and case studies can reveal innovative approaches to energy efficiency improvements. This knowledge is invaluable, not only for potential applicants but also for industry professionals aiming to promote effective practices.

Furthermore, exploring upcoming opportunities for financing programs and grants enables you to plan effectively and make informed decisions about your energy projects, thereby maximizing the benefits of any financing you pursue.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete energy loan application and online?

How do I edit energy loan application and on an iOS device?

How do I fill out energy loan application and on an Android device?

What is energy loan application?

Who is required to file energy loan application?

How to fill out energy loan application?

What is the purpose of energy loan application?

What information must be reported on energy loan application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.