Get the free per capita tax withholding authorization

Get, Create, Make and Sign per capita tax withholding

How to edit per capita tax withholding online

Uncompromising security for your PDF editing and eSignature needs

How to fill out per capita tax withholding

How to fill out per capita tax withholding

Who needs per capita tax withholding?

Comprehensive Guide to the Per Capita Tax Withholding Form

Understanding the per capita tax withholding form

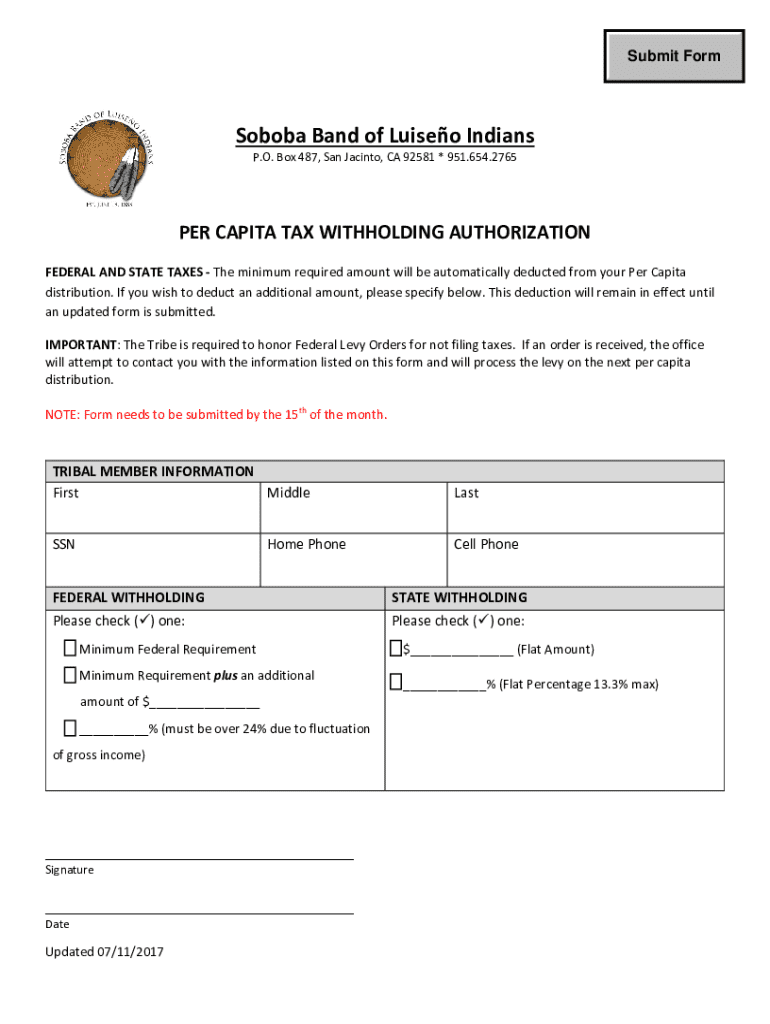

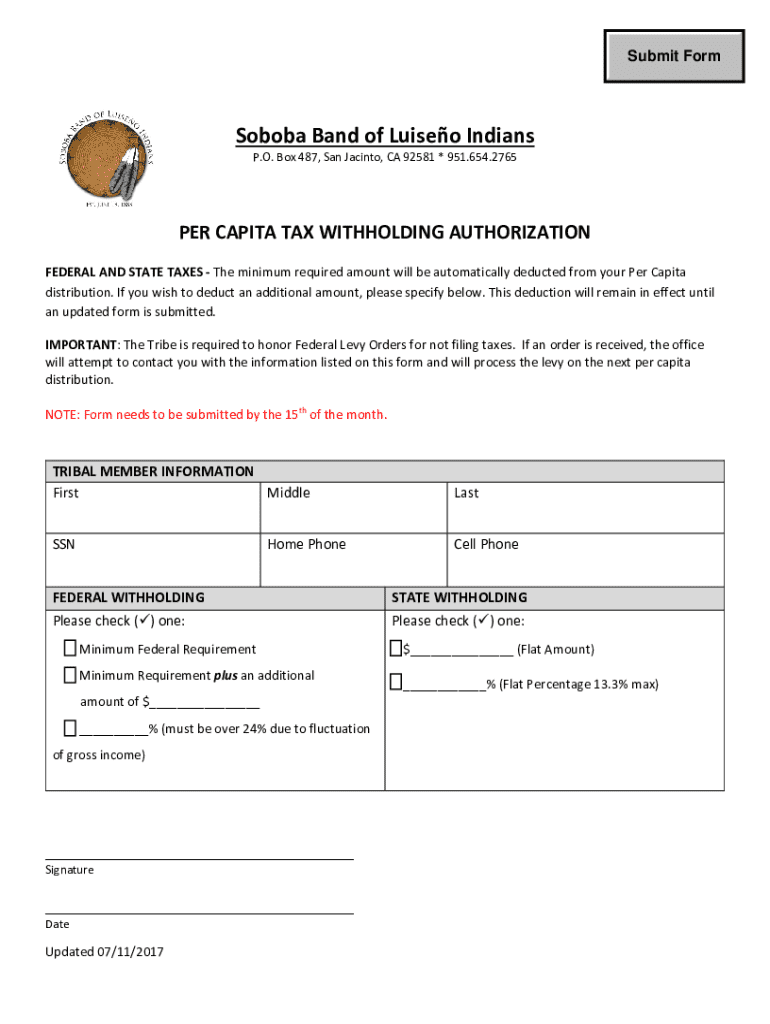

The per capita tax withholding form is a critical document required by certain jurisdictions for tax purposes. Essentially, it records the amount of tax that is withheld from an individual's paycheck, ensuring that adequate amounts are being set aside to meet tax obligations. Understanding this form is essential for both employees and employers alike, as inaccuracies in withholding can lead to tax liabilities or potential penalties.

Accurate tax withholding plays a significant role in managing personal finances and ensuring compliance with tax laws. Employees need to have the correct amount withheld to avoid underpayment penalties or receiving a larger-than-necessary tax refund, which means money could have been better utilized during the tax year. Moreover, those who support a family or have multiple sources of income will benefit from understanding how to optimize their withholding on this form.

Generally, anyone who earns income and resides in a jurisdiction where a per capita tax applies needs this form. This typically includes employees but may also extend to independent contractors and other earners, depending on local regulations.

Key components of the per capita tax withholding form

Filling out the per capita tax withholding form accurately requires specific information. First, personal identification details are necessary to ensure that the tax authority can link the withholding to the correct taxpayer. This includes information such as name, address, social security number, or taxpayer identification number. Additionally, employment information is critical and should encompass your employer's name, address, and your job title.

Another essential component is your tax residency status. Generally, your residency for tax purposes can differ from your legal residency. Therefore, it’s vital to confirm the tax status that your state or locality recognizes. Common terms found on the form may include 'withholding allowance,' 'exemptions,' and 'filing status,' all of which affect how much tax is withheld from each paycheck.

Step-by-step instructions for filling out the form

Completing the per capita tax withholding form requires preparation and attention to detail. Initially, gather all necessary documentation, including your social security number, employment information, and any documentation about your tax residency status. It's also helpful to have your previous tax returns on hand to reference withholding amounts or exemptions.

Now, let’s break down the filling process into steps:

Editing and managing your form

After filling out the per capita tax withholding form, you might need to edit it for accuracy or to reflect changes in your situation. Tools like pdfFiller make it easy to upload, edit, and manage your forms digitally. Uploading your document is straightforward; simply drag and drop it into the platform's interface.

Modifications come in many forms. You can add new information, delete outdated entries, or rearrange sections to clarify your information. It's always good practice to save a copy of your original form and any subsequent versions for your records. Keep track of all changes and use clear naming conventions for your files to ensure you do not confuse different versions in the future.

eSigning your per capita tax withholding form

Adding your signature to the per capita tax withholding form through eSigning is essential for authenticity and validation. ESigning uses digital technology to ensure your signature can't be forged or altered after signing. With pdfFiller’s eSignature tool, the process is efficient and secure.

You can create a signature in various formats—draw it, upload a photo, or choose from a pre-developed option. Ensure that your eSignature is presented clearly, as it serves as your legal confirmation of the document's accuracy and compliance.

Common errors and how to avoid them

Even minor mistakes can lead to significant consequences when filling out the per capita tax withholding form. Common errors include incorrect social security numbers, misreported employment details, and failing to indicate the proper tax residency status. Each of these can result in liabilities or even audits by tax authorities.

To minimize mistakes, it’s wise to double-check each entry. Before submission, review the entire form, and consider seeking a second opinion from someone familiar with tax forms. Errors can lead to improper withholding levels, which may affect your cash flow throughout the year, so it's worth dedicating time to accuracy.

Frequently asked questions (FAQs)

Many people encounter questions while handling their per capita tax withholding forms. Here are some of the most common inquiries addressed:

Collaborating on tax forms within teams

For businesses or teams, it's crucial to ensure that all employees are correctly completing their per capita tax withholding forms. Collaboration can enhance accuracy and streamline tax management. Tools like pdfFiller simplify this process by offering the ability to share the form with colleagues for input.

Utilizing collaboration features allows multiple team members to communicate directly within the document, ensuring everyone is aligned on tax designations and any necessary updates. This collective approach not only improves accountability but also minimizes the chances of errors slipping through the cracks.

Accessing your document from anywhere

One of the key advantages of using pdfFiller is the cloud-based platform that allows users to access their per capita tax withholding forms from any device with an internet connection. Whether you are working on a desktop at home, a tablet in a coffee shop, or a smartphone while traveling, your documents are at your fingertips.

Additionally, any edits made on one device sync across all platforms in real-time. This ensures that the latest version of your document is always accessible, providing you the flexibility to manage your forms efficiently from various locations.

Conclusion: The benefits of using pdfFiller for your tax forms

Utilizing pdfFiller for completing your per capita tax withholding form simplifies the otherwise tedious documentation process. With seamless editing capabilities, eSigning, and effective collaboration tools, pdfFiller empowers users to manage their documents efficiently. These features not only save time but also enhance the accuracy and professionalism of your tax documentation.

As individuals or teams strive to navigate their tax responsibilities, having a robust platform like pdfFiller enables them to stay organized and in control of their forms. In today’s fast-paced environment, leveraging technology for document management is not just a convenience; it's essential for effective tax compliance.

Getting in touch for further support

For those needing additional help regarding their per capita tax withholding forms or any other tax-related queries, pdfFiller offers various support avenues. Users can reach out to pdfFiller support through email or phone. Additionally, the platform provides online chat options for immediate assistance.

Moreover, users can connect with a community through forums for advice and tips from fellow users who may share similar experiences, further enhancing the resource network available to anyone navigating tax processes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send per capita tax withholding to be eSigned by others?

How do I edit per capita tax withholding straight from my smartphone?

How do I fill out per capita tax withholding using my mobile device?

What is per capita tax withholding?

Who is required to file per capita tax withholding?

How to fill out per capita tax withholding?

What is the purpose of per capita tax withholding?

What information must be reported on per capita tax withholding?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.