Trust Service Providers Supervisory Form: A Comprehensive Guide

Overview of trust service providers

Trust Service Providers (TSPs) play a pivotal role in ensuring the integrity and security of digital transactions. They offer a range of services, including electronic signatures, digital certificates, and timestamping, which are critical in building trust in the digital world. As businesses increasingly utilize digital solutions, the necessity for robust trust services becomes more pronounced. By facilitating secure and legally recognized transactions, TSPs ensure that both consumers and businesses feel confident in adopting digital methodologies.

The importance of trust services cannot be understated in today's global economy. As transactions shift increasingly online, stakeholders, including businesses and individuals, require assurance that their digital interactions are secure and valid. TSPs act as the backbone of this security, providing the essential infrastructure for a reliable online environment.

Regulatory framework surrounding TSPs

TSPs operate under stringent regulatory frameworks designed to ensure compliance and uphold consumer trust. Various legislations govern these providers, such as the eIDAS Regulation in the European Union, which outlines the legal standards for electronic identification and trust services. Compliance with these regulations is paramount for TSPs, as they not only have to demonstrate adherence to technical standards but must also maintain operational integrity.

Supervisory forms play a crucial role within this regulatory landscape. These forms are essential for demonstrating compliance and ensuring that TSPs align with the applicable legal requirements. By providing accurate and detailed information through the supervisory form, TSPs can establish their credibility and adherence to industry standards, which is vital for building trust with clients.

Understanding the trust service providers supervisory form

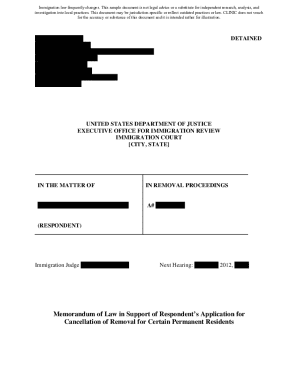

The Trust Service Providers Supervisory Form is a critical document that outlines the operations, compliance, and risk management strategies of a TSP. This form serves multiple purposes, including facilitating communication with regulatory authorities, providing transparency, and ensuring compliance with applicable laws. It is essentially a declaration of a TSP’s commitment to adhering to industry standards and regulations.

Key components of the supervisory form typically include identification of the trust services offered, compliance and regulatory declarations, and risk assessment and management strategies. Each section of the form is designed to verify that the TSP meets the necessary legal and operational criteria, emphasizing the significance of this document in a TSP's operational framework.

Who needs the supervisory form?

The Trust Service Providers Supervisory Form is primarily targeted at businesses and organizations that offer or wish to offer trust services. This includes entities involved in electronic signatures, those providing secure digital certificates, and businesses looking to become accredited TSPs. The implications of the supervisory form extend beyond just the TSPs themselves; clients utilizing these services are directly impacted, as the level of trust and compliance demonstrated through this form determines the reliability of the digital services they engage with.

Stakeholders in the trust service ecosystem, including auditors and regulatory agencies, also require this form. This need arises from the necessity to monitor, assess, and ensure that TSPs comply with established guidelines and maintain a high standard of operation.

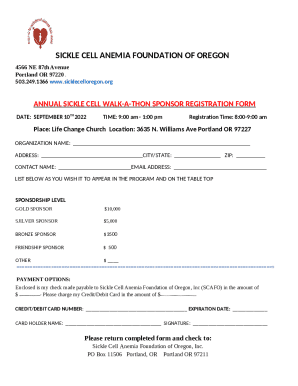

Step-by-step guide to completing the supervisory form

Completing the Trust Service Providers Supervisory Form can seem daunting, but with proper preparation, the process can be much simpler. The first step is to gather all necessary information, including organizational details, a list of services offered, and compliance documentation. Tools like pdfFiller can streamline this process by providing templates that can be digitally filled out, ensuring all the required components are covered.

Next, proceed with filling out the form. To make this easier, it's beneficial to break down the form section by section. For example, in Section 1, you'll provide identification of trust services offered, while Section 2 focuses on compliance and regulatory declarations. Finally, Section 3 evaluates your risk assessment and management strategies. It is crucial to avoid common mistakes such as incomplete information or missing signatures, which can lead to delays in processing the form.

Editing and finalizing your form

After all sections have been filled out, the next critical phase is to review and edit the form to ensure accuracy and completeness. pdfFiller offers various editing features that can help refine the document, including options for real-time collaboration and comments from team members. It is essential to utilize these tools to detect any errors or omissions before final submission.

Once satisfied with the edits, finalize your form by saving it in the correct format and ensuring all signatures are in place. Proper preparation at this stage greatly enhances the chances of your form being approved without any unnecessary delays.

eSigning and submission process

The integration of eSigning into document management has significantly streamlined processes, offering both legal validity and enhanced security for digital documents. For TSPs, using electronic signatures on the supervisory form not only ensures rapid processing but also instills a level of security that traditional methods may lack. eSignatures validate the identity of signatories, thereby reinforcing the integrity of the information provided.

To electronically sign with pdfFiller, users can simply upload the completed form and follow the prompts for signing, which are designed to be user-friendly. If multiple signatories are required, pdfFiller includes features to enable sequential signing or allow all parties to sign at once, facilitating a more efficient workflow.

Submission guidelines should be carefully followed based on your jurisdiction. After the supervisory form is signed, ensure that you submit it to the correct regulatory body along with any accompanying documents required for compliance. Familiarizing yourself with submission best practices can help avoid delays that could affect your TSP operations.

Managing your trust service providers supervisory form

Once you have completed and submitted the Supervisory Form, effective management becomes paramount. Storage and organization tips are crucial for ensuring that compliance documents are easily accessible and retrievable. Utilizing cloud storage solutions not only provides remote access but also guarantees that your documentation is secure and backed up.

Implementing a version control system is essential for compliance, as regulations may change over time. Teams should collaborate effectively using tools that allow for real-time tracking of changes and approvals, ensuring everyone involved is on the same page, which greatly reduces the risk of miscommunication and errors.

Our commitment to integrity and compliance

At pdfFiller, we recognize the importance of integrity and compliance in document management, especially for trust service providers. Our platform is designed to provide a seamless experience for users by ensuring that all documents, including supervisory forms, are managed with the utmost attention to regulatory compliance. By providing a centralized platform, we enable TSPs to maintain organized records and adhere to industry standards without the hassle of navigating multiple tools.

Our commitment to security is reflected in our user policies and the technology we implement to safeguard user data. Whether it’s through encrypted storage solutions or robust access controls, pdfFiller enhances the confidence users have in managing compliance documentation like the supervisory form.

Testimonials and case studies

Numerous users have experienced significant improvements in their operational efficiency by utilizing pdfFiller for their supervisory forms. For example, a medium-sized TSP shared how transitioning to pdfFiller's platform allowed them to complete their documentation in half the time compared to previous methods, significantly reducing bottlenecks in their compliance workflow.

Another user highlighted the ease of collaboration within teams when multiple stakeholders were involved in reviewing and signing documents. With real-time updates and easy accessibility, communication among team members became more straightforward, directly contributing to faster compliance with regulatory requirements.

Questions and answers on trust service providers and eIDAS compliance

Many users have common inquiries when it comes to the Trust Service Providers Supervisory Form and eIDAS compliance. A frequent question is whether all TSPs are required to submit the supervisory form or if it is only mandatory for specific types of trust services. The answer is that all TSPs must comply, regardless of the specific services offered, as regulatory authorities aim to maintain a consistent standard across the board.

Another common concern revolves around timelines for submitting the form. Depending on jurisdiction, submission deadlines can vary, highlighting the importance of staying informed about local requirements to avoid potential penalties or compliance issues. For personalized assistance, users can reach out to pdfFiller support, where a dedicated team is available to provide guidance and answer any specific queries you may have regarding the supervisory form.

Contact support for personal assistance

For any further questions regarding the Trust Service Providers Supervisory Form or the eIDAS compliance process, users are encouraged to contact pdfFiller support. Our dedicated team is available to discuss unique needs and provide tailored solutions for managing your trust service documentation, ensuring you remain compliant while streamlining your operations.

We offer various resources, including webinars, FAQs, and one-on-one consultations, to guide users through the complexities of documenting and managing trust services. Our objective is to empower you with the tools necessary for successful compliance, leaving you free to focus on your core business objectives.