Get the free C,o (Y:tt.d

Get, Create, Make and Sign co yttd

How to edit co yttd online

Uncompromising security for your PDF editing and eSignature needs

How to fill out co yttd

How to fill out co yttd

Who needs co yttd?

Co yttd form: A comprehensive how-to guide

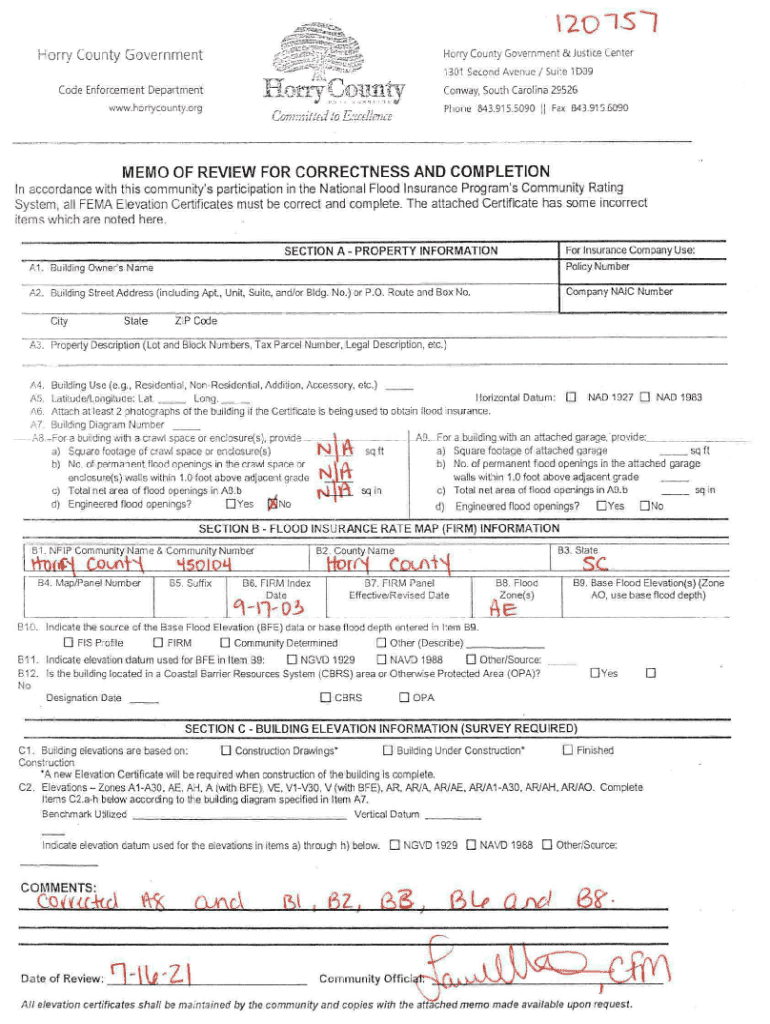

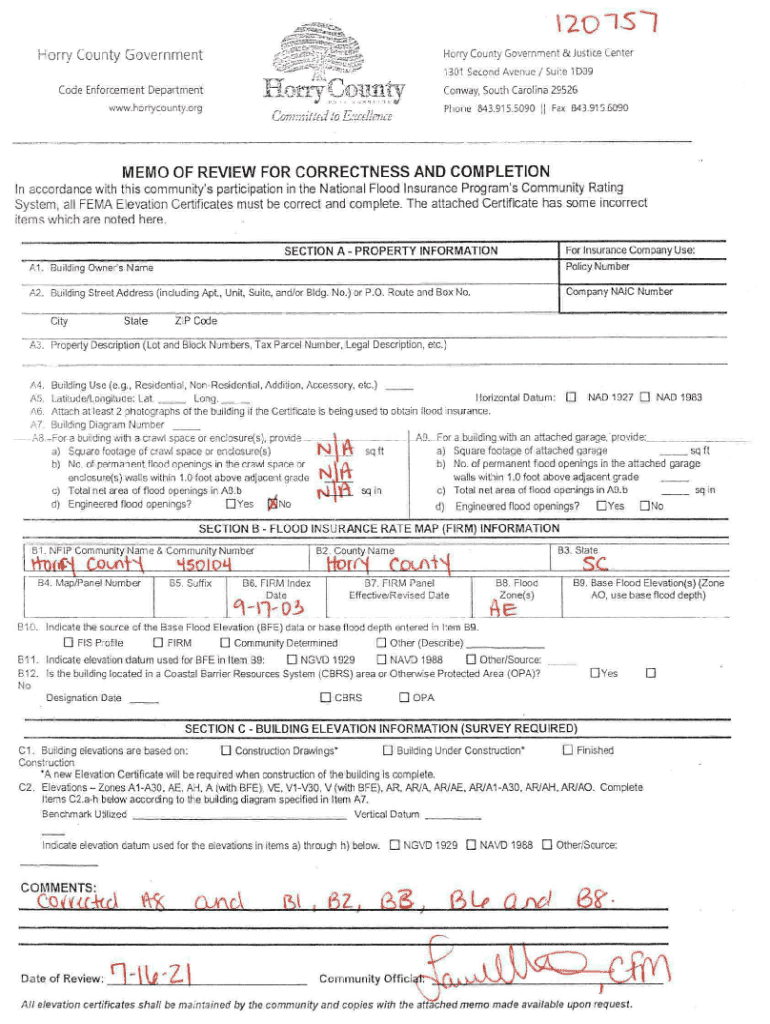

Overview of the co yttd form

The co yttd form refers to a specific document used in various administrative processes, predominantly in organizational and institutional settings. This form serves a critical purpose, acting as a standardized means of gathering essential information related to a variety of applications, requests, or submissions.

Its key features include sections for entering personal data, financial information, and additional context that can vary based on the use case. Understanding the components of the co yttd form is vital to ensure accurate completion, which in turn enables timely processing of submissions.

Accessing the co yttd form

To access the co yttd form, users can visit pdfFiller, a comprehensive online platform for document management. On pdfFiller, the navigation is straightforward; users can quickly locate the co yttd form through the search feature.

Users have the option to either download the form for offline use or fill it out online. Creating an account with pdfFiller enables better document organization and management, offering users the convenience of storing, editing, and retrieving their forms whenever necessary.

Detailed breakdown of the co yttd form structure

Understanding the section structure of the co yttd form is essential for effective completion. The form generally includes key fields such as personal information, financial details, and an additional information section. Each of these sections plays a critical role in ensuring that all necessary data is captured accurately.

Common terminology used within the form, such as 'applicant', 'submitter', or 'financial disclosure', can be clearly defined. For instance, an 'applicant' refers to the person filling out the form, while 'financial disclosure' pertains to any relevant monetary information that must be provided.

Step-by-step instructions for filling out the co yttd form

Before diving into filling the co yttd form, it's crucial to gather all necessary information and documentation. This includes personal identification, proof of income, and any previous correspondence related to your application.

When filling out the personal information section, ensure names are spelled correctly, and all contact details are accurate. In the financial information section, avoid common mistakes such as incorrect entries or misunderstandings regarding gross versus net income. The additional information section typically contains both optional and mandatory fields, highlighting the importance of clearly differentiating between the two to avoid omissions.

Utilizing pdfFiller's tools, such as autofill features, can immensely speed up the process, making it more efficient.

Editing and modifying the co yttd form

After completing the co yttd form, you may find that edits or modifications are necessary. pdfFiller offers robust editing tools that allow users to easily annotate or add text as needed.

If you discover errors post-completion, revising the form is straightforward. Make the necessary changes, ensuring all updates accurately reflect your information, and be aware of the resubmission process that may be required depending on the institution’s requirements.

Signing the co yttd form electronically

The importance of electronic signatures cannot be understated. These signatures validate the authenticity of the document and allow for quick processing. pdfFiller enables users to eSign documents seamlessly.

The signing process entails navigating to the designated signing area on the form, selecting eSign options, and following the on-screen prompts. This method not only facilitates ease of use but ensures legal validity, as electronic signatures are recognized within many jurisdictions.

Collaborating with team members on the co yttd form

For teams working collaboratively, pdfFiller provides sharing options that facilitate inviting collaborators to work on the co yttd form together. This feature is particularly beneficial for ensuring that all relevant parties have input on the information being submitted.

Real-time collaboration features allow users to track changes as they occur, promoting transparency and efficiency. Additionally, managing different versions of the form can help keep a well-organized record of edits and contributions from each team member.

Managing your completed co yttd forms

Once completed, managing your co yttd forms effectively is crucial. pdfFiller provides cloud storage solutions, allowing users to access their forms from anywhere at any time. Best practices for document organization include categorizing forms by type or submission date.

Moreover, knowing how to retrieve completed forms is vital. When forms are no longer needed, users can easily delete or archive them to maintain a clutter-free interface, thus ensuring that important documents remain accessible while minimizing the risk of confusion.

Troubleshooting common issues with the co yttd form

Facing issues while working on the co yttd form is not uncommon. A frequently asked question pertains to what users should do if their information changes after completion. In such cases, updating your form and ensuring timely resubmission is important.

Additionally, technical problems may arise during the process. Users should know the steps to address these issues, as well as the option of contacting support through pdfFiller for assistance, ensuring a smooth experience overall.

Utilizing advanced features of pdfFiller for co yttd form management

pdfFiller continuously enhances user experience by integrating with various software. Supporting integrations can facilitate syncing data and improve workflow efficiency, particularly when managing multiple documents.

Moreover, automating workflow with templates can save time for repeat users needing to complete similar submissions in the future. Tracking form usage and analyzing data, such as completion metrics, can further refine processes and improve accuracy.

User experiences and testimonials

Numerous users have shared success stories regarding their experience with pdfFiller in managing the co yttd form. Many note how the platform has streamlined their processes, reducing turnaround times and increasing accuracy.

Testimonials often highlight how collaborative tools enabled team members to contribute effortlessly, resulting in higher quality submissions and more cohesive documents.

Next steps after completing the co yttd form

Once the co yttd form is completed and submitted, understanding the follow-up actions that may be necessary is vital. Some processes may require users to await confirmation, while others might involve additional documentation or clarification.

Users are encouraged to keep documentation organized and accessible for any future needs. Recommended resources for further assistance are also available through pdfFiller, allowing users to enhance their understanding and capabilities in document management.

Quick reference guides and tips

To streamline the completion of the co yttd form, users can benefit from quick tips designed for faster handling. For instance, outlining the required information before starting the completion process can save time.

Essential do's and don'ts can also enhance the user experience. Do ensure all information is accurate; Don’t overlook optional fields if they could add value to your submission.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my co yttd in Gmail?

Can I edit co yttd on an iOS device?

How do I fill out co yttd on an Android device?

What is co yttd?

Who is required to file co yttd?

How to fill out co yttd?

What is the purpose of co yttd?

What information must be reported on co yttd?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.