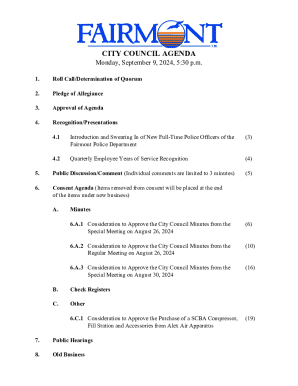

Get the free Foreign Tax Organizer - Form 1040NR

Get, Create, Make and Sign foreign tax organizer

How to edit foreign tax organizer online

Uncompromising security for your PDF editing and eSignature needs

How to fill out foreign tax organizer

How to fill out foreign tax organizer

Who needs foreign tax organizer?

Foreign Tax Organizer Form - How-to Guide Long-Read

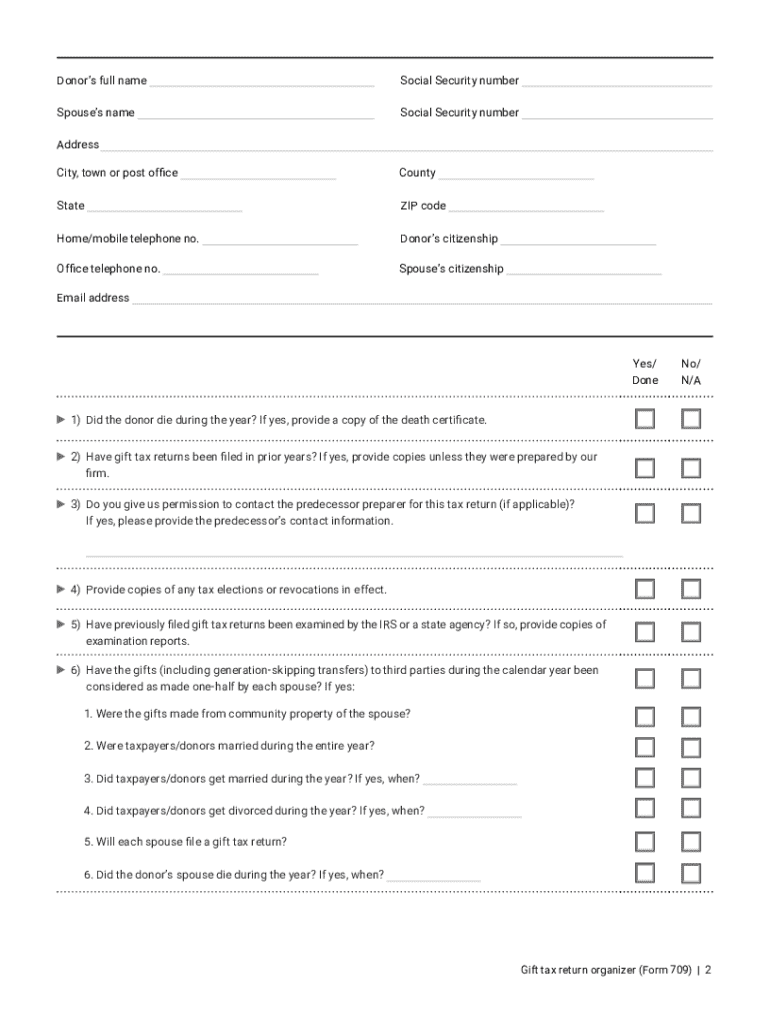

Overview of the Foreign Tax Organizer Form

The Foreign Tax Organizer Form is a vital tool designed to facilitate the tax reporting process for individuals with foreign income or assets. It serves to summarize all necessary information related to foreign earnings, taxes paid abroad, and foreign investments, ensuring compliance with U.S. tax laws while availing opportunities for credits and deductions.

Understanding this form is crucial for minimizing tax liabilities and avoiding potential pitfalls that may arise from misreporting. Whether you’re living abroad or dealing with foreign income sources while residing in your home country, utilizing the Foreign Tax Organizer Form is indispensable.

Key features of the Foreign Tax Organizer Form

The Foreign Tax Organizer Form is loaded with key features that streamline the reporting process for foreign income. One of its primary functions is comprehensive income tracking, which encompasses various foreign income sources and types of investments. Taxpayers can specify the money earned from different countries, ensuring that all taxable amounts are captured efficiently.

Another significant feature is the asset disclosure requirements, which compel taxpayers to report any foreign bank accounts and other offshore assets. This is particularly important for compliance with the Foreign Account Tax Compliance Act (FATCA) and can prevent legal issues that arise from non-disclosure.

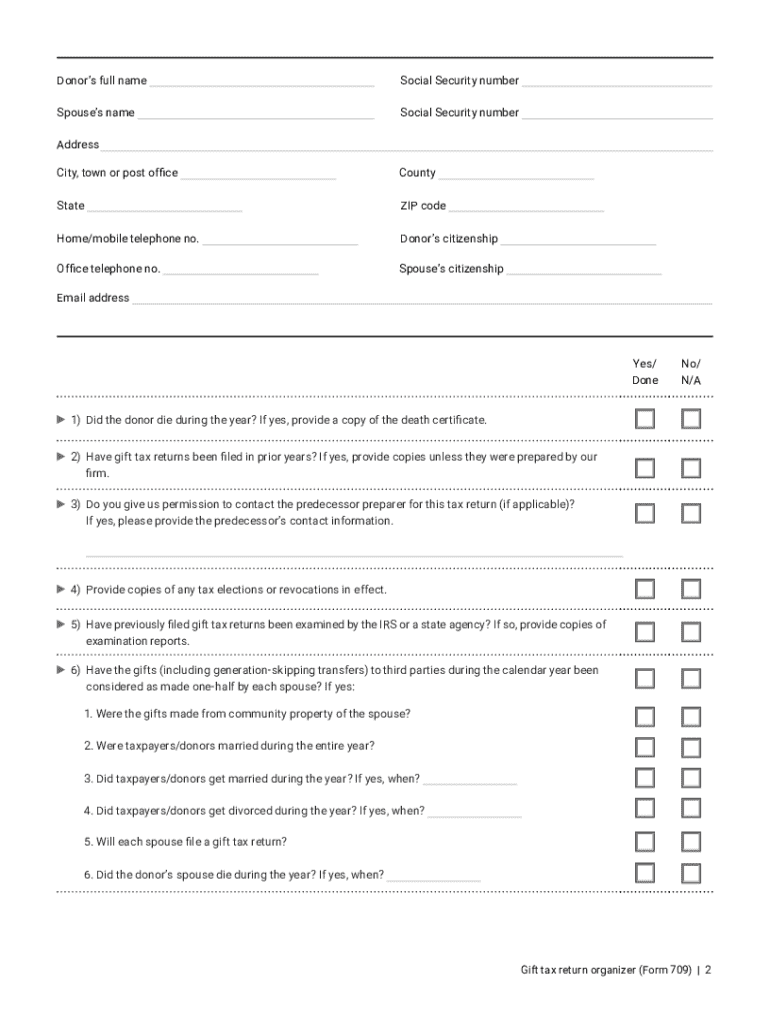

Step-by-step guide to filling out the Foreign Tax Organizer Form

Filling out the Foreign Tax Organizer Form involves a systematic approach to ensure that all required information is accurately captured. The following steps are a detailed breakdown of how to tackle the form effectively.

Step 1: Gather Necessary Documentation

Before you dive into the form, it’s essential to collect all necessary documentation. This includes various income reports and proof of foreign taxes paid. A comprehensive list of required documents is crucial for smooth completion.

Step 2: Section-by-Section Breakdown

Now, you can proceed with filling out the form section by section. Begin with personal information, ensuring that all names, addresses, and identification numbers are accurate. Move to the income section where different sources of income are documented, followed by the asset section, which includes details on foreign banks and investments.

The last step involves the deductions and credits section, which allows you to declare eligible foreign tax credits aimed at reducing U.S. tax liability.

Step 3: Common Errors to Avoid

As you fill out the Foreign Tax Organizer Form, it’s crucial to be vigilant about common errors that may occur. Misreporting foreign income can lead to substantial penalties, while failure to disclose foreign accounts can trigger audits or legal issues.

Utilizing pdfFiller for the Foreign Tax Organizer Form

pdfFiller is an excellent platform for managing your Foreign Tax Organizer Form. Its intuitive features make document management easier than ever, helping you access, edit, and store forms securely from anywhere.

Advantages of Using pdfFiller for Document Management

One of the biggest advantages of using pdfFiller is the ability to edit your documents easily. The platform provides tools for adding and deleting information effortlessly. Additionally, features such as eSign allow for quick approvals and finalizations, reducing the time needed to get documents in order.

How to Access and Use the Foreign Tax Organizer Template

To access and use the Foreign Tax Organizer template, a user simply needs to log into pdfFiller and search for the template. The platform offers interactive tools that allow for customization depending on individual needs. You can further utilize collaboration features to work with your tax team smoothly.

Managing the Foreign Tax Organizer After Completion

Once the Foreign Tax Organizer Form is filled out, proper management is necessary to ensure compliance and efficiency in future filings. Storing your completed forms securely is key to maintaining important tax documentation.

Storage and Organization of Completed Forms

Using cloud-based storage options can provide easy access to your tax documents. Additionally, regularly organizing your forms by year and type can streamline the process during any future audits.

Sign and Share Features

pdfFiller provides features that allow users to eSign forms promptly and share them effortlessly with tax preparers or stakeholders. This ensures that the forms are returned swiftly and minimizes delays in the filing process.

Regular Updates and How to Stay Compliant with Tax Laws

Staying compliant with tax laws necessitates regular updates to your records. Ensure that you review new guidelines and changes in tax regulations that might affect reporting foreign income or assets. This vigilance can ultimately save you time and resources while avoiding costly fines.

Frequently asked questions

Users often have questions about the Foreign Tax Organizer Form as they navigate their tax situations. Here are some common inquiries and answers that can shed light on typical concerns.

Related tax compliance resources

In addition to the Foreign Tax Organizer Form, there are several related tax compliance resources that taxpayers should be aware of. These resources can provide further assistance and tools necessary for efficient tax reporting.

Important filing resources and links

To help facilitate the tax filing process, it’s wise to keep a list of crucial resources and links readily accessible. These can promptly direct you to the forms and information necessary for compliance.

Enhancing your tax filing experience with pdfFiller

pdfFiller enhances the entire tax filing experience by integrating seamlessly with other tax software. This means less time juggling various applications and more focus on accurately completing tax forms.

User testimonials on streamlined tax processes

Users consistently give positive feedback regarding their experiences when utilizing pdfFiller for tax forms, citing improved efficiency and clarity throughout the filing process.

Accessing client portals for team collaboration

Within pdfFiller, users can take advantage of client portals designed to facilitate team collaborations on tax forms. Such features foster smoother communication and faster turnaround times.

Let's get started with your Foreign Tax Organizer

Now that you have an understanding of the Foreign Tax Organizer Form, here are some tips to kick start your filing journey.

Contacting support for assistance

Sometimes, navigating the complexities of tax forms requires additional support. If you find yourself in need of help, don’t hesitate to reach out to the pdfFiller support team.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my foreign tax organizer in Gmail?

How do I edit foreign tax organizer in Chrome?

How do I fill out the foreign tax organizer form on my smartphone?

What is foreign tax organizer?

Who is required to file foreign tax organizer?

How to fill out foreign tax organizer?

What is the purpose of foreign tax organizer?

What information must be reported on foreign tax organizer?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.