Understanding and Using the Simple Financial Procedures Policy Form

Understanding financial procedures policies

Financial Procedures Policies serve as foundational guidelines that govern how financial transactions and processes are handled within an organization. They provide a structured approach to managing funds, ensuring accountability, and establishing clear expectations among staff members involved in financial operations.

The importance of having Financial Procedures Policies cannot be overstated. These policies mitigate risks associated with financial mismanagement and help organizations maintain compliance with regulations. Well-defined policies provide transparency, foster trust among stakeholders, and contribute to overall organizational efficiency.

Clarity: Establish specific guidelines for fiscal responsibilities.

Compliance: Ensure adherence to legal and regulatory standards.

Accountability: Promote responsible management of financial resources.

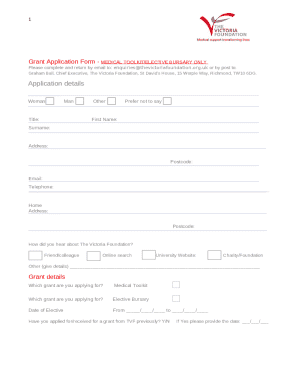

Overview of the simple financial procedures policy form

The Simple Financial Procedures Policy Form is a practical tool designed to assist organizations in documenting their financial procedures. It captures necessary information required to implement effective financial management practices and ensures consistency across various operations.

While filling out the form, users can expect a straightforward process with clear guidelines. The form simplifies the documentation of key financial responsibilities, controls, and reporting measures essential for maintaining organizational integrity in financial matters.

Formats: Available in various digital formats for ease of access.

Versions: Customizable versions suited to different organizational needs.

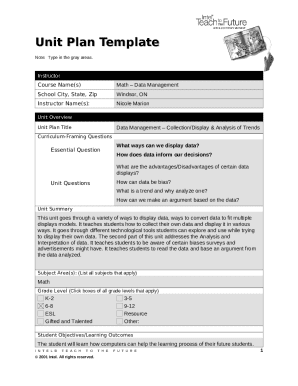

Step-by-step guide to filling the form

To effectively fill out the Simple Financial Procedures Policy Form, follow these clear steps:

Step 1: Preparation and gathering information

Before starting, it is crucial to gather all necessary documents and information. This includes previous financial reports, organizational charts, and any existing financial policies that may need to be integrated.

Organizational structure documentation.

Current budgeting documents or financial statements.

Existing procedures or policies for reference.

Step 2: Completing the form

Begin completing the form by filling out each section carefully. This should include:

Identification of roles and responsibilities: Clearly define who handles what in the financial process.

Fiscal controls and budgetary guidelines: Outline the budget management process and constraints.

Procedures for approving expenditures: Detail the steps needed for financial approvals.

Reporting and accountability measures: Include how and when financial reporting will take place.

Step 3: Reviewing your entries

After filling out the form, take the time to review your entries. A checklist can be helpful to ensure all sections are completed accurately.

Verify the accuracy of names and financial figures.

Ensure all required fields are filled.

Confirm that the roles listed correspond to organizational protocols.

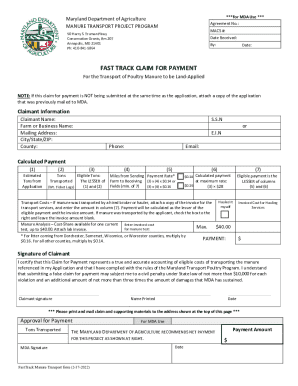

Step 4: Submitting the form

Once you have completed and reviewed the form, you must submit it. Submission options can vary but generally include online submission, PDF uploads, or physical copies if necessary. Be mindful of any required signatures and approvals that must accompany the form.

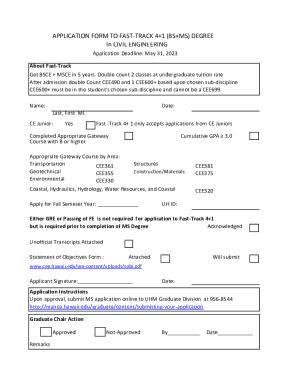

Editing and managing your form with pdfFiller

Utilizing pdfFiller for document editing enhances the management of your Simple Financial Procedures Policy Form. The platform provides user-friendly editing features that allow for seamless modifications.

Editing text and fields in the PDF: Use pdfFiller's tools to adjust and correct entries.

Adding annotations and comments: Engage with team members by sharing feedback directly on the document.

The eSigning process

Signing the form electronically is made easy with pdfFiller. The eSigning process is straightforward and includes steps to electronically sign and date your form. Additionally, pdfFiller offers collaboration features, allowing team members to review and approve the document before final submission.

Common issues and solutions

While using the Simple Financial Procedures Policy Form, users may encounter common issues that can disrupt the workflow. To address these, it’s essential to understand the frequently asked questions (FAQs) related to the form’s usage.

Missing Information: Ensure all required fields are filled to avoid delays.

Technical Glitches: Restart your device or clear your browser cache if the form isn’t loading correctly.

Signature issues: Verify that all required signatures are present before submission.

By being proactive and familiarizing yourself with potential pitfalls, you can enhance your experience with the Simple Financial Procedures Policy Form.

Best practices for financial procedures and policies

Implementing effective financial procedures requires continuous improvement and adaptation of policies. Regular updates to your financial procedures ensure they remain relevant and effective.

Conduct Training: Regularly inform and train staff on the policies to ensure compliance.

Communicate Clearly: Maintain open channels of communication regarding financial procedures.

Integrate with Business Operations: Ensure that financial processes align with other organizational operations to maintain consistency.

These best practices enhance accountability and foster a culture of financial responsibility within your organization.

Examples of effective financial procedures

Real-life examples from various industries demonstrate the effectiveness of well-structured financial procedures. For instance, nonprofits often have stringent financial controls to ensure that donations are managed responsibly and transparently to maintain donor trust.

Similarly, startups benefit from streamlined financial procedures that enable them to keep track of expenditures carefully and prevent resource wastage as they scale. Learning from financial mismanagement cases, such as those arising from inadequate budgeting or oversight, can provide valuable lessons on the importance of robust financial procedures.

Integrating financial procedures with other operations

Aligning financial procedures with project management and operations ensures a cohesive workflow. Utilizing digital tools can facilitate comprehensive financial management by allowing real-time collaboration and monitoring of financial data across departments.

Organizations that leverage technology to integrate their financial procedures within their operational strategies experience greater efficiency and accuracy in their financial reporting.

Exploring advanced topics related to financial procedures

For organizations striving to improve financial effectiveness, delving into advanced financial topics becomes essential. Utilizing metrics and key performance indicators (KPIs) in financial reporting can help organizations track performance and drive decision-making.

Moreover, understanding regulatory compliance and ethical practices in financial management is crucial for maintaining integrity in financial operations. Creating a continuous improvement loop in financial procedures promotes adaptability and positions organizations for future success.

Conclusion: Empowering your financial management with pdfFiller

Utilizing the Simple Financial Procedures Policy Form simplifies your organization’s financial management. pdfFiller supports the entire process from form filling to collaboration and eSigning, making document management hassle-free.

Empower your financial practices with pdfFiller, and experience a seamless approach to creating and managing financial policy forms.

Related articles you might find useful

Exploring essential financial policies for your organization.

Steps to create your first financial policy manual.

Streamlining approval workflows for financial documents.

Interactive tools and resources

Accessing interactive tools and resources enhances the user experience. pdfFiller provides a variety of templates tailored to your needs, along with tutorials that deepen your understanding of document management capabilities.

Engaging in community discussions around financial procedures best practices can also equip you with insights and support from peers.