Get the free I 3 7721

Get, Create, Make and Sign i 3 7721

Editing i 3 7721 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out i 3 7721

How to fill out i 3 7721

Who needs i 3 7721?

Understanding the 3 7721 Form: A Comprehensive Guide

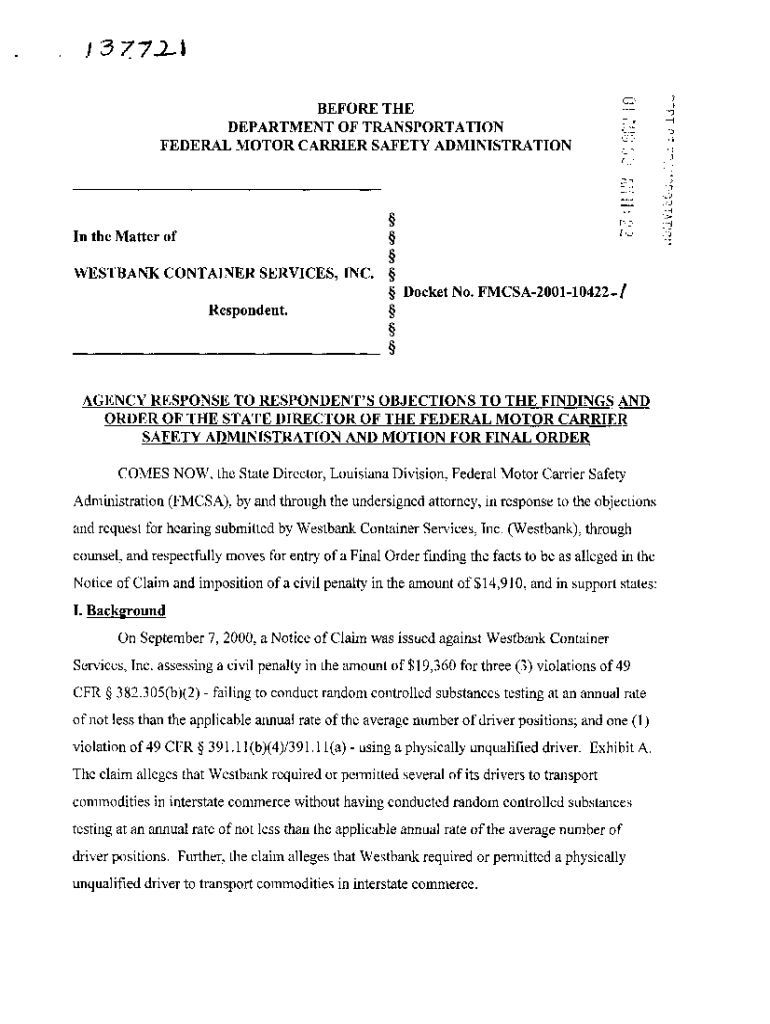

Overview of the 3 7721 Form

The i 3 7721 form serves a vital role in tax documentation, specifically for individuals and businesses conducting specific financial activities within the United States. Its primary purpose is to assist users in reporting income, deductions, and other necessary financial information to comply with tax regulations. Understanding the i 3 7721 form is essential not only for legal compliance but also for optimizing potential tax benefits.

Key features of the i 3 7721 form include its structured layout, which allows for detailed information capture across multiple areas. Users can declare their personal information, income sources, applicable deductions, and credits. This systematic approach ensures accuracy and supports efficient tax planning.

Detailed description of the 3 7721 Form

The i 3 7721 form is typically divided into several sections designed to capture all necessary details relevant to an individual's or entity's financial situation. Each section plays an important role in the overall completion of the form, ensuring comprehensive reporting.

Common use cases for the i 3 7721 form include individuals filing their annual tax returns, self-employed individuals reporting their business income, and businesses claiming tax credits. Almost everyone engaged in any income-generating activity will need to fill out this form to ensure accurate reporting.

It is essential for anyone who has had taxable income during the year, expects to claim deductions, or needs to report specific financial activities related to their business.

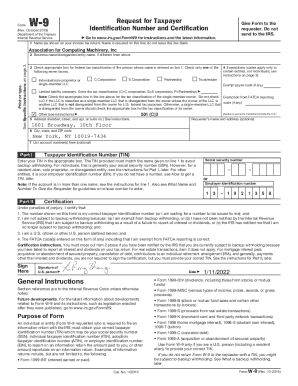

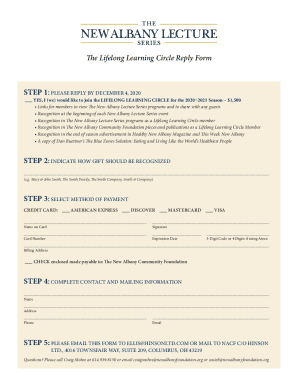

Step-by-step guide to filling out the 3 7721 Form

Filling out the i 3 7721 form may seem daunting, but breaking it down into manageable steps can simplify the process significantly. Here’s a step-by-step guide to help you through.

Interactive tools for the 3 7721 Form

Utilizing interactive tools can greatly enhance your experience while completing the i 3 7721 form. These resources are designed to simplify the form-filling process and provide guidance where needed.

Managing your 3 7721 Form submission

Once you've submitted your i 3 7721 form, effective management of your submission is crucial to ensure a smooth filing process. Here are some tips to help you navigate this phase.

Advanced options related to the 3 7721 Form

As technology progresses, users of the i 3 7721 form have access to advanced options that enhance the form-filling experience.

Potential pitfalls and how to avoid them

Filing the i 3 7721 form comes with its challenges. Awareness of potential pitfalls can help filers avoid complications during the submission process.

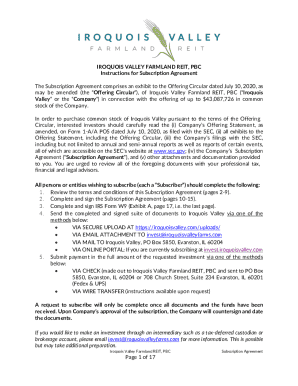

Additional considerations for specific audiences

Recognizing that different groups may have unique requirements when filling out the i 3 7721 form, tailoring guidance to specific audiences can improve compliance and understanding.

Related FAQs about the 3 7721 Form

As you navigate the intricacies of the i 3 7721 form, you may have questions related to its submission and processes. Here are answers to some frequently asked questions.

The value of using pdfFiller for the 3 7721 Form

pdfFiller offers a powerful solution for completing the i 3 7721 form seamlessly. Users benefit from a cloud-based platform that simplifies the document management process.

Additional tools from pdfFiller for document management

Beyond the i 3 7721 form, pdfFiller provides users with various tools and templates for comprehensive document management. These additional offerings can enhance your overall experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find i 3 7721?

Can I create an electronic signature for the i 3 7721 in Chrome?

Can I create an eSignature for the i 3 7721 in Gmail?

What is i 3 7721?

Who is required to file i 3 7721?

How to fill out i 3 7721?

What is the purpose of i 3 7721?

What information must be reported on i 3 7721?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.