Get the free form 10-q - march 31, 1996

Get, Create, Make and Sign form 10-q - march

How to edit form 10-q - march online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 10-q - march

How to fill out form 10-q - march

Who needs form 10-q - march?

How to Fill Out the March Form 10-Q

Overview of the March Form 10-Q

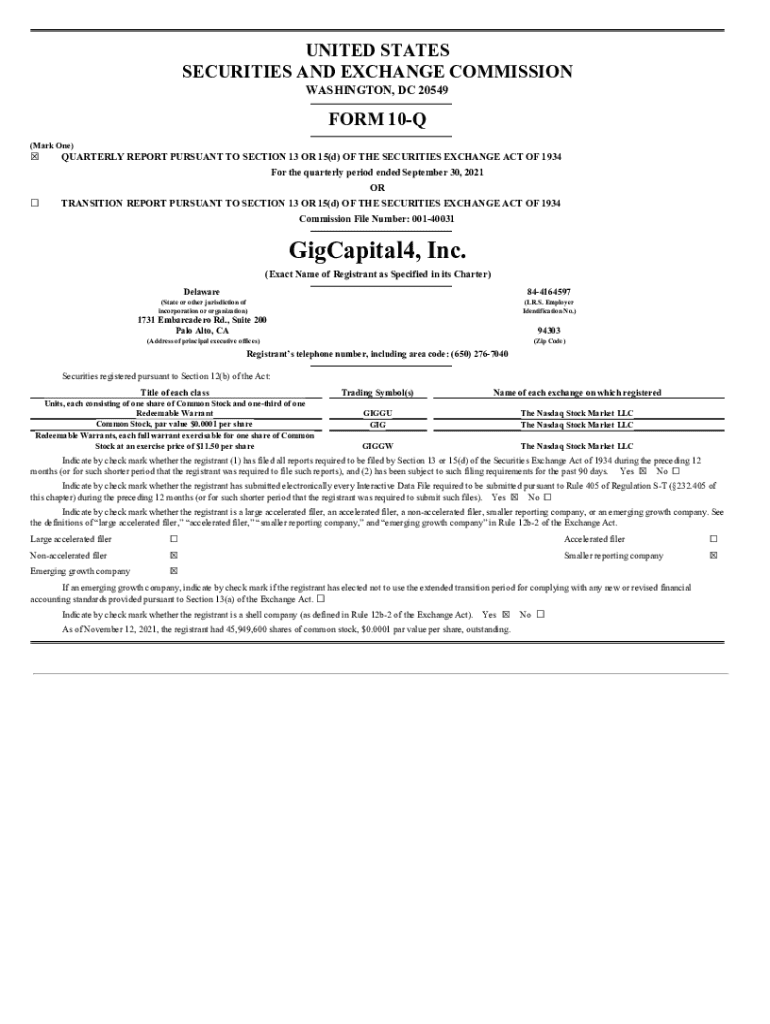

The March Form 10-Q is a crucial quarterly report submitted by publicly traded companies in the United States to the Securities and Exchange Commission (SEC). This document provides a comprehensive overview of a company’s financial health and operational performance over the first quarter of the fiscal year. Its main purpose is to keep investors informed about ongoing business developments, ensuring transparency and fostering trust in the market. Filing the March Form 10-Q is essential not only for legal compliance but also as a tool for investor relations, influencing market perceptions and investment decisions.

The March filing varies significantly from the annual Form 10-K. While the latter encompasses a holistic view of the company over the entire year and contains detailed disclosures, the 10-Q is streamlined for quarterly updates. Key differences include the depth of information required, the time sensitivity of disclosures, and the frequency of reporting. Understanding these distinctions is vital for any financial team managing company filings and investor relations.

Structure of the March 10-Q Document

The structure of the March Form 10-Q includes specific sections that are standardized for ease of analysis and comparison across various filings. The major sections of the form include:

Typically, the company must file its Form 10-Q within 40 days of the end of the quarter, making the March filing a critical touchpoint for timely updates. After submission, companies may also need to respond promptly to any SEC comments, reinforcing the importance of accuracy and clarity in these reports.

Preparing to complete the March Form 10-Q

To effectively complete the March Form 10-Q, it is essential to gather all necessary information and documentation beforehand. This includes the previous quarter's financial data, operational metrics, and market analysis. Understanding key terminology such as GAAP (Generally Accepted Accounting Principles) and SEC guidelines is also important for clarity throughout the reporting process.

Furthermore, it’s crucial to comprehend the reporting periods that the 10-Q covers, typically including the last three months of the fiscal year’s first quarter. Companies should also align their disclosures with recent changes in regulations or market conditions to ensure compliance and relevance.

Step-by-step guide to filling out the March Form 10-Q

Filling out the March Form 10-Q involves several meticulous steps, ensuring thoroughness and compliance. Here’s a structured guide to navigate the process effectively:

Editing and reviewing your March Form 10-Q

Once the draft of the March Form 10-Q is complete, editing and reviewing become essential steps to ensure the submission's accuracy. The significance of precision and clarity cannot be overstated, as errors may lead to compliance issues or misinterpretation by investors.

Utilizing document management tools can aid in streamlining this review process. Platforms like pdfFiller can facilitate seamless revisions and collaborative reviews, allowing various departments to contribute efficiently. Common mistakes to avoid include omissions of key data, incorrect financial metrics, and inconsistent terminology throughout the document.

Submission process for the March Form 10-Q

Submitting the completed March Form 10-Q to the SEC requires adherence to specific guidelines. The SEC mandates that documents must be filed electronically through the EDGAR (Electronic Data Gathering, Analysis, and Retrieval) system for efficient processing and public access.

Key deadlines are vital in the submission process. Generally, filers must submit their 10-Q within 40 days following the end of the fiscal quarter. Keeping track of these deadlines is crucial to avoid penalties or reputational damage. Timely submission is also pivotal in maintaining investor relationships and ensuring ongoing transparency with stakeholders.

Post-submission: what’s next?

After submission, companies should monitor the filing status on the SEC’s EDGAR system to confirm acceptance and address any feedback that may arise. The SEC might send comments or request additional information, necessitating prompt responses to maintain good standing.

Engaging with investors post-submission is equally crucial. Companies should prepare press releases or updates through investor relations channels to communicate key highlights from the filing, ensuring transparency and fostering trust. Establishing a proactive communication strategy can enhance investor relations and potentially sway market perceptions positively.

Utilizing pdfFiller for the March 10-Q process

pdfFiller offers a robust solution for managing the complexities of the March Form 10-Q. Its cloud-based platform allows users to edit PDFs seamlessly, sign documents electronically, and collaborate with team members effectively. This integration minimizes errors and enhances productivity across the entire reporting process.

Utilizing pdfFiller not only simplifies the editing process but also ensures that completed forms adhere to regulatory compliance requirements. Users can leverage template features specifically designed for financial documents, providing industry-standard layouts and terminology. Furthermore, the platform prioritizes security, ensuring that sensitive financial data remains protected throughout the filing process.

Case studies and examples

To better grasp the effective completion of the March Form 10-Q, examining successful case studies from leading companies can be highly instructive. These examples often highlight the best practices for format, content clarity, and comprehensive risk disclosures.

Additionally, reviewing instances where companies stumbled or faced regulatory scrutiny for insufficient disclosures can help communicate the importance of thoroughness. Lessons learned from such case studies can provide financial teams valuable insights into common pitfalls and how to avoid them in future filings.

Frequently asked questions about the March Form 10-Q

Several common queries arise concerning the March Form 10-Q process from preparers, especially regarding compliance and reporting standards. Addressing these can clarify misconceptions and reinforce understanding. For instance, many may wonder about the differences in disclosures between quarterly and annual forms, or how to align with SEC updates.

Should questions persist concerning specific aspects of the Form 10-Q or the filing procedure, it is crucial for companies to seek guidance from financial advisors or legal counsel specializing in SEC regulations. This proactive approach helps ensure complete compliance with regulatory requirements.

Contact information for assistance

For additional support regarding the March Form 10-Q, individuals or teams can reach out to the SEC office for guidance on filing questions. Alternatively, platforms like pdfFiller also offer resources for document management support, ensuring users understand how to navigate the complexities of filing procedures.

Investing time to ensure accurate and timely completion of the Form 10-Q not only adheres to SEC regulations but also reinforces a company’s commitment to transparency and accountability in financial reporting.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit form 10-q - march from Google Drive?

Where do I find form 10-q - march?

Can I edit form 10-q - march on an iOS device?

What is form 10-q - march?

Who is required to file form 10-q - march?

How to fill out form 10-q - march?

What is the purpose of form 10-q - march?

What information must be reported on form 10-q - march?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.