Extrajudicial Settlement of Estate1 Form - A Comprehensive How-To Guide

Understanding extrajudicial settlement of estate

Extrajudicial settlement of estate refers to the process where the heirs of a deceased individual, especially where no will exists, settle the distribution of the deceased’s assets among themselves without court intervention. This procedure is significant as it allows heirs to finalize ownership of properties and other assets without enduring the complexities and delays of probate.

In contrast to a testate succession, where the deceased has left a will, extrajudicial settlements offer a more straightforward approach to estate distribution. Instead of navigating legal formalities and potential courtroom battles, heirs can directly engage in discussions and negotiations, thus expediting the settlement process significantly.

Who can initiate an extrajudicial settlement?

Eligible parties for initiating an extrajudicial settlement typically include the direct descendants of the deceased, such as children, parents, or spouses, as well as siblings or designated representatives if those primary heirs are unable to act. The crucial factor is that all heirs must agree to the terms of the settlement before proceeding.

Interested heirs or representatives should gather all essential information regarding estate assets and liabilities. Engaging in an open dialogue and potentially negotiating the terms of the settlement can help prevent disputes, ensuring all parties feel represented and satisfied with the agreed distribution.

Benefits of using an extrajudicial settlement

One of the primary benefits of utilizing an extrajudicial settlement is the simplicity and speed of the process. In contrast to formal probate procedures, which can take months or even years to finalize, extrajudicial settlements typically enable heirs to resolve matters within a few weeks or months.

This approach is also cost-effective, as it reduces legal fees and court costs associated with probate. Moreover, the flexibility inherent in extrajudicial settlements allows heirs to devise a distribution plan that best meets their unique family dynamics and asset considerations.

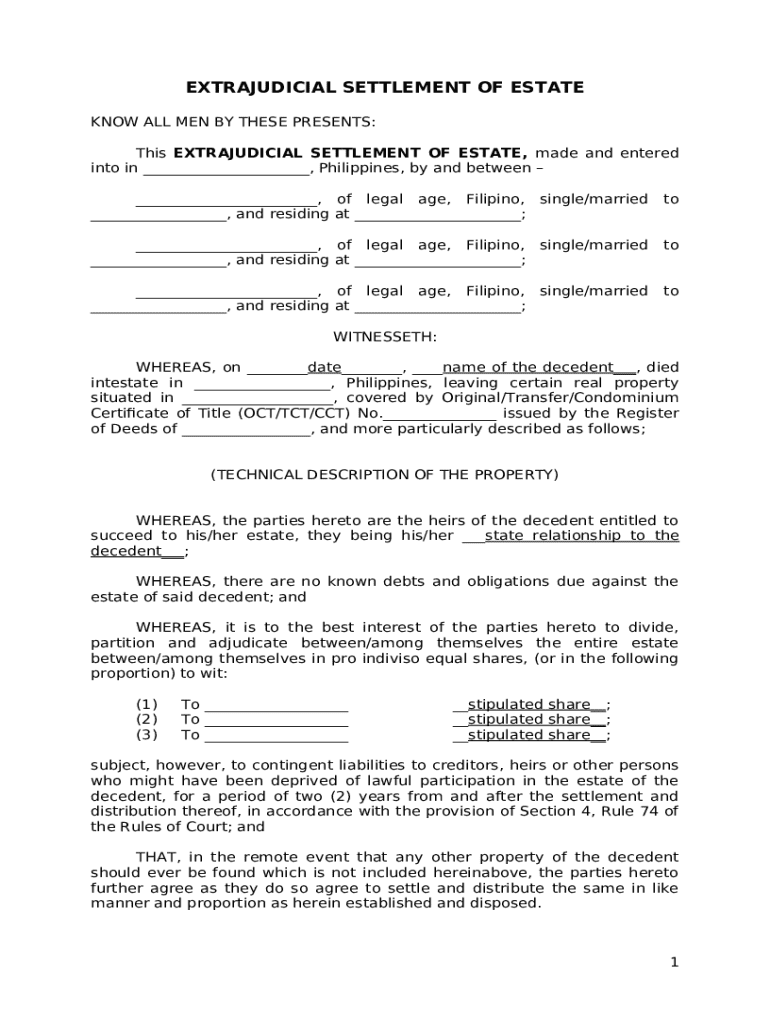

Requirements for an extrajudicial settlement of estate1 form

Completing the extrajudicial settlement of estate1 form necessitates several identification details, including the full names of all heirs, the deceased’s information, and detailed descriptions of all assets being distributed. Required documentation typically includes a death certificate, property titles, and any other relevant legal papers.

Verification of heirs is a critical step; this often entails producing birth certificates, marriage licenses, or other documentation to substantiate relationships. Steps for obtaining necessary documents should begin with local civil registries for death certificates and respective offices for property titles, ensuring all required paperwork is organized efficiently.

Interactive tools for preparing the estate1 form

pdfFiller provides interactive features that simplify the preparation of the extrajudicial settlement form. Users can access a user-friendly interface to fill out the necessary information and edit the document to ensure accuracy before submission.

Upload the completed extrajudicial settlement of estate1 form to pdfFiller’s platform.

Edit the uploaded document, adding or correcting information as required.

Sign the form electronically to validate it before final submission.

Utilize the cloud storage options for easy management and sharing of the form.

Filling out the extrajudicial settlement of estate1 form

Filling out the extrajudicial settlement of estate1 form involves a detailed breakdown of several sections to ensure completeness. The personal information section requires details such as the names and contacts of all heirs and the deceased, establishing clear identities for documentation.

The asset declaration section must include a meticulous list of all property, investments, and liabilities of the deceased. Finally, the heirship assent section is critical, where all participating heirs must consent to the proposed distribution. Common mistakes to avoid include overlooking the requirement of all heirs' signatures and failing to accurately list all assets, as these can complicate the settlement process significantly.

Steps in the extrajudicial settlement process

The first step in the extrajudicial settlement process is preparation, which includes gathering all necessary documents and information about the deceased's estate. Once the extrajudicial settlement of estate1 form is completed with accurate details, it is imperative to verify that all required information is included to avoid delays.

Submission procedures typically involve presenting the completed form to relevant government agencies, such as local land registries or civil offices. Following submission, it’s important to understand the expected timeline for the settlement process, which can range from a few weeks to several months, depending on local regulations and the complexity of the estate.

Handling complex situations in estate settlements

Facing complex situations in estate settlements requires an understanding of several scenarios. If disputes arise among heirs, clear communication and possibly third-party mediation can help resolve differences. It’s crucial to address inheritance rights, especially for minors and incapacitated individuals, ensuring their interests are duly protected in the settlement.

Additionally, if properties are located in different jurisdictions, it may necessitate understanding varying local laws regarding estate distribution which can make the process more complicated. Consulting with legal counsel can offer guidance on navigating these complexities efficiently.

Legal guidance and support

Consulting a lawyer for guidance on estate matters is advisable when the estate includes significant assets, if there are multiple heirs, or when disputes are likely. The role of legal counsel can prove invaluable, offering insights into the intricacies of estate laws and helping to mediate discussions between heirs.

When seeking legal advice, consider asking questions concerning the timeline for settlement, potential tax implications, and any concerns over the legality of proposed distributions, providing a framework for informed decision-making.

FAQs about extrajudicial settlement of estate1 form

Several common queries arise concerning the extrajudicial settlement of estate1 form. Heirs often wonder what to expect after filing the form with local authorities. Typically, after submission, a review period follows, during which any discrepancies may be flagged, or additional documentation may be requested.

Other frequent concerns include how to handle disputes among heirs or the implications for taxes on inherited assets. Addressing these questions beforehand can help ensure that the extrajudicial settlement process runs smoothly and efficiently.

Final checklist before completing your extrajudicial settlement

Before finalizing the extrajudicial settlement of estate1 form, it’s essential to confirm that all required information is accurately provided. This involves a thorough review of the completed form to ensure no essential details are overlooked.

Make sure all heirs have signed the form, indicating their agreement.

Double-check the accuracy of asset valuations and descriptions.

Keep a copy of submitted documents and notes on follow-up actions.