Get the free Beneficiary Designation - Securian Life Insurance Company

Get, Create, Make and Sign beneficiary designation - securian

Editing beneficiary designation - securian online

Uncompromising security for your PDF editing and eSignature needs

How to fill out beneficiary designation - securian

How to fill out beneficiary designation - securian

Who needs beneficiary designation - securian?

Beneficiary designation - Securian form: A comprehensive guide for effective planning

Understanding beneficiary designation forms

Beneficiary designation forms are essential tools for ensuring that your assets are distributed according to your wishes after your passing. Understanding their importance is crucial for everyone, regardless of wealth. The designation process provides clarity for your loved ones and can streamline the heirs' access to your assets, attempting to reduce confusion during an already emotional time.

Various key terms need to be clarified when discussing beneficiary designations. A 'beneficiary' refers to the person or entity designated to receive assets from a policy or account upon the account owner’s death. Choosing between 'primary' and 'contingent beneficiaries' is essential; primary beneficiaries are the first in line to inherit, while contingent beneficiaries receive assets only if the primary ones are unavailable. Finally, knowing the difference between 'revocable' and 'irrevocable beneficiaries' can significantly impact your control over the assets.

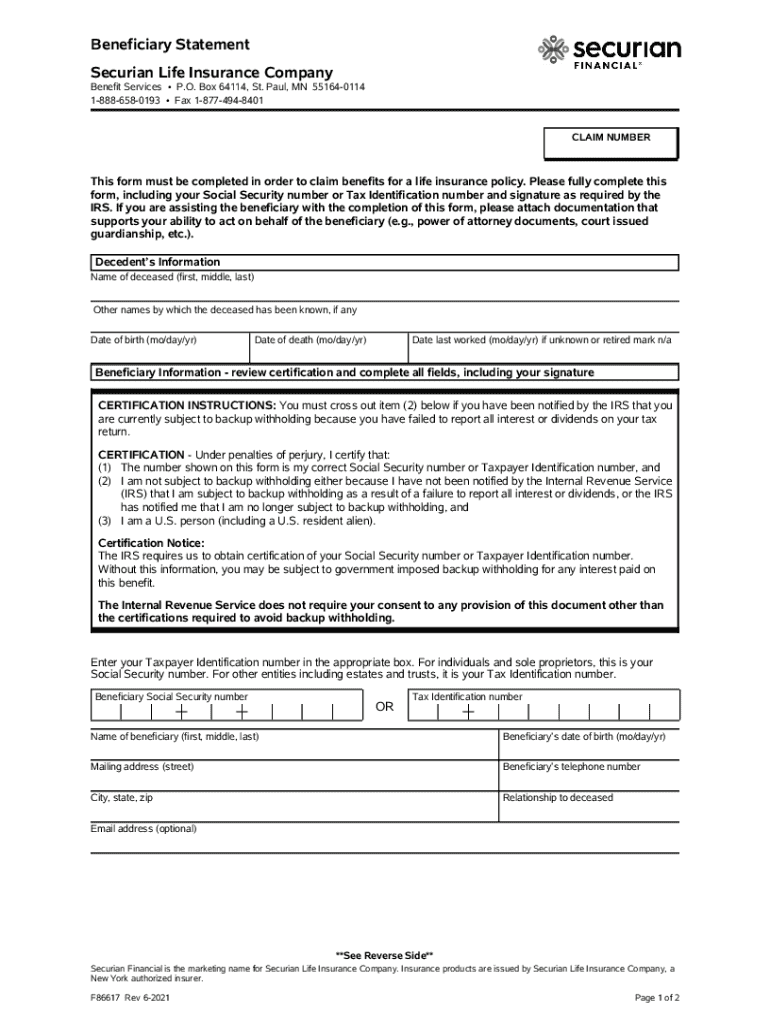

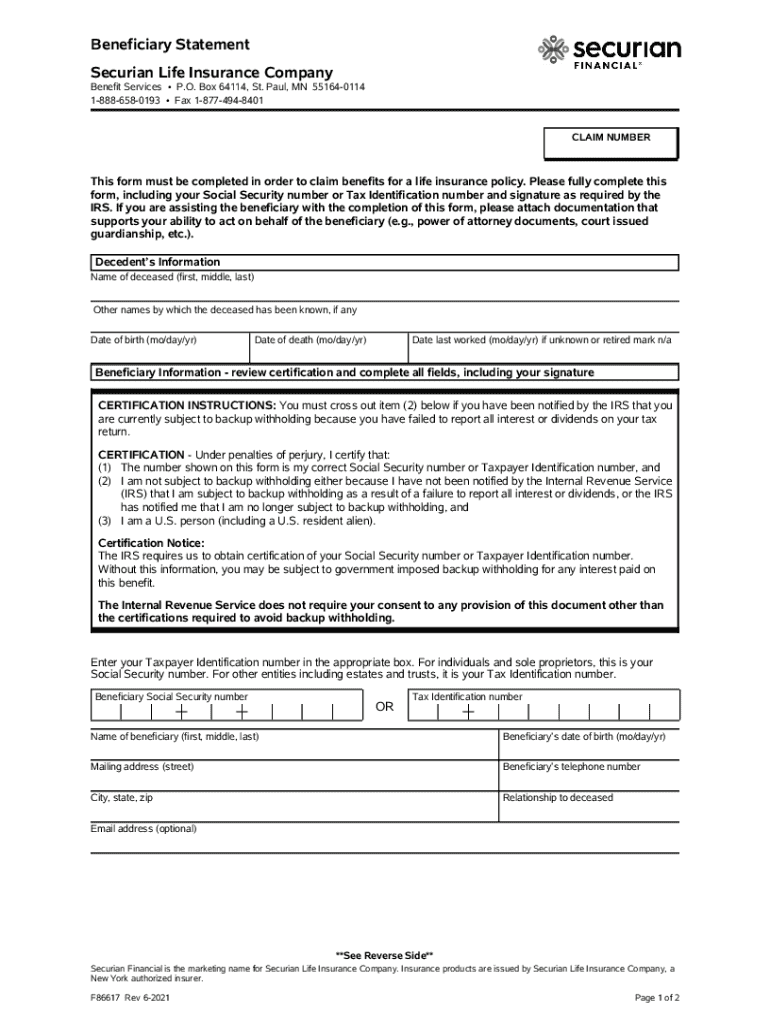

Overview of Securian beneficiary designation form

The Securian Beneficiary Designation Form is a vital document for those looking to manage their beneficiaries efficiently. This form allows individuals to specify how their assets should be distributed, thus ensuring their final wishes are honored. Using the Securian form brings several significant advantages, such as simplifying a potentially complicated process and ensuring clarity and security for all designated beneficiaries.

An important note regarding the Securian form is that there are common pitfalls to avoid, such as not including all necessary information or failing to update your designations when life changes occur (e.g., marriage, divorce, or the birth of a child). Additionally, ensuring that the form meets specific requirements for validity—like correct signatures and the inclusion of vital information—is critical to preventing disputes.

Step-by-step guide to completing the Securian beneficiary designation form

Completing the Securian Beneficiary Designation Form can be simplified by following a structured approach. The first step is gathering necessary information—start with your personal details, such as your full name, address, date of birth, and the information for each beneficiary you wish to designate. This includes their names, relationship to you, and contact details.

Step two involves filling out the form itself. Pay attention to sections such as the personal details section, beneficiary allocation section, and signature requirements. The personal details section is straightforward, while the beneficiary allocation requires you to specify what percentage of your assets each beneficiary will receive. Notably, this is also the area where you can designate both primary and contingent beneficiaries.

Lastly, step three is about reviewing and verifying your provided information. It is crucial to double-check input to avoid misunderstandings that could arise from errors, such as misspelled names or incorrect relationships. Understanding the implications of errors in this document can save beneficiaries significant heartache during an already trying time.

Digital editing and management through pdfFiller

Accessing the Securian form through pdfFiller presents users with an efficient way to manage their documents digitally. This platform allows you to access, edit, and store your beneficiary designation forms securely. The editing capabilities offered by pdfFiller include modifying text, adding new sections, or even deleting outdated entries, which can help maintain your records accurately.

pdfFiller also provides eSignature options, ensuring the legal validity of your signed documents. This feature is crucial for forms like beneficiary designations, as many require signatures to be considered valid. Furthermore, collaboration tools allow multiple users—like family members or trusted advisors—to review and make necessary changes to the form efficiently.

How to submit your completed beneficiary designation form

Once you complete the Securian Beneficiary Designation Form, you'll need to submit it to ensure it is officially recognized. Several submission options exist, such as eSubmission procedures, which can be done securely online through pdfFiller or directly via Securian’s website. Ensuring you follow the correct procedure can help speed up the process and avoid delays.

For those preferring traditional methods, mail-in instructions will guide you on where to send the form. Following these guidelines is crucial, as errors could lead to your form going unprocessed. After submission, expect a confirmation of receipt from Securian, providing peace of mind that your designations are being handled appropriately. If you do not receive confirmation within a designated timeframe, follow-up protocols are advised to ensure the form is correctly on file.

Managing changes to your beneficiary designation

Life changes often necessitate updates to your beneficiary designations. Therefore, it's important to know when and why to make those changes. Key events, such as marriage, divorce, the birth of a child, or changes in your relationship with current beneficiaries, are vital for reassessing your designations.

Amending the Securian form correctly involves filling out a new form and potentially including an amendment statement if required. Keeping accurate beneficiary records ensures that your assets are distributed per your wishes, and regular reviews can help avoid potential legal disputes later on.

FAQs about beneficiary designation and Securian forms

Many individuals have common questions regarding the beneficiary designation process. For instance, what should you do if a beneficiary becomes deceased or is no longer reachable? Maintaining an updated list is key; you may need to replace them with a contingent beneficiary or update your designations altogether. Another frequently asked question relates to how often you should review your designations – ideally, this should occur at least once a year.

Additionally, if you find yourself frequently wanting to change beneficiaries, consider designating more than one beneficiary in varying percentages to minimize future complications.

Expert tips for ensuring your beneficiary designation reflects your wishes

To ensure your beneficiary designation accurately reflects your intentions, regularly reviewing your designations is essential. A change in life circumstances may necessitate a revision in beneficiaries. Open communication with your beneficiaries about your intentions can also prevent misunderstandings after your passing.

Lastly, it’s advisable to consult with a legal expert to understand the implications of your choices fully. They can provide tailored advice, ensuring everything is set up in accordance with your desires and inhibiting potential disputes from arising later.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send beneficiary designation - securian for eSignature?

How can I fill out beneficiary designation - securian on an iOS device?

How do I fill out beneficiary designation - securian on an Android device?

What is beneficiary designation - securian?

Who is required to file beneficiary designation - securian?

How to fill out beneficiary designation - securian?

What is the purpose of beneficiary designation - securian?

What information must be reported on beneficiary designation - securian?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.