Get the free IRS Mileage Rates: Deduct Miles Driven for Work ...

Get, Create, Make and Sign irs mileage rates deduct

How to edit irs mileage rates deduct online

Uncompromising security for your PDF editing and eSignature needs

How to fill out irs mileage rates deduct

How to fill out irs mileage rates deduct

Who needs irs mileage rates deduct?

Understanding IRS Mileage Rates Deduct Form: A Comprehensive Guide

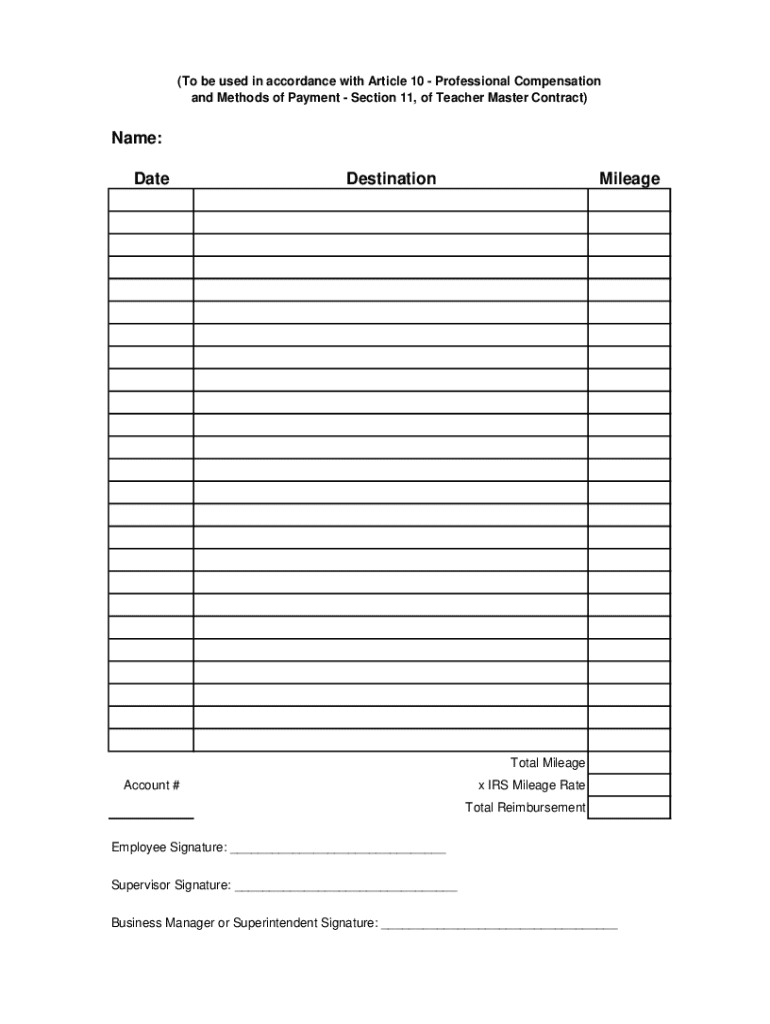

Understanding IRS mileage rates

IRS mileage rates are the standard rates set by the Internal Revenue Service (IRS) that taxpayers can use to deduct expenses related to the business use of their vehicles. This system allows individuals and businesses to claim a deduction on their taxes based on the distance driven for work purposes. The significance of these rates lies in their ability to provide a consistent, easy-to-calculate methodology for reporting vehicle-related expenses, which can lead to substantial tax savings.

In 2023, the IRS has established specific mileage rates that have seen adjustments based on inflation and economic changes. Staying informed about these rates is vital as they directly impact the financial aspects of business operations and personal tax returns.

Types of mileage rates

There are two main methods for claiming vehicle expenses: the standard mileage rate and the actual expense method. The standard mileage rate is a set rate per mile driven that taxpayers can use as a straightforward approach to calculate their vehicle-related deductions.

The choice between these two methods can significantly impact the deduction amount and should be carefully considered based on personal or business circumstances.

How to claim tax deductions for mileage

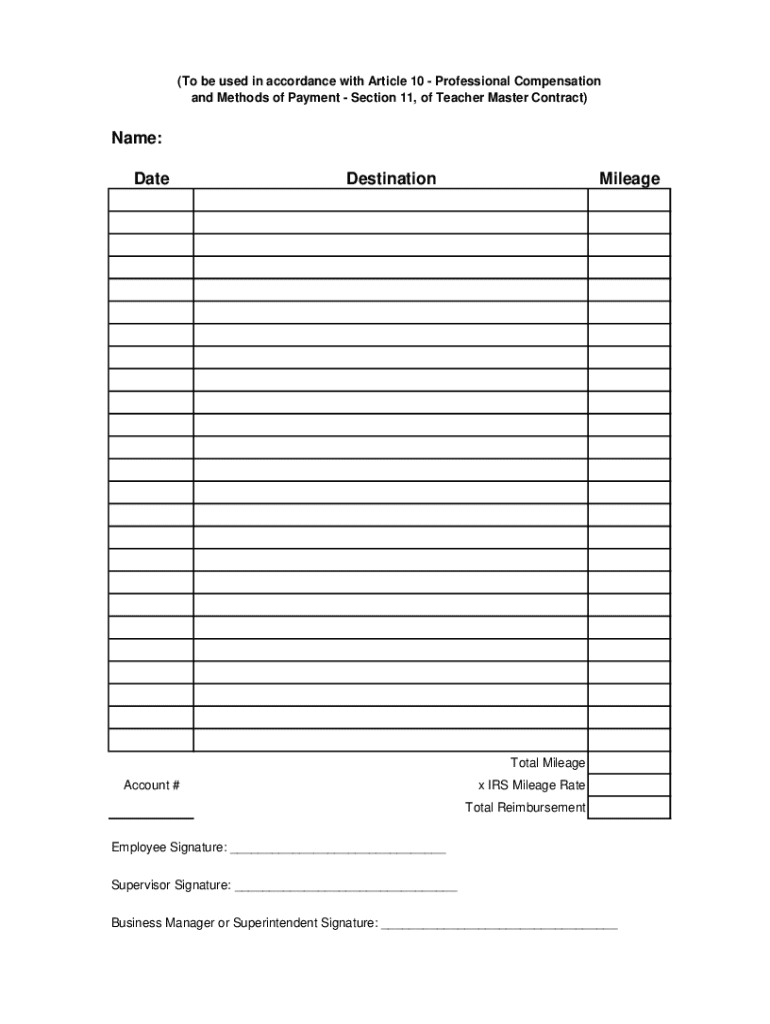

To successfully claim mileage deductions on your tax return, you'll need to adhere to specific eligibility criteria and gather the necessary documentation. The IRS requires clear records showing the mileage driven for business purposes.

Essential details for filling out the IRS mileage rates deduct form

Filing your mileage deduction correctly requires a thorough understanding of the IRS forms that are relevant to your tax situation. The most common forms used include Schedule C for business income and expenses and Form 2106 for employees.

Maintaining accurate mileage records

Keeping thorough and accurate mileage records is vital not just for maximizing deductions, but also for compliance with IRS rules. Failure to maintain proper documentation could lead to audits or denied deductions. Accurate logs should include the date, the purpose of each trip, and the starting and ending odometer readings.

Special considerations for different mileage types

Certain types of mileage incur unique allowances and documentation requirements. Volunteer and charitable activities, for example, allow for a specific deduction rate, while moving and medical-related travel have their rates and rules.

Common mistakes and misconceptions

Navigating IRS mileage deductions can be complex, and many taxpayers fall prey to common mistakes. Understanding these can help you avoid similar pitfalls. Misreporting personal mileage as business mileage, failing to adequately document trips, and ignoring the record-keeping requirements are among the usual errors.

Utilizing pdfFiller for efficient document management

Leveraging tools that simplify documentation is essential, especially when preparing tax forms. pdfFiller empowers users to manage their tax-related forms effectively. With its cloud-based platform, users can seamlessly edit PDFs, eSign, and collaborate on documents, ensuring all submissions are accurate.

Insights on upcoming IRS mileage rate changes

Anticipating changes in IRS mileage rates can enhance your tax planning. Each year, the IRS assesses economic factors which may result in adjustments to the standard mileage rates for the following tax year. Keeping abreast of these changes is crucial.

Frequently asked questions

As taxpayers approach tax season, many have questions about mileage rates and deductions. It's important to provide clarity regarding common queries.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my irs mileage rates deduct in Gmail?

How can I edit irs mileage rates deduct from Google Drive?

How do I edit irs mileage rates deduct in Chrome?

What is irs mileage rates deduct?

Who is required to file irs mileage rates deduct?

How to fill out irs mileage rates deduct?

What is the purpose of irs mileage rates deduct?

What information must be reported on irs mileage rates deduct?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.