Legal aspects of incorporation form: A comprehensive guide

Understanding incorporation: An overview

Incorporation is the legal process of forming a corporation, a specific type of business entity that is distinct from its owners. This formal structure grants liability protection, meaning personal assets are shielded from business debts and liabilities. The incorporation process is crucial for entrepreneurs looking to establish a brand or organization in a capable and legally recognized manner.

The importance of adhering to legal formalities in incorporation cannot be overlooked. Failing to comply with state-specific requirements can lead to delays or even the rejection of incorporation applications, which can jeopardize a company's launch. Understanding the diverse types of corporations available, such as C Corporations, S Corporations, Close Corporations, and Professional Corporations is essential for selecting the right structure for a business.

C Corporation - A standard corporation subject to income tax.

S Corporation - A corporate structure allowing profits and losses to be passed through to shareholders.

Close Corporation - A corporation with a limited number of shareholders, often family-run.

Professional Corporation - A corporation formed by professionals such as doctors or lawyers.

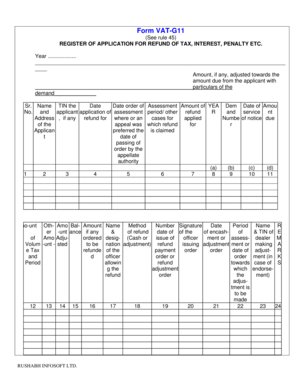

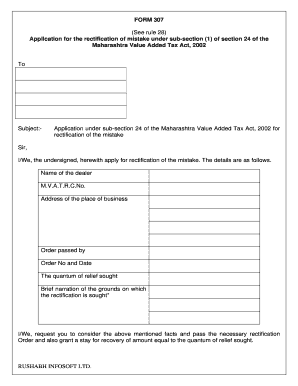

Key legal aspects of the incorporation form

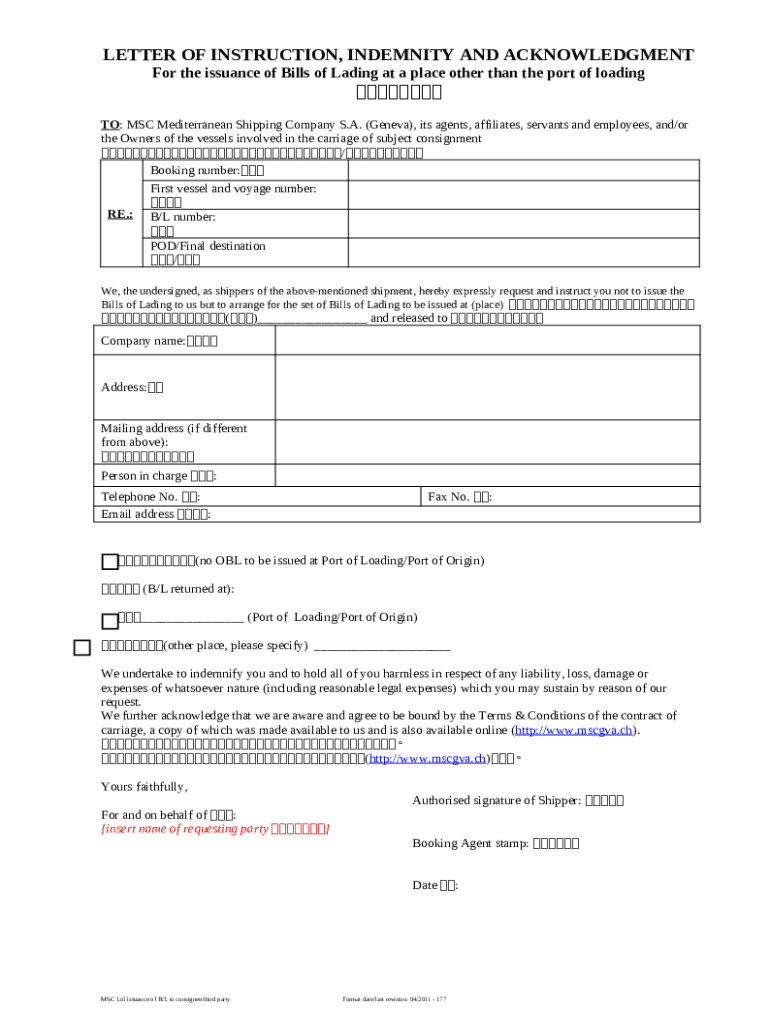

When filling out the incorporation form, certain pieces of information are mandatory. Key elements include the business name and structure, which must comply with state naming laws, and details about the registered agent responsible for receiving legal documents on behalf of the corporation. Providing a viable business address and a clear purpose for the incorporation is also necessary for compliance and operational clarity.

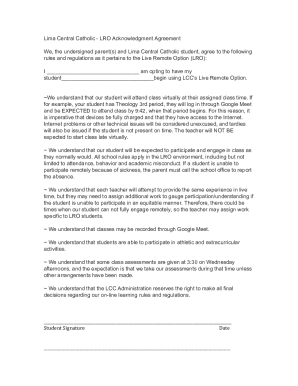

Another crucial legal aspect is understanding corporate bylaws, which serve as the governing document for the corporation. Bylaws outline the operational procedures, rights, and responsibilities of shareholders and board members. They usually include elements such as the frequency of board meetings, voting procedures, and rules for amending the bylaws. While bylaws typically do not require filing with the state, they are critical for internal governance.

Business name should comply with state regulations.

Registered agent's details must be accurate for legal correspondence.

Provide a physical address for official business communication.

Clearly outline the purpose of the incorporation.

Steps to complete the incorporation form

Preparation is key before tackling the incorporation form. Gathering necessary documentation, such as identification, an outline of business purpose, and financial details is crucial. It is often beneficial to consult with legal professionals to ensure that all specific state laws are met and to avoid errors that could lead to costly revisions.

Follow this step-by-step guide to complete the incorporation form accurately:

Select the correct form based on the intended business structure.

Fill out personal and business information completely.

Provide details regarding stock structure, including types of shares and number of shares authorized.

Clearly specify the purpose of incorporation.

Ensure the form is signed and dated accurately before submission.

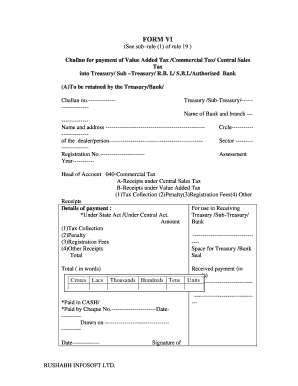

Filing the incorporation form

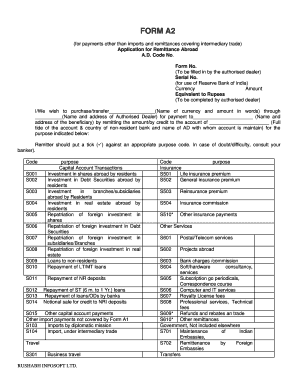

Once the incorporation form is complete, the next step is filing it with the appropriate state authorities. Different states have unique requirements, including specific deadlines for submission. Traditionally, businesses can choose between online and offline filing options, although many states are increasingly shifting to digital platforms for speed and efficiency.

It is essential to be aware of filing fees, which can vary significantly from state to state. Ensuring all state-specific documentation is in order can save time and prevent common mistakes. Common filing pitfalls include misinformation, missing signatures, or failure to adhere to state-specific formatting guidelines.

Research state requirements before filing.

Choose between online filing and traditional mail.

Confirm the exact fees and deadlines for your state.

Double-check all entries for accuracy to avoid rejections.

Legal obligations post-incorporation

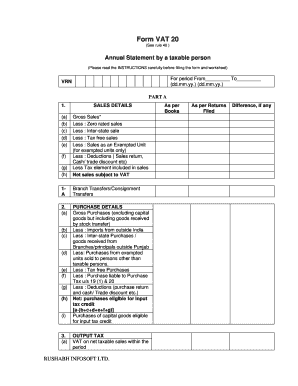

Legal obligations do not end after incorporation. It is crucial to maintain corporate compliance by submitting annual reports, adhering to ongoing filing requirements, and abiding by federal and state tax obligations. The distinction between C and S Corporations significantly affects tax responsibilities, so understanding these differences is vital for financial planning.

Additionally, corporate governance practices, including scheduling regular meetings for shareholders and maintaining records of business transactions, are essential for demonstrating compliance. Updating corporate records and bylaws whenever there are significant changes in the business structure is also critical to avoid potential legal complications.

Prepare and submit annual reports to maintain compliance.

Understand the differences in tax responsibilities for C and S Corporations.

Hold regular meetings as required by bylaws.

Ensure records and bylaws are updated as business dynamics change.

Liability considerations for corporations

One of the primary advantages of incorporation is the separation of personal and business assets. This separation affords limited liability protection, meaning personal assets are generally not at risk for business debts and legal issues, provided legal formalities are observed. However, risk remains in situations where the corporate veil may be pierced, often due to negligence in adherence to corporate formalities or if fraud is detected.

To mitigate risks, corporate officers should ensure compliance with all legal requirements, maintain accurate records, and avoid commingling personal and business finances.

Maintain clear separation between personal and business finances.

Stay updated on compliance with state incorporation laws.

Document all corporate decisions formally to protect against claims.

Corporation FAQs: Legal considerations

Incorporating a business leads to various questions regarding the legal aspects of the incorporation form. Common inquiries include what happens if an incorporation form is incorrect, which can lead to rejection or returning the form for corrections. Prospective corporations often ask whether they need to file bylaws with the state, which are usually not required but essential for internal governance.

Another frequent concern is the need for specific licenses based on the business type, as regulations can vary widely between industries. Non-compliance with incorporation laws may result in fines or legal challenges, highlighting the importance of understanding these legal requirements.

Incorrect forms can lead to processing delays or denial.

Bylaws are generally for internal guidance and not filed with the state.

Licenses vary by business type and must be researched.

Non-compliance can lead to legal penalties.

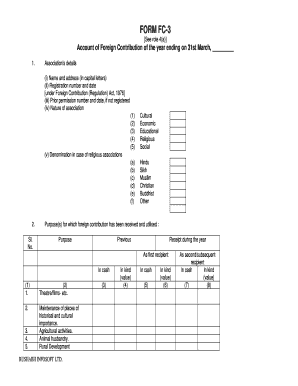

Forming a corporation in different jurisdictions

Incorporation requirements can change significantly across states, highlighting the need for thorough research. Each state's regulations may include different filing fees, timelines, and documentation requirements. For example, Delaware is known for its business-friendly laws and streamlined processes, making it a popular incorporation destination. In contrast, California has more stringent rules and higher fees.

Businesses considering incorporation should also be aware of special considerations for unique structures like nonprofit corporations or Limited Liability Companies (LLCs). Each type has specific requirements and compliance obligations that must be addressed at both the state and federal levels.

Understand state-specific incorporation laws before proceeding.

Consider the advantages of incorporating in states like Delaware.

Research nonprofit and LLC requirements to ensure compliance.

Additional tools and resources

Leveraging the right tools can greatly simplify the incorporation process. pdfFiller offers a comprehensive platform for document management, allowing users to create, edit, eSign, and collaborate on incorporation forms efficiently. Utilizing features such as interactive tools for form completion and document collaboration can streamline the ordinarily cumbersome process, helping users maintain accuracy.

With cloud-based convenience, businesses can access templates, track changes, and ensure all necessary paperwork is formatted correctly, making documents easy to manage regardless of location. Incorporating these tools ensures that businesses can focus on growth instead of getting bogged down by administrative hurdles.

Utilize pdfFiller's interactive tools for quick form completion.

Employ eSigning features for efficient document management.

Access diverse templates tailored for incorporation needs.

Exploring related topics

Understanding the legal aspects of incorporation forms lays the foundation for successful business operations. Moreover, contrasting various business structures, ensuring proper corporate governance to maintain continuity, and implementing effective internal controls to prevent fraud are strategic insights that businesses can capitalize on. Detailed consideration of incorporation, governance practices, and compliance can keep a business resilient and adaptable.

Additionally, for businesses eyeing global expansion, insights on international incorporation, including requirements and variances in compliance across different countries, can position entrepreneurs advantageously in a competitive marketplace.

Compare different business structures to find the best fit.

Establish internal controls to protect against fraud.

Explore global incorporation for multinational business strategies.