Get the free Form 990-EZ Instructions for 2024

Get, Create, Make and Sign form 990-ez instructions for

How to edit form 990-ez instructions for online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990-ez instructions for

How to fill out form 990-ez instructions for

Who needs form 990-ez instructions for?

Form 990-EZ Instructions for Form

Overview of Form 990-EZ

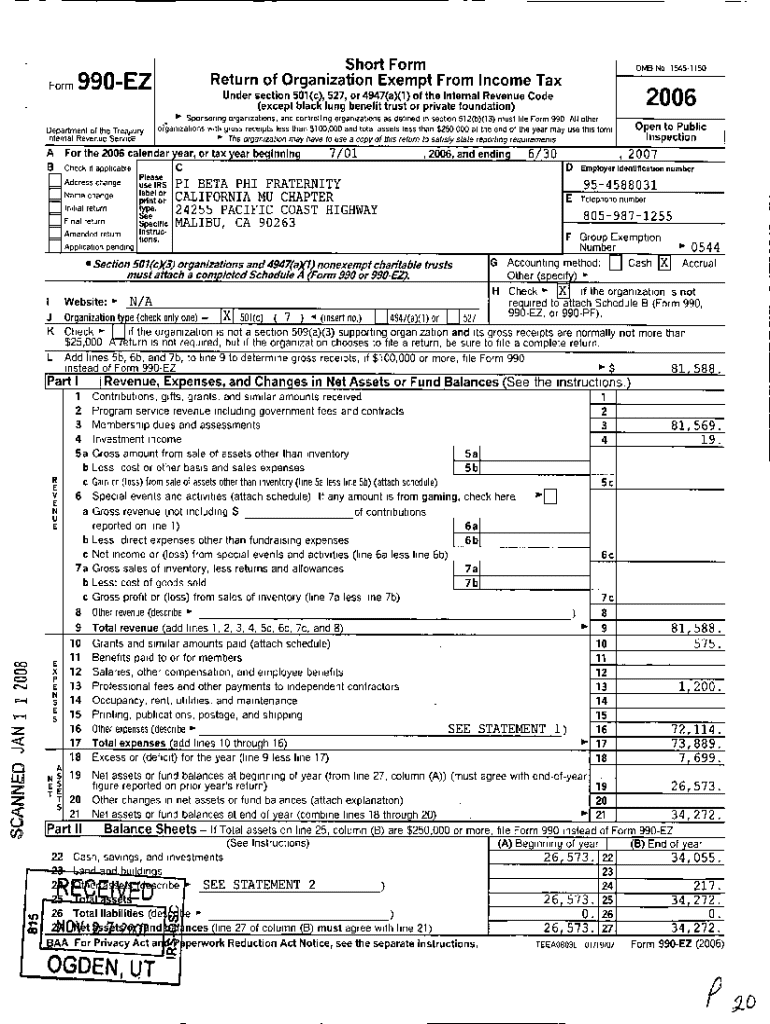

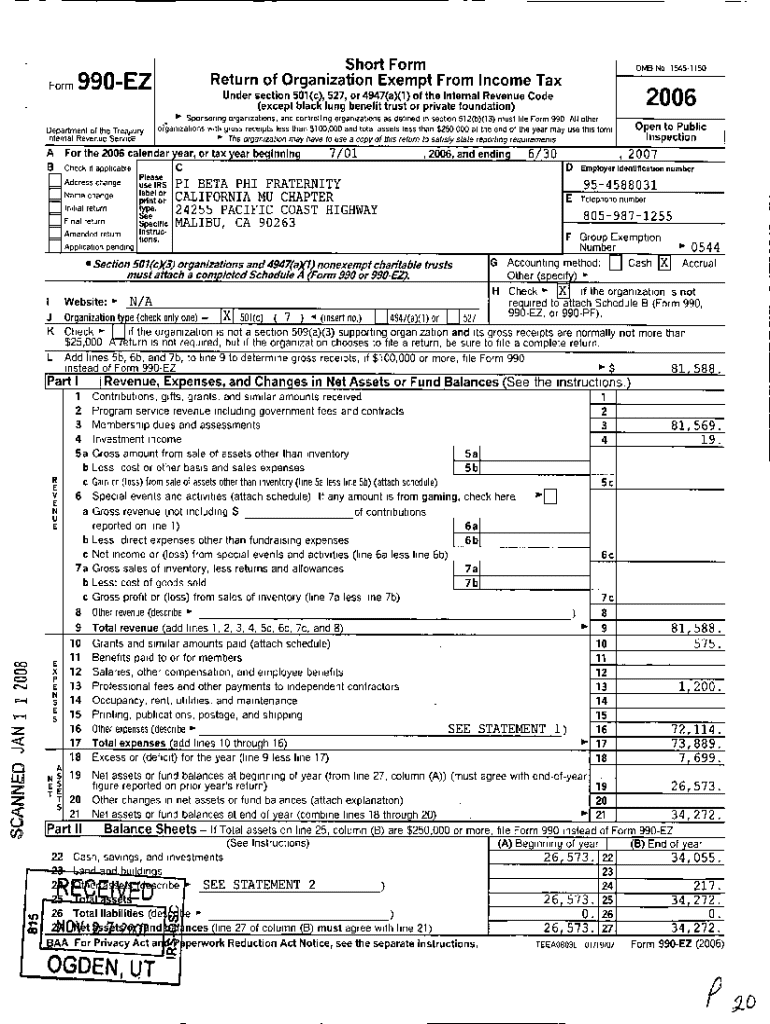

Form 990-EZ is a key financial reporting document for tax-exempt organizations, serving as a streamlined alternative to the more comprehensive Form 990. This form is essential for nonprofits that typically generate gross receipts of less than $200,000 and have total assets under $500,000. By filing Form 990-EZ, organizations share critical financial information with the IRS, ensuring transparency and promoting accountability within the nonprofit sector.

The primary purpose of Form 990-EZ is to provide a comprehensive overview of a nonprofit’s financial health, funding sources, and spending practices. By gathering essential details, this form serves to assure donors, stakeholders, and the IRS that resources are being utilized effectively.

Benefits of using Form 990-EZ

Form 990-EZ offers several advantages that make it a favored choice for smaller organizations. The simplicity of this form compared to the full Form 990 is one of its most significant selling points. It reduces the burden of reporting while still ensuring compliance with federal regulations, allowing smaller nonprofits to focus more on their missions rather than extensive paperwork.

Organizations benefit from a faster preparation time, enabling them to file more quickly and often receive their acknowledgment from the IRS sooner. Additionally, by opting for Form 990-EZ, organizations simplify their record-keeping, making financial data management more efficient.

Key features of Form 990-EZ instructions

The Form 990-EZ instructions are designed to help organizations navigate the complexities of financial reporting. One of the standout features of these instructions is its user-friendly approach, integrating interactive elements conducive to a streamlined filing process. By utilizing platforms such as pdfFiller, users can take advantage of enhanced document management solutions.

These features ensure that organizations can avoid common errors easily while maintaining the accuracy and integrity of their submissions.

Getting started with Form 990-EZ

To successfully file Form 990-EZ, organizations should follow a clear step-by-step process. The first step involves providing basic organizational information, including the organization's legal name, Employer Identification Number (EIN), and contact address. Accuracy in these details sets the foundation for a smooth filing experience.

Next, choosing the correct tax year is paramount. Failing to select the appropriate period can lead to discrepancies and potential compliance issues. Once this is established, organizations move onto reporting revenue and expenses. This involves creating a comprehensive overview in Part I of the form, ensuring all metrics are reported accurately.

Detailed instructions for completing Form 990-EZ

Completing Form 990-EZ requires attention to detail, especially for each part of the submission. In Part I, organizations report revenue, expenses, and any changes in net assets. A line-by-line breakdown is crucial here; erroneous data can lead to significant issues.

Part II focuses on the balance sheet, where assets and liabilities must be reported accurately. Understanding how to categorize financial data properly is essential to provide a clear financial picture to the IRS. The program service accomplishments in Part III require organizations to articulate their mission impact effectively, highlighting key programs and outcomes.

Filing requirements for Form 990-EZ

Timeliness is critical when filing Form 990-EZ. Organizations are required to file within five months after the end of their tax year. Understanding these deadlines is crucial to avoid penalties. Organizations must familiarize themselves with the electronic filing process as well, which has become increasingly popular due to its convenience and expedited processing.

Utilizing platforms like pdfFiller can significantly streamline this process. Users can submit their forms quickly and efficiently, taking advantage of e-filing features that reduce processing time and ensure prompt acknowledgment from the IRS.

Common challenges and solutions

Many nonprofits face challenges when completing Form 990-EZ. Common issues include errors and omissions, which can lead to IRS notifications and requests for correction. Understanding these potential issues before filing can help prevent unnecessary complications.

Solutions include thoroughly reviewing instructional materials and utilizing support tools from platforms like pdfFiller. These resources provide guidance on common mistakes and an option for live assistance through webinars, ensuring users can confidently navigate the filing process.

Additional forms and schedules related to Form 990-EZ

Organizations may find it necessary to file additional forms and schedules along with Form 990-EZ. For instance, Form 990-N is essential for smaller organizations that qualify for minimal reporting requirements, while Form 990-PF is targeted towards private foundations. Understanding these forms and citing relevant schedules can expand transparency and provide a complete financial overview to the IRS.

Specific situations and considerations

Certain conditions may exempt organizations from filing Form 990-EZ altogether. For instance, religious organizations or nonprofits earning below a specific revenue threshold might be exempt. Understanding these exemptions is crucial for compliance and for avoiding unnecessary filings.

Additionally, organizations must recognize the potential penalties for non-filing or late filing. These penalties can accumulate quickly, impacting the organization’s fiscal health and reputation. A proactive approach to meeting filing requirements can mitigate these risks.

Enhancing your filing experience

Using pdfFiller can immensely simplify the process of filing Form 990-EZ. The cloud-based management allows teams to access documents irrespective of location, promoting efficiencies in collaboration. With integrated e-signatures and streamlined organization of forms, nonprofits can keep all their essential documentation in one accessible location.

Moreover, leveraging collaboration tools fosters teamwork and accountability. Team members can easily contribute to the document, reviewing and editing in real-time to enhance accuracy and ensure thoroughness.

Final steps before submission

Prior to submission, a thorough review of the completed Form 990-EZ is essential. A checklist should include confirming organizational information, verifying revenue and expenses, and ensuring all required sections are filled out completely. This step minimizes the chance of errors that could lead to unnecessary delays or complications during processing.

After ensuring that everything is accurate, organizations submit their Form 990-EZ to the IRS. Understanding what to expect post-filing is crucial—typically, organizations will receive confirmation of receipt, which should be safely stored for record-keeping purposes.

Frequently asked questions (FAQs)

Organizations often have numerous questions about Form 990-EZ, ranging from filing procedures to understanding specific regulations applicable to their situation. Addressing these inquiries can significantly enhance the filing experience and reduce uncertainty. Since requirements may change over time, utilizing reliable sources such as pdfFiller’s support resources can ensure that organizations stay informed about the current best practices in filing.

Testimonials and success stories

Hearing from organizations that have successfully navigated Form 990-EZ can provide reassurance and practical examples for others. Testimonials often highlight how tools like pdfFiller have transformed their filing experience, making the process smoother, more efficient, and less daunting. By leveraging digital solutions, these organizations have enhanced their compliance and dedicated more time to their mission-driven work.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete form 990-ez instructions for online?

How do I edit form 990-ez instructions for in Chrome?

How can I edit form 990-ez instructions for on a smartphone?

What is form 990-ez instructions for?

Who is required to file form 990-ez instructions for?

How to fill out form 990-ez instructions for?

What is the purpose of form 990-ez instructions for?

What information must be reported on form 990-ez instructions for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.