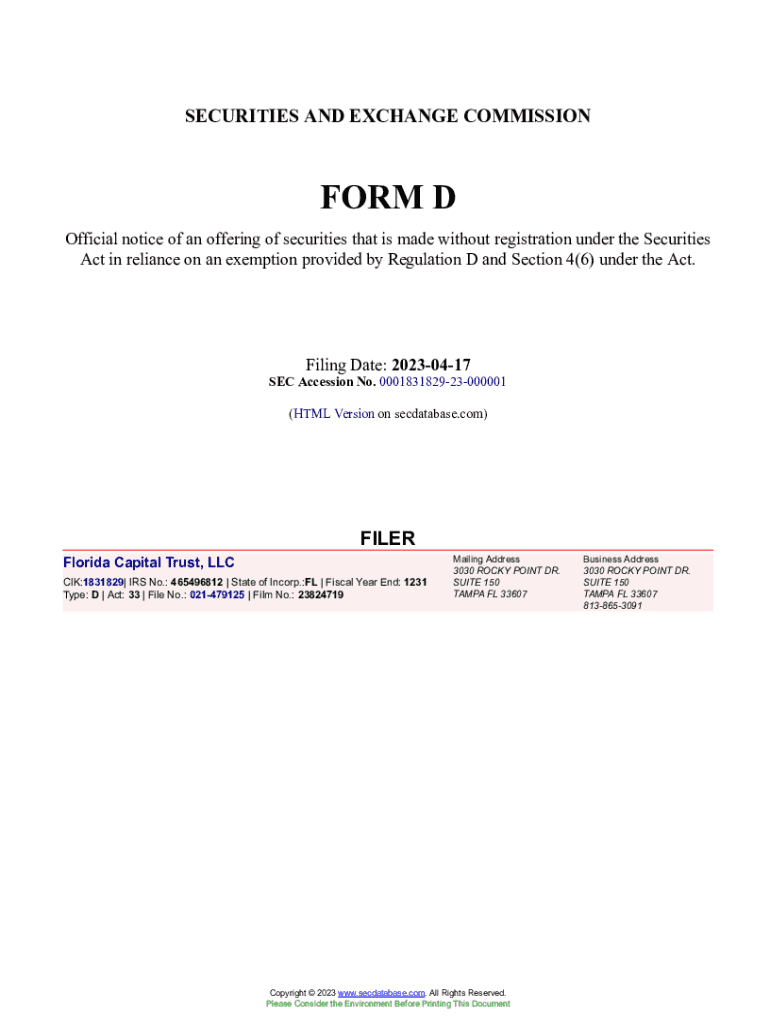

Get the free Florida Capital Trust, LLC Form D Filed 2023-04-17. Accession Number

Get, Create, Make and Sign florida capital trust llc

How to edit florida capital trust llc online

Uncompromising security for your PDF editing and eSignature needs

How to fill out florida capital trust llc

How to fill out florida capital trust llc

Who needs florida capital trust llc?

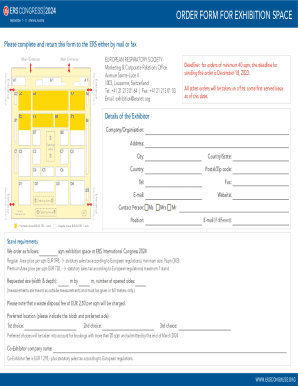

A comprehensive guide to the Florida capital trust form

Understanding the Florida capital trust form

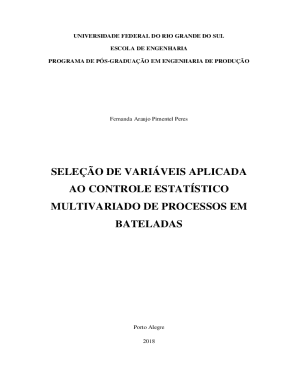

The Florida capital trust LLC form is essential for establishing a limited liability company (LLC) within the state of Florida. This document serves as the foundational legal instrument that formally creates the LLC, outlining the structure and operational parameters of the business. Its purpose is twofold: it not only creates a separate legal entity that protects the owners from personal liability but also establishes the framework for managing the business. By understanding this form, business owners can navigate the complexities of Florida’s legal requirements more effectively.

Incorporating a Florida capital trust LLC is an important step in business management, as it provides various benefits, such as limited liability protection, tax advantages, and increased credibility with clients and vendors. Additionally, it fosters a clear organization and structure for businesses, making it easier to operate efficiently. Entrepreneurs recognize the value of this form, as it lays the groundwork for future success.

Key components of the Florida capital trust form

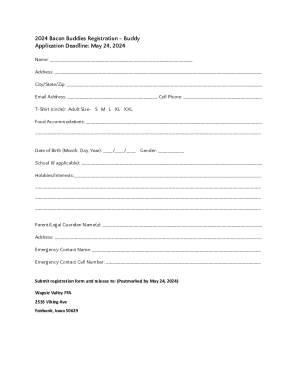

To complete the Florida capital trust LLC form, applicants must provide specific information:

Moreover, understanding the ownership structure is crucial, as it defines how the LLC’s ownership is laid out. This includes the following elements:

Lastly, the operating agreement essentials need to be meticulously defined, covering:

Step-by-step process to complete the Florida capital trust form

Completing the Florida capital trust LLC form can seem daunting, but breaking it down into manageable steps simplifies the process.

Common mistakes during this process often involve incorrect information, missing signatures, or failure to provide the proper documentation. Taking time to review the form can save headaches down the line.

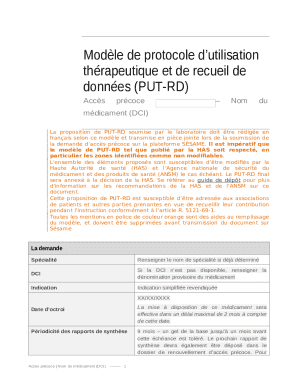

eSigning the Florida capital trust form

In an increasingly digital world, eSigning has become a convenient option for finalizing legal documents, including the Florida capital trust LLC form. The benefits of eSigning encompass not only added convenience but also enhanced security and time-saving efficiencies.

To eSign through pdfFiller, follow this step-by-step guide:

Security is also paramount when dealing with sensitive information. pdfFiller implements various features to safeguard your data, making it a trusted solution for eSigning.

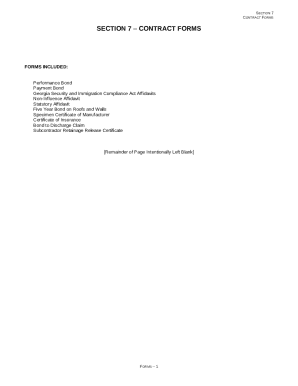

Managing your Florida capital trust documentation

Effective document management is crucial for Florida capital trust LLC owners. Organizing your documentation ensures quick access when needed, whether for compliance checks or audits.

Utilizing tools available on pdfFiller can enhance this organization. Here are a few strategies:

An organized approach not only minimizes the risk of losing important paperwork but also optimizes your operational efficacy.

Frequently asked questions (FAQs) about the Florida capital trust form

New business owners typically have several questions regarding the Florida capital trust LLC form. Below are some common inquiries:

Understanding these aspects can prepare entrepreneurs for the administrative tasks ahead.

Best practices for maintaining your Florida capital trust

Once your Florida capital trust LLC is established, ongoing maintenance is vital for long-term success. Here are some best practices to follow:

Implementing these practices ensures that your LLC remains compliant and well-organized, capable of navigating any challenges that may arise.

Success stories: How others have benefited from using the Florida capital trust form

Many entrepreneurs have successfully established their businesses using the Florida capital trust LLC form. Case studies highlight how this form facilitated seamless entry into the marketplace.

These stories showcase the practical benefits that accompany a well-executed LLC formation, especially when utilizing effective document management platforms.

Exploring additional resources related to Florida LLCs

When navigating the landscape of Florida LLCs, additional resources can prove invaluable. For those interested in expanding their knowledge, resources include legal templates, guidance on different LLC structures, and significant information regarding tax implications.

Utilizing every available resource can enhance compliance and operational effectiveness.

Advanced topics in capital trust management

Once a Florida capital trust LLC is established, the complexity of management can deepen, requiring a solid understanding of advanced strategies. Entrepreneurs should be aware of:

By committing to these advanced topics, Florida capital trust LLC owners can foster robust, successful businesses ready for the future.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify florida capital trust llc without leaving Google Drive?

Can I create an electronic signature for the florida capital trust llc in Chrome?

Can I edit florida capital trust llc on an iOS device?

What is Florida Capital Trust LLC?

Who is required to file Florida Capital Trust LLC?

How to fill out Florida Capital Trust LLC?

What is the purpose of Florida Capital Trust LLC?

What information must be reported on Florida Capital Trust LLC?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.