A Comprehensive Guide to the Transient Occupancy Tax Remittance Form

Understanding transient occupancy tax (TOT)

Transient occupancy tax (TOT), often referred to as hotel tax or lodging tax, is a tax imposed on individuals who occupy a room or suite in a hotel, motel, or other short-term rental accommodations. This form of taxation is critical for local municipalities as it generates revenue that can fund public services such as transportation, parks, public safety, and tourism initiatives. TOT serves as a significant financial resource for many communities, enhancing local infrastructure and quality of life.

The applicability of TOT can vary significantly from one jurisdiction to another, though it generally targets businesses that offer short-term lodging. This includes hotels, motels, vacation rentals, and even platforms facilitating short-term home rentals. Understanding which properties are subject to TOT is essential for compliance and ensures that all necessary taxes are collected and remitted timely.

Hotels and Motels – Traditional lodging establishments

Short-term rentals – Platforms like Airbnb or VRBO

Hostel and shared accommodations – Budget-friendly options

Bed and breakfast establishments – Unique lodging experiences

The transient occupancy tax remittance process

The process of remitting the transient occupancy tax involves several steps to ensure accuracy and compliance. It is vital for hosts and business owners to familiarize themselves with this process to avoid penalties and maintain good standing with local tax authorities. Below is a step-by-step guide to remitting TOT effectively.

Determine the reporting period. This is typically defined by your jurisdiction – most commonly monthly or quarterly.

Calculate the total gross receipts from your rentals. Be sure to account for any exemptions or deductions.

Using the appropriate tax rate, calculate the total tax due based on your gross receipts.

Fill out the transient occupancy tax remittance form accurately, ensuring that all information is up to date and correctly reported.

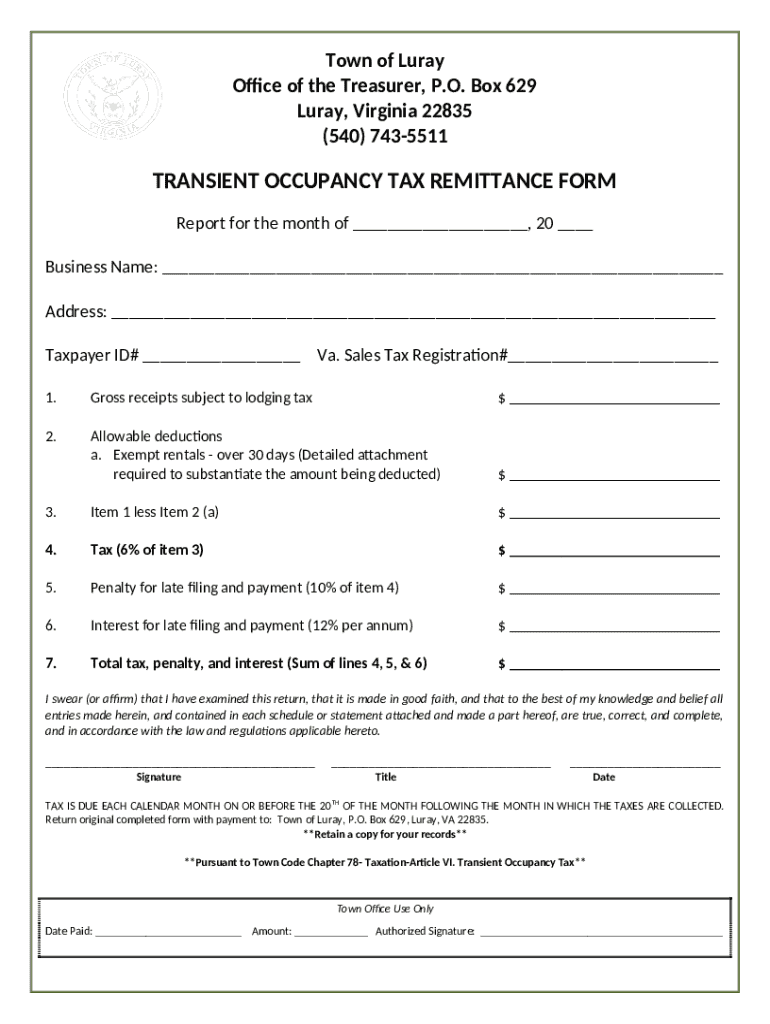

Detailed examination of the remittance form

The transient occupancy tax remittance form generally consists of several key components designed to collect essential information efficiently. Each section serves a specific purpose and requires careful attention to detail to avoid common pitfalls. Here’s a breakdown of what you can expect when completing this form.

Provide accurate contact details, including your name, address, and phone number.

Include information about the property such as its name, address, and type of rental.

This section requires you to input gross receipts, exemptions, deductions, and calculate the total tax due.

Common pitfalls to avoid include omitting information, using incorrect figures for tax calculations, and failing to take advantage of available exemptions. Double-checking your work can save you from future complications.

Utilizing tools like pdfFiller can greatly enhance your efficiency when completing the transient occupancy tax remittance form. Their platform allows users to edit, sign, and collaborate on documents, ensuring a smooth and streamlined process. pdfFiller also provides step-by-step walkthroughs to guide you through filling out the form accurately.

Filing and submission guidelines

Once your transient occupancy tax remittance form is complete, it is vital to understand the filing and submission guidelines to ensure your payments are timely and avoid late fees. The timelines for filing and payment can vary depending on the local jurisdiction, typically occurring monthly or quarterly.

Most jurisdictions will specify due dates for submissions, and it's essential to adhere to these timelines. Keep an updated calendar reminder for each reporting period to avoid missing deadlines.

Most jurisdictions allow online submissions for convenience. Check local tax authority websites for specific details.

Accepted methods usually include credit cards, e-checks, and sometimes cash or checks if submitting in person.

Troubleshooting common issues

Encountering issues when filing your transient occupancy tax remittance form is not uncommon. Whether it’s a missing payment, a late submission, or trouble locating the correct form, knowing how to address these challenges is crucial. Consequences for late payments can include fines or additional charges, so swift action is important.

If you are unable to locate your remittance form, start by checking your local tax authority's website. They often provide downloadable versions of the form. If you’ve already submitted the form but notice mistakes, contact your local tax office immediately to discuss rectifying the situation and avoid potential penalties.

Contact the tax office to verify the status of your account and payment records.

Settle any outstanding amounts quickly to minimize penalties.

Request instructions from the local authorities on how to amend an incorrect submission.

Exemptions and special cases

While transient occupancy tax applies to most short-term rentals, there are exemptions and special circumstances worth noting. Some properties may qualify for tax exemption due to specific criteria determined by local regulations. For instance, rentals that cater primarily to government officials, non-profit organizations, or other specific groups might find themselves exempt.

To apply for an exemption, you typically need to complete a request form and provide documentation supporting your claim. For property owners with seasonal rentals, it’s also crucial to familiarize yourself with local rules regarding the occupancy periods that may impact your tax obligations.

Rental type, length of stay, specific demographic of renters.

Understand local regulations around occupying properties seasonally.

Follow up with local authorities about the correct procedures when selling or closing a rental.

Frequently asked questions (FAQs)

Navigating the realm of transient occupancy tax can raise numerous questions. Frequently, hosts and businesses wonder what specific inclusions make up gross revenue or how to accurately calculate their tax liability. Our insights below aim to provide clarity on these common inquiries.

Gross revenue typically includes all rental payments received, cleaning fees, and additional service charges.

Multiply your gross revenue by the applicable TOT rate set by your jurisdiction.

Certain jurisdictions may provide guidelines for reduced tax rates or exemptions based on occupancy levels.

Keeping records and compliance

Maintaining accurate records is essential for compliance and can significantly simplify the process of preparing your transient occupancy tax remittance form. Not only does good record-keeping ensure you meet legal requirements, but it also aids in a smoother audit process if necessary.

Best practices for maintaining your tax records include keeping detailed accounts of all rental transactions, receipts for expenses, and communication with your local tax authority. It’s advisable to retain these records for a minimum of three to five years and to organize them methodically to facilitate any audits or reviews.

Use digital tools or spreadsheets to track income and expenditures consistently.

Maintain records for at least 3-5 years as per standard regulations.

Contact information and support

When issues arise or questions persist regarding the transient occupancy tax remittance form, knowing where to seek assistance is paramount. Local tax administration offices often provide specific guidance and support tailored to your community.

Moreover, utilizing resources from platforms like pdfFiller can be indispensable. They offer comprehensive support services and can guide you through the nuances of document management, ensuring a smooth filing experience.

Related information and resources

To stay informed about transient occupancy tax obligations and best practices, accessing reliable information from local tax authority websites, regulations documentation, and industry-specific community forums can be invaluable. Engaging with tax professionals can also provide personalized assistance as needed.

pdfFiller enhances document management beyond just remittance forms. With features such as eSignature, collaborative editing, and cloud storage, it empowers users to manage a plethora of documents while ensuring compliance and efficiency.