Get the free Working After Retirement Forms

Get, Create, Make and Sign working after retirement forms

How to edit working after retirement forms online

Uncompromising security for your PDF editing and eSignature needs

How to fill out working after retirement forms

How to fill out working after retirement forms

Who needs working after retirement forms?

Working After Retirement Forms Form - A Comprehensive Guide

Understanding the concept of working after retirement

Retirement signifies a significant transition in an individual's life, often marked by the cessation of full-time employment. However, many retirees find themselves drawn to post-retirement work for several reasons, including financial stability, personal fulfillment, and social engagement. Despite having completed their primary career, individuals may choose to continue working in different capacities that align more closely with their passions.

Choosing to work after retirement can serve multiple purposes. For some, financial needs may necessitate income, while others pursue work to remain active and engaged within the community. Regardless of individual motivations, there are key benefits to working after retirement, such as maintaining cognitive function, fostering social interactions, and enjoying a sense of purpose.

Types of employment available post-retirement

Post-retirement work can take several forms, each catering to different preferences, schedules, and financial needs. Here are some options:

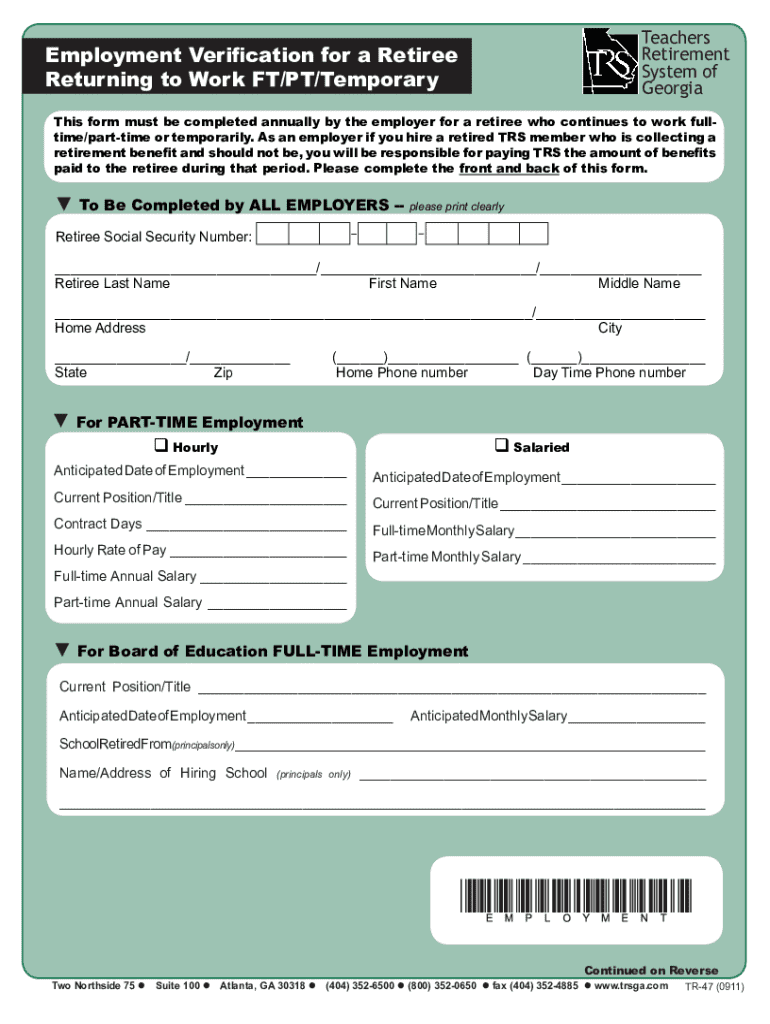

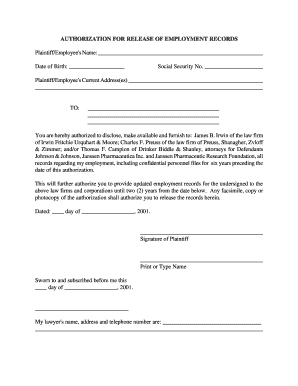

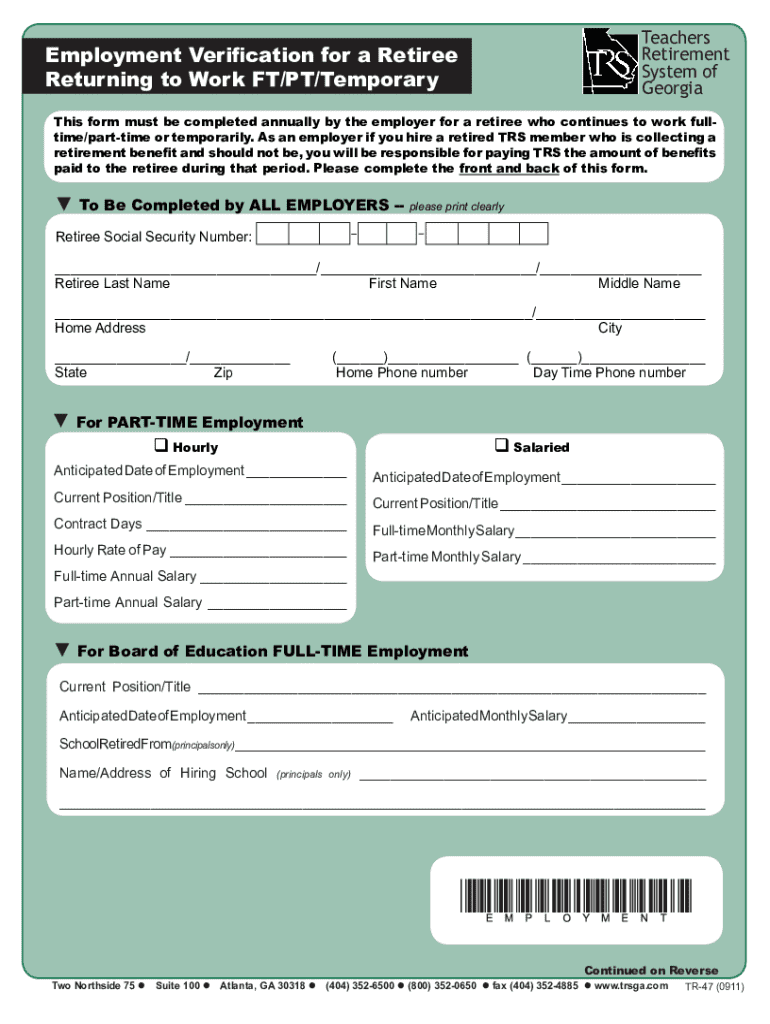

Key forms and documentation required for retirees

To optimize post-retirement employment experiences, retirees must familiarize themselves with specific documentation, notably the Working After Retirement Form. Understanding its purpose and importance can help ensure a smoother transition back into the workforce.

Accessing and filling out necessary forms is crucial. For instance, pdfFiller provides users with the ability to download and manage forms seamlessly. Here's a step-by-step guide to filling out the Working After Retirement Form:

Legal and regulatory considerations

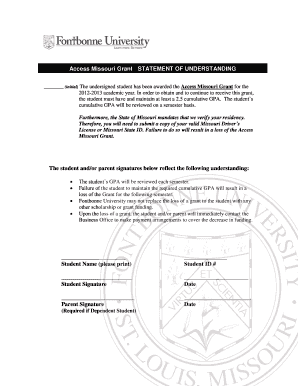

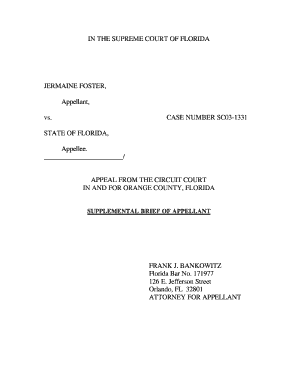

Understanding your rights as a retiree is essential when considering post-retirement work. Familiarity with specific regulations can help protect individuals from potential missteps. Sections 211 and 212 of the General Municipal Law, for example, outline important factors that may affect work options for retirees.

It's also important to consider reporting and disclosure requirements when returning to work. Maintaining accurate records of employment can prevent unwanted complications and ensure compliance with state and federal regulations.

Financial implications of working after retirement

Retirees must consider how their earnings will impact their finances, especially regarding tax implications. Different tax forms, such as W-2 for traditional employment and 1099-R for retirement income, play pivotal roles in managing finances.

Additionally, it's vital to understand how working might affect pension and Social Security benefits. Earnings limits often apply, and crossing those thresholds can lead to reduced benefits, so careful assessment is crucial.

Strategies for successfully managing work and retirement

Balancing work and retirement requires intentional strategies that emphasize health and well-being. It’s essential to prioritize time management and create a structured schedule that accommodates both work duties and leisure activities.

Moreover, maintaining a healthy work-life balance is critical. Engaging in hobbies, spending time with family, and prioritizing self-care should remain integral parts of life to avoid burnout.

Frequently asked questions (FAQ)

Post-retirement work raises several common questions: What are the implications of returning to work on retirement benefits? How will earning additional income affect my tax situation? Is working after retirement really beneficial?

Addressing these queries effectively clarifies misconceptions and empowers retirees to make informed decisions regarding their post-retirement paths.

Insights on volunteering vs. paid work post-retirement

Volunteering offers personal fulfillment that paid work may not always provide. Many retirees find great joy in supporting their communities through charitable work and learning new skills while volunteering.

Transitioning from volunteer work to paid opportunities can also be beneficial, providing valuable experience and networking chances that enhance one's prospects in the job market.

Understanding employer regulations and limitations

Different employers have specific regulations concerning employed retirees. Understanding policies related to reemployment can help retirees avoid disruptions in benefits. These regulations can significantly differ based on whether the retiree holds a disability status, making it essential to know the implications of returning to work.

Tools and resources for navigating post-retirement work

Managing forms and documentation shouldn’t be a headache. pdfFiller empowers retirees with tools to create, edit, sign, and share important forms in a user-friendly cloud-based platform. This accessibility is crucial for navigating the complexities surrounding post-retirement work.

Furthermore, online communities and support networks provide avenues for retirees to connect and share experiences, while ongoing opportunities for skill development can help retirees remain competitive in the job market.

Additional insights on future trends in post-retirement employment

The gig economy continues to expand, presenting new opportunities for retirees seeking flexible work arrangements. Additionally, lifelong learning initiatives allow retirees to engage in training programs that enhance their skill sets, vital for embracing evolving job markets.

Adapting to technological advancements also empowers retirees to use digital tools effectively, bridging generational gaps in workplace settings and enhancing job prospects.

Get in touch with experts at pdfFiller

When navigating the landscape of working after retirement, having access to professional assistance for filling out forms is invaluable. pdfFiller offers customer support and an array of resources that cater to retirees, ensuring they have the tools needed for successful document management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit working after retirement forms on a smartphone?

How do I fill out working after retirement forms using my mobile device?

How do I complete working after retirement forms on an iOS device?

What is working after retirement forms?

Who is required to file working after retirement forms?

How to fill out working after retirement forms?

What is the purpose of working after retirement forms?

What information must be reported on working after retirement forms?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.