Find your national insurance form: A comprehensive guide

Understanding the national insurance number

A National Insurance Number (NIN) serves as a unique identifier for individuals in the UK when it comes to managing their contributions towards social security, pensions, and tax. Essentially, it ensures that the work you do and the taxes you pay are correctly recorded against your name.

The importance of your National Insurance Number cannot be overstated. It's crucial for various official processes such as applying for a job, claiming benefits, and accessing healthcare services. Without a NIN, you might find it challenging to navigate through these essential aspects of life.

Who needs a National Insurance Number? Generally, anyone who is 16 years or older and plans to work or study in the UK should have one. This includes citizens and residents, as well as non-UK residents looking to contribute to the UK’s social security system.

When you may need to find your national insurance form

Several life situations may prompt the need to find your National Insurance Form. Starting a new job is the most common scenario where you are required to provide or confirm your National Insurance Number. Employers need this number to ensure that your tax contributions are processed correctly.

Applying for benefits or credits is another critical occasion. Whether you are considering Universal Credit, Jobseeker's Allowance, or other welfare programs, having your NIN readily available simplifies the application process.

Common life events, such as moving back to the UK after some time abroad or transitioning from school to work, may also require you to locate your National Insurance Form swiftly.

How to find your national insurance number

Your National Insurance Number can be located in several places. Most commonly, it appears on your payslips, personal tax documents, and any correspondence from HM Revenue and Customs (HMRC). Therefore, checking previous payslips or tax returns can save you time.

If you're struggling to find your number, there are methods to easily retrieve it. You can use online verification through pdfFiller, where you can access and manage documentation seamlessly. Alternatively, you can request your NIN by post through HMRC or reach out via phone support for immediate assistance.

Finding it in personal tax documents

Checking previous HMRC letters

Eligibility to apply for a national insurance number

To apply for a National Insurance Number, certain criteria must be met. Generally, you can apply if you are 16 or older, reside in the UK, or are working in the UK. However, specific cases like non-UK residents seeking employment can also apply, provided they have the right to work.

When applying, it's essential to prepare the necessary supporting documents such as proof of identity (passport or national ID), residency verification (utility bill or bank statement), and any other paperwork to prove your eligibility status.

Finding your national insurance form

Various National Insurance Forms cater to different situations. For instance, the CA5403 form is used primarily for individuals looking to claim National Insurance credits that support their eligibility for certain benefits and pensions. This form, among others, is vital in ensuring that you're correctly registered and contributing to the National Insurance system.

Accessing the National Insurance Form is straightforward. You can easily download the required forms from pdfFiller’s repository, or use their interactive tools for quick and easy access to the necessary documents tailored to your situation.

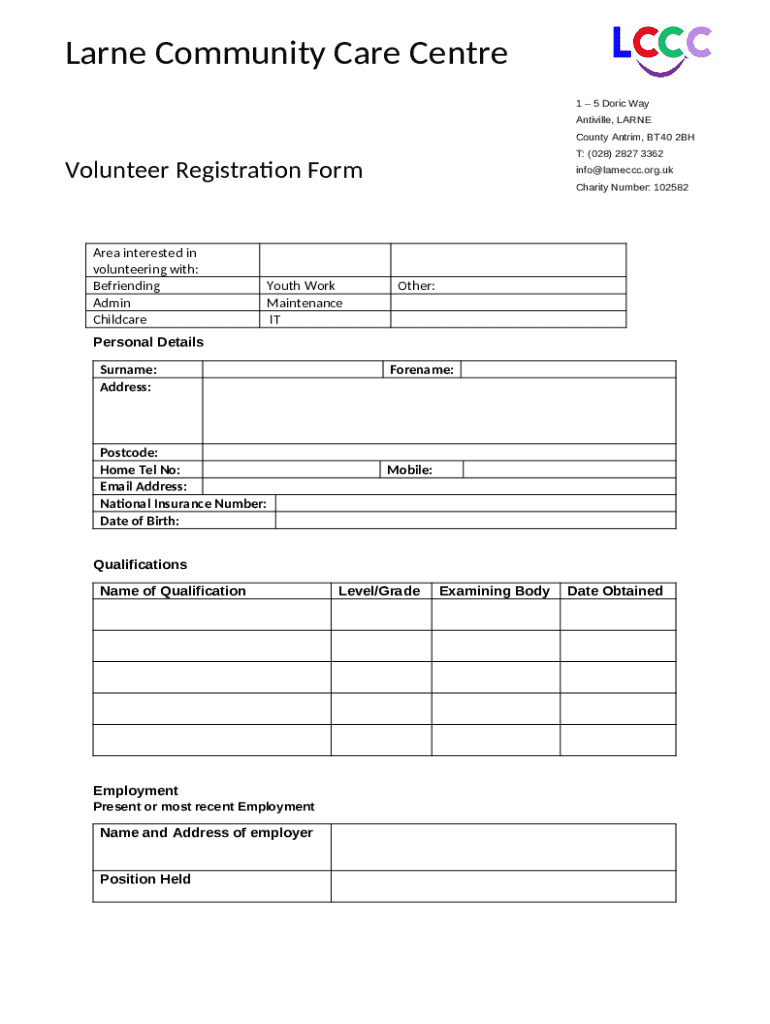

Filling out your national insurance form

Completing your National Insurance Form requires careful attention to detail. Begin by ensuring you include your full name, National Insurance Number, and any relevant details such as your address. It's important to double-check all entries to avoid mistakes that could delay processing.

Common mistakes to avoid include providing incorrect personal details or failing to sign the form. To enhance efficiency, consider utilizing pdfFiller’s features, which allow you to edit your PDFs easily, ensuring that your documents look professional and are free from errors before submission.

Ensure full name and address are accurate

Verify your National Insurance Number

Sign the form appropriately

Submitting your national insurance form

Once you’ve filled out your National Insurance Form, it’s time to submit it. There are several options available. If your form allows for online submission, this is generally the fastest method. You may also mail the completed form to HMRC, ensuring you use the correct address listed on the official guidelines.

For those who prefer a personal touch, in-person submission at your local HMRC office is an option as well. After sending in your application, you might wonder about the status. You can check your application progress through pdfFiller, which offers tracking features for easy updates.

Online submission processes

Mailing instructions for HMRC

In-person submission details

Resolving issues with your national insurance number

Issues surrounding your National Insurance Number can arise from time to time. A lost or forgotten NIN, for example, can be quite distressing, while incorrect information on your National Insurance Form can lead to further complications. Understanding how to resolve these issues is crucial.

If you find yourself facing problems, contacting HMRC directly is often the quickest solution. They provide several communication channels that can assist you in retrieving your number or correcting any discrepancies. Additionally, pdfFiller can help manage and store your documents, allowing you to keep track of all essential paperwork effortlessly.

Contact HMRC for lost numbers

Use pdfFiller for document management

Resolve incorrect information promptly

Frequently asked questions (FAQs)

It can be helpful to address some of the common questions surrounding National Insurance Numbers. For example, what if your application for a National Insurance Number is rejected? In such cases, reviewing the reasons for the rejection and addressing any issues mentioned is essential for a successful re-application.

Another frequently asked question revolves around the timeline for receiving your National Insurance Number. Generally, you can expect to receive your number within a few weeks after your application is processed, depending on HMRC's workload. Finally, if errors were made on the form after submission, contacting HMRC promptly is vital for rectifying those mistakes.

Additional assistance and support

For those seeking further help with their National Insurance forms, leveraging pdfFiller can enhance your experience. With robust document management solutions, you can easily adjust, fill, and manage forms with clarity and confidence. Additionally, check the FAQs and support sections on pdfFiller for any additional queries you may have regarding your documentation.

If you ever find yourself needing to speak to a representative, contacting local HMRC offices can offer support tailored to your situation, ensuring all your questions are effectively addressed.