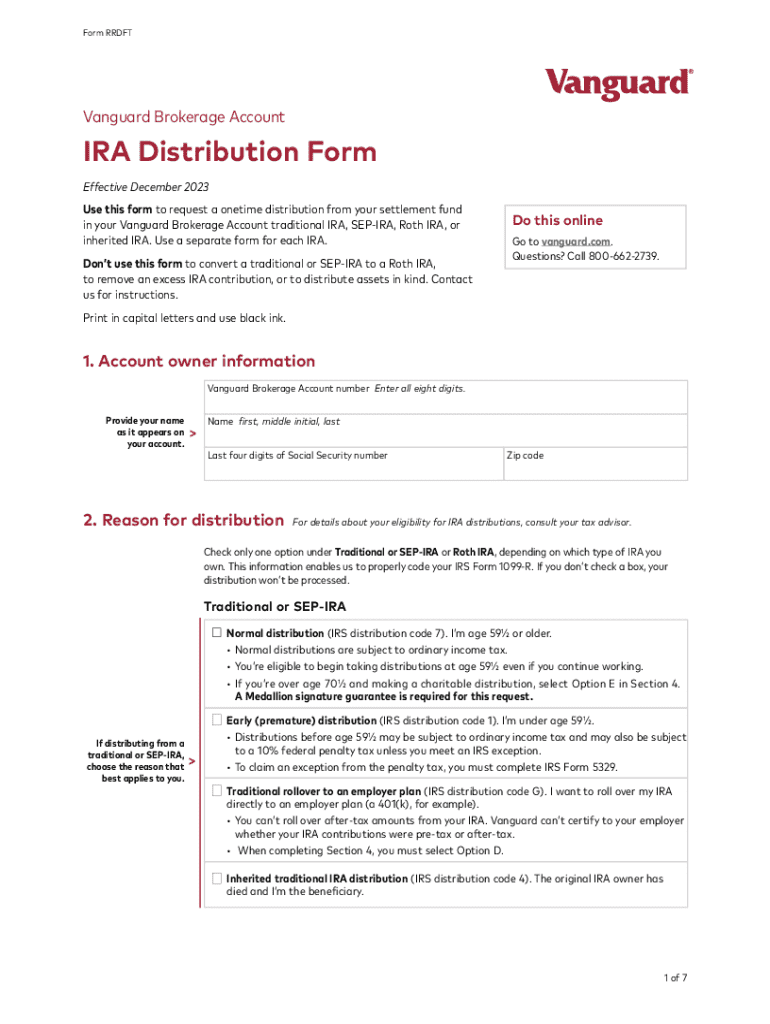

Get the free Vanguard IRA Distribution Kit & Form

Get, Create, Make and Sign vanguard ira distribution kit

How to edit vanguard ira distribution kit online

Uncompromising security for your PDF editing and eSignature needs

How to fill out vanguard ira distribution kit

How to fill out vanguard ira distribution kit

Who needs vanguard ira distribution kit?

A Comprehensive Guide to the Vanguard IRA Distribution Kit Form

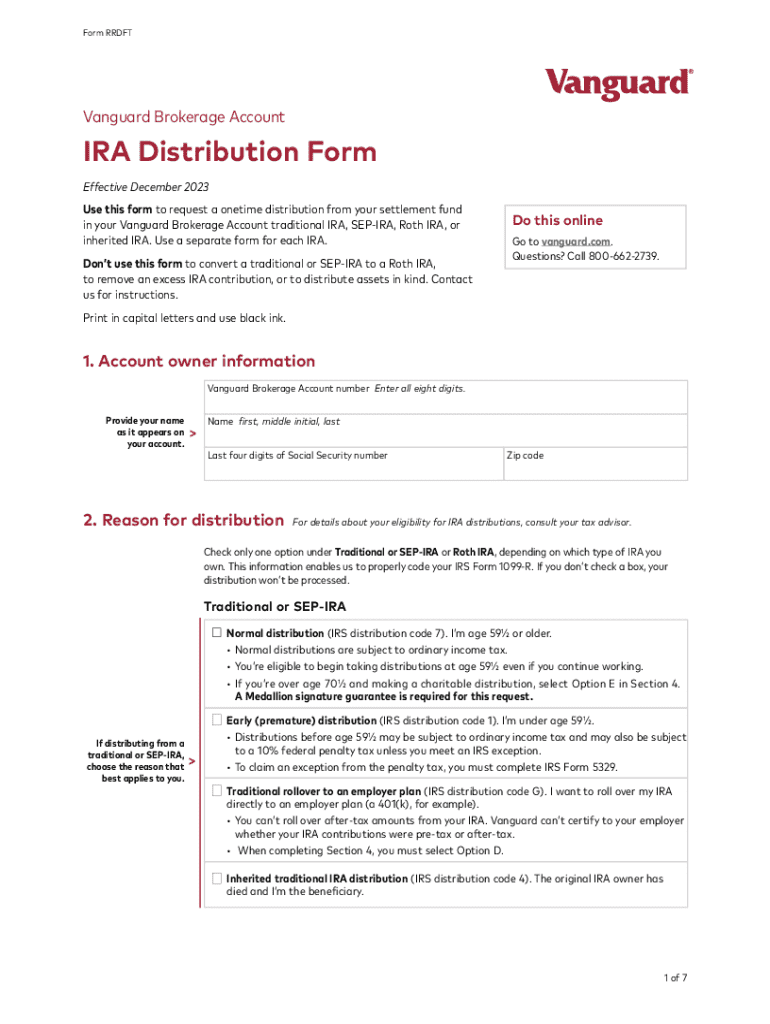

Overview of the Vanguard IRA Distribution Kit

The Vanguard IRA Distribution Kit is an essential resource for individuals looking to make withdrawals from their Individual Retirement Accounts (IRAs). Designed to simplify the process, this kit provides a structured approach to help account holders navigate their distribution options effectively. By comprehensively detailing the necessary information and procedures, it serves not only as a form but also as a roadmap for making informed financial decisions during retirement.

Understanding the importance of the Vanguard IRA Distribution Kit is integral to efficient retirement planning. It allows individuals to withdraw funds when needed, such as for emergencies or planned expenses, while ensuring compliance with tax regulations. By utilizing this kit, users can mitigate mistakes that could lead to costly tax implications or penalties, providing peace of mind as they manage their retirement savings.

Understanding IRA distributions

IRA distributions refer to the withdrawal of funds from an Individual Retirement Account, a fundamental aspect of managing retirement savings. These distributions can occur at various points during retirement, allowing account holders to access their funds as needed. Understanding the different types of distributions and their implications is crucial for effective financial planning.

Types of distributions can vary significantly, including regular distributions taken at or after retirement age, as well as early withdrawals subject to penalties. Additionally, IRA holders can opt for rollovers and transfers to move funds into other accounts without incurring immediate tax liabilities. Each option comes with its own set of rules and potential impacts on taxable income, which must be carefully considered.

Tax implications play a significant role in the decision-making process concerning IRA distributions. Generally, the amount withdrawn is added to the taxpayer’s gross income and taxed accordingly. Moreover, IRA holders must adhere to specific withholding requirements to ensure that sufficient taxes are paid upfront, preventing unexpected liabilities during tax season.

Accessing the Vanguard IRA Distribution Kit

Finding the Vanguard IRA Distribution Kit is a straightforward process that can be done through the Vanguard website. Users can navigate to their accounts or search for the distribution kit directly in the resources section. This accessibility ensures that users can obtain the necessary forms whenever they need them, eliminating delays in withdrawal processing.

To effectively locate the form, follow these steps: Visit the Vanguard website, log in to your account, and navigate to the ‘Forms & Literature’ section. There, you will find a dedicated category for ‘Distribution Forms.’ This section provides easy access to the IRA Distribution Kit and any other relevant documents. Keeping the kit at hand, whether in print or digital formats, is advantageous for planning.

Detailed steps to complete the Vanguard IRA Distribution Kit form

Before filling out the Vanguard IRA Distribution Kit Form, it’s essential to gather necessary information, such as your Social Security number, account details, and tax identification information. Doing so will ensure a smoother completion process. Additionally, being aware of common pitfalls, such as incorrect account numbers or missing signatures, can save time and prevent delays.

Completing each section of the form involves specific details. For personal information, pay close attention to spelling and accuracy to match your accounts. When selecting the type of distribution, carefully read descriptions to make informed choices that suit your current financial situation. Tax withholding preferences must also adhere to your overall tax strategy, so consultation with a tax advisor may be beneficial.

Finally, when it comes to signatures, ensure your signature is legible and properly executed. The option of digital signatures is available, facilitating ease of use; however, ensure compliance with relevant laws regarding electronic signatures in your jurisdiction. Once completed, submit the form following the instructions provided within the kit.

Interactive tools for managing your IRA distribution

Managing your IRA distributions efficiently can greatly enhance your retirement planning experience. Utilizing online tools such as calculators can assist in estimating the amount of withdrawal you might need. These tools take into account your financial goals and current income, providing a clearer picture of how withdrawals will impact your overall tax situation. By planning effectively, you can anticipate necessary adjustments in your financial landscape.

In addition to calculators, document management solutions such as pdfFiller enable users to store and keep track of their submissions with ease. By holding onto past forms and necessary correspondence, users can streamline future withdrawals. Easy access to these records aids in record-keeping during tax season and prompts financial reviews as retirement progresses.

Frequently asked questions (FAQs)

When using the Vanguard IRA Distribution Kit, users often have questions regarding the process. Common inquiries include situations where personal information changes after submission. In such cases, it’s essential to contact Vanguard immediately to update details or verify the status of your distribution. This proactive approach can prevent future complications that might arise from outdated information.

Another frequent concern is the processing time for distributions. Generally, IRA distributions are processed within five to ten business days, depending on the completeness of the submitted form and the type of distribution requested. Being aware of these timelines can help you manage your financial obligations effectively. To troubleshoot common issues, such as incorrect information submissions, contact Vanguard's support for guidance on proper resubmission.

Additional forms related to IRA distributions

Along with the Vanguard IRA Distribution Kit, users may encounter various supporting documentation required for their retirement account transactions. These forms may include tax forms, direct transfer forms, or additional requests related to financial transactions. Being meticulous in filling out each form accurately not only aids in effective service but also significantly reduces delays in processing.

For easy access to other essential forms, users can find relevant documents in the ‘Forms & Literature’ section of the Vanguard website. This ensures that alongside the distribution kit, you have all required documents at your fingertips, streamlining processes and interactions with Vanguard.

Contacting Vanguard for assistance

When issues arise or questions persist regarding the Vanguard IRA Distribution Kit, seeking assistance from Vanguard’s customer support is highly recommended. Vanguard offers various support options, including direct contact through phone or secure messaging, ensuring personalized help tailored to your unique situation. Their representatives are typically well-trained to address specific inquiries and provide timely resolutions.

For more immediate support, utilizing online chat features or exploring their extensive FAQs can provide quick answers to most commonly asked questions. Additionally, community resources like online forums can connect you with other Vanguard users, allowing for shared knowledge and experience about best practices when handling retirement distributions.

Final thoughts on using the Vanguard IRA distribution kit

Effectively utilizing the Vanguard IRA Distribution Kit plays a significant role in ensuring a smooth financial journey towards retirement. By understanding and accurately completing the distribution process, individuals can maintain control over their retirement funds, ensuring that they are used wisely and compliant with regulatory demands. This proactive management is vital in today's ever-changing financial landscape.

Being informed about different distribution options and maintaining timely withdrawals can further enhance your retirement experience. Staying updated on the Vanguard IRA guidelines and available resources will empower you to make informed decisions that contribute positively to your financial future.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify vanguard ira distribution kit without leaving Google Drive?

How can I edit vanguard ira distribution kit on a smartphone?

How do I complete vanguard ira distribution kit on an iOS device?

What is vanguard ira distribution kit?

Who is required to file vanguard ira distribution kit?

How to fill out vanguard ira distribution kit?

What is the purpose of vanguard ira distribution kit?

What information must be reported on vanguard ira distribution kit?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.