CARES Act Emergency Financial Form - How-To Guide

Understanding the CARES Act basics

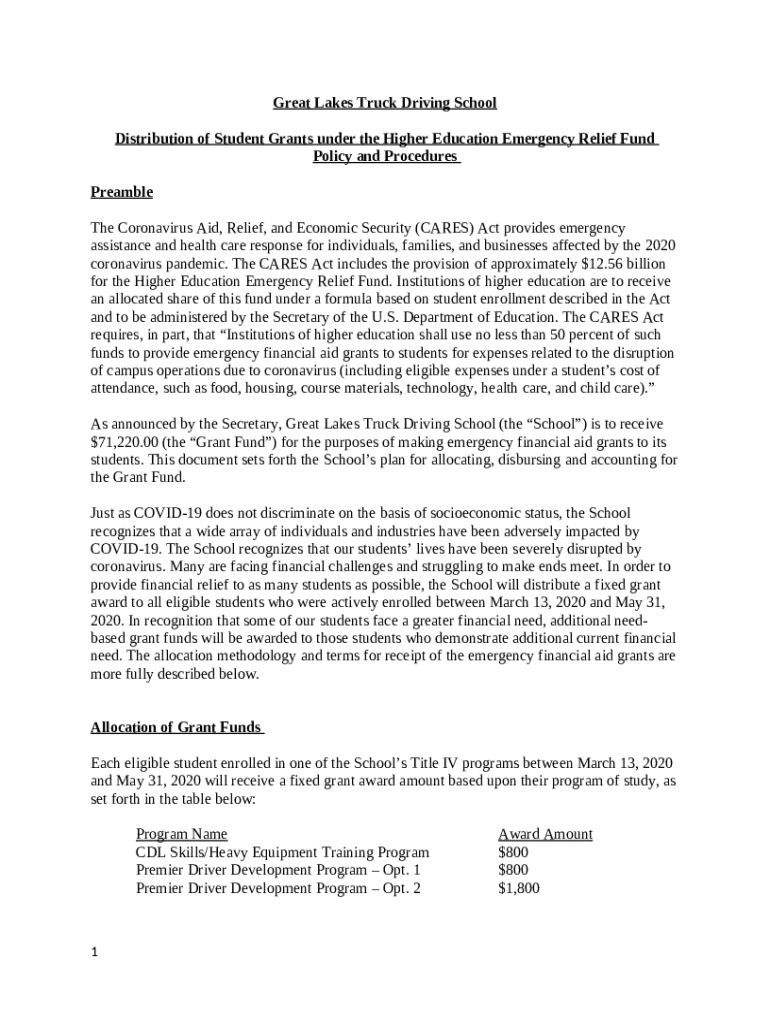

The Coronavirus Aid, Relief, and Economic Security (CARES) Act was enacted on March 27, 2020, as part of the federal government's response to the COVID-19 pandemic. The primary purpose of this legislation is to provide economic relief to individuals, businesses, and industries severely impacted by the pandemic. Among its many provisions, the CARES Act offers Emergency Financial Aid Grants to ensure that students and educational institutions have the necessary resources to navigate these unprecedented times.

Emergency Financial Aid Grants are designed to help students cover expenses related to the disruption of their educational experience due to COVID-19. These expenses can include tuition, food, housing, health care, and childcare. To take advantage of this funding, students must meet specific eligibility criteria, which generally include being enrolled in an eligible institution and having completed a Free Application for Federal Student Aid (FAFSA) or equivalent.

Students enrolled in a degree or certificate program at an eligible institution.

Students who have completed a FAFSA or equivalent documentation.

Students who were impacted by the COVID-19 pandemic, necessitating additional financial support.

The process for applying for these grants generally involves completing the CARES Act Emergency Financial Form, which allows institutions to assess the financial needs of their students accurately.

Accessing the emergency financial form

To apply for financial aid under the CARES Act, you will need to access the CARES Act Emergency Financial Form. This crucial document serves as the application you submit to your institution for evaluation and potential support. Students can usually find the form on their college or university's website, often located in the financial aid section. The importance of this form cannot be overstated, as it initiates the application process.

Many institutions also provide this form in different formats, making it accessible to all. Options generally include downloadable PDFs and online forms. This flexibility ensures that students can easily fill out and submit the document according to their preferences.

Visit your school's financial aid webpage.

Locate the CARES Act Emergency Financial Form link.

Choose between downloading the form or filling it out online.

Preparing to fill out the form

Before you start filling out the CARES Act Emergency Financial Form, it’s important to gather the necessary documents that will support your application. This preparation will help you complete the form accurately and efficiently.

Key documents to have on hand include personal identification, financial documentation such as income statements and bills, and enrollment verification if applicable. Understanding the questions on the form is equally important, as each section is designed to capture specific financial information needed for the evaluation.

Personal identification, such as a driver’s license or student ID.

Financial documentation, including recent pay stubs, tax returns, or bank statements.

Enrollment verification, which may involve transcripts or a letter from your institution.

Familiarizing yourself with the form's key sections and the associated terminology will enable you to fill it out correctly and may make the process smoother.

Step-by-step instructions for completing the form

Completing the CARES Act Emergency Financial Form can be straightforward if you follow a systematic approach. Here’s a breakdown of each section to help guide your submission.

Section 1 typically requires basic personal information, including your name, address, and Social Security Number. Ensure that this information is accurate to prevent delays in processing.

Section 2 dives into your financial information. This includes detailing your income sources and amounts, as well as any additional expenses incurred due to COVID-19, such as unexpected medical bills or increased utility costs. Be as detailed as possible.

If applicable, Section 3 will ask about your academic information. This section may require details about your enrollment status and other pertinent information about your institution.

Finally, Section 4 is crucial; it includes a certification and signature area. It’s important to emphasize that all information provided must be accurate and honest, as submitting false information can have serious consequences. If you’re filling out the form electronically through platforms like pdfFiller, you can conveniently use their e-signature feature for this section.

Submitting the form

After completing the CARES Act Emergency Financial Form, the next step is to submit it according to your institution's guidelines. Submission methods may vary; some schools allow for electronic submission while others may require mailing a hard copy. Referencing specific instructions from your institution's website will help ensure compliance with their preferred submission method.

Be mindful of important deadlines associated with submitting your application. These deadlines vary by institution, and timely submission is crucial for consideration. Once you’ve submitted your form, you should receive confirmation of its receipt. Keeping track of your submitted application helps in follow-up inquiries if needed.

Follow your institution's specific submission instructions.

Mark important deadlines on your calendar.

Look for confirmation of your submission from your institution.

Tracking your application status

Staying informed about your application status after submitting the CARES Act Emergency Financial Form is essential. Most institutions provide a way to check the status of your application, whether through an online portal or by direct inquiry with the financial aid office.

Developing a list of contact points for inquiries will streamline the process, enabling you to communicate effectively should any questions arise. Be sure to utilize your institution's resources, as they will be the best source of more detailed information regarding your application.

Access your institution’s financial aid portal for application status updates.

Contact the financial aid office directly for personalized assistance.

Utilize online tracking tools provided by your institution if available.

FAQs about the CARES Act emergency financial aid

As you navigate the application process for the CARES Act Emergency Financial Aid, you may have questions about eligibility and funding. Common inquiries generally include what expenses are deemed eligible for reimbursement, how long the processing time may take, and whether there could be tax implications of receiving aid.

Most institutions aim to process applications promptly, often notifying students within a few weeks. Regarding tax implications, the IRS has provided guidance indicating that funds received through these emergency grants do not generally count as taxable income, but it’s advisable to consult with a tax professional for personal circumstances.

Eligible expenses include tuition, housing, food, and medical bills related to COVID-19.

Processing time varies; expect a few weeks for notifications.

Funds received typically do not count as taxable income, but consult a tax professional for specifics.

Tips for maximizing your grant eligibility

Maximizing your eligibility for the CARES Act Emergency Financial Aid Grant involves understanding and adhering to application best practices. First, ensure you’re following the guidelines set forth by your institution for a complete and accurate application.

Additionally, keeping meticulous records of all expenses related to COVID-19 is crucial as it supports your claims and reflects your financial situation accurately. Finally, avoid common pitfalls such as missing vital information or not submitting documents by stated deadlines.

Follow application guidelines carefully to meet all requirements.

Document all eligible expenses thoroughly.

Double-check for completeness before submission and adhere to deadlines.

Insights into document management with pdfFiller

Utilizing a platform like pdfFiller can significantly enhance your experience with the CARES Act Emergency Financial Form. This cloud-based solution allows you to seamlessly edit, e-sign, and manage your documents securely from anywhere. With built-in collaboration features, you can share documents with advisors or family members who may assist in the application process.

The benefits extend beyond merely filling out the form; pdfFiller makes managing your records straightforward, giving you access to all documents anytime, anywhere. This approach not only streamlines your application process but also ensures that you’re precisely tracking your communications with your educational institution and any forms you submit.

Edit the CARES Act Emergency Financial Form efficiently.

Utilize e-signature features for quick submission.

Access documents from any device through cloud-based solutions.

Additional considerations for emergency funding

While the CARES Act provides relief, it is essential to be aware of additional funding opportunities that may be available to you. Programs such as the Higher Education Emergency Relief Fund (HEERF) supplement the CARES Act funding, providing further financial assistance to address the unique challenges posed by the pandemic.

Looking ahead, future acts and additional resources might emerge to bolster support for students transitioning back into traditional educational settings. Staying informed about these changes can ensure you’re leveraging all available resources effectively.

Explore additional relief funding sources like HEERF.

Stay informed on future legislative changes affecting student aid.

Engage with your institution for updates on available resources.