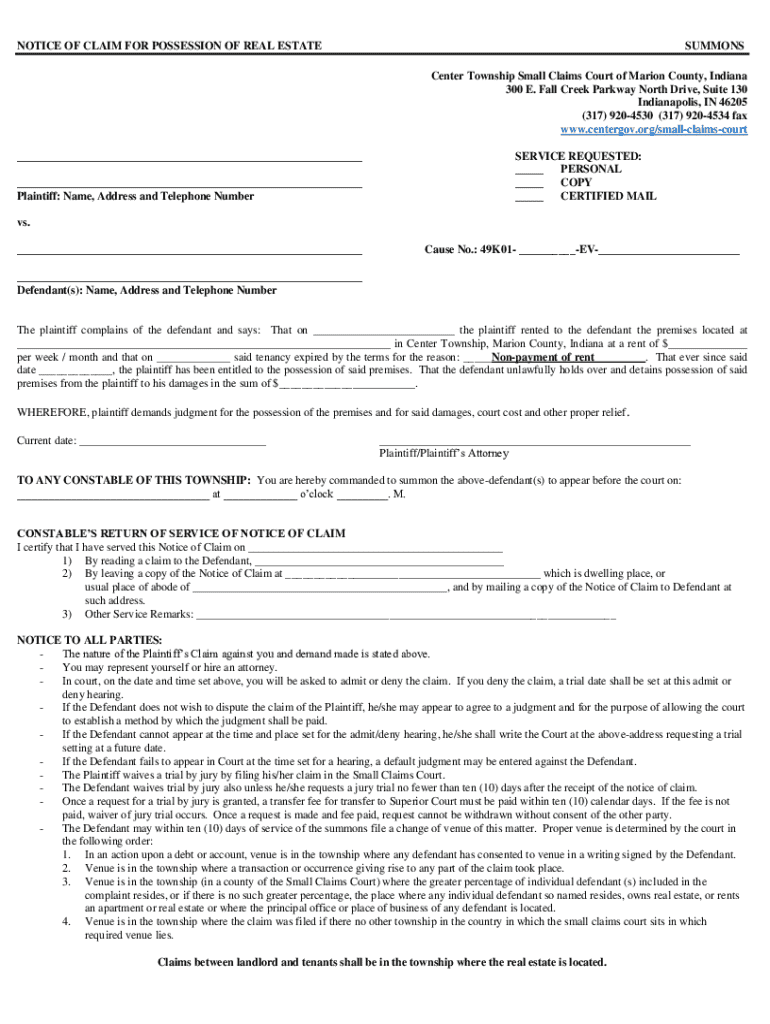

Get the free How Does the Indiana Small Claims Court Work?

Get, Create, Make and Sign how does form indiana

How to edit how does form indiana online

Uncompromising security for your PDF editing and eSignature needs

How to fill out how does form indiana

How to fill out how does form indiana

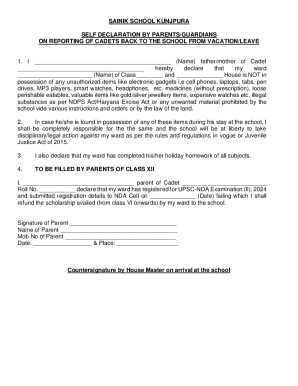

Who needs how does form indiana?

How Does Form Indiana Form

Overview of Indiana Forms

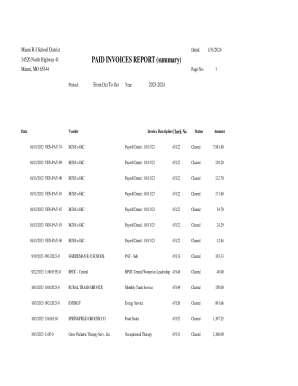

Indiana offers a wide range of forms catering to various needs from individuals to businesses. Understanding the types of forms available is crucial for efficient navigation through bureaucracy. There are four primary categories of forms in Indiana: individual tax forms, business tax forms, corporate tax forms, and licensing and registration forms. Each category serves distinct purposes and is designed to streamline communication with government entities.

Step-by-step guide: How to complete Indiana Forms

Completing Indiana forms involves several distinct steps to ensure accuracy and compliance. Here’s a concise breakdown of the process:

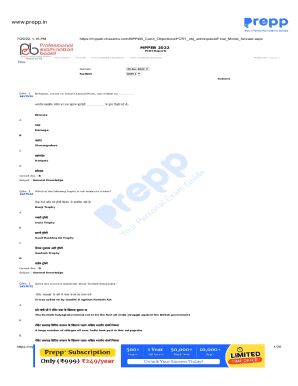

Filling out the form

When filling out any Indiana form, accuracy is paramount. Begin by analyzing all fields in the form; for example, personal data, income figures, or specific business details must be precise. You should avoid common mistakes such as missing signatures, incorrect numbers, or leaving required fields blank. Utilize pdfFiller’s interactive tools to prevent these errors by guiding you through the filling process, ensuring you don’t overlook critical sections.

Additionally, apply the formatting guidelines provided with the forms. Many government forms insist on specific formats for dates and numbers, so take time to familiarize yourself with these requirements. If using pdfFiller, you'll benefit from real-time validations that prompt you to correct any discrepancies as you work.

Editing and customizing your form

Once your form is filled, pdfFiller allows various editing options. You can modify PDF files by adding or removing text and images, ensuring that it meets your specific needs. This customizable capability makes it easier for businesses to present their documents professionally and individuals to include personal touches.

Moreover, collaborative features in pdfFiller enable multiple users to work on the same document. This function is particularly useful for teams who need to contribute to forms and allows for a seamless merging of information, ensuring that everyone’s input is captured effectively.

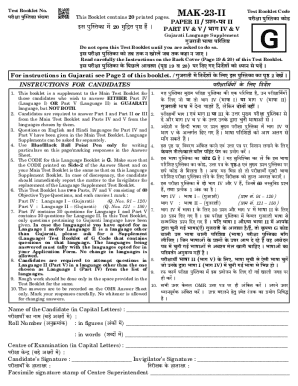

Signing Indiana forms

Signing documents electronically is becoming a widespread practice, particularly in business settings, and pdfFiller's eSignature tool meets that need. With this feature, you can sign forms digitally, which is legally accepted in Indiana and simplifies the signing process. You can also invite others to sign the document, making it an effective solution for team-oriented submissions.

When using eSignatures, it’s essential to ensure authenticity. Always verify that the signature matches the individual’s official identification to maintain document integrity. pdfFiller’s compliance with legal standards helps ensure that your digital signature is as valid as a handwritten one.

Submitting your form

After completing your form, you need to decide on a submission method. Indiana forms can typically be submitted online, by mail, or in-person, depending on the type of form and your preference. Familiarize yourself with any deadlines associated with the form to ensure timely processing; for example, tax filings usually have established cut-off dates.

To enhance the likelihood of prompt processing, double-check that you’ve included all necessary documentation and followed any particular submission guidelines. Using resources such as pdfFiller can streamline this process, as it provides submission tracking features, allowing you to monitor the status after submission.

Managing your forms

Document management becomes especially pivotal once forms are completed. With pdfFiller, organizing completed forms in a structured manner becomes straightforward. You can create folders for different categories to keep track of your documents, which is particularly helpful for individuals and businesses dealing with numerous forms.

Sharing forms with stakeholders is also simplified. You can use pdfFiller's sharing features to ensure that relevant parties have access to necessary documents, maintaining transparency and collaboration within teams. Moreover, the cloud storage options available mean that accessing your forms from anywhere is highly convenient, protecting your work against loss due to device failures.

Troubleshooting common issues

Encountering issues while filling out or submitting forms is not uncommon, but knowing where to find help can alleviate headaches. Frequently asked questions on the Indiana forms website provide clarity on common problems, from accessing forms to submission requirements. If issues persist, contacting support via pdfFiller can offer solutions tailored to your unique situation.

Additionally, if you experience submission problems, reviewing checklists for proper documentation can expose errors that require correction. Turn to video tutorials and community forums for practical advice and shared experiences that might shed light on your issues.

Interactive tools for enhanced document management

Utilizing interactive tools available from pdfFiller not only simplifies the initial form filling process but also enhances ongoing document management. By leveraging templates for common forms, you can save significant time by avoiding repetitive data entry. These templates come pre-filled with common information, streamlining the workflow.

Furthermore, pdfFiller’s automation features help manage repeated forms efficiently. This allows organizations to trigger actions such as sending out forms, reminders for renewal submissions, and setting up recurring document workflows, thus enhancing productivity across teams.

Recent changes to indiana forms

It is essential to stay updated on any modifications to Indiana forms, as changes can significantly affect how documents need to be completed. The Indiana Department of Revenue regularly updates forms, incorporating adjustments to regulations, tax rates, or filing requirements.

To remain informed of these changes, routinely check the Indiana forms website or subscribe to updates through platforms like pdfFiller, which often provides feeds on these modifications directly related to your documents. Employing proactive strategies to stay informed will ensure compliance and can save both time and resources.

Related indiana forms and resources

Indiana’s expansive documentation needs span various fields – from personal tax to business registration. Understanding related forms is crucial for individuals and organizations to navigate their obligations effectively. For instance, family and personal forms might include health benefits claims or guardianship applications, whereas businesses may require documentation for various certifications.

Access to related legal information and forms is also vital. Resources like the Indiana Secretary of State website can provide insights into other necessary documentation that may accompany tax forms or business filings. Utilizing these comprehensive resources helps paint a clearer picture of the requirements and ensures that users do not miss any vital aspects of their administrative duties.

User experience enhancements

In our increasingly mobile world, the ability to access Indiana forms and manage documents on-the-go is invaluable. pdfFiller provides a user-friendly interface optimized for mobile devices, meaning you don’t need to wait until you return to your desktop to begin filling out important papers.

Additionally, cross-device compatibility is a significant advantage. Whether you’re working from a smartphone, tablet, or computer, your documents are synchronized and accessible whenever you need them. This seamless accessibility ensures that whether you're in the field or at the office, you're equipped to manage your documentation with ease.

Tips for effective document management

Effective document management pivots around organization, regular reviews, and clear labeling. Keeping forms organized by category and ensuring that they are accessible will save time in the long run. Establishing a routine for reviewing documents helps catch any necessary updates or discrepancies that may arise due to changing laws or personal circumstances.

Furthermore, using consistent naming conventions for files related to your Indiana forms can enhance retrieval ease. Consider including key details like the type of form, the filing date, and any specific identifiers. By doing this, you’ll create a personal archive that enhances efficiency in managing administrative tasks.

Explore more with pdfFiller

pdfFiller not only equips users with advanced tools for form management but also provides a wealth of resources through videos, tutorials, and community forums. Engaging with these materials can enhance your understanding of how to leverage the platform to its fullest potential.

Community forums serve as channels where users can share stories, tips, and best practices, enriching the overall learning experience. Explore these features to discover new methods for managing your forms and enhancing your productivity.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get how does form indiana?

How do I edit how does form indiana straight from my smartphone?

Can I edit how does form indiana on an iOS device?

What is how does form indiana?

Who is required to file how does form indiana?

How to fill out how does form indiana?

What is the purpose of how does form indiana?

What information must be reported on how does form indiana?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.