Get the free COI Request Form - 8.22.18.rtf

Get, Create, Make and Sign coi request form

Editing coi request form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out coi request form

How to fill out coi request form

Who needs coi request form?

COI Request Form - How-to Guide

Understanding the COI request form

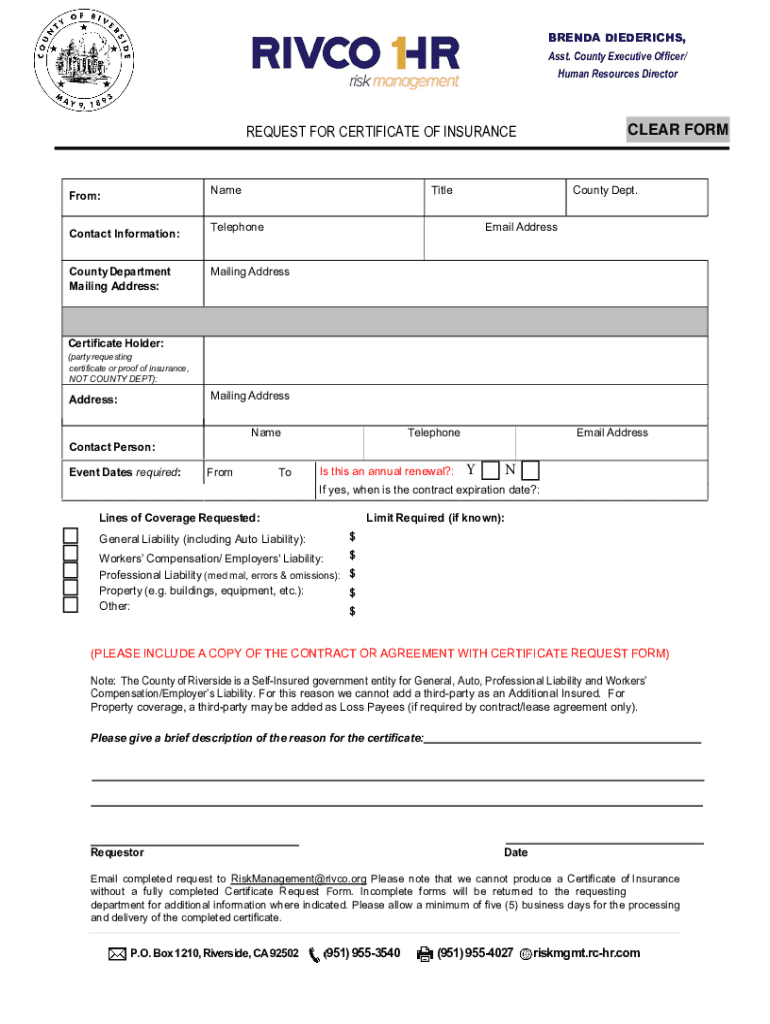

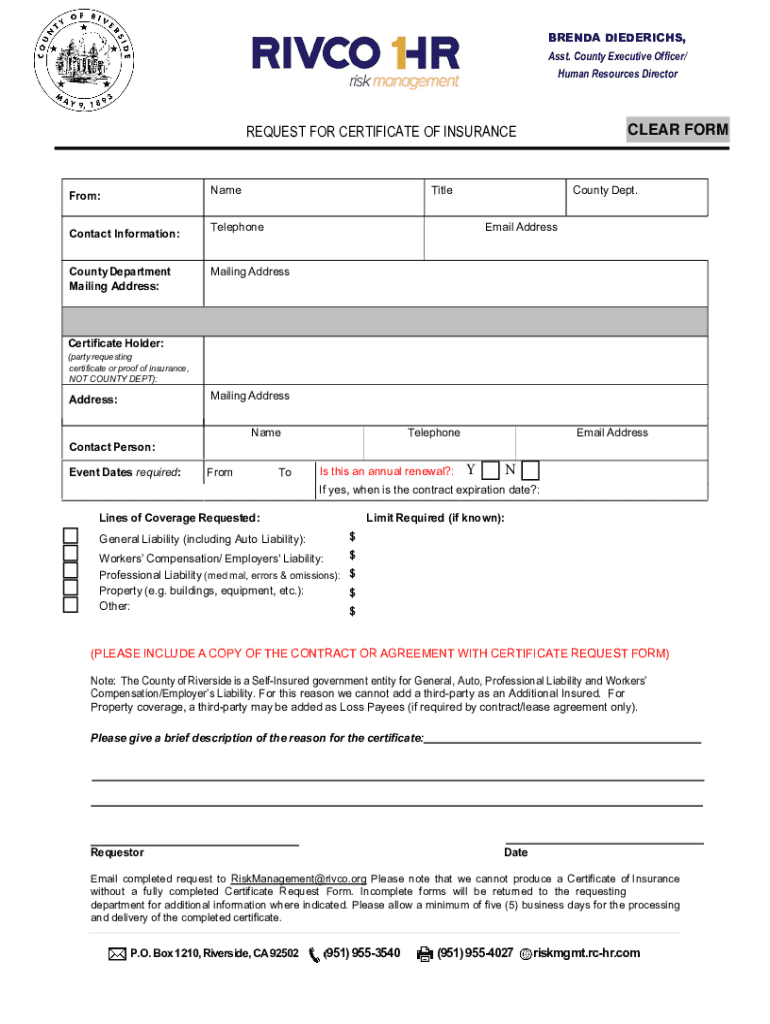

A Certificate of Insurance (COI) is a document that provides proof of insurance coverage for a business, individual, or organization. It typically includes details on policy limits, types of coverage, and the insurer’s contact information. In various industries—from construction to event planning—a COI is crucial for demonstrating compliance with legal and contractual obligations. A COI request form encompasses essential details needed to obtain this document from an insurance provider or vendor.

Purpose and benefits of using a COI request form

Utilizing a COI request form serves several important purposes. It not only protects businesses by ensuring that all parties involved in a transaction are adequately insured but also helps in managing potential risks. By securing a COI before engagements, businesses fulfill compliance with contractual obligations, especially those that require proof of insurance. Moreover, presenting a COI fosters trust and professionalism between clients and vendors, easing the way for smoother business relationships.

How to fill out a COI request form

To effectively complete a COI request form, begin by gathering all necessary information. This includes the policyholder's name, contact details, type of insurance coverage required, and the address where the COI should be sent. Ensure the form is filled in accurately, as errors can lead to delays in securing coverage. After you’ve filled out the form, it’s crucial to review all details—double-checking for completeness and correctness to avoid any complications.

Navigating vendor communication for COIs

When requesting COIs from vendors, clear communication is key. Start by explaining the purpose of the COI and why you need it in a straightforward manner. Be sure to specify any particular requirements or deadlines, and establish a timeline for follow-up communications. For best practices, send polite reminders if you don’t receive a timely response, and prepare to handle any delays professionally without compromising your business relationships.

Online vs. offline requests for a COI

Choosing between online and offline methods to request a COI has its pros and cons. Online requests are typically faster and streamline communications, while offline requests can provide a more personal touch. When emailing vendors, ensure that your message is clear and concise, avoiding jargon. Additionally, consider including a deadline in your email, making it easier for vendors to prioritize your request.

Managing COI records efficiently

Proper document management is essential for COIs. Utilizing platforms like pdfFiller helps organize and store COIs effectively, allowing easy access when needed. Users can categorize documents, tag them for quick retrieval, and even set reminders for policy renewals. With the right tools, businesses can ensure that their COI records remain current and compliant, ultimately enhancing risk management.

Common mistakes to avoid when requesting a COI

Several pitfalls can undermine the effectiveness of requesting a COI. Common errors include overlooking necessary details in the form, leading to delays in processing. Miscommunication with vendors can similarly create complications if expectations aren’t clearly set. Additionally, failing to follow up can result in missed deadlines or gaps in coverage, emphasizing the importance of proactive communication throughout the process.

Understanding COI costs and financial implications

Obtaining a COI is often associated with certain costs depending on the type of coverage needed and the industry standards. Factors influencing pricing include the type of business, insurance risk levels, and the scope of coverage required. Failing to secure a COI when required can result in significant financial implications, from lost business opportunities to potential legal liabilities.

Innovations in COI management: The role of technology

Technology continues to revolutionize the way businesses manage COIs. Platforms like pdfFiller streamline the process of requesting, filling out, and obtaining electronic signatures for COIs. Features such as automated reminders, document tracking, and easy shareability enhance efficiency, while AI integrations assist with compliance checks and risk assessments, providing businesses with a robust solution for COI management.

Particular industries and their COI requirements

Each industry has specific COI requirements tailored to their unique risks and operational demands. For instance, construction companies often require extensive coverage due to high-risk environments, while real estate professionals may need general liability and property damage coverage. Understanding these distinctions helps businesses prepare appropriate COIs, aligning their insurance practices with industry standards and legal requirements.

Frequently asked questions about COI requests

As businesses venture into requesting COIs, they often have several questions regarding the process. Common inquiries include the expected contents of a COI, such as the coverage types and limits, as well as typical turnaround times for receiving a COI from vendors. Furthermore, understanding what to do if a vendor cannot provide a COI is crucial; businesses should consider seeking alternative vendors or exploring additional coverage options.

Special situations requiring COI adjustments

Sometimes businesses face special situations that necessitate adjustments to COIs, such as changing vendors or entering into short-term agreements. In such cases, understanding how to manage these transitional COIs becomes crucial. Businesses must communicate any changes in coverage or requirements clearly to the insurers or vendors to ensure seamless transitions and maintain compliance with insurance standards.

Integrating COI management into your workflow

Streamlining COI requests and renewals can effectively enhance operational efficiency. Tools like pdfFiller help automate much of the manual work associated with COI management, allowing teams to collaborate on documents in real-time. Moreover, leveraging cloud platforms ensures that everyone has access to the same files, enhancing transparency and maximizing the overall workflow efficiency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete coi request form online?

Can I edit coi request form on an iOS device?

Can I edit coi request form on an Android device?

What is coi request form?

Who is required to file coi request form?

How to fill out coi request form?

What is the purpose of coi request form?

What information must be reported on coi request form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.