Get the free New Rental ApplicationPDFLandlordCredit History

Get, Create, Make and Sign new rental applicationpdflandlordcredit history

How to edit new rental applicationpdflandlordcredit history online

Uncompromising security for your PDF editing and eSignature needs

How to fill out new rental applicationpdflandlordcredit history

How to fill out new rental applicationpdflandlordcredit history

Who needs new rental applicationpdflandlordcredit history?

Navigating the New Rental Application PDF Landlord Credit History Form

Understanding the rental application process

Submitting a rental application is often the first step for potential tenants seeking a new home. In an increasingly competitive rental market, understanding the components of a rental application is crucial. A comprehensive rental application not only provides landlords with necessary information but also positions applicants positively in their search for residence.

Common requirements in rental applications vary by location and landlord preferences but often include proof of income, rental history, and personal identification documents. With these in mind, being informed and prepared can significantly enhance your chances of securing your desired rental property.

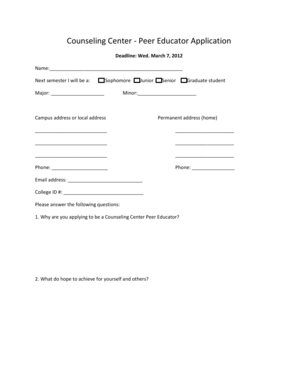

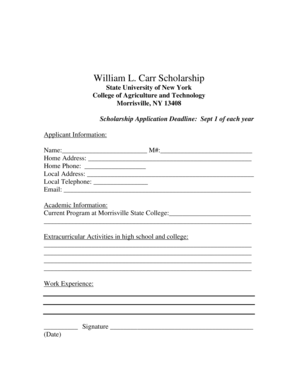

Key components of the rental application PDF

The new rental application PDF serves as a structured template for collecting necessary information. Key components include:

The role of credit history in rental applications

Landlords routinely require credit checks as part of the rental application process. This is due to the fact that an applicant's credit report provides insights into their financial responsibility, past rental behavior, and overall reliability. A higher credit score often signifies a lower risk, which is why landlords are vigilant in reviewing these scores.

Understanding your credit score is thus paramount. It ranges from 300 to 850, with higher scores representing better creditworthiness. Common credit-related concerns for renters may include late payments, high debt levels, or recent bankruptcies, which could be red flags for landlords. Applicants should take active steps to review and improve their credit profile before applying.

Step-by-step guide to filling out the new rental application PDF

Filling out the new rental application PDF can be a streamlined process if approached methodically. Follow these steps:

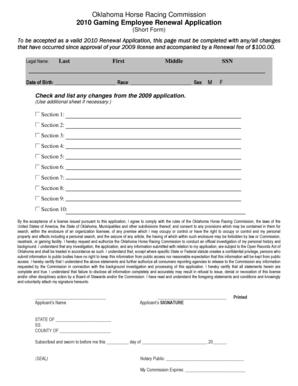

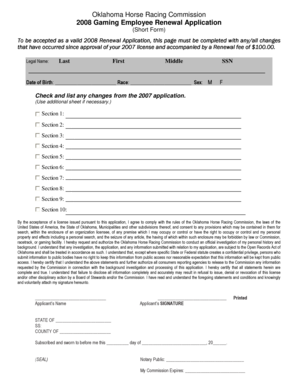

Editing and customizing your rental application PDF

Once your rental application PDF is downloaded, you may need to edit or customize it for specific landlords. pdfFiller offers intuitive tools for this purpose, allowing you to make necessary adjustments such as adding or removing information.

Using pdfFiller, ensure you can:

By tailoring your application, you can present a polished document that aligns with a landlord's expectations.

Collaborating with co-applicants

If you’re applying alongside co-applicants, effective collaboration becomes key. pdfFiller's sharing functionality allows you to effortlessly share the PDF among applicants, ensuring everyone contributes necessary information.

Use the built-in collaboration tools to collect and merge information efficiently. Ensure co-applicants are aligned on the details they provide, from financial records to rental history, to maintain a cohesive application.

Common pitfalls to avoid in rental applications

Navigating the rental application process is rife with potential pitfalls. Here are common mistakes to avoid:

Understanding your rights as an applicant

Understanding your rights during the rental application process is critical. Fair Housing laws protect applicants from discrimination based on race, gender, religion, disability, and other factors. Be aware of your rights and ensure that the landlord adheres to these regulations.

If your application is denied, landlords are required to furnish a reason. If you believe you’ve been unfairly denied, consider what steps you may take, including seeking further advice or legal assistance.

FAQs about the rental application PDF

As you complete your rental application PDF, you may have questions. Here are some common FAQs:

Enhancing your rental application success

Besides the core elements of your rental application, preparing supplementary documentation can enhance your appeal to landlords. Consider preparing:

In a competitive rental market, it’s important that your application stands out. Approach it with professionalism and thoroughness.

Final steps before submission

Before submitting your application, take the final steps to ensure completeness. Review all provided information carefully, confirming accuracy and clarity.

Ensure you have the required supporting documents, such as proofs of income and identity, which can considerably expedite the review process. Once you've confirmed everything, submit the application through the specified method—whether by email, online portal, or in-person—and best practices dictate following up within a day or two to express your continued interest.

Resources for further assistance

For additional support during your rental application process, consider reaching out to local housing authorities for guidance. Online resources such as templates for additional documents or legal aid services can provide necessary assistance and insights. Leverage these resources to ensure a smooth and informed application experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my new rental applicationpdflandlordcredit history in Gmail?

How do I make changes in new rental applicationpdflandlordcredit history?

How do I edit new rental applicationpdflandlordcredit history on an iOS device?

What is new rental applicationpdflandlordcredit history?

Who is required to file new rental applicationpdflandlordcredit history?

How to fill out new rental applicationpdflandlordcredit history?

What is the purpose of new rental applicationpdflandlordcredit history?

What information must be reported on new rental applicationpdflandlordcredit history?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.