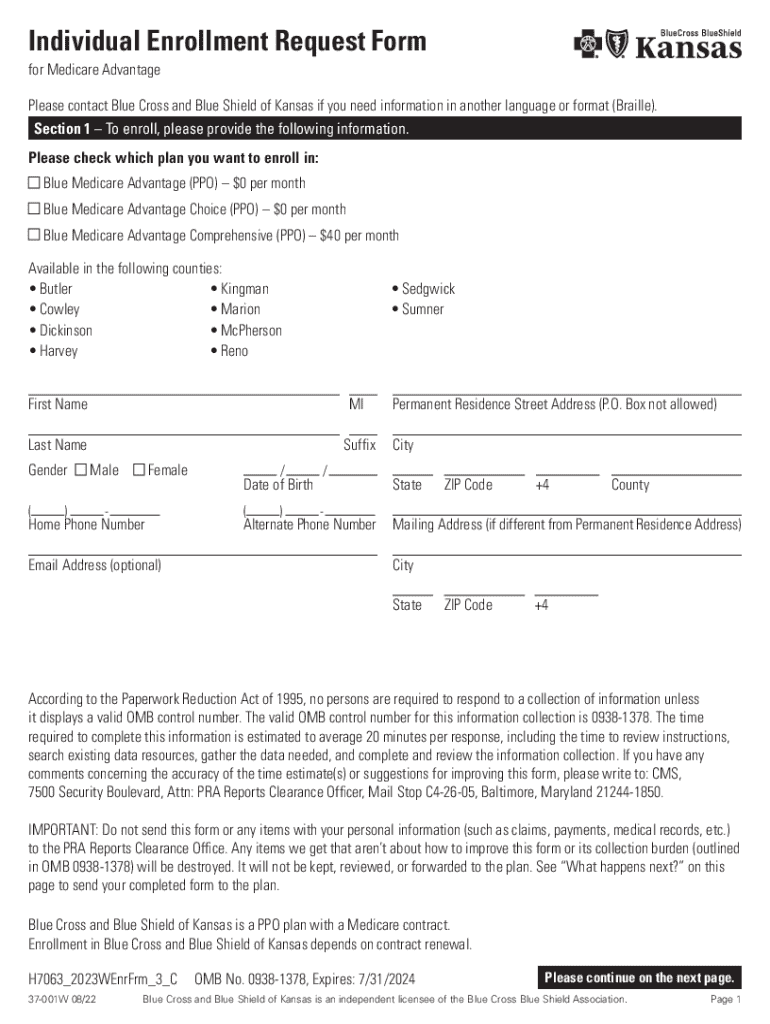

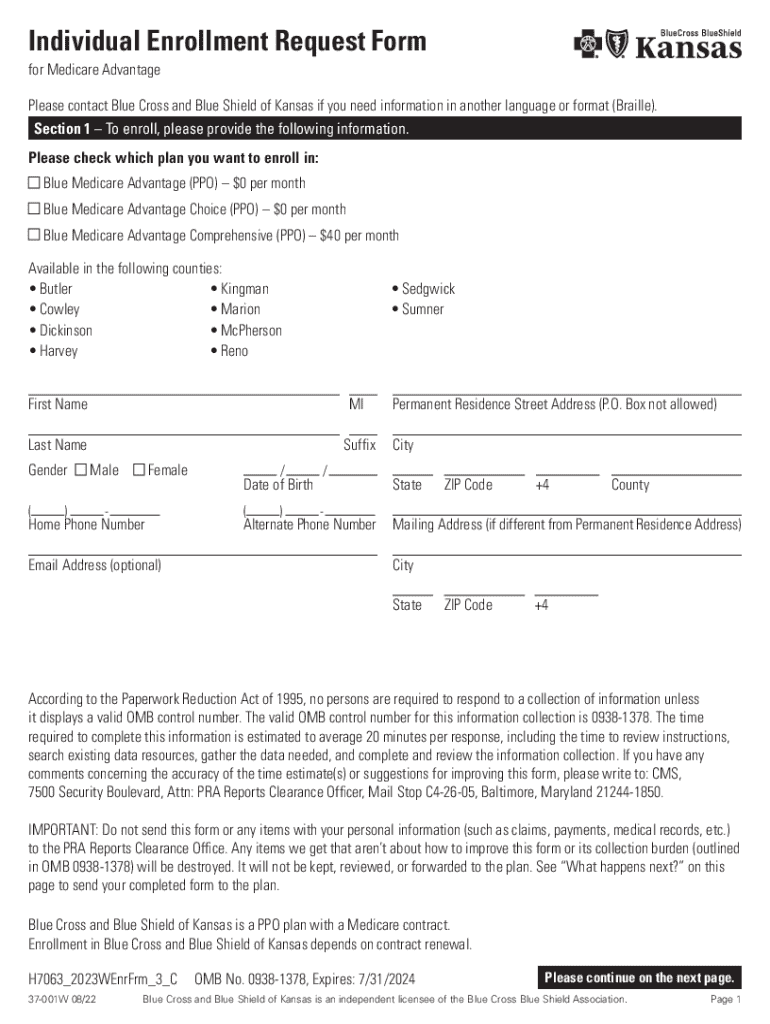

Get the free Evidence of Coverage for Employer Groups:

Get, Create, Make and Sign evidence of coverage for

Editing evidence of coverage for online

Uncompromising security for your PDF editing and eSignature needs

How to fill out evidence of coverage for

How to fill out evidence of coverage for

Who needs evidence of coverage for?

Evidence of Coverage for Form - How-to Guide

Understanding evidence of coverage (EOC)

Evidence of Coverage (EOC) is a key document that articulates the specific details of a health insurance plan. It outlines the terms of the coverage provided by insurance providers, ensuring customers know what benefits they can expect, including critical information about covered services, exclusions, and conditions.

The importance of EOC cannot be overstated for policyholders; it serves as a comprehensive guide to understanding healthcare benefits. An accurate and detailed EOC enables individuals to make informed choices about their healthcare, facilitating greater satisfaction and better health outcomes.

Importance of EOC for individuals and teams

Obtaining an EOC is crucial, especially in new insurance enrollments or when changes occur. Understanding the implications of the EOC enables better decision-making. For individuals, knowing the specifics of their health coverage prevents unexpected surprises when medical needs arise.

For teams managing employee benefits, having a thorough understanding of EOCs ensures that employees receive the best possible coverage tailored to their needs. This can enhance employee satisfaction and retention, making EOCs equally important for businesses.

When will you receive your EOC?

The distribution of the EOC typically coincides with enrollment periods and is updated during plan renewals. For example, once you select a plan during Open Enrollment, your EOC will arrive shortly after, providing all necessary details about your new coverage.

It's also common for updates to be supplied at least annually or when there are significant changes to plan features. You can generally expect your EOC through various delivery methods, including traditional mail, email notifications, or secure online accounts.

Who sends the EOC?

The responsibility for distributing EOCs primarily lies with insurance companies, health maintenance organizations (HMOs), and government health programs like Medicare and Medicaid. Each of these entities will provide their members with EOCs that reflect their specific coverage provisions.

It’s essential to understand the difference between various sources of EOCs, as private insurance companies may have different requirements and coverage details compared to public options. This distinction can guide beneficiaries in choosing the most suitable healthcare plans.

What to do upon receiving your EOC

Upon receiving your EOC, it's vital to take immediate action to ensure your understanding and satisfaction with your healthcare plan. Begin by thoroughly reviewing the key sections of your EOC. Pay close attention to coverage details and exclusions, making sure everything aligns with your expectations.

If you find any inconsistencies or have questions, don't hesitate to reach out to member services. It's helpful to have specific questions prepared and any documentation related to your plan on hand when contacting member services for assistance.

Navigating the contents of the EOC

EOCs can be lengthy and complex documents. To navigate them efficiently, it helps to understand how the sections are organized. Typically, you will find a benefits summary at the beginning, followed by exclusions and limitations, which detail what is and isn't covered under the plan.

To facilitate comprehension, there are interactive tools that can help break down the information. Platforms like pdfFiller offer features to elucidate the contents of your EOC, guiding you through different sections with clarity.

Downloading and managing your EOC

Accessing your EOC online is typically straightforward, with most insurance providers offering downloadable PDFs. Follow these steps: log in to your provider account, navigate to the documents section, and look for the link or button to download your EOC.

Once you've downloaded your document, you can save it to your preferred device or share it with family members or professionals who may need to review it. pdfFiller’s platform also allows you to edit and customize your EOC, making notes or highlighting important sections directly within the document for future reference.

Explaining common EOC terminology

EOCs often contain technical jargon that may confuse policyholders. To help clarify, here’s a glossary of common terms related to EOCs. Recognizing these terms enables individuals to navigate their EOC effectively and understand the implications of their coverage.

Familiarizing yourself with these terms can empower you to engage in discussions about your healthcare plan with confidence and ensure you're making informed decisions.

Additional information & helpful links

For more insights and information on health coverage and EOCs, check official resources such as the Centers for Medicare & Medicaid Services (CMS) and the Department of Health and Human Services (HHS). These organizations provide valuable information about health plans and beneficiary rights.

Access to publications like HealthMatters can also enhance your understanding of health coverage options and tips for maximizing your benefits.

Keeping track of your coverage

Proactively managing your health coverage ensures that you stay informed about changes and renewals. Develop a habit of regularly reviewing your EOC and staying updated about any notifications from your insurance provider regarding amendments or alterations in coverage.

Establishing reminders for renewals or updates in your policy will prevent lapses in coverage. Utilize calendar tools or apps to schedule these reminders, keeping your healthcare benefits seamless.

Sign up for updates and alerts

Staying informed about your healthcare coverage changes is critical, especially as plans evolve over time. You can sign up for email updates or alerts from your insurance provider. Doing so will help you navigate any changes in benefits, coverage limits, or cost-sharing provisions effectively.

These updates can include reminders for annual enrollment periods or notifications regarding updates that require your attention, allowing you to make timely decisions about your healthcare.

Contacting support

If you need assistance or have questions regarding your EOC, reaching out to member services is crucial. Typically, your insurance provider will list contact information directly on the EOC document. Ensure you check the available hours to connect with a representative.

Preparing for your call with essential questions regarding your coverage — whether it’s about benefits, exclusions, or claims — is vital. Gathering important documents to reference during your inquiry will enhance the efficiency of the resolution process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my evidence of coverage for directly from Gmail?

How can I edit evidence of coverage for from Google Drive?

How do I edit evidence of coverage for straight from my smartphone?

What is evidence of coverage for?

Who is required to file evidence of coverage for?

How to fill out evidence of coverage for?

What is the purpose of evidence of coverage for?

What information must be reported on evidence of coverage for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.