Get the free CITY OF HUTCHINS TAX INCREMENT REINVESTMENT ... - d3n9y02raazwpg cloudfront

Get, Create, Make and Sign city of hutchins tax

Editing city of hutchins tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out city of hutchins tax

How to fill out city of hutchins tax

Who needs city of hutchins tax?

City of Hutchins Tax Form How-To Guide

Understanding the City of Hutchins tax form

The City of Hutchins tax form serves as a crucial tool for residents and businesses to accurately report their tax obligations. This form is vital not just for compliance but also for ensuring that the city has the funding it needs to provide essential services such as education, infrastructure, and local law enforcement.

Identifying who needs to file is the next step in this process. Generally, this tax form is required for various taxpayers, including individual residents, businesses operating within city limits, and property owners. It’s essential to understand your classification to ensure proper filing and avoid potential penalties.

Key dates and deadlines are critical in tax season. The city mandates submissions by April 15th each year, but this can occasionally vary. Keeping track of these dates ensures you avoid late fees and other penalties that can arise from missed deadlines.

Accessing the City of Hutchins tax form

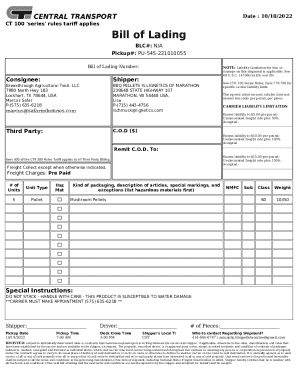

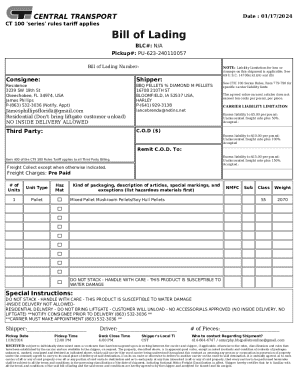

To access the City of Hutchins tax form, residents can visit the official city website where the form is readily available in PDF format. Additionally, platforms like pdfFiller provide convenient access to this form, allowing for both online completion and download options.

While downloading the form is an option, utilizing online access can streamline the process. Cloud-based solutions allow users to fill out tax forms from anywhere, while also saving their progress. This is particularly useful for taxpayers who may not have all their documents at once and need flexibility.

Step-by-step guide to filling out the tax form

Filling out the City of Hutchins tax form begins with gathering required documentation. Essential documents include W-2 forms, 1099s, and any pertinent receipts or statements that substantiate your income and expenses. Having these documents organized ahead of time can simplify the filing process significantly.

The personal information section must be filled out accurately. This includes your full name, residential address, and taxpayer identification numbers. Ensuring this information is correct is crucial, as any inaccuracies can delay processing or result in complications with your tax account.

In the income section, report all sources of income, including wages, freelance work, and interest earnings. It is recommended to use best practices for reporting, which entails providing exact figures as listed on your tax documentation. For deductions and credits, familiarize yourself with localized deductions offered both at the local and state levels, as these can significantly decrease your taxable amount.

Completing the form's signature and submission section thoughtfully ensures that you’ve verified all the information provided. Opting for eSigning through pdfFiller can quicken the process. This method allows fast processing and provides an electronic trail of your submission.

Editing and managing your tax form

Once your tax form is filled out, you may realize corrections are needed. pdfFiller's editing tools facilitate easy adjustments directly to the PDF document without having to restart the entire process, which can save precious time.

Additionally, managing your documents effectively in the cloud helps keep all your tax forms organized. Cloud storage options allow for categorization, easy retrieval, and the opportunity to back up your important financial documents, reducing the risk of loss or damage.

Collaborating with others on submissions

If you’re part of a team or have collaborators who need to review your tax form, utilizing pdfFiller, you can invite them to review your submission. This collaborative feature enhances the accuracy of your documents, as team members can provide feedback and suggestions directly.

The commenting feature allows for effective communication among team members. It ensures that all inquiries and adjustments can be addressed promptly, minimizing misunderstandings and streamlining the submission process.

Frequently asked questions (FAQs)

Taxpayers often have common queries about the City of Hutchins tax form. Questions may include topics such as alteration procedures for incorrect submissions or how to track the status of a submitted form. Familiarizing yourself with these frequently asked questions can save time and frustration during the tax season.

In addition, troubleshooting tips for common errors can aid in minimizing the risk of issues arising during submission. Knowing how to rectify simple mistakes or understanding whom to contact for assistance can provide peace of mind as you navigate the filing process.

Best practices for successful paperwork management

Organizing your financial records is foundational for painless tax filing. Develop a system to categorize your documents, such as keeping income information in one folder, and deductions in another. This not only simplifies the process during tax season but can also help you throughout the year.

Maintaining an audit trail is important for transparency and accountability in your records. Consider documenting any changes made to your tax documents and keeping copies of all submissions. This allows you to provide necessary documentation should questions arise about your submitted tax form.

Staying informed about tax changes

Given how frequently local taxation policies can change, staying informed is essential. Regularly check the City of Hutchins official website for updates concerning tax rates and filing requirements that could impact your obligations.

Resources such as pdfFiller's alerts and notifications feature help you stay ahead of any changes. By proactively monitoring tax announcements, you can avoid last-minute hiccups during your filing process.

Engaging with local tax support services

For those who may feel overwhelmed during tax season, engaging with local tax support services can be beneficial. Services from tax experts can provide clarity on any complex issues you might encounter when filing your City of Hutchins tax form. Discovering local experts can grant you the peace of mind that your submission is accurate.

Utilizing community resources, including workshops or informational sessions hosted by local organizations, can also provide valuable insights into tax filing best practices and updates.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the city of hutchins tax in Chrome?

How do I edit city of hutchins tax on an iOS device?

How do I complete city of hutchins tax on an Android device?

What is city of hutchins tax?

Who is required to file city of hutchins tax?

How to fill out city of hutchins tax?

What is the purpose of city of hutchins tax?

What information must be reported on city of hutchins tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.