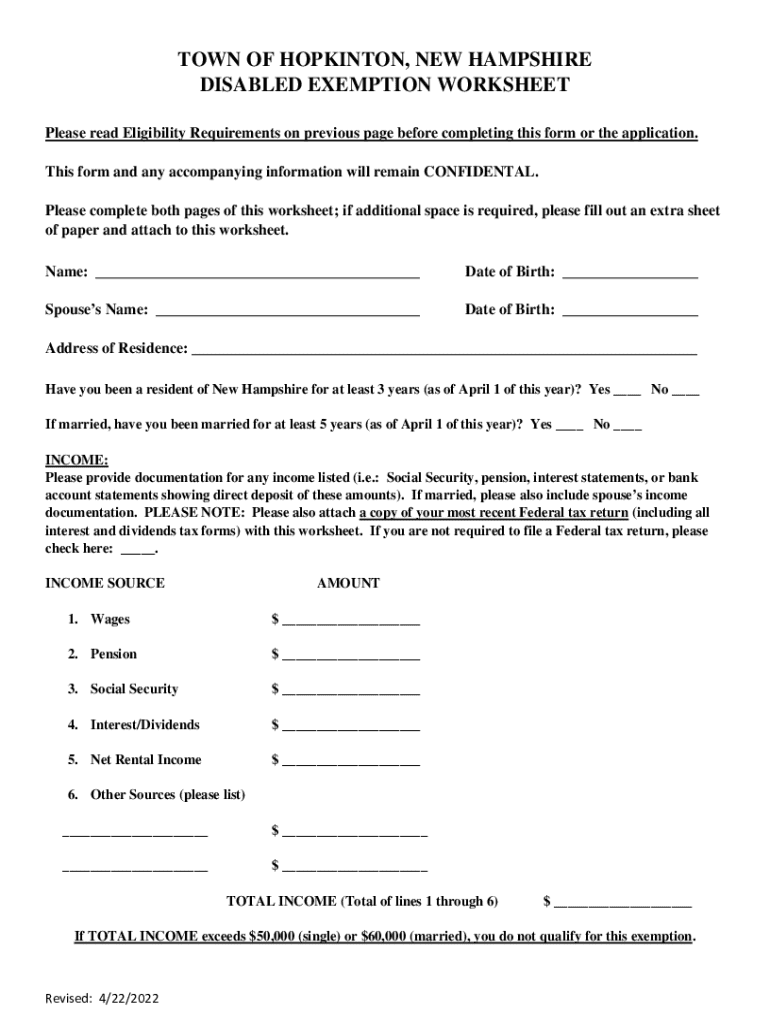

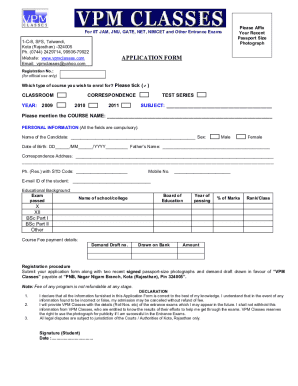

Get the free Disability Tax Exemption Qualifications Work Sheet

Get, Create, Make and Sign disability tax exemption qualifications

Editing disability tax exemption qualifications online

Uncompromising security for your PDF editing and eSignature needs

How to fill out disability tax exemption qualifications

How to fill out disability tax exemption qualifications

Who needs disability tax exemption qualifications?

Navigating the Disability Tax Exemption Qualifications Form: A Complete Guide

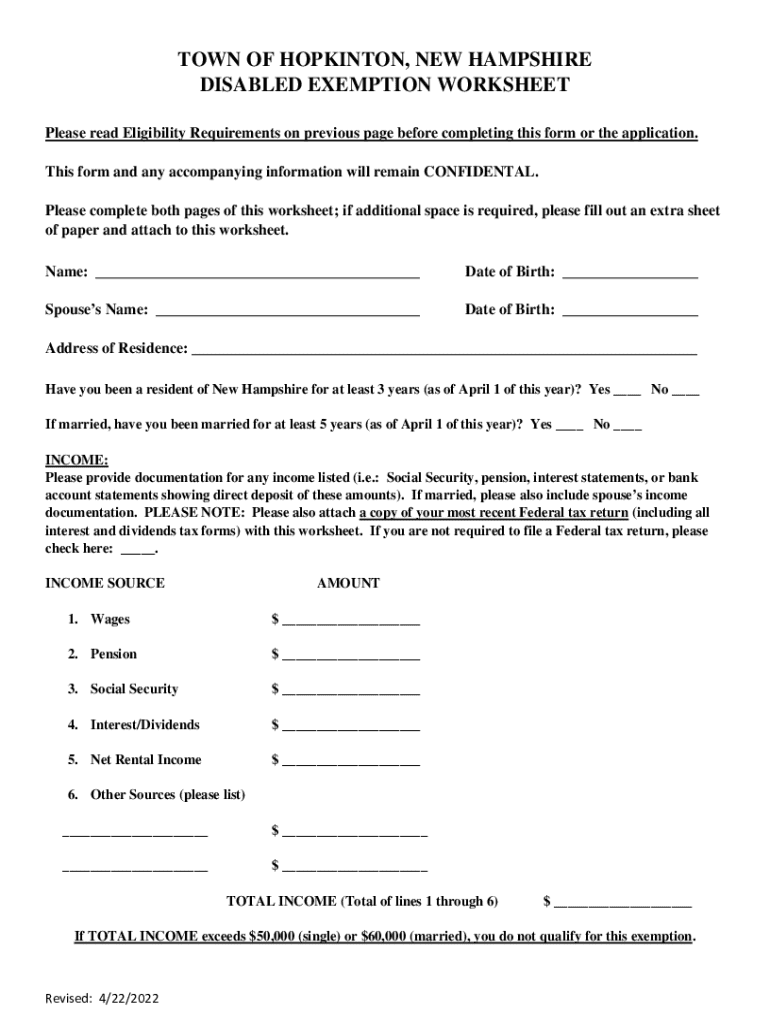

Overview of disability tax exemption

The disability tax exemption is a crucial financial relief aimed at supporting individuals with disabilities, helping them alleviate some of their tax burdens. This exemption is specifically designed to counterbalance the economic challenges that come with living with a disability, effectively allowing eligible taxpayers to benefit from reduced income taxes based on their unique circumstances.

Securing a disability tax exemption can significantly enhance financial stability for individuals and families affected by disabilities. By reducing taxable income, beneficiaries can redirect funds toward essential services, healthcare, education, and other necessities. In many cases, benefits may also extend to caregiving family members, thereby fostering a supportive environment.

Understanding eligibility criteria

Eligibility criteria for the disability tax exemption can vary significantly between federal and state guidelines, reflecting local policies and services tailored to support disabled residents. At the federal level, the IRS provides broad definitions and classifications of disabilities. However, states may impose additional requirements that users need to familiarize themselves with to maximize benefits.

Common disabilities recognized by the IRS typically include severe physical impairments such as mobility limitations or severe vision loss, as well as significant mental health conditions like major depression or schizophrenia. Each condition's severity often plays a crucial role in determining qualification.

Particular conditions, like terminal illnesses, can automatically qualify a taxpayer. In contrast, less severe conditions may require extensive documentation. Gathering adequate medical documentation becomes essential — without it, the claim may not pass scrutiny. Forms from healthcare providers detailing the diagnosis, duration, and severity of the impairment are vital.

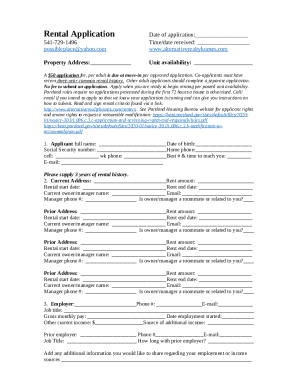

Completing the disability tax exemption qualifications form

Completing the disability tax exemption qualifications form can seem daunting without clear instructions. The process can be simplified into structured steps to ensure everything required is covered systematically and correctly.

Common mistakes to avoid include misreporting medical conditions or failing to provide adequate income disclosures. Ensure that any discrepancies are clarified and corrected. A meticulous approach can save considerable time and stress in the application process.

To complete the form accurately, cross-check all entries, utilize tools such as pdfFiller’s features for form entry, and leverage any pre-existing templates to minimize errors.

Interactive tools and resources

Utilizing pdfFiller’s capabilities can streamline the process of managing the disability tax exemption qualifications form. The platform offers features that aid users in completing their documentation efficiently and accurately.

Access to templates and examples can guide users, providing pre-filled forms that illustrate the necessary structure and detail expected. These resources foster a greater understanding of the requirements and expectations associated with the submission process.

Submitting the form

The submission process of the disability tax exemption qualifications form can be completed through both electronic and paper methods, depending on user preference and available resources. Electronic submissions can offer quicker processing times, while paper submissions may be more familiar to some users.

Post-submission, it is critical to track the application status at regular intervals. Be proactive in responding to any requests for additional information, as delays in submission could lead to processing holdups or denials.

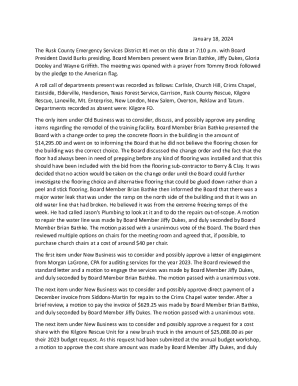

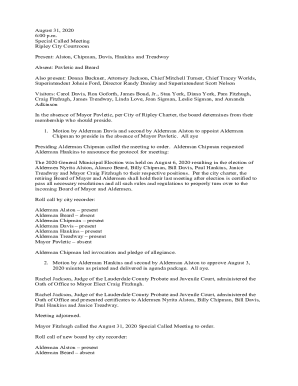

Frequently asked questions

Clarifying common misunderstandings regarding the disability tax exemption qualifications is vital for informed completion. A prevalent concern is what happens if a person's condition changes post-qualification. Generally, the IRS mandates reporting any significant changes, which could affect eligibility.

Inquiries about processing times are also common. The duration may vary significantly based on the method of submission and the complexity of individual cases, with some applications taking several weeks to process.

Troubleshooting and support

In the unfortunate event that an application is denied, knowing the right steps to appeal the decision is essential. Understanding the appeals process can lead to a successful overturn of the decision in many cases. Familiarize yourself with the necessary legal resources and avenues of support.

For any immediate inquiries during the form-filling or submission process, utilizing pdfFiller’s support resources can offer rapid assistance. Contact options, whether via chat, email, or phone, ensure that help is accessible at critical times.

Conclusion

The benefits associated with the disability tax exemption are significant, providing individuals and families with crucial support tailored to their unique circumstances. By understanding the qualification process and utilizing comprehensive document solutions, users can navigate this process with greater ease.

Leveraging pdfFiller tools for effective document management not only simplifies the form completion but also empowers users to focus on what truly matters — their well-being and support systems.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my disability tax exemption qualifications in Gmail?

Where do I find disability tax exemption qualifications?

How do I fill out disability tax exemption qualifications using my mobile device?

What is disability tax exemption qualifications?

Who is required to file disability tax exemption qualifications?

How to fill out disability tax exemption qualifications?

What is the purpose of disability tax exemption qualifications?

What information must be reported on disability tax exemption qualifications?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.