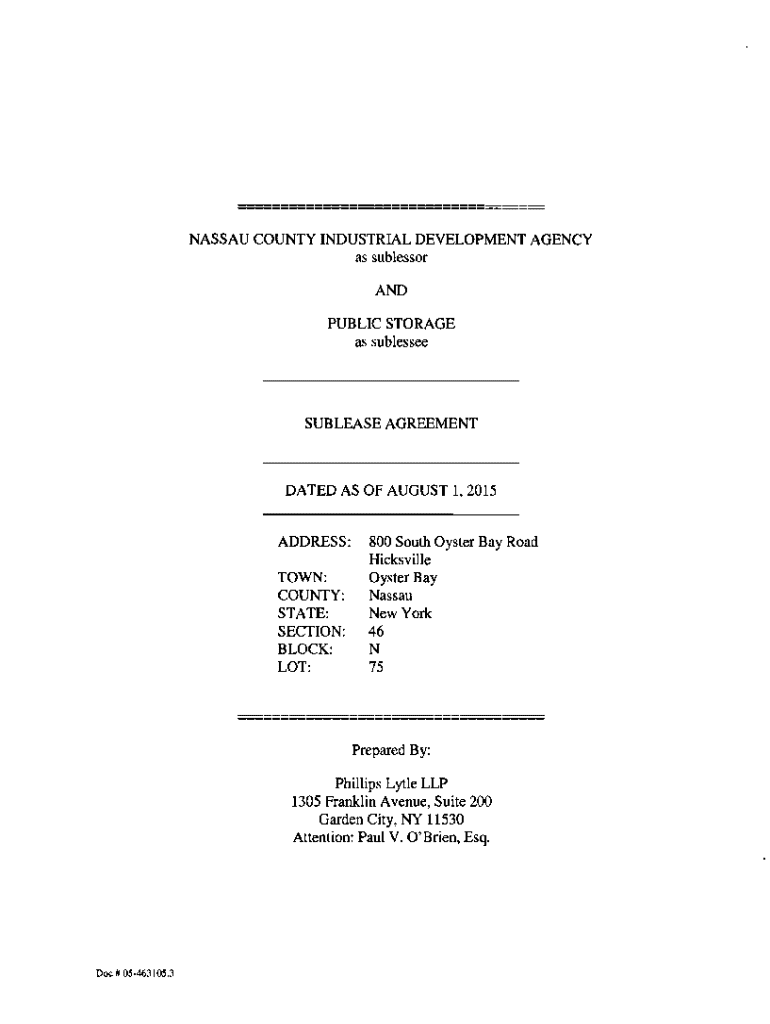

Get the free Nassau IDA gives tax breaks to storage company that will ...

Get, Create, Make and Sign nassau ida gives tax

Editing nassau ida gives tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nassau ida gives tax

How to fill out nassau ida gives tax

Who needs nassau ida gives tax?

Comprehensive Guide to Navigating the Nassau IDA Tax Form

Understanding the Nassau IDA tax form

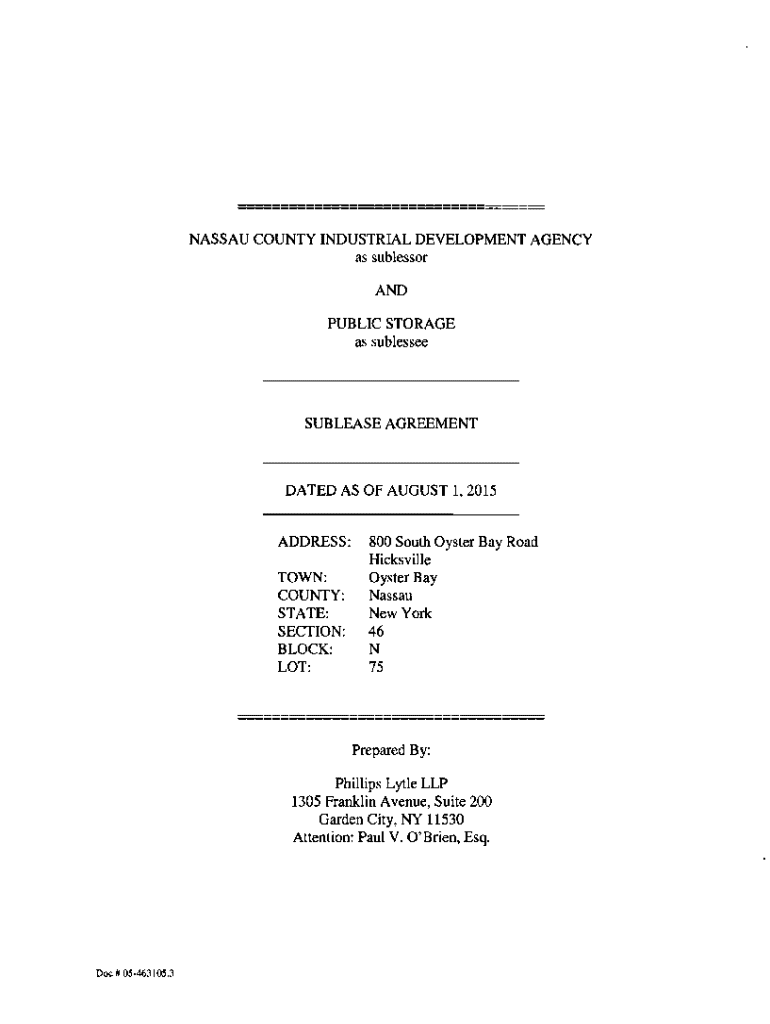

The Nassau County Industrial Development Agency (Nassau IDA) plays a critical role in fostering economic growth by offering various tax incentives and financing options to eligible businesses. Understanding the Nassau IDA tax form is vital for individuals and businesses seeking financial benefits. By leveraging this form, applicants can access crucial funding opportunities designed to stimulate economic development within the county.

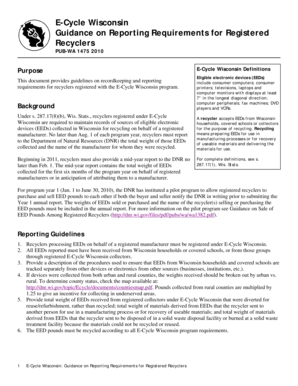

To qualify for benefits administered by the Nassau IDA, applicants must meet certain eligibility criteria. Typically, these include demonstrating a commitment to creating jobs, investing in capital improvements, or supporting community initiatives. Ultimately, the purpose of the IDA is to promote growth and development, ensuring that local economies flourish.

Key features of the Nassau IDA tax form

The Nassau IDA tax form is a pivotal document that requires careful completion to ensure access to potential financial benefits. Applicants must include specific information to provide a comprehensive overview of their business operations and proposed projects. This section will outline the essential specifications and components of the form.

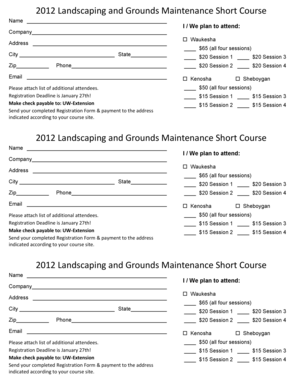

While filling out the Nassau IDA tax form, you will encounter various sections requiring detailed information. Among these are the business name, tax identification number, proposed project description, estimated costs, and number of jobs created. Adhering to important deadlines and submission guidelines is crucial to avoid delays in processing.

Step-by-step instructions for completing the Nassau IDA tax form

Completing the Nassau IDA tax form involves several essential steps, beginning with gathering all necessary documentation. Collecting supporting documents in advance can streamline the application process, making it easier to provide the required insights when filling out the form.

The list of required documents typically includes financial statements, project feasibility studies, and proof of previous job creation or investment. These documents serve to validate claims made in your application and provide the Nassau IDA with a complete picture of your business.

After gathering necessary documents, the next step is filling out the Nassau IDA tax form. Each section requires precise details; hence, it’s crucial to understand what is being asked. For example, when outlining financial projections, ensure that all figures accurately reflect your business model and future outlook.

Common mistakes include overlooking required sections, inaccurate financial reporting, and failing to submit your form by the stated deadline. To prevent these issues, create a checklist and review each part of the form before submission.

Editing and signing your Nassau IDA tax form

Once the Nassau IDA tax form is completed, the next logical step is to edit and put your final touches on it. Utilizing tools like pdfFiller allows for seamless editing of PDFs while also providing an interface to easily customize your form as necessary.

With pdfFiller, uploading and accessing your Nassau IDA tax form is straightforward. You can make necessary edits, adding or replacing information, observing the document's overall coherence and flow. Moreover, once all edits are complete, the platform offers robust features for digital signatures, ensuring your form is legally executed.

Collaborative tools for teams

Working on the Nassau IDA tax form can often require input from multiple stakeholders within a team. Collaboration becomes significantly easier through pdfFiller’s features that allow team members to work together on the same document, ensuring all necessary contributions are captured effectively.

You can quickly share the form with colleagues for review or input, allowing for real-time collaboration. This ensures that every team member's insights are considered while minimizing the potential for errors that could arise from lack of communication.

Managing your Nassau IDA tax form after submission

Once you have submitted the Nassau IDA tax form, managing your documentation effectively is crucial. Having a structured system for storing and organizing your documents can save time and frustration when you need to reference them later.

pdfFiller’s cloud storage solutions offer a secure method for keeping your documents safe and easily accessible. You can tag your forms, making it effortless to search for specific documents whenever needed. Maintaining a well-organized system can mitigate future issues when tracking submission statuses.

Frequently asked questions (FAQs)

After submitting the Nassau IDA tax form, applicants often have questions regarding follow-ups and processing times. Typically, processing can take several weeks, depending on the volume of applications. Maintaining communication with Nassau IDA can provide clarity on your application status.

If delays arise, it’s essential to reach out promptly to understand the situation. Applicants can contact the IDA support team for assistance related to their submissions.

Learn from real experiences

Hearing about real experiences from past applicants can provide valuable insights into the Nassau IDA tax form submission process. Many individuals have successfully navigated the process and kindly shared tips and best practices. These anecdotes can serve as a learning tool for those new to the form.

Success stories often highlight the importance of thorough preparation, clear project descriptions, and prompt follow-ups with Nassau IDA representatives. Such experiences underline the significance of attention to detail, encouraging proactivity at different stages of the submission process.

Additional information and updates

As the Nassau IDA continually adapts to meet the evolving needs of local businesses, staying informed about any legislative changes or updates regarding IDA benefits is crucial. These changes can impact eligibility, benefits offered, or application processes.

Prospective applicants should utilize available resources, including workshops and information sessions hosted by Nassau IDA to educate themselves about recent developments. This knowledge will enhance their ability to leverage the full suite of benefits that the IDA offers.

Stay connected

As the environment surrounding the Nassau IDA tax form evolves, staying connected with resources like pdfFiller can provide continuous support. Subscribing to updates can help you stay informed about new features and guides related to document management, including tips specifically tailored to navigating forms like the Nassau IDA tax form.

The pdfFiller community is a valuable resource, offering strategies and shareable knowledge for document creation and management that simplify otherwise cumbersome processes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in nassau ida gives tax?

How can I edit nassau ida gives tax on a smartphone?

How do I fill out nassau ida gives tax on an Android device?

What is Nassau IDA Gives Tax?

Who is required to file Nassau IDA Gives Tax?

How to fill out Nassau IDA Gives Tax?

What is the purpose of Nassau IDA Gives Tax?

What information must be reported on Nassau IDA Gives Tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.