Get the free Gifts of Stock, Mutual Funds, and Wire Transfers

Get, Create, Make and Sign gifts of stock mutual

How to edit gifts of stock mutual online

Uncompromising security for your PDF editing and eSignature needs

How to fill out gifts of stock mutual

How to fill out gifts of stock mutual

Who needs gifts of stock mutual?

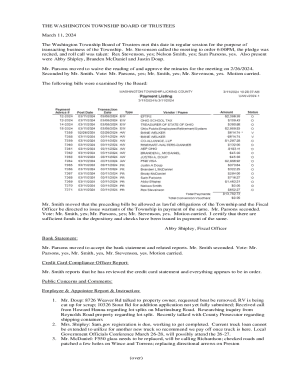

Gifts of Stock Mutual Form: A Comprehensive Guide

Understanding gifts of stock and mutual funds

Gifts of stock and mutual funds refer to the act of donating shares of publicly traded companies or investing in mutual funds to charitable organizations. This practice not only provides financial support to non-profit entities but also offers donors a range of benefits including tax advantages and the satisfaction of contributing to causes they care about.

Donating securities can maximize the impact on recipient organizations compared to cash donations, as they often allow entities to receive more funds while minimizing the tax burden on donors. Many donors find that using appreciated stocks or mutual funds can be a more impactful way to support philanthropic efforts.

Eligibility criteria for donating stock and mutual funds

Understanding who can donate stocks and mutual funds is crucial for effective philanthropic giving. Individual donors, such as individuals looking to give back to their community, play a critical role in this process. Corporations, too, can offer shares as part of their corporate social responsibility initiatives.

On the receiving end, qualifying entities must be recognized as charitable organizations, non-profits, or foundations. It’s vital for donors to ensure the organization they wish to support meets IRS requirements to receive tax-deductible donations.

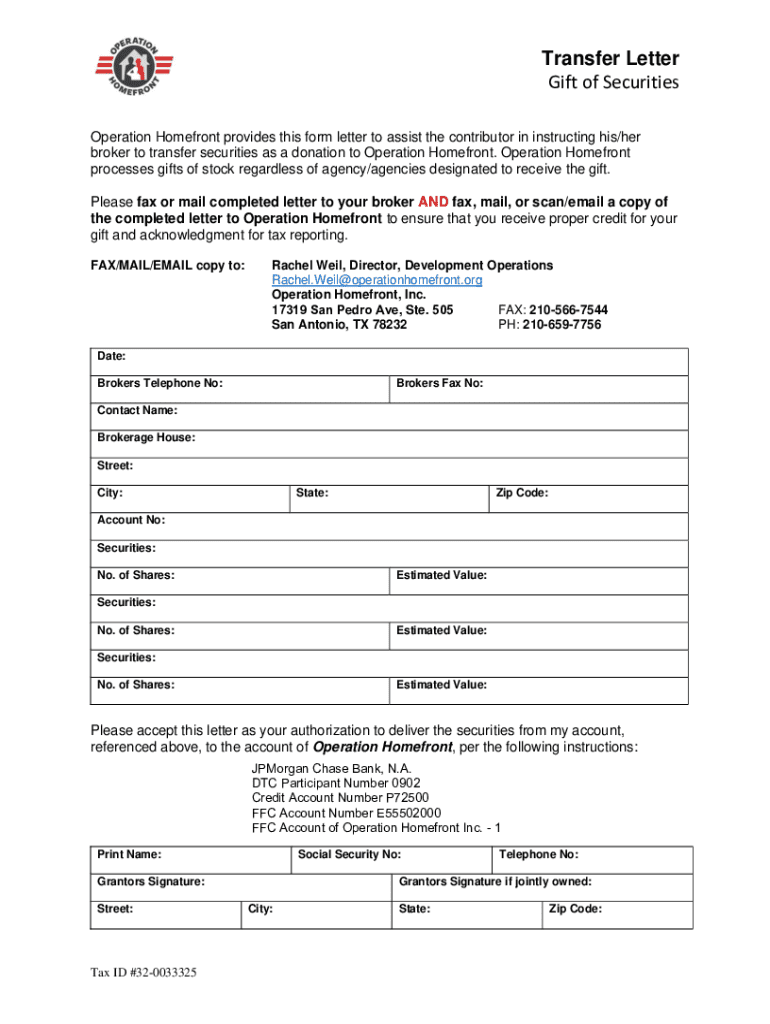

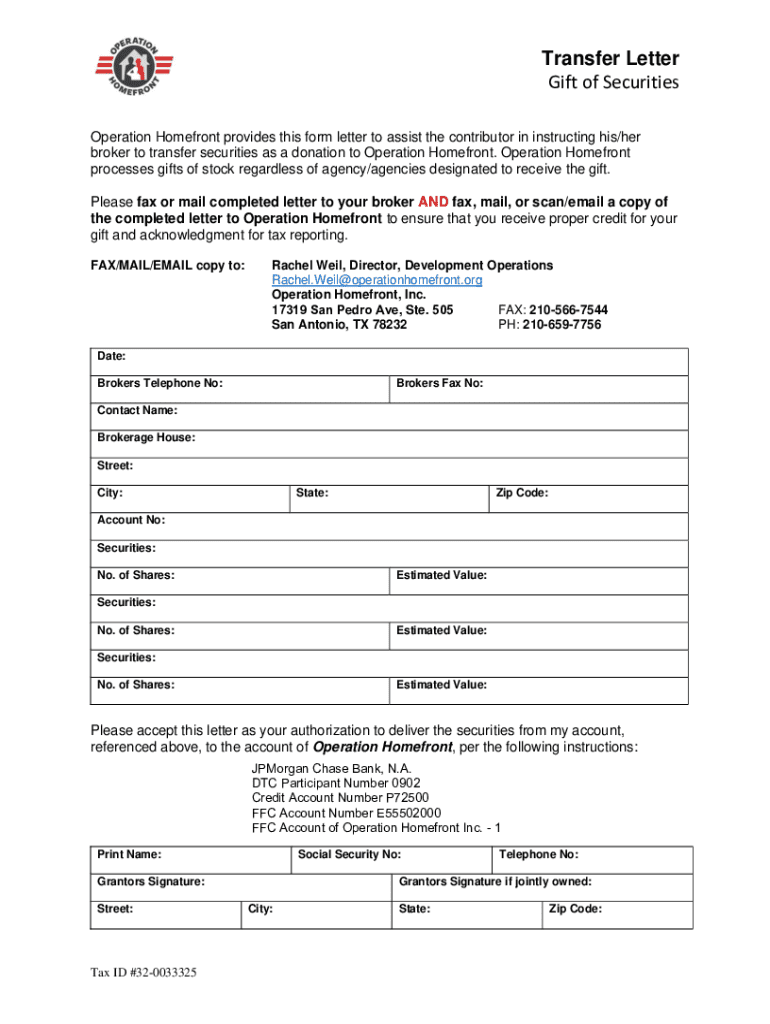

The process of donating stocks and mutual funds

The process of donating stocks and mutual funds involves several key steps. Proper documentation and a clear understanding of the donation process are essential to ensure the transaction is smooth and compliant with IRS regulations.

The first step is to determine which stocks or mutual funds are eligible for donation. Next, assess the current market value of these securities. Finally, reach out to the organization you wish to support to begin the donation process.

Important documents required include a gift notification form, which informs the organization about your donation, and IRS Form 8283 for non-cash contributions, which serves as a record of your donation for tax purposes.

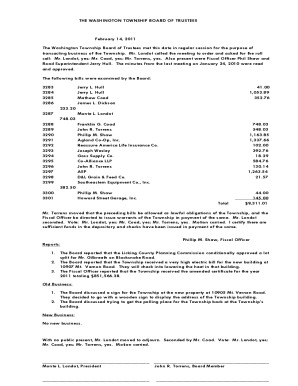

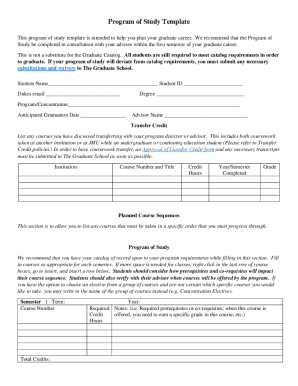

How to fill out the gifts of stock mutual form

Filling out the gifts of stock mutual form involves several sections that require precise details. It is important to accurately provide the information needed to avoid any issues with the donation process.

Sections typically include the donor's information, a description of the stock or mutual fund, and specifics about valuation and transfer details. Being diligent in completing this form ensures that the intended charitable cause receives your donation without challenges.

To avoid common errors, double-check that all information matches relevant documentation. An interactive example can aid in visualizing a completed form.

Tax implications of donating stocks and mutual funds

Donating stocks and mutual funds has several tax implications that can significantly benefit the donor. Understanding capital gains tax is crucial; when appreciating assets like stocks are donated, donors can avoid the taxes they would incur if they sold the stocks.

Additionally, the amount donated may be deductible on your tax return, depending on the fair market value of the stock or fund at the time of donation. It’s essential to follow IRS guidelines for non-cash contributions, which dictate record-keeping and specific forms to be filed.

Managing your stock and mutual fund donations

After you complete the donation process, managing your stock and mutual fund gifts becomes crucial for effective documentation and future tax benefits. Keeping track of your donations allows you to maintain accurate records that are essential for tax filing and personal financial planning.

Regular communication with the charity about your donations enables you to stay updated on how your contributions impact their work. Additionally, ensure you keep all related documentation, such as the completed forms and your acknowledgment letter, to provide clear evidence of your charitable gifting.

Real-life impact of gifts of stock and mutual funds

The effects of donating stocks and mutual funds extend far beyond mere financial contributions; they embody a commitment to making a real difference in communities. Many organizations have shared testimonials illustrating how stock donations have transformed their capacity to operate, fund programs, and expand their reach.

Case studies demonstrate the positive outcomes of stock donations, often detailing how these contributions have allowed organizations to enhance services, support more beneficiaries, or invest in crucial infrastructure and mission-related projects.

Common questions and misconceptions

Many individuals pondering over donating stock may harbor misconceptions about the process. One common myth is that donating stocks is more complicated than cash contributions. In reality, the procedures are straightforward and can often prove beneficial for both the donor and the charity.

Moreover, frequent questions include concerns about tax implications and eligibility. Awareness of the actual processes can dismantle misconceptions and encourage more potential donors to consider stock contributions.

Explore interactive tools for donors

As technology enhances how we manage our finances, interactive tools for donors can greatly simplify the donation process. Online stock donation calculators allow donors to estimate the potential tax benefits and impact of their contributions.

Additionally, suggested charitable organizations that accept stock donations can guide potential donors towards impactful causes. pdfFiller provides links to downloadable forms and templates to facilitate the process, ensuring a seamless contribution experience.

Staying updated on stock and mutual fund donations

Staying informed about changes in tax laws or donation processes is crucial for effective philanthropic contributions. Regularly reviewing updates and guidelines not only enhances your understanding but assures that your contributions remain compliant with current regulations.

Consider subscribing to donor engagement newsletters to receive the latest news on developments in charitable giving, including stock donations. Participation in webinars and workshops can also provide deeper insights into effective giving strategies.

Building a legacy through stock donations

Integrating stock gifts into your estate planning can significantly enhance your legacy, ensuring that your values and philanthropic wishes are honored after your passing. By strategically planning stock donations, you will not only support causes that matter to you but can also render substantial financial benefits for your estate.

Donor-advised funds represent a strategic avenue for those wishing to make regular stock donations while retaining some control over how and when their gifts are distributed. Cultivating a long-term impact through consistent stock donations can solidify your legacy and create a ripple effect of philanthropic support.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send gifts of stock mutual to be eSigned by others?

Can I create an electronic signature for the gifts of stock mutual in Chrome?

How can I fill out gifts of stock mutual on an iOS device?

What is gifts of stock mutual?

Who is required to file gifts of stock mutual?

How to fill out gifts of stock mutual?

What is the purpose of gifts of stock mutual?

What information must be reported on gifts of stock mutual?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.