Get the free Publicationsotr - DC Office of Tax and Revenue - DC.gov

Get, Create, Make and Sign publicationsotr - dc office

How to edit publicationsotr - dc office online

Uncompromising security for your PDF editing and eSignature needs

How to fill out publicationsotr - dc office

How to fill out publicationsotr - dc office

Who needs publicationsotr - dc office?

Navigating the Publications OTR - Office Form: Your Ultimate Guide

Understanding the Publications OTR - Office Form

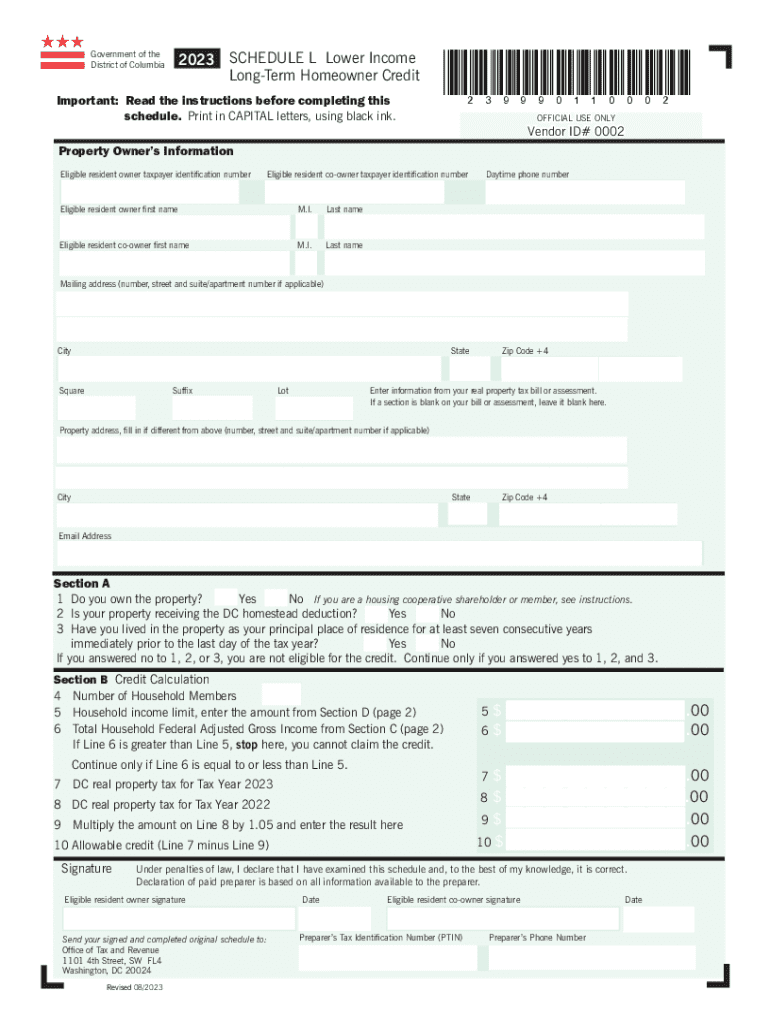

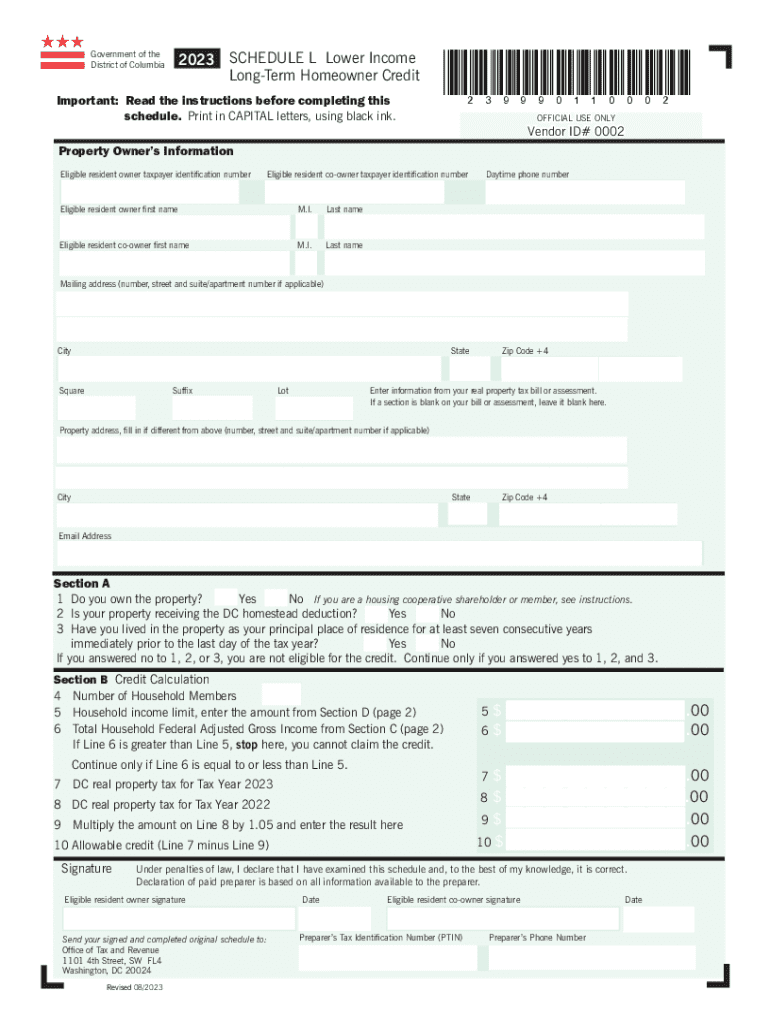

The Publications OTR (Office of Tax and Revenue) - DC Office Form is a vital document within Washington, D.C.’s tax framework. Designed for various filings related to property taxes, business licenses, and other statutory requirements, this form serves as the gateway to compliance with local regulations.

The primary purpose of the Publications OTR is to ensure that individuals and entities accurately report their tax obligations. Beyond simple compliance, it plays a critical role in document management, facilitating organized record-keeping and enabling easier retrieval when necessary.

Understanding who needs this form helps clarify its application:

Key features of the Publications OTR - Office Form

The Publications OTR - DC Office Form comes equipped with vital features that streamline the filing process. One of the standout attributes is its interactive tools that guide users through a customized form-filling experience, making the process more intuitive.

Additionally, the form offers real-time editing capabilities, allowing users to modify entries on the spot. This significantly reduces errors before the final submission. Furthermore, the integration of eSignature technology ensures that users can sign off on documents quickly and securely, without the need for printing or scanning.

Step-by-step guide to filling out the Publications OTR - Office Form

Filling out the Publications OTR - DC Office Form can seem daunting, but following these steps can simplify the process.

Step 1: Accessing the Form - You can easily find the form on the Washington, D.C. Office of Tax and Revenue website. Ensure that you are using a modern browser to avoid compatibility issues.

Step 2: Completing the Form - This step requires detailed attention. Key sections include:

Common mistakes to avoid include neglecting to complete mandatory fields or incorrectly entering numerical data.

Step 3: Reviewing Your Entries - Take the time to double-check your information thoroughly. You can utilize the auto-check tool available in pdfFiller to identify potential errors.

Step 4: Signing the Form - Choose an eSignature method convenient for you. Remember, eSignatures are legally valid under Washington D.C. law, ensuring that your document is recognized without the need for physical copies.

Step 5: Submitting Your Form - You have multiple submission options, including electronic submission via email or direct upload through the website. After submission, keep track of your submission status to confirm receipt.

Editing and updating the Publications OTR - Office Form

Once you've submitted the Publications OTR - DC Office Form, you may need to edit or update it, especially if changes in your circumstances arise. To edit submitted forms, log into your pdfFiller account and access the saved documents. With pdfFiller, you maintain simplicity and control over your documents, quickly making any necessary updates.

It's crucial to keep a record of changes made to any form to uphold a history of your submissions. Version control features within pdfFiller help you track alterations, ensuring that the latest version is always at your fingertips.

Managing your documents with pdfFiller

pdfFiller provides a robust platform for document management, particularly advantageous for handling the Publications OTR - DC Office Form. Users can take advantage of a wide range of document management features, including cloud storage where you can store and organize your forms securely.

Collaboration tools within pdfFiller allow team members to work together seamlessly, sharing access to forms when needed. Further, the platform ensures document security and compliance, which is paramount when dealing with sensitive tax information.

Troubleshooting common issues with the Publications OTR - Office Form

Even with a streamlined process, users may encounter issues while submitting the Publications OTR - DC Office Form. A common question involves how to manage delays or errors during submission. If you experience any problems, consult the FAQs on the D.C. Office of Tax and Revenue website, which provide timely information addressing frequent concerns.

In cases of persistent issues, contacting pdfFiller support can offer personalized assistance. Moreover, utilizing community forums and help guides can yield insights from other users who have faced similar challenges.

Real-life use cases of the Publications OTR - Office Form

Understanding how various individuals and organizations utilize the Publications OTR - DC Office Form provides insight into its efficiency. For instance, an individual filer recently navigated their property tax responsibilities using this form, discovering how streamlined the online submission process could be compared to previous years.

Similarly, businesses have optimized their filing processes by integrating this form into their established workflows, allowing for rapid compliance with local tax regulations. Professionals in sectors like accounting have also praised the form for its clarity and organization, making it easier to assist clients efficiently.

Best practices for using Publications OTR - Office Form

Adopting best practices can significantly increase your efficiency when using the Publications OTR - DC Office Form. To ensure effective document management, consider the following recommendations:

During tax seasons, staying organized and proactive in your filing processes can pay off, significantly reducing last-minute stress.

Additional features of pdfFiller relevant to the Publications OTR

pdfFiller offers additional features that streamline the use of the Publications OTR - DC Office Form. Integration with other platforms, such as CRM systems, allows for an even more interconnected document management system, enhancing overall productivity.

Utilizing analytics within pdfFiller can lead to improved filing practices, as data insights can pinpoint bottlenecks or frequent issues. Lastly, the mobile access feature ensures that documents can be filled, signed, and managed on the go, adding flexibility to an often rigid process.

User testimonials and success stories

User feedback on the Publications OTR - DC Office Form showcases its utility and impact. Individual users have expressed gratitude for the time saved during tax submissions, noting that the online platform has transformed a historically cumbersome process into a streamlined experience.

Corporate clients have shared success stories about how pdfFiller has expedited their filing and compliance, emphasizing incredible efficiency gains in their operations, ultimately translating to better service for their own clients.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send publicationsotr - dc office for eSignature?

Can I create an electronic signature for the publicationsotr - dc office in Chrome?

How do I complete publicationsotr - dc office on an Android device?

What is publicationsotr - dc office?

Who is required to file publicationsotr - dc office?

How to fill out publicationsotr - dc office?

What is the purpose of publicationsotr - dc office?

What information must be reported on publicationsotr - dc office?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.