Get the free YUM! 401(k) Plan - Financial Hardship Withdrawal Form

Get, Create, Make and Sign yum 401k plan

Editing yum 401k plan online

Uncompromising security for your PDF editing and eSignature needs

How to fill out yum 401k plan

How to fill out yum 401k plan

Who needs yum 401k plan?

Yum 401k Plan Form How-to Guide

Understanding the Yum 401k plan

The Yum 401k plan is a retirement savings program that allows employees of Yum! Brands to invest a portion of their salary tax-deferred. This means that contributions to the plan are made before income taxes are deducted, which can significantly enhance the growth potential of your savings over time. A critical aspect of the Yum 401k plan is its adaptability—employees can tailor their contributions according to their financial goals.

Key features of the Yum 401k plan include: variable contribution rates, employer matching funds, and a selection of investment options. The plan not only encourages savings but also facilitates wealth building through its diverse investment strategies.

Participating in the Yum 401k plan comes with numerous benefits, making it an important financial tool for employees. First, the tax advantages are a significant incentive since they reduce taxable income. Second, the employer's matching contributions can maximize your investment potential. Lastly, the plan helps secure long-term financial stability by fostering a habit of saving and investing.

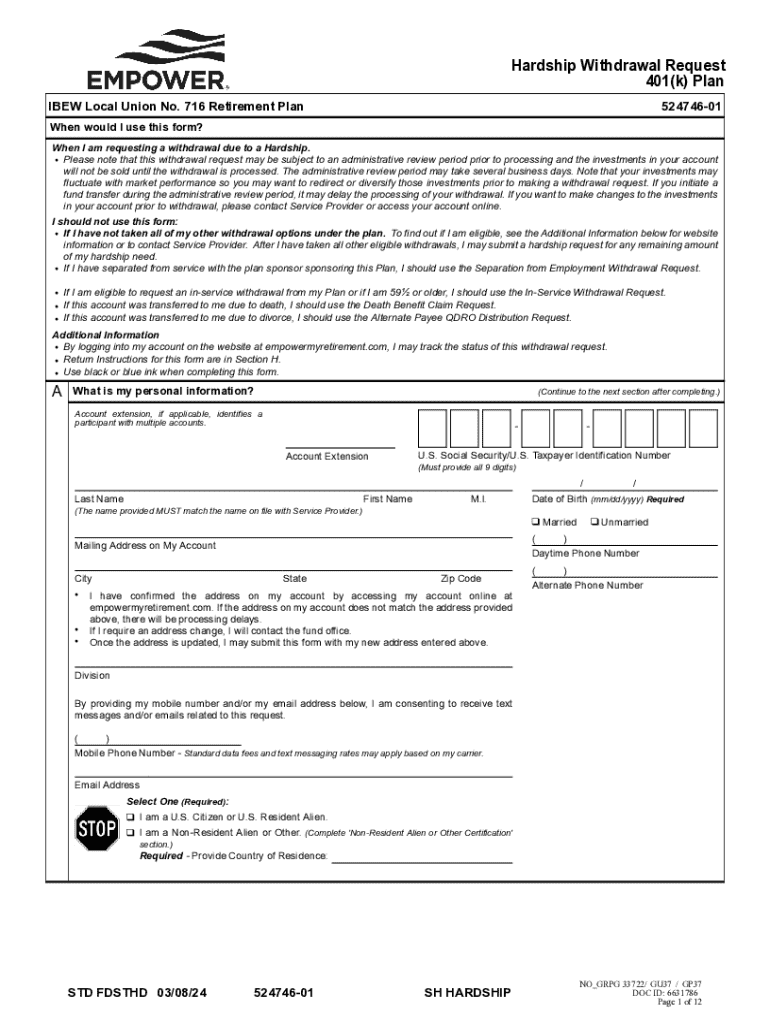

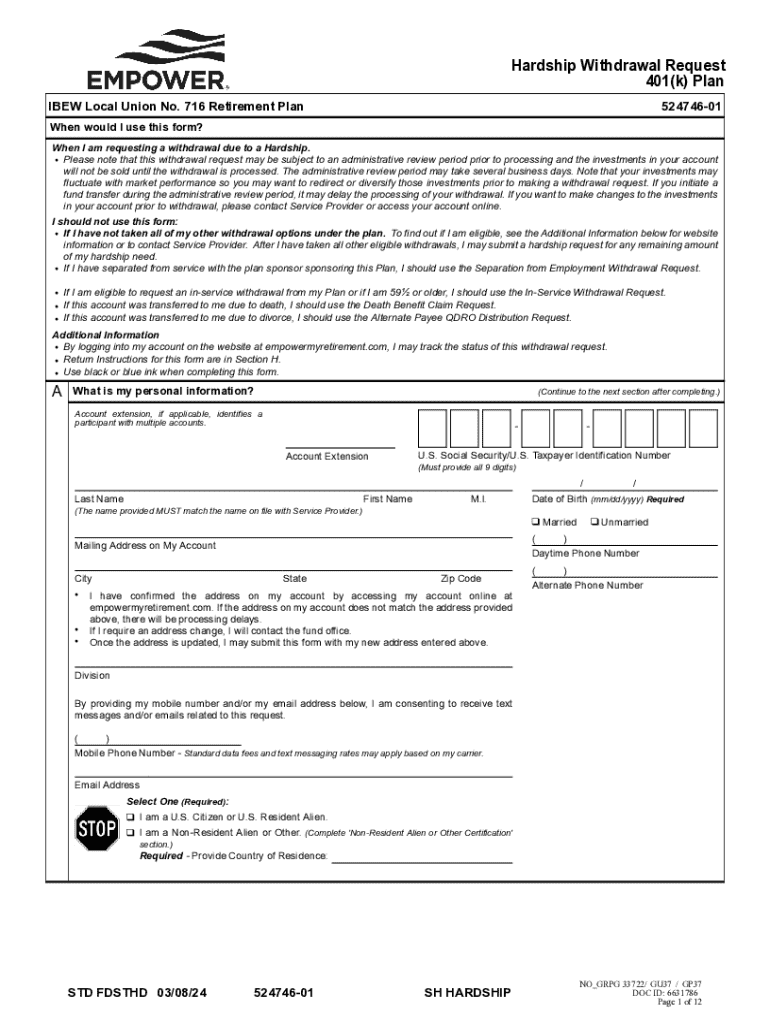

Accessing the Yum 401k plan form

Finding the Yum 401k plan form is essential for enrolling or making changes to your retirement savings. The primary source for this form is the official Yum website, where it is easily downloadable. You can navigate through the company's employee resources section to access the form directly online.

Alternative methods to retrieve the Yum 401k plan form include reaching out to your HR department directly, who can provide you with the necessary documents via email or in-person.

Detailed instructions for filling out the Yum 401k plan form

Completing the Yum 401k plan form accurately is crucial to ensure your retirement savings begin without any delays. Here’s a step-by-step guide on how to fill it out effectively.

Editing and reviewing your completed form

Before submitting your Yum 401k plan form, it’s important to thoroughly review it to avoid common mistakes. Incomplete information, especially in the personal details or contribution sections, can delay your enrollment.

Additionally, understanding the contribution limits enforced by the IRS is vital. These limits can change yearly, so staying updated can help you avoid errors. Using tools like pdfFiller can streamline this review process, as it allows users to edit and manage their documents conveniently.

Signing and submitting the Yum 401k plan form

Signing your Yum 401k plan form is a mandatory step among the final ones before submission. Depending on your preference, you have several options available for signing. eSigning methods through platforms like pdfFiller can expedite the process, allowing for a quick and secure digital signature.

For traditionalists, printing the form, signing it manually, and submitting it physically are still viable options. After signing, ensure that you submit your form to the correct department, and if possible, track your submission status, confirming that your form is processed without issues.

Managing your Yum 401k account post-submission

Once you have submitted your Yum 401k plan form, managing your retirement account efficiently becomes paramount. To begin, you will need to create an online profile on the Yum 401k management platform. This access allows you to monitor your investments, track contributions, and make necessary adjustments as your financial situation evolves.

Notably, many employees may wish to modify their contribution levels or add beneficiaries after initial submission. The online account management system makes these updates straightforward, ensuring that your investments continue aligning with your retirement goals.

Frequently asked questions (FAQs)

Understanding the ins and outs of the Yum 401k plan form involves addressing common queries that many employees might have. A frequent concern is what to do if a mistake is made during filling out the form. If recognized promptly, most inaccuracies can be corrected by simply re-filling the form with the corrected information.

Another common question relates to altering contribution amounts after initial enrollment. Yes, you can change your contributions at any time, subject to the annual IRS limits. Also, accessing your past submissions is typically available through your online account, making it easy to track changes over time.

Additional support and guidance

For those needing further assistance with the Yum 401k plan form, your HR department is typically the best contact point. They can address specific questions or provide clarification on nominee designations, contribution capabilities, and other common inquiries.

Moreover, utilizing pdfFiller's customer service and support resources can be beneficial if you're facing challenges with document management or online submissions. Their help articles and live customer service ensure that you won't have to navigate the process alone.

Benefits of using pdfFiller for your Yum 401k form

Using pdfFiller for your Yum 401k plan form enhances the entire experience of document management. This cloud-based platform empowers users to create, edit, eSign, and store documents all in one place, reducing the hassle of juggling multiple applications.

One of the notable advantages of pdfFiller is its commitment to protecting sensitive information. With robust security features, users can confidently navigate their financial documents without worrying about data breaches or unauthorized access.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit yum 401k plan on a smartphone?

How do I edit yum 401k plan on an iOS device?

How do I complete yum 401k plan on an Android device?

What is yum 401k plan?

Who is required to file yum 401k plan?

How to fill out yum 401k plan?

What is the purpose of yum 401k plan?

What information must be reported on yum 401k plan?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.