Get the free HDFC ERGO General Insurance Company Limited Claim ...

Get, Create, Make and Sign hdfc ergo general insurance

Editing hdfc ergo general insurance online

Uncompromising security for your PDF editing and eSignature needs

How to fill out hdfc ergo general insurance

How to fill out hdfc ergo general insurance

Who needs hdfc ergo general insurance?

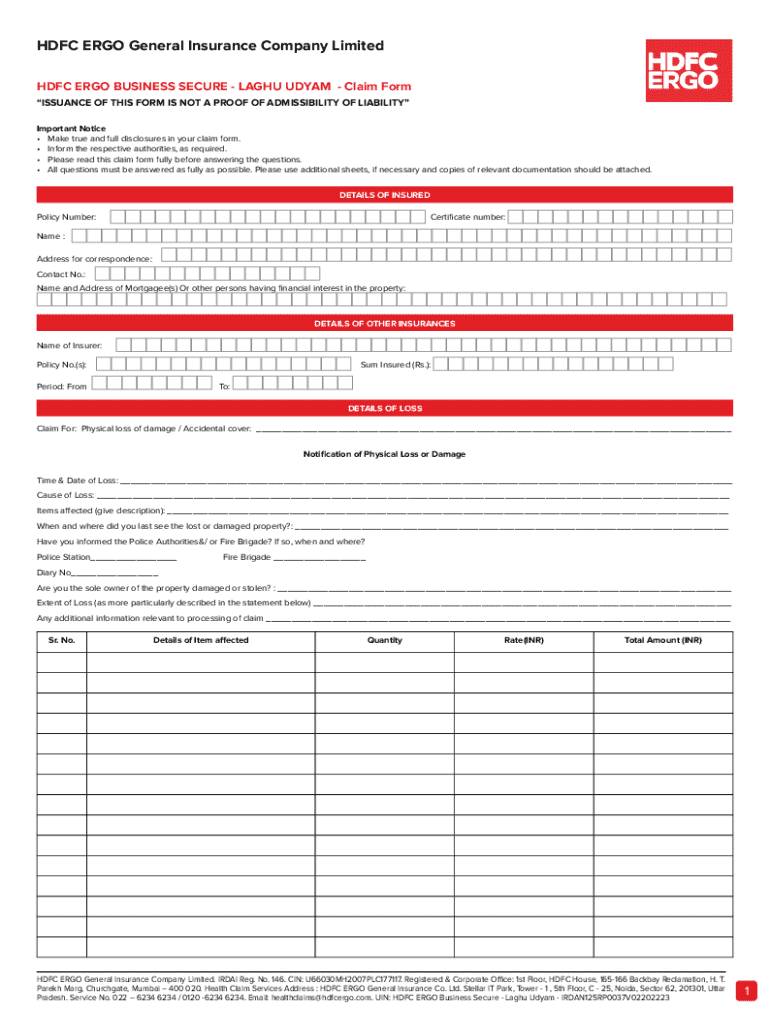

A comprehensive guide to the HDFC Ergo general insurance form

Understanding HDFC Ergo general insurance

HDFC Ergo General Insurance is a trusted provider in the Indian insurance sector, offering a diverse range of products designed to cater to individual and business needs. With a strong emphasis on customer satisfaction and claim settlement, HDFC Ergo stands out for its innovative offerings and robust service ecosystem.

The company provides various types of general insurance, each tailored to meet specific requirements. From health insurance that safeguards against medical emergencies to motor insurance covering vehicular damages, HDFC Ergo aims to deliver peace of mind through comprehensive risk management solutions.

Importance of filling the insurance form correctly

Completing the HDFC Ergo general insurance form accurately is critical for ensuring your coverage is effective. Misinformation can lead to delays in claim settlements or, in some cases, rejection of the policy. Providing precise and comprehensive details on the form streamlines the underwriting process, facilitating quicker policy issuance.

Common mistakes include typos in personal information, selecting incorrect coverage options, and failing to provide supplementary documentation. These errors not only complicate the application process but can also impact your insurance premiums and claims satisfaction in the future.

How to access the HDFC Ergo general insurance form

Accessing the HDFC Ergo general insurance form is a straightforward process, allowing users easy navigation via their official website. This also highlights the user-friendly approach of HDFC Ergo to help customers engage with their products effortlessly.

Follow these steps to find the form online:

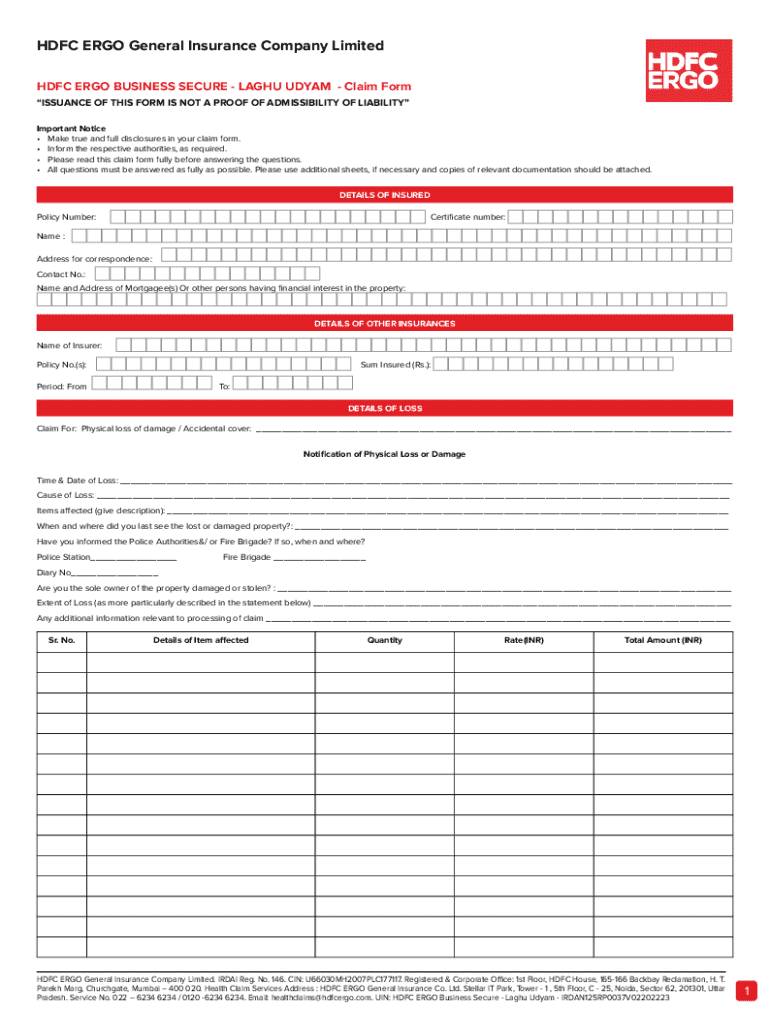

Detailed instructions for filling the HDFC Ergo insurance form

Before filling out the HDFC Ergo insurance form, it's vital to gather all necessary documents. This ensures that your application is complete and accurate, reducing the likelihood of callbacks for missing information.

Key documents typically needed include:

The insurance form comprises several crucial sections that need careful attention:

Editing and managing your HDFC Ergo insurance form

Once you have completed your HDFC Ergo insurance form, utilizing tools like pdfFiller can streamline the process of editing and managing your documents. This platform offers a range of functionalities, enhancing your user experience significantly.

Follow these steps to edit the form using pdfFiller:

Additionally, pdfFiller allows you to eSign your form digitally, which is both convenient and secure. Sharing features enable you to collaborate seamlessly with family members or teams, ensuring everyone involved is up to date.

Submitting the HDFC Ergo general insurance form

Submitting your completed HDFC Ergo insurance form can be done through various channels, ensuring flexibility for users. Understanding these options can expedite the process of finalizing your insurance coverage.

You can submit your form via:

Once submitted, you can easily track your application status online, ensuring you remain informed throughout the process.

Common queries about HDFC Ergo general insurance

Navigating the complexities of insurance can raise various questions. To address this, HDFC Ergo provides resources to clarify doubts and create a transparent process.

Here are some frequently asked questions regarding the HDFC Ergo insurance form:

Understanding claims with HDFC Ergo

Filing a claim under your HDFC Ergo insurance policy is a pivotal aspect that showcases the importance of your chosen coverage. The claim process is designed to simplify how you receive financial support in unfortunate circumstances.

The types of claims covered include:

To initiate a claim, necessary documentation must be submitted along with the claim form. Follow the prescribed steps to ensure a smooth claims process, as per HDFC Ergo's guidelines.

Additional tools and resources

For individuals looking to manage their documents more effectively, pdfFiller provides a suite of interactive tools that enhance user experience. Document comparison tools, form analytics, and other features enable a more streamlined management process.

You can also easily access other related insurance forms such as portability forms and claim intimation forms through the platform, ensuring all your insurance needs are covered comprehensively.

Connecting with HDFC Ergo customer support

For further assistance regarding the HDFC Ergo general insurance form, connecting with customer support is crucial. They are equipped to resolve queries efficiently and guide you through necessary processes.

Customers can reach out via various channels to seek assistance:

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get hdfc ergo general insurance?

Can I create an eSignature for the hdfc ergo general insurance in Gmail?

How do I complete hdfc ergo general insurance on an Android device?

What is hdfc ergo general insurance?

Who is required to file hdfc ergo general insurance?

How to fill out hdfc ergo general insurance?

What is the purpose of hdfc ergo general insurance?

What information must be reported on hdfc ergo general insurance?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.