Get the free 2026 draft housing credit qualified allocation plan

Get, Create, Make and Sign 2026 draft housing credit

Editing 2026 draft housing credit online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2026 draft housing credit

How to fill out 2026 draft housing credit

Who needs 2026 draft housing credit?

Navigating the 2026 Draft Housing Credit Form: A Comprehensive Guide

Overview of the 2026 draft housing credit form

The 2026 Draft Housing Credit Form serves as a pivotal document in the realm of affordable housing initiatives, designed to streamline the process of applying for housing tax credits. This form outlines the necessary steps and requirements for individuals and developers seeking financial assistance to create affordable housing projects. With its focus on transparency and accessibility, the 2026 Draft aims to encourage growth in affordable housing across various communities.

In the wake of increasing housing demands and the need for equitable living conditions, the significance of the 2026 Draft cannot be overstated. It caters to both new applicants and previous participants in housing programs, ensuring that they have the tools and knowledge needed to navigate the complexities of the application process.

Understanding housing tax credit programs

Housing Tax Credit (HTC) programs fundamentally aim to incentivize the development of affordable rental housing. The two primary categories under these programs are the 4% and 9% Housing Tax Credits, each designed to cater to varying project needs. The 9% credit is typically more advantageous as it offers a larger tax incentive, making it the preferred choice for new developments. Conversely, the 4% credit is commonly utilized in conjunction with other funding sources.

Historically, federal housing credits have evolved significantly since their introduction in the 1980s. Over the years, adjustments have been made to better align with the burgeoning need for affordable housing, responding directly to economic conditions and community feedback. Understanding this evolution is crucial for applicants as it shapes the current standards and requirements laid out in the 2026 Draft.

Key features of the 2026 draft housing credit form

The 2026 Draft Housing Credit Form introduces several significant updates aimed at enhancing usability and compliance. Compared to previous versions, this draft emphasizes clarity, ensuring that all applicants can easily understand and fulfill the requirements. Essential sections of the form detail the eligibility criteria, which dictate who can apply, as well as income limits and rent restrictions that govern how affordable housing is defined.

Moreover, compliance and reporting requirements have been streamlined to facilitate easier tracking and monitoring of projects. This not only benefits the applicants but also helps regulatory bodies maintain oversight and ensure the success of funded initiatives.

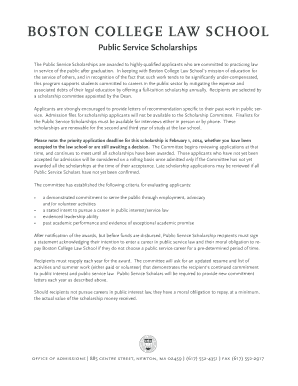

Step-by-step guide to completing the 2026 draft housing credit form

Completing the 2026 Draft Housing Credit Form requires careful attention to detail. Below is a simplified guide to assist applicants throughout the process:

Common pitfalls include providing outdated information, failing to meet deadlines, or neglecting to double-check for errors. To facilitate accurate data entry, it's advisable to utilize checklist tools and ensure all parties involved are aligned on the information provided. Compliance with all requirements is essential to avoid delays or denials.

Interactive tools for form management

Using resources like pdfFiller enhances the experience of completing the 2026 Draft Housing Credit Form. With interactive tools available, users can efficiently edit PDFs, make real-time adjustments, and maintain a collaborative environment.

The platform offers online editing features that simplify the process, alongside eSigning capabilities for faster document processing. Teams can also leverage collaboration features, allowing real-time commenting and approval processes that enhance productivity.

FAQs about the 2026 draft housing credit form

One of the frequent concerns among applicants is the risk of encountering issues while filling out the form. In such cases, it is recommended to consult detailed guides or reach out for technical support available through resources like pdfFiller.

Additionally, tracking the status of your submission is crucial. Applicants are encouraged to maintain records of submission confirmations and use tracking tools provided by platforms to keep tabs on application progress. Clearing up misconceptions surrounding the Housing Credit program can also help mitigate confusion and enhance applicants’ chances of success.

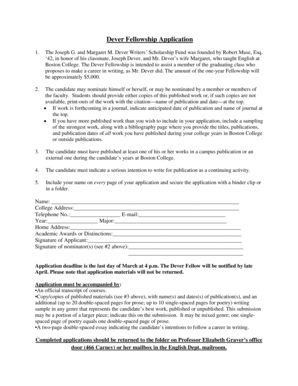

Supporting documents and additional requirements

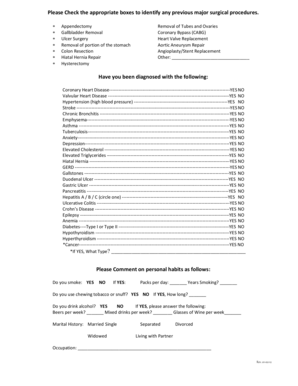

In conjunction with the 2026 Draft Housing Credit Form, applicants must prepare a set of supporting documents. This includes but is not limited to:

Organizing these documents efficiently will significantly streamline the application process and enhance the chances of approval.

Submission process for the 2026 draft housing credit form

Submitting the 2026 Draft Housing Credit Form is a straightforward process but requires careful adherence to guidelines. Applicants should utilize online submission options offered by pdfFiller to ensure timely processing.

Key deadlines ought to be noted to avoid missing critical submissions. Ensuring compliance after submission through routine follow-ups is equally essential to making sure that everything remains in order and that any potential issues are addressed promptly.

Historical overview of housing tax credit rounds

To gauge the efficacy of the 2026 Draft, it helps to look at prior Housing Tax Credit Rounds, such as those in 2025 and 2024. Each of these rounds brought unique challenges and opportunities that can inform current practices.

Key successes from previous submissions often rested on robust documentation and clear alignment with program goals. Lessons learned from earlier rounds emphasize the importance of community engagement and feedback, shaping a stronger approach for the present 2026 Draft initiatives.

Feedback mechanism: Comments and recommendations

Stakeholder feedback serves an important role in the optimization of the 2026 Draft Housing Credit Form. Communities and applicants are encouraged to provide insightful commentary on their experiences.

Such input not only assists in refining the form but also strengthens the overall housing credit programs. Leveraging tools like pdfFiller for effective document collaboration enhances the feedback process, ensuring that all relevant voices are considered.

Contact information and support resources

For assistance with the 2026 Draft Housing Credit Form, individuals can reach out to pdfFiller support channels. Their dedicated resources often provide helpful FAQs and troubleshooting assistance for common issues encountered during the application process.

In addition, a well-structured help section on their website can guide users through the nuances of form completion and submission, ensuring they have the necessary resources at their fingertips.

Future trends in housing credit programs

As we look ahead, anticipated changes in housing policy and tax credits will likely influence the structure and availability of housing financing options. These changes may reflect a shift towards greater inclusivity and responsiveness to community needs.

Technology will play a vital role in simplifying housing documentation and compliance processes, enhancing user experience across platforms such as pdfFiller that emphasize ease of use and accessibility.

Accessibility and digital tools for housing credit form management

Ensuring that the 2026 Draft Housing Credit Form is accessible to all users is a priority. pdfFiller provides various features designed to accommodate users with diverse needs, allowing an inclusive approach to document management.

The cloud-based functionalities of pdfFiller enable seamless access and editing of housing documentation, enhancing the overall management experience for users from different backgrounds and abilities.

Conclusion of insights

The 2026 Draft Housing Credit Form represents a significant advancement in the pursuit of affordable housing solutions. By integrating feedback, incorporating technology, and focusing on clarity in the application process, stakeholders can expect a more streamlined experience.

It's vital to utilize the resources available through pdfFiller, ensuring that each step from filling out to submitting the form is as effective and efficient as possible, paving the way for successful housing initiatives.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete 2026 draft housing credit online?

Can I create an electronic signature for signing my 2026 draft housing credit in Gmail?

How can I edit 2026 draft housing credit on a smartphone?

What is 2026 draft housing credit?

Who is required to file 2026 draft housing credit?

How to fill out 2026 draft housing credit?

What is the purpose of 2026 draft housing credit?

What information must be reported on 2026 draft housing credit?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.