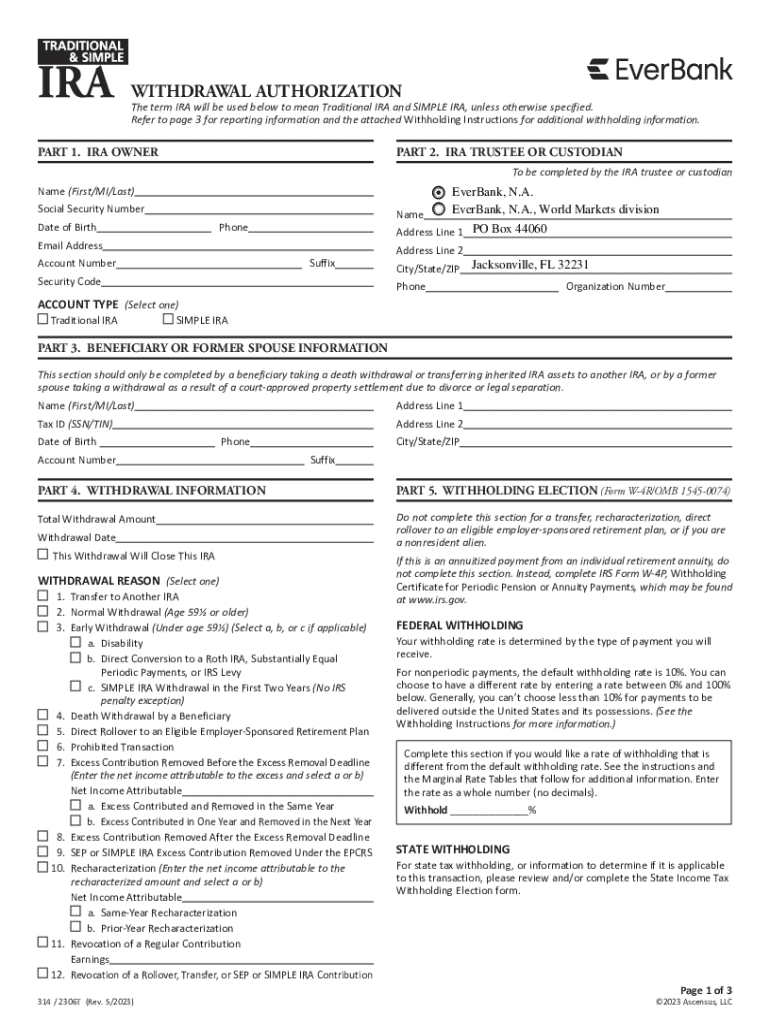

Get the free SIMPLE IRA vs. Traditional IRA: What's the Difference?

Get, Create, Make and Sign simple ira vs traditional

How to edit simple ira vs traditional online

Uncompromising security for your PDF editing and eSignature needs

How to fill out simple ira vs traditional

How to fill out simple ira vs traditional

Who needs simple ira vs traditional?

Simple IRA vs Traditional IRA: What's the Difference?

Overview of SIMPLE IRA vs Traditional IRA

Understanding retirement plans is essential for effective financial planning, and distinguishing between a SIMPLE IRA and a Traditional IRA plays a crucial role in managing retirement savings. Both options serve as foundational tools for individuals looking to secure their financial future, but they have distinct purposes and features. A well-informed choice can significantly impact one’s retirement outcomes.

Key definitions

A SIMPLE IRA (Savings Incentive Match Plan for Employees) is designed for small businesses and self-employed individuals. It offers an easy way to save for retirement, with reduced administrative responsibilities and no complex compliance requirements. Generally, it allows both employers and employees to make contributions, making it an appealing choice for smaller firms.

On the other hand, a Traditional IRA is an individual retirement account that allows individuals to make tax-deductible contributions, which can grow tax-deferred until withdrawal during retirement. This type of IRA is open to anyone with earned income, and it provides greater flexibility in terms of investment choices compared to a SIMPLE IRA.

Eligibility requirements

To be eligible for a SIMPLE IRA, a business must have 100 or fewer employees who earned at least $5,000 in the preceding year. Businesses cannot have other retirement plans established.

In contrast, any individual with earned income can contribute to a Traditional IRA, regardless of their employment status. However, those wishing to claim tax deductions for their contributions may face income limits depending on their filing status and whether they are covered by an employer-sponsored retirement plan.

Contribution limits

SIMPLE IRA contribution limits

For 2023, the maximum contribution limit for a SIMPLE IRA is $15,500, with an additional catch-up contribution of $3,500 for individuals aged 50 and above. Employers are required to match employee contributions up to 3% of the employee's compensation.

Traditional IRA contribution limits

In 2023, the contribution limit for a Traditional IRA stands at $6,500, with a catch-up contribution of $1,000 for those aged 50 and older. Unlike SIMPLE IRAs, contributions to a Traditional IRA can be made regardless of whether the individual participates in any employer retirement plan, but their deductibility may be limited.

Comparison of contribution limits

Tax advantages

SIMPLE IRA tax benefits

One key benefit of a SIMPLE IRA is that contributions are made with pre-tax dollars, which lowers your taxable income for the year. Therefore, the growth from investments is tax-deferred until you withdraw funds in retirement, which can provide significant tax advantages.

Traditional IRA tax benefits

Similarly, Traditional IRA contributions can be fully or partially tax-deductible based on income levels and participation in other retirement plans. This tax deductibility combined with tax-deferred growth also leads to potentially larger retirement savings over time.

Key differences in tax treatment

The primary difference lies in the contexts in which individuals can take advantage of these benefits. SIMPLE IRAs are often more suited for employees of smaller businesses, while Traditional IRAs are highly accessible for all taxpayers looking for individual retirement savings options. Understanding these nuances is essential for making the right decision.

Investment options

Investment choices available in SIMPLE IRAs

SIMPLE IRAs typically offer a narrower range of investment choices, usually involving mutual funds and stocks. The limited options cater to more straightforward investment strategies, appealing to individuals who prefer simplicity over complexity in their retirement plans.

Investment choices available in Traditional IRAs

In contrast, Traditional IRAs provide a broader selection of investment options, including stocks, bonds, mutual funds, and ETFs. This flexibility allows investors to customize their portfolios according to their individual preferences and risk tolerances, which can lead to improved long-term outcomes.

Withdrawal rules and required minimum distributions (rmds)

Withdrawal rules for SIMPLE IRAs

Withdrawals from a SIMPLE IRA before age 59½ generally incur a 10% penalty, but if the withdrawal occurs within the first two years of participation, this penalty increases to 25%. Once participants reach 59½, they can withdraw funds without penalty, although regular income tax will still apply.

Withdrawal rules for Traditional IRAs

Similarly, Traditional IRAs enforce a 10% penalty for early withdrawals; however, there are exceptions such as disability or certain qualified expenses. Unlike SIMPLE IRAs, there is no increased penalty for early withdrawals regardless of participation duration.

RMDs: what you need to know

Both SIMPLE and Traditional IRAs require account holders to begin taking required minimum distributions (RMDs) by age 72. It is crucial to plan for RMDs to avoid unexpected tax penalties, as failing to withdraw the appropriate amount incurs a hefty 50% penalty on the shortfall.

Comparing SIMPLE IRAs and Traditional IRAs

Who should choose a SIMPLE IRA?

SIMPLE IRAs are most beneficial for small business owners looking to provide retirement benefits to their employees while minimizing administrative responsibilities. They cater to businesses with fewer than 100 employees and generally incentivize employee participation through employer matching.

Who should choose a Traditional IRA?

In contrast, those who are self-employed or working for larger organizations where other retirement plans are not available may find Traditional IRAs to be more advantageous. They can offer greater flexibility and larger contribution limit opportunities.

Detailed side-by-side comparison of key features

Special scenarios

Can you have both SIMPLE and Traditional IRAs?

Yes, individuals can contribute to both a SIMPLE IRA and a Traditional IRA, provided they stay within the annual contribution limits specific to each type of account. However, it's essential to track contributions to avoid exceeding annual caps.

Conversions: SIMPLE IRA to Traditional IRA

It is also permissible to convert a SIMPLE IRA into a Traditional IRA. However, one must wait for two years after the SIMPLE IRA was established before doing so. Conversions can be a strategic move, particularly if an individual seeks to gain access to a broader array of investment options.

Strategic considerations for choosing

Assessing financial goals

When deciding between a SIMPLE IRA or a Traditional IRA, it's crucial to align the choice with specific financial goals. Individuals should consider their current and expected income, tax bracket, and retirement plans to evaluate their best option.

Long-term vs short-term benefits

Evaluating long-term and short-term benefits should also factor into the decision-making process. While SIMPLE IRAs may provide easier management for small business owners, Traditional IRAs offer flexible investment opportunities catering to unique financial situations.

How to maximize contributions

Timing contributions to align with IRS guidelines is critical for both account types. Engaging with a financial advisor can also optimize contribution strategies, ensuring that individuals capitalize on available tax benefits to the fullest.

FAQs

Common questions about SIMPLE IRAs

It is common for individuals to wonder whether they can still contribute to a SIMPLE IRA if they leave their employer. The answer is yes, but new contributions can only continue if the IRA is independently maintained. Additionally, many ask about the implications of withdrawing funds: the penalties increase significantly during the first two years.

Common questions about Traditional IRAs

Traditional IRA holders frequently inquire about the deductibility of contributions, primarily influenced by income levels and other retirement plans. It's essential to understand how deductions impact overall taxable income.

Specific situations and their consequences

There are many circumstances that can alter the tax or withdrawal implications of both SIMPLE and Traditional IRAs. For example, making an early withdrawal for medical expenses is an exception for both types, while rolling over funds from employer-sponsored plans requires stricter adherence to timelines.

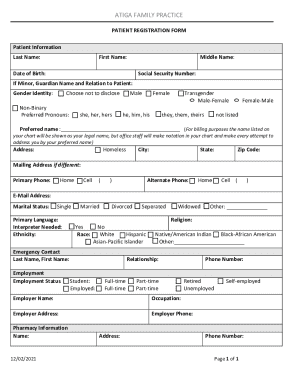

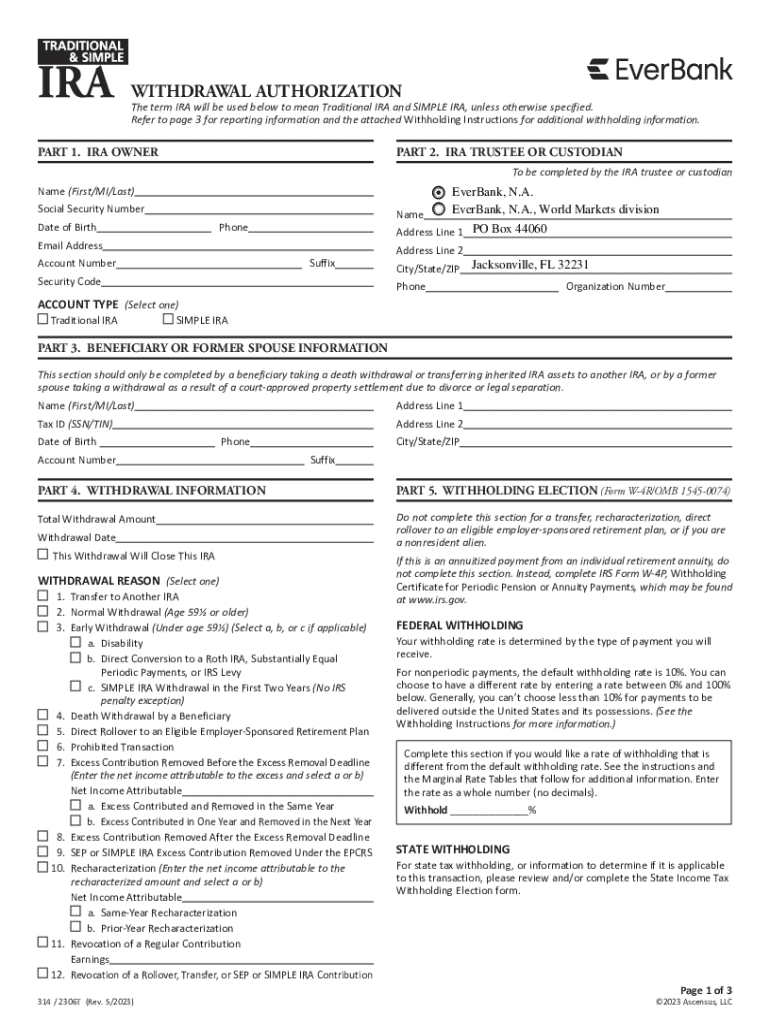

Leveraging pdfFiller for your IRA documentation

How to access and fill IRA forms with pdfFiller

Utilizing pdfFiller empowers users to access and fill the required IRA forms quickly and efficiently. With its user-friendly interface, individuals and businesses can manage their IRA paperwork from anywhere, eliminating the hassle and time-intensive nature of traditional documentation.

The benefits of digital document management for investment planning

Digital document management offers significant advantages such as convenience, accessibility, and storage efficiency. Users can save time spent on managing paper documents, streamline the filing process, and keep track of critical deadlines, ensuring smooth compliance with retirement account regulations.

Step-by-step guide to filling out SIMPLE IRA and Traditional IRA forms with pdfFiller

To fill out your IRA forms using pdfFiller, start by selecting the appropriate form. Once selected, utilize the fillable fields to enter your information. After filling in the required sections, users can easily share, sign, and store digitally, ensuring that all documents are organized and accessible.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my simple ira vs traditional in Gmail?

How do I fill out simple ira vs traditional using my mobile device?

Can I edit simple ira vs traditional on an iOS device?

What is simple ira vs traditional?

Who is required to file simple ira vs traditional?

How to fill out simple ira vs traditional?

What is the purpose of simple ira vs traditional?

What information must be reported on simple ira vs traditional?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.