Get the free Correspondent Scrubbing Checklist

Get, Create, Make and Sign correspondent scrubbing checklist

How to edit correspondent scrubbing checklist online

Uncompromising security for your PDF editing and eSignature needs

How to fill out correspondent scrubbing checklist

How to fill out correspondent scrubbing checklist

Who needs correspondent scrubbing checklist?

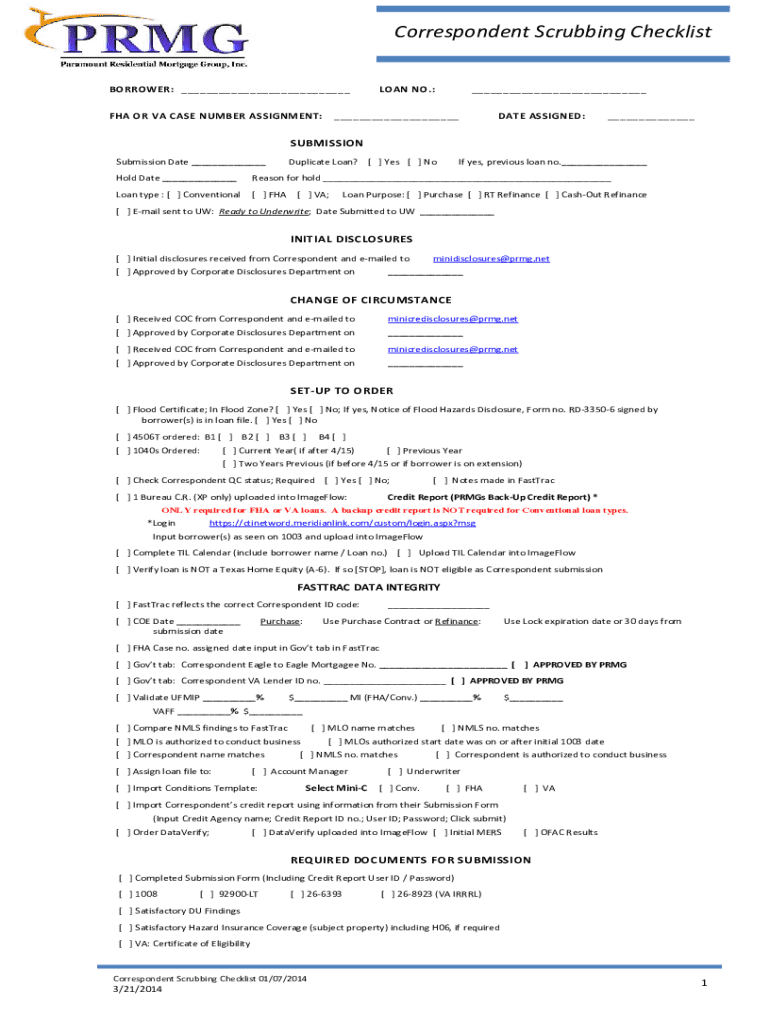

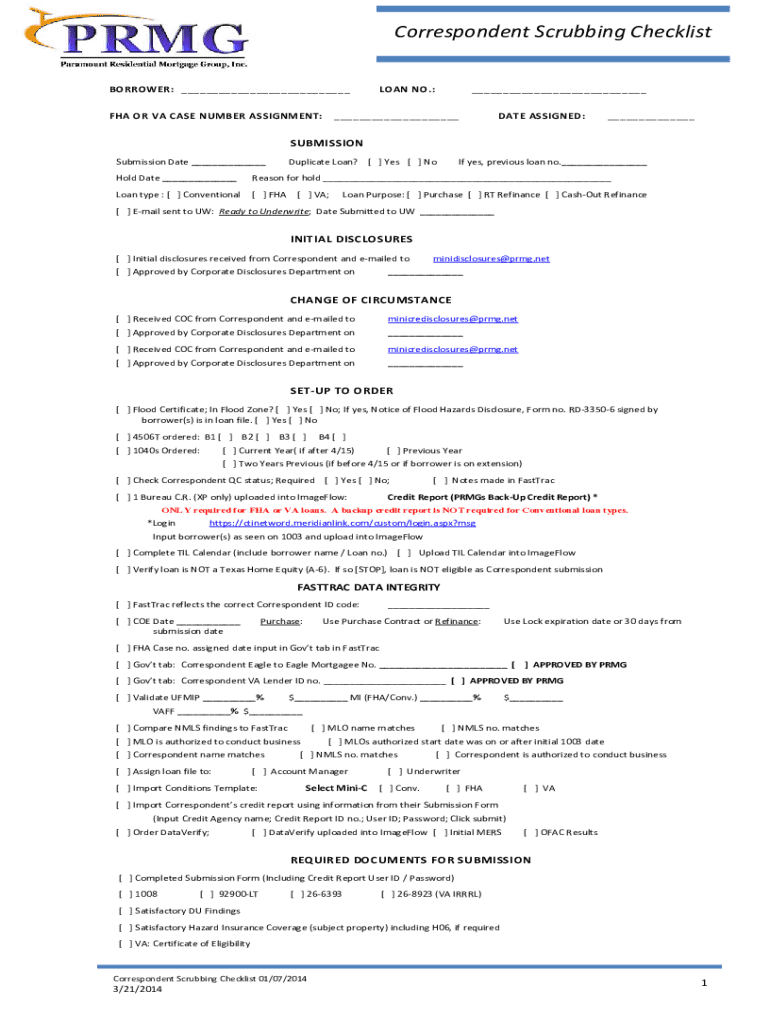

Correspondent Scrubbing Checklist Form: A Comprehensive Guide

Overview of the correspondent scrubbing process

Correspondent scrubbing is a crucial process for financial institutions that involves the review and verification of correspondent banking relationships to ensure compliance with regulatory standards. This process is vital for identifying potential risks associated with money laundering, fraud, and other financial crimes. It serves as a preventative measure, safeguarding institutions from reputational damage, financial losses, and regulatory penalties.

The importance of scrubbing cannot be overstated, especially in today’s complex regulatory environment. By effectively scrubbing correspondent relationships, financial entities can mitigate risks and enhance their operational integrity. This process also contributes to maintaining trust with stakeholders and regulatory bodies.

Understanding the correspondent scrubbing checklist form

The correspondent scrubbing checklist form is a structured tool designed to systematically assess and document the details surrounding correspondent banking relationships. This form comprises several integral components that guide users through the scrubbing process, ensuring comprehensive evaluations are achieved.

Essential components of the checklist include Identification Information, Risk Assessment Parameters, and Follow-up Actions. Each section gathers vital information that aids in determining the risk profile of each correspondent bank or entity.

The form also includes interactive elements such as dropdown menus and checkboxes to enhance usability, allowing for quicker data entry and reducing the chances of errors.

Step-by-step instructions for using the checklist form

To effectively use the correspondent scrubbing checklist form on pdfFiller, follow these structured steps for optimal results.

Step 1: Accessing the Correspondent Scrubbing Checklist Form. Begin by navigating to the pdfFiller platform where you can find the form. If you don’t have an account, signing up is straightforward; you simply need to provide an email and create a password. Once this is complete, log in to access all available forms.

Step 2: Filling out the Form. Once you have accessed the form, enter the required identification information accurately. Pay special attention to the risk assessment data, ensuring you utilize dropdowns effectively for swift selection and providing clear, concise information in text fields.

Step 3: Reviewing and Editing Your Entries. Before finalizing the form, review all entries for accuracy. It’s beneficial to involve team members in this process to gain different perspectives and catch any potential errors.

Step 4: Signing and Finalizing the Form. Upon completing the form, you can utilize e-signature options offered by pdfFiller for quick signing. Following that, adhere to best practices when submitting your completed form, ensuring that all necessary documentation is attached.

Managing correspondent scrubbing documents

Managing the files associated with the correspondent scrubbing checklist is an important part of maintaining organized records. pdfFiller provides a suite of document management features tailored for this purpose. Users can easily save, download, and share their filled-out scrubbing checklists.

To save your checklist, simply click the save option after completing the necessary information. You can choose to download your document in multiple formats, such as PDF or Word, depending on your needs. For enhanced collaboration, utilize the share features to invite relevant stakeholders to review or comment on the checklist.

Additionally, creating a systematic filing method using folders can keep your scrubbing checklists easily accessible for future reference, ensuring compliance continuity.

Compliance considerations in correspondent scrubbing

Understanding the regulatory landscape is essential for compliance during correspondent scrubbing. Different regions have specific regulations, such as the FATF guidelines or local AML laws, which need to be adhered to. Utilizing the correspondent scrubbing checklist form effectively supports compliance efforts by ensuring that critical information is collected and reviewed.

This checklist helps institutions avoid common pitfalls, such as overlooking key risk factors or misinterpreting regulatory requirements. It's crucial to periodically reassess and update practices in response to changing regulations and best practices.

Troubleshooting and FAQs

While using the correspondent scrubbing checklist form, users may encounter several common issues. One frequent concern is how to effectively manage incomplete forms. When facing this issue, it’s advisable to save the form as a draft and return to it once all necessary information is gathered.

Another point of confusion may be utilizing the interactive features effectively. Engaging with customer support for assistance or looking into guidance provided on the pdfFiller platform can be invaluable. Below are frequently asked questions that can assist in facilitating a smoother experience.

Tips for maximizing the use of the correspondent scrubbing checklist

To fully leverage the correspondent scrubbing checklist form, it’s important to incorporate best practices and collaborate effectively as a team. Utilizing shared access tools offered by pdfFiller can streamline the reviewing and editing processes, making collaboration effortless.

Encouraging team members to provide feedback on both the checklist process and the form's usability promotes a culture of continuous improvement. Regularly revisiting and refining your scrubbing practices ensures that compliance measures are both robust and up-to-date.

Resources for further learning

For users looking to delve deeper into the correspondent scrubbing checklist form and related practices, pdfFiller offers an array of forms and templates that can enhance the scrubbing experience. Additionally, educational resources, including webinars and detailed guides, are available to equip users with knowledge on document management and compliance.

Exploring success stories from other users can provide unique insights and practical examples that demonstrate effective usage of the checklist and overall document management strategies.

Summary of key points

In conclusion, the correspondent scrubbing checklist form serves as an essential tool for financial institutions focused on compliance and risk management. By following organized practices and utilizing the interactive capabilities of the form, users can efficiently scrub correspondents, reducing risks and enhancing accountability.

Investing time to understand and implement the points discussed throughout this guide will not only streamline the scrubbing process but also ensure that you remain compliant with regulatory standards. pdfFiller's platform continues to offer innovative document management solutions that empower users to stay efficient and organized.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify correspondent scrubbing checklist without leaving Google Drive?

Can I create an electronic signature for signing my correspondent scrubbing checklist in Gmail?

How do I fill out correspondent scrubbing checklist on an Android device?

What is correspondent scrubbing checklist?

Who is required to file correspondent scrubbing checklist?

How to fill out correspondent scrubbing checklist?

What is the purpose of correspondent scrubbing checklist?

What information must be reported on correspondent scrubbing checklist?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.