Get the free Maryland Hospital Audited Financial Statements

Get, Create, Make and Sign maryland hospital audited financial

How to edit maryland hospital audited financial online

Uncompromising security for your PDF editing and eSignature needs

How to fill out maryland hospital audited financial

How to fill out maryland hospital audited financial

Who needs maryland hospital audited financial?

Understanding the Maryland Hospital Audited Financial Form

Understanding the Maryland hospital audited financial form

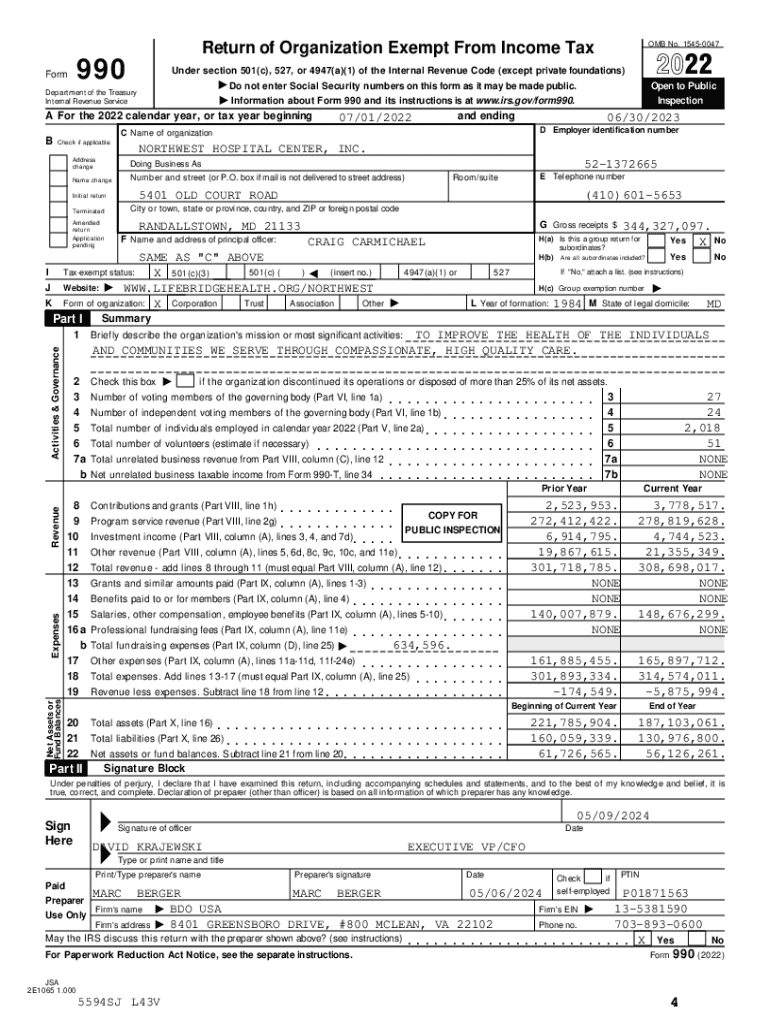

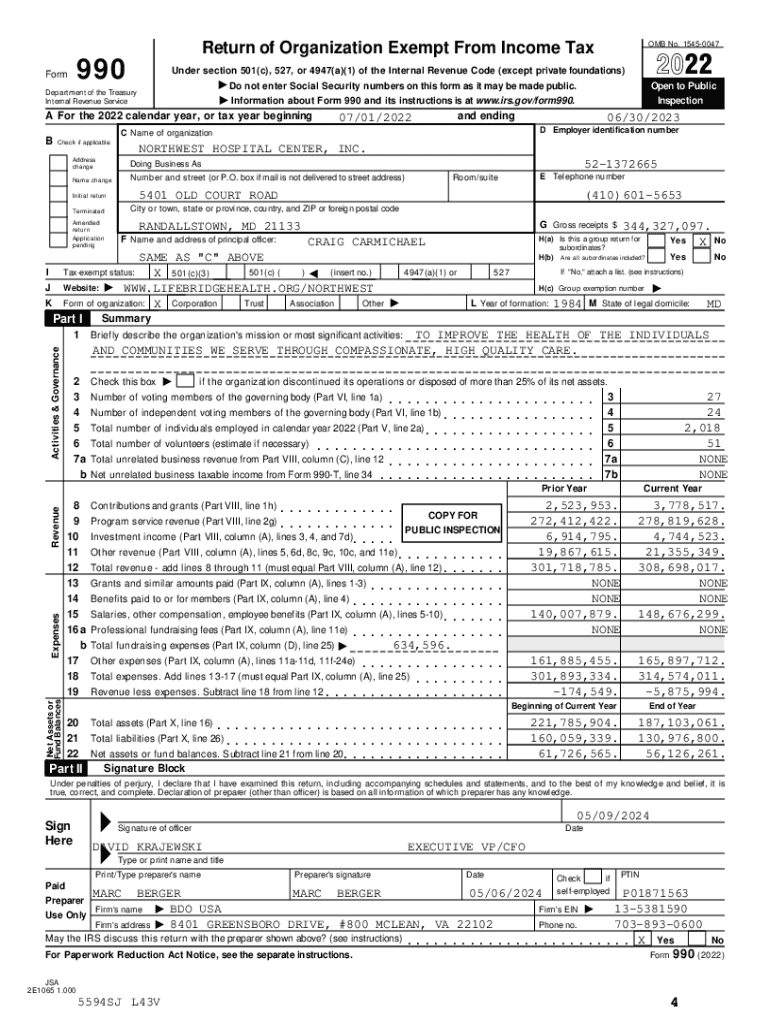

The Maryland Hospital Audited Financial Form is a critical document that hospitals in Maryland are required to complete annually. Its purpose is to provide a transparent overview of a hospital's financial status, ensuring compliance with state regulations and promoting accountability. Accurate financial reporting is crucial in a healthcare setting, as it impacts funding, insurance negotiations, and the overall sustainability of the institution.

In the state of Maryland, the healthcare regulatory environment mandates stringent financial oversight. This includes detailed audits and reports that are designed to protect public health interests and ensure that hospitals operate efficiently and effectively. The Maryland Hospital Audited Financial Form plays a pivotal role in achieving these objectives, serving as a comprehensive financial snapshot that aids in decision-making for stakeholders.

Who must file the Maryland hospital audited financial form?

All general hospitals licensed in the state of Maryland are required to file the Maryland Hospital Audited Financial Form. This includes both nonprofit and for-profit hospitals, ensuring that all institutions are held to the same financial reporting standards. However, there are specific exemptions for certain facilities, like critical access hospitals or those receiving minimal funding. Understanding which entities are subject to this requirement is essential for compliance.

Key components of the Maryland hospital audited financial form

The Maryland Hospital Audited Financial Form comprises several essential financial statements that provide a comprehensive view of the hospital's financial health. These components include the Balance Sheet, the Statement of Operations, and the Statement of Cash Flows. Each statement serves a specific purpose, offering critical insights into different areas of the hospital's financial performance.

In addition to these financial statements, hospitals must include supporting documentation such as audit reports and financial notes. These documents provide context and further explain the numbers reflected in the financial statements. Proper documentation is crucial for substantiating entries and ensuring compliance with state regulations.

Step-by-step guide to completing the form

Completing the Maryland Hospital Audited Financial Form can seem daunting, but following a structured approach simplifies the process. The first step involves gathering the necessary documentation. This includes financial records, previous audit reports, and any supporting invoices or contracts relevant to the financial data.

The review process is particularly important; it ensures every piece of required information is included and accurately represented. Missing or incorrect entries can lead to compliance issues or delays in processing.

Common errors in hospital audited financial forms and how to avoid them

Completing the Maryland Hospital Audited Financial Form can uncover several common errors that impact the accuracy of the submission. One prevalent issue is the inclusion of incomplete financial statements. Ensure all necessary sections are filled in, and if certain sections do not apply, indicate them appropriately.

By carefully reviewing each component of the form and implementing a double-checking process, hospitals can minimize these common mistakes.

The role of auditors in the Maryland hospital audited financial form process

Auditors play a vital role in the Maryland Hospital Audited Financial Form process. They are responsible for verifying the accuracy of financial data, ensuring that all reported information aligns with standard accounting practices, and is compliant with state regulations. Selecting a qualified auditor is crucial, as their expertise can significantly affect the credibility of the financial reports.

Collaboration between the hospital and auditors is essential for a smooth process. Hospitals should provide auditors with all necessary documentation and be open to their inquiries, establishing a clear communication channel that fosters an efficient audit process.

Electronic submission and management of the form

Utilizing online platforms for submitting the Maryland Hospital Audited Financial Form offers numerous advantages. Electronic submission not only speeds up the process but also provides enhanced accuracy and reduces paperwork, which can often lead to errors. pdfFiller offers a streamlined solution for hospitals, allowing users to fill out and submit forms electronically.

Guided steps for electronic submission via pdfFiller include importing the form, filling in all required information, saving, and securely submitting it to the designated regulatory body. Embracing cloud-based document management systems also facilitates easy access and tracking of financial submissions, making it simpler for teams within the hospital to collaborate and manage documents efficiently.

Resources for Maryland hospitals

Maryland hospitals can leverage a range of state resources to guide them through completing the Maryland Hospital Audited Financial Form. The Maryland Health Care Commission is a primary regulatory body; their website contains relevant guidelines and updates pertaining to financial reporting. FAQs about the form can clear up common doubts, while contact information for state representatives is invaluable for personalized assistance.

These resources provide vital support throughout the financial reporting process, helping hospitals maintain compliance while enhancing their operational efficiencies.

Case studies: Successful compliance with the Maryland hospital audited financial form

Several hospitals in Maryland have successfully streamlined their submission process for the Maryland Hospital Audited Financial Form, setting examples for others to follow. For instance, a prominent health system implemented a dedicated compliance team responsible for overseeing the entire reporting process. This lead to improved data accuracy and timely submissions, showcasing the effectiveness of having a focused approach.

By analyzing these cases, other institutions can identify the key strategies that led to successful compliance, such as adopting electronic tools, promoting team collaboration, and investing in staff training.

Future trends in hospital financial reporting

The landscape of hospital financial reporting is dynamic, with anticipated changes in regulations and innovations in management practices on the horizon. As regulatory bodies aim for heightened transparency, hospitals can expect increased scrutiny on financial reporting. Adapting to this environment will require innovative approaches, including advanced financial management systems and regular training for financial staff.

The role of technology, especially cloud-based solutions like pdfFiller, will be essential in enhancing the efficiency and reliability of financial reporting practices in hospitals across Maryland, making compliance efforts smoother and more effective.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my maryland hospital audited financial in Gmail?

How can I get maryland hospital audited financial?

How do I edit maryland hospital audited financial straight from my smartphone?

What is Maryland hospital audited financial?

Who is required to file Maryland hospital audited financial?

How to fill out Maryland hospital audited financial?

What is the purpose of Maryland hospital audited financial?

What information must be reported on Maryland hospital audited financial?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.