Calendar - Tax Appeal Form: A Comprehensive Guide

Understanding the tax appeal process

Tax appeals are crucial for property owners seeking to contest their property tax assessments. The appeal process allows homeowners and businesses to challenge perceived discrepancies in their assessed property values, which directly impacts their tax obligations. Knowing the tax assessment calendar is integral to this process, as it provides the essential timeline within which assessments and appeals must be completed.

The significance of tax appeals lies in their potential to reduce property tax burdens and ensure assessments are fair and accurate. Familiarity with key dates ensures that property owners do not miss critical filing periods.

File appeals within the stipulated period to avoid losing the right to contest an assessment.

Understand the timeline for property tax assessments, as it varies by location.

The 2025 tax assessment calendar

For the upcoming year, the 2025 tax assessment calendar outlines key dates relevant for property owners in various regions, including critical submission deadlines for appeals. Property owners must remain updated on these dates to ensure they complete the necessary filings in time.

In North Suburban Cook County, for example, owners should mark deadlines related to assessments and appeals. Specific attention should also be given to the City of Chicago’s calendar, which may differ from surrounding suburbs, impacting residents significantly.

Consult your municipal website for the full 2025 assessment calendar.

Take note of any changes or new deadlines that may have been implemented compared to previous years.

Review the 2024 assessment calendar for patterns or insights that could inform your appeal strategy for 2025.

Locating property details using PIN

Locating property details through the Property Index Number (PIN) is essential for understanding your current assessments when filing a tax appeal. The PIN uniquely identifies your property and allows you to access comprehensive information online.

To begin, visit your local assessor's website and navigate to the property search tool. Input your PIN in the designated field, ensuring accuracy to obtain correct results. This process not only enhances your understanding of your property’s assessment data but also highlights changes from previous years that could be pertinent to your appeal.

Enter your PIN accurately to avoid incorrect data retrieval.

Review assessment history to identify any significant increases or discrepancies.

Gather any relevant documents that reference your assessment to aid in your appeal.

Navigating the tax appeal form

The PT-311A Appeal of Assessment Form is pivotal in the tax appeal process. This form allows property owners to officially contest their property tax assessments. Understanding how to access and correctly fill out the form is crucial for a successful appeal.

To obtain the PT-311A form, you can download it directly from your local assessor's website. When filling the form, pay attention to each section, providing accurate and comprehensive information. Each part has specific requirements, and omitting important details may jeopardize your appeal.

Download the PT-311A form from the relevant property assessor’s website.

Fill out each section diligently, avoiding assumptions about what information is required.

Choose your submission method wisely; consider filing online for quicker processing.

Filing types and processes

There are various types of appeals that property owners can pursue depending on their circumstances. Understanding which type applies to your situation not only streamlines the process but also increases your chances of a successful appeal.

Individual tax appeals typically follow a straightforward process, while commercial property appeals may involve more complex considerations and documentation requirements. Knowledge of the correct filing type is essential in preparing the appeal effectively.

Determine whether your appeal falls under residential or commercial categories.

Collect necessary documents such as recent appraisals or market comparisons.

Craft a clear and compelling case to support your appeal.

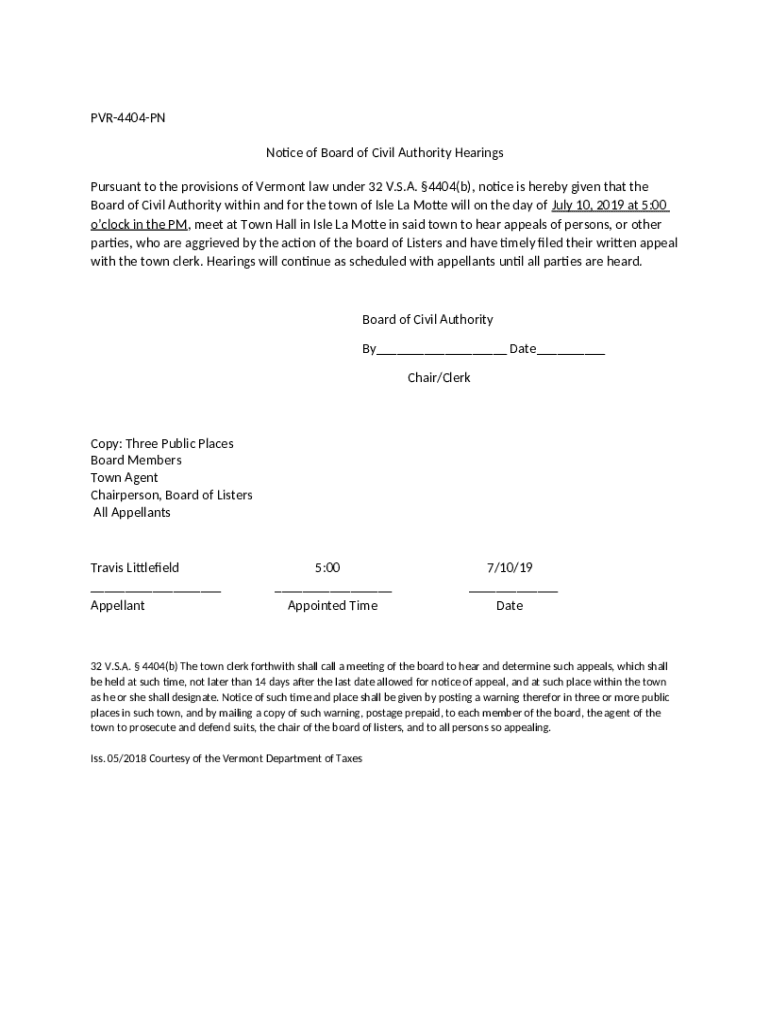

Understanding the hearing calendar

After filing your appeal, the next step involves the hearing process, where you can present your case to the board. Understanding the hearing calendar is vital for knowing when to appear and what to prepare.

Prepare for these hearings by familiarizing yourself with specific dates relevant to your appeal, as they will determine when you must appear. This preparation not only ensures you are present but also allows adequate time to frame your arguments and gather necessary evidence.

Stay informed about hearing dates to ensure your presence at the correct session.

Organize your materials ahead of time, including evidence and documentation.

Practice presenting your case, anticipating potential questions from the board to strengthen your delivery.

Assessors office and local resources

Connecting with your local assessor's office can provide essential support during the appeal process. Understanding how to reach them and what resources they offer will aid in navigating your appeal efficiently.

Each local assessor's office has specific procedures; knowing the correct contact information and available assistance can simplify your query process. Additionally, leveraging online tools from your office can provide instant access to vital assessment information.

Check your local government website for contact details of the assessor's office.

Utilize any online resources or interactive tools provided by the assessor’s office.

Seek assistance for any specific questions regarding your property assessment.

Recent changes in tax filing regulations

Staying informed about recent changes in tax filing regulations is crucial for property owners considering an appeal. The 2025 filing regulations may include modifications that impact how appeals are managed, and understanding these is necessary for compliance.

Additionally, changes in sales tax regulations may also have implications for property owners beyond just property tax considerations. Keeping an eye on these procedural changes can enhance your understanding and navigation of the filing process.

Review updated filing regulations from the IRS and local government.

Understand how these changes may affect your current and future appeals.

Consult professionals if necessary for guidance on adaptations needed due to regulatory changes.

Helpful advice and FAQs

As you navigate the tax appeal process, numerous questions may arise. Common inquiries often involve timelines, documentation requirements, and procedures. Addressing these FAQs can provide clarity and ease any concerns.

It’s essential to adopt best practices that ensure a smooth appeal journey. Learning from past experiences can guide you in gathering comprehensive documentation, understanding filing types, and preparing adequately for hearings.

Keep a checklist of requirements for filing to avoid missing any critical steps.

Document all communications with your local assessor’s office.

Continue monitoring your property’s assessed value after your appeal to keep abreast of future changes.

Engaging with the appeal community

Joining online forums and support groups can enhance your understanding of tax appeals significantly. Engaging with peers who have similar experiences offers valuable insights and support throughout the process.

Moreover, pursuing continued education through webinars and workshops dedicated to tax appeals helps you stay informed about changing regulations and strategies. These resources provide an enriching complement to the official information you gather.

Find community forums on social media platforms focused on tax appeals.

Sign up for webinars featuring experts discussing current trends and strategies in tax appeals.

Share your experiences within these communities for mutual learning opportunities.