North Carolina subordinate deed form: A comprehensive guide

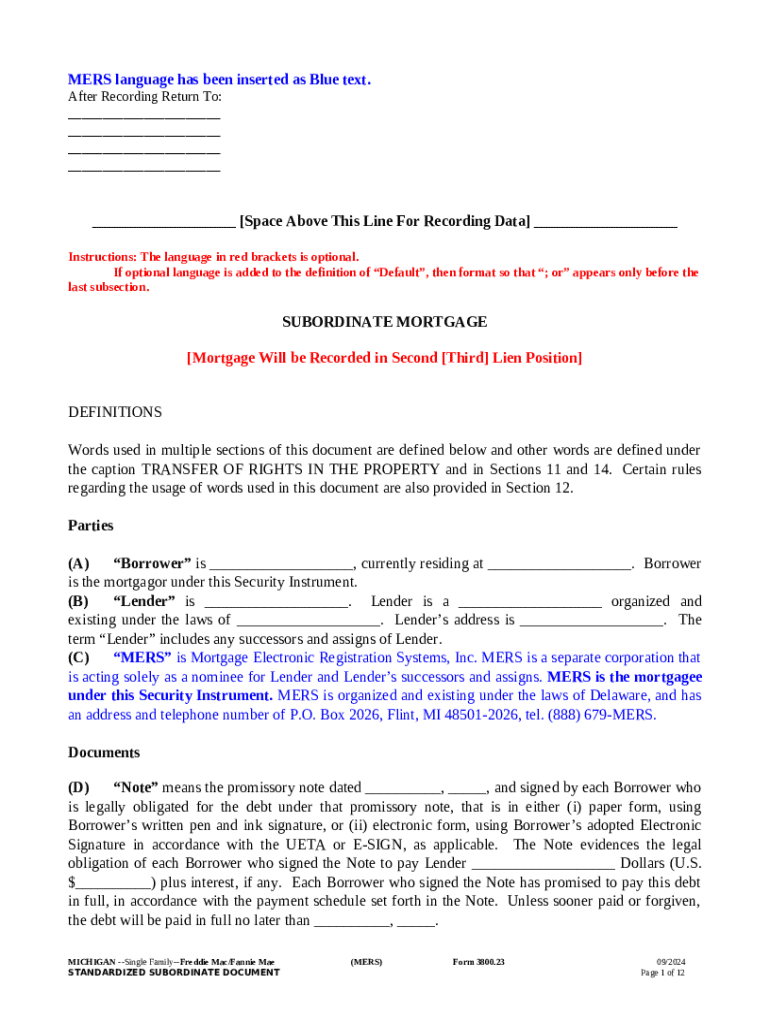

Understanding the North Carolina subordinate deed form

A North Carolina subordinate deed form is a crucial document in real estate transactions, reflecting the hierarchy of liens against a property. Essentially, this form allows a secondary loan or lien to take precedence in terms of repayment, which is vital in cases where multiple loans are secured by a single property.

In real estate transactions, the subordinate deed plays a significant role, especially for borrowers looking to refinance or secure additional financing. It serves the purpose of modifying the priority of existing debts, which can either enhance a borrower's credit options or reduce the overall cost of borrowing.

Subordination is essential because it allows property owners to consolidate or refinance their debts without losing their primary mortgage's benefits. For lenders, it presents an opportunity to invest in secondary financing, while still maintaining a claim against the property.

Defines the hierarchy of liens on a property.

Facilitates the refinancing process for borrowers.

Allows lenders to offer secondary loans while ensuring their interests are protected.

Types of North Carolina subordinate deed forms

In North Carolina, there are several standardized subordinate deed forms that cater to different needs. Each form varies based on the type of financing, such as amortizing loans and forgivable notes, making it critical for borrowers to understand which form best suits their financial situations.

Key features of these forms often include terms related to repayment schedules, interest rates, and maturity dates. Utilizing the correct form ensures that all parties involved are protected and obligations are clearly outlined.

Standard Subordinate Deed Form: Typically used for most transactions.

Amortizing Subordinate Note: Requires scheduled payments, reducing the principal over time.

Forgivable Subordinate Note: Offers terms where part or all of the debt may be forgiven under specified conditions.

Additionally, special purpose documents, such as modification agreements or assignments, may be utilized alongside subordinate deeds, offering flexibility in managing finances.

Key components of the form

Filling out a North Carolina subordinate deed form requires careful attention to detail as certain crucial information must be included. This typically encompasses the borrower's and lender's names, the property's details, the loan amount, and the specific terms and conditions governing the subordinate loan.

Some key sections to be addressed in the form include terms and conditions, outlining repayment schedules, and defining the responsibilities of each party involved. Understanding the terminology associated with subordinate deeds, such as 'subordination', 'priority', and 'collateral', is also vital for navigating this landscape.

Borrower's name and contact information.

Lender's details, including the institution or individual.

Property description: address, lot number, and legal description.

Loan amount and interest rate.

Terms for repayment including schedule and milestones.

How to fill out the North Carolina subordinate deed form

Completing a North Carolina subordinate deed form can initially seem daunting, but following a step-by-step process can simplify the task. Start by gathering all necessary information, then proceed to fill out the borrower and lender sections followed by the property details.

After completing these sections, review the terms and conditions carefully. Ensure that the repayment schedule aligns with agreed-upon terms, and double-check that all parties have signed and dated the document before submission.

Gather necessary documentation to support all data needed.

Carefully input each section as defined.

Review and verify all details to prevent any inaccuracies.

Ensure appropriate parties sign the form to validate the document.

When filling out forms digitally, pdfFiller provides interactive tools that enhance the process, allowing users to edit, manage, and share documents seamlessly.

Managing and editing your subordinate deed form

Document management becomes straightforward with tools like pdfFiller, which enable users to handle their subordinate deed forms efficiently. One notable feature of pdfFiller is its collaborative capabilities, which allow multiple users to work on a document simultaneously.

eSigning is another crucial function provided by pdfFiller, ensuring that all signatures collected are legally binding in North Carolina. This process not only saves time but also provides an excellent way to secure documents remotely.

Use pdfFiller's editing options to modify existing forms, ensuring compliance.

Invite collaborators to provide feedback or make adjustments.

Utilize eSigning for quick and secure validation of documents.

Store all completed documents in the cloud for easy retrieval and security.

Common issues and troubleshooting

Although filling out the North Carolina subordinate deed form is generally straightforward, challenges may arise. Common issues include incomplete information, incorrect details, and delays in receiving necessary signatures.

Troubleshooting these challenges is often a matter of attention to detail. Reviewing the document multiple times and comparing it with what was discussed in loan agreements could help in mitigating these issues.

Check for missing signatures or initials.

Verify that all information is consistent with supporting documents.

Consult with a legal professional if significant discrepancies are found.

Use support resources offered by pdfFiller for additional assistance.

If you still have questions or require additional guidance, seeking assistance from a real estate professional or an attorney can simplify the process and provide peace of mind.

Additional documentation and resources

In conjunction with the subordinate deed form, several complementary documents may be necessary. These include original loan agreements, property deeds, and any modification agreements that clarify terms and obligations.

Legal considerations in North Carolina also necessitate understanding state-specific requirements for forms like subordinate deeds, especially concerning the recording process with county offices.

Loan agreements: Outlining original loan terms.

Property deeds: Confirming ownership details.

Modification agreements: Documenting changes in loan terms.

For further learning, numerous resources such as webinars or local real estate workshops can provide deeper insights into the use and implications of subordinate deeds.

Customer support and assistance

Accessing customer support through pdfFiller is an excellent way to resolve any queries related to completing or editing your subordinate deed form. The platform provides various support channels, including live chat and email support, ensuring that help is readily available.

User feedback has consistently highlighted the ease of use and efficiency of pdfFiller's tools, showcasing success stories from individuals who have streamlined their document signing and management processes.

Utilize the live chat feature for immediate assistance.

Check the help center for frequently asked questions.

Provide feedback on your experience to help improve services.