Get the free Traditional Individual Retirement Account Custodial ...

Get, Create, Make and Sign traditional individual retirement account

Editing traditional individual retirement account online

Uncompromising security for your PDF editing and eSignature needs

How to fill out traditional individual retirement account

How to fill out traditional individual retirement account

Who needs traditional individual retirement account?

Traditional Individual Retirement Account Form: A Comprehensive Guide

Understanding the traditional individual retirement account (IRA)

A Traditional Individual Retirement Account (IRA) is a type of retirement savings account that allows individuals to invest pre-tax income towards their retirement. By contributing to a traditional IRA, individuals can defer taxes on earnings until withdrawals are made during retirement, making it an appealing option for long-term savings.

For many, the primary benefit of a Traditional IRA lies in its tax advantages. Contributions made to this account may be tax-deductible, lowering taxable income in the contribution year. Moreover, the funds grow tax-deferred until retirement, allowing for compounding growth without immediate tax implications.

When considering various retirement accounts, comparing Traditional IRAs to options like Roth IRAs, 401(k) plans, and SEP IRAs is essential. Each has unique features, such as contribution limits and tax implications, which cater to different retirement planning strategies.

The importance of the traditional IRA form

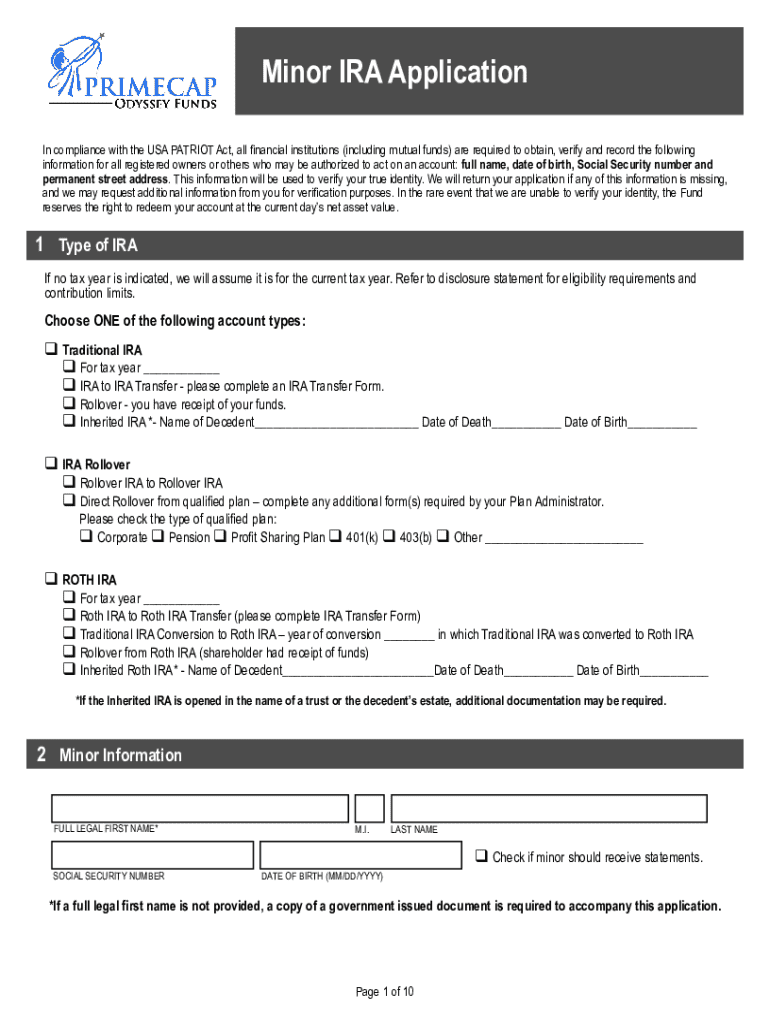

The Traditional IRA Form is a crucial document for individuals looking to open and manage their retirement accounts. It serves as the official application for establishing an IRA and outlines the terms and conditions under which your investments will operate.

Accurate completion of this form is vital to ensure compliance with IRS regulations and to secure the tax advantages afforded by the account. Errors or omissions in the form can lead to delays in processing or, worse, potential tax penalties.

Step-by-step guide to filling out the traditional IRA form

Filling out the Traditional IRA Form requires careful attention. Start by gathering all necessary information, including personal identification, financial data, and, if applicable, employer information. It’s essential to have accurate and current details ready to prevent errors.

Once you have the required information, proceed to complete each section of the form. This step includes providing your name, contact information, and Social Security number, followed by contribution intentions and beneficiary selections. It’s paramount to be thorough and precise.

Before submitting the form, take the time to review it carefully. Creating a checklist can help ensure you’ve completed all necessary sections, and double-checking details for accuracy can prevent future issues.

Editing and managing your traditional IRA form

After filling out your Traditional IRA Form, managing it effectively is vital to ensure it meets your evolving retirement needs. One efficient way to edit your IRA Form is by using pdfFiller, which simplifies the document management process.

To begin, upload your completed document to pdfFiller. This cloud-based platform offers a variety of tools to modify, annotate, and manage your document effortlessly. Should you need to make changes or corrections, pdfFiller’s intuitive interface allows for easy editing.

eSigning your traditional IRA form

eSigning your Traditional IRA Form is an increasingly popular option that enhances convenience and accelerates the submission process. An electronic signature holds the same legal weight as a handwritten one, making it a secure alternative.

Using pdfFiller, eSigning is a straightforward process. Simply navigate to the signing section, follow the prompts to create your signature, and place it directly onto the form.

Submitting your traditional IRA form

With your Traditional IRA Form completed and signed, the next step is submission. There are various submission methods, and choosing the right one depends on your preferences and the requirements of the financial institution.

Submitting your form via traditional paper methods is often standard, requiring you to mail the completed forms to your chosen financial institution. Alternatively, electronic filing methods are gaining prominence due to their speed and convenience.

After submission, you can expect confirmation of receipt from your financial institution. Keep an eye on your email or account notifications for updates regarding your application status.

Frequently asked questions about traditional IRAs

While many individuals are eager to open a Traditional IRA, various common issues can arise when filling out the associated form. Understanding these issues can help prevent delays in managing your retirement savings.

Some common questions include concerns about contribution limits, eligibility restrictions based on income, and the implications of beneficiary designations. Additionally, knowing how to troubleshoot when issues arise, such as corrections needed on submitted forms, enhances your understanding.

Keeping your IRA account management organized

Post-submission, it is essential to keep your Traditional IRA account management organized. Utilizing tools provided by pdfFiller can greatly assist in tracking your investments and managing documents relevant to your retirement account.

Regularly checking the status of your Traditional IRA ensures that your contributions are correctly recorded and that your investment strategies are aligned with your retirement goals. Furthermore, making ongoing contributions requires keeping your information updated.

Understanding the tax implications related to your traditional IRA form

A key aspect of managing a Traditional IRA is understanding the tax implications associated with contributions and withdrawals. Since contributions may be tax-deductible, knowing how this affects your overall tax strategy is crucial.

Moreover, if you withdraw funds from your Traditional IRA before the age of 59½, you may incur an early withdrawal penalty of 10%. Also, individuals must begin taking required minimum distributions (RMDs) starting at the age of 72, which is an important factor to factor into your retirement planning.

Final thoughts on managing your traditional IRA

In today's ever-evolving financial landscape, leveraging technology for retirement planning has never been more accessible. Utilizing platforms like pdfFiller not only streamlines the process of filling out and managing your Traditional IRA Form but also equips you with the tools for easier document creation, editing, and collaboration.

Staying informed about changes in IRA regulations is crucial for optimizing your retirement planning strategy. Engage with resources, webinars, or financial advisors to ensure that your approach remains aligned with current best practices and regulations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my traditional individual retirement account directly from Gmail?

How do I execute traditional individual retirement account online?

How do I fill out traditional individual retirement account using my mobile device?

What is traditional individual retirement account?

Who is required to file traditional individual retirement account?

How to fill out traditional individual retirement account?

What is the purpose of traditional individual retirement account?

What information must be reported on traditional individual retirement account?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.