Get the free BEQUEST INTENTION NOTIFICATION FORM

Get, Create, Make and Sign bequest intention notification form

How to edit bequest intention notification form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out bequest intention notification form

How to fill out bequest intention notification form

Who needs bequest intention notification form?

Understanding the Bequest Intention Notification Form

Overview of bequest intention notification

A bequest intention refers to the desire of an individual to leave a portion of their estate to a designated charitable organization upon their passing. Communicating these intentions not only clarifies the individual’s wishes but also provides valuable insight to organizations regarding future funding opportunities. This is where a bequest intention notification form comes into play, serving as a formal means to communicate a person’s legacy plans.

The importance of notifying organizations about one’s bequest intentions cannot be overstated. It allows charities to plan for their futures, aligns potential contributions with their missions, and fosters trust between donors and organizations. The form acts as a transparent medium that ensures the intentions of the bequest are formally recorded.

By completing a bequest intention notification form, donors provide charities with essential information related to the size and nature of the gift, enabling organizations to make strategic decisions in their planning and outreach efforts.

Benefits of completing a bequest intention notification form

Filling out a bequest intention notification form comes with numerous benefits, primarily enhancing clarity for beneficiaries. When intentions are documented and shared, it eliminates any ambiguity about how assets will be distributed, ensuring that both the beneficiaries and organizations clearly understand the expectations.

Additionally, this proactive step significantly contributes to the planning efforts of charitable organizations. Knowing the bequest intentions allows these organizations to budget and allocate resources more efficiently. It creates a stronger relationship built on trust and transparency between donors and charities, showcasing a mutual commitment to shared values.

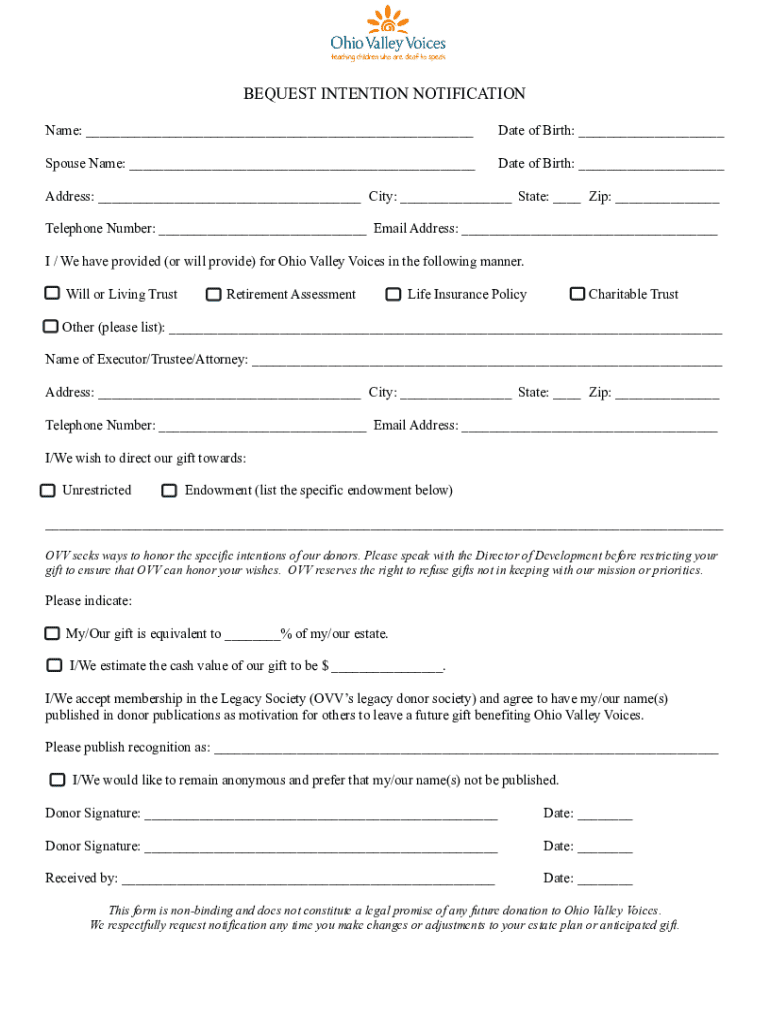

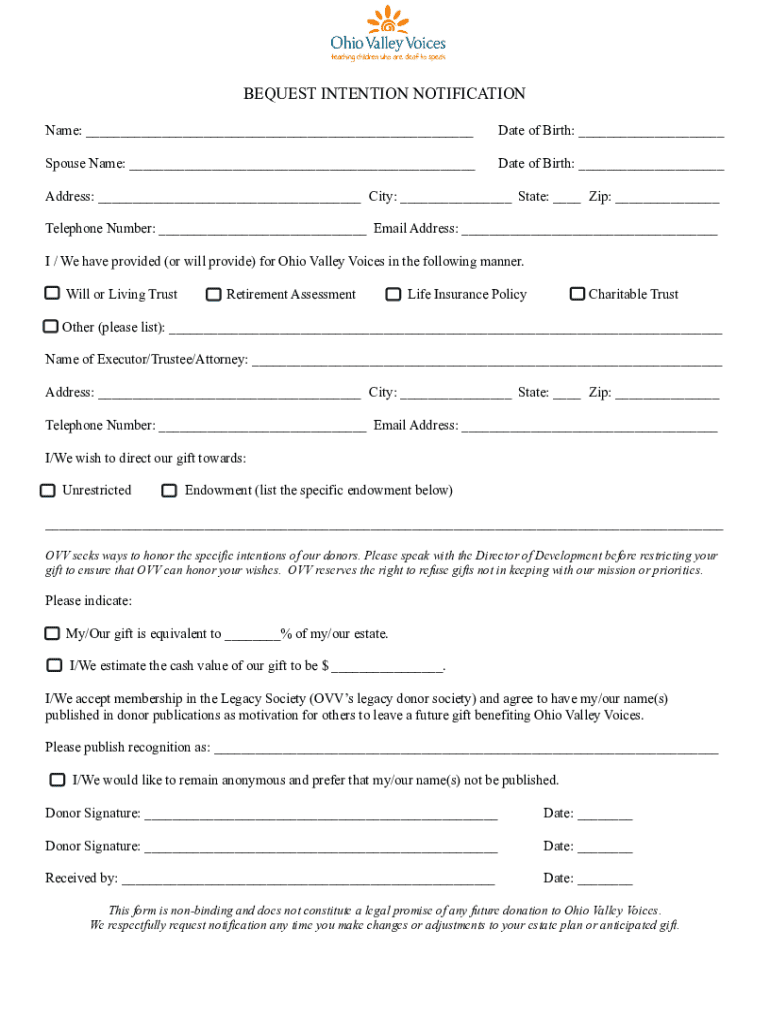

Key components of the bequest intention notification form

A comprehensive bequest intention notification form includes several key components. First, it comprises a personal information section that captures the donor’s name, contact details, and their relationship to the organization. This identification is crucial for establishing the context of the bequest.

The form also outlines gift details, such as the type of bequest—whether a percentage of the estate, a specific amount, or a particular asset—thereby ensuring clarity in what the organization can expect. Additionally, a intentions statement allows donors to express how the bequest reflects their personal values and aspirations, reinforcing the intent behind their generosity.

Step-by-step guide to filling out the form

Filling out the bequest intention notification form does not have to be a daunting task. Here’s a straightforward, step-by-step guide to help individuals through the process.

Editing and customizing your bequest intention form

Customizing your bequest intention form can greatly enhance the effectiveness and clarity of your communication. Tools like pdfFiller allow users to easily edit and customize forms, adapting them to fit specific needs or preferences.

Editing your document is straightforward; pdfFiller offers intuitive features enabling individuals to modify text, update asset descriptions, or even revise the intentions statement with ease. Collaboration is also facilitated through this platform, making it easy for donors to involve family members or advisors in the process, ensuring everyone is aligned.

Signing and submitting the bequest intention notification form

Once your bequest intention notification form is completed, signing it is the next step. pdfFiller allows for eSigning, ensuring that the document is legally binding without any hassle. By opting for electronic signatures, donors can save time while ensuring their intentions are documented.

After signing, submission options are flexible. Donors can opt for online submission directly to the organization or choose to mail a hard copy. Regardless of the method chosen, it’s advisable to request confirmation of receipt to ensure that the notification has been recorded by the intended party.

Managing your bequest intention notification form

Managing your bequest intention notification form post-submission is crucial for maintaining accurate records of your intentions. Storing your completed document securely through a platform like pdfFiller enables easy access whenever needed.

Updating the form periodically is also important, especially if there are changes in personal circumstances or assets. Sharing the form with executors or family members ensures that key stakeholders are aware of your intentions, fostering transparency and preventing misunderstandings in the future.

Frequently asked questions about bequest intention notifications

Several common queries often arise concerning bequest intention notifications, primarily focusing on the flexibility of one’s decisions. Individuals may wonder, 'What if I change my mind about my bequest?' The good news is that donors can update their intentions whenever needed. It is a living document meant to evolve with one’s circumstances.

Moreover, prospective donors often want to know, 'Who should I contact with questions about my intentions?' The organization receiving the bequest will likely have a designated point of contact who can provide clarity and guidance regarding the bequest process and its intentions.

Additional support and resources

For those navigating the bequest intention notification process, additional support is readily available. pdfFiller not only provides a platform for creating and managing these documents but also offers technical assistance should any issues arise during the usage of their tools.

Understanding legal considerations is also an important aspect of creating a bequest intention notification. Freelance legal advisors or specialized estate planning attorneys can guide individuals on the implications and structure of the bequest to ensure it fulfills personal wishes while complying with legal standards.

Case studies: successful bequest intention notifications

Examples of impactful bequest intention notifications abound, illustrating how clearly defined intentions can create lasting legacies. By documenting their plans, many individuals have contributed significantly to charities, enabling organizations to expand their services, invest in community programs, or fund research initiatives.

Testimonials from previous donors highlight the fulfillment derived from giving back and ensuring their personal values live on through charitable legacies. Furthermore, feedback from organizations that have benefitted from such contributions underscores the importance of clarity and planning that a bequest intention notification provides.

Bequest intention notifications in the context of estate planning

Incorporating a bequest intention notification into broader estate planning efforts is a crucial step for individuals looking to leave a mark on causes they care about. These notifications should be harmoniously integrated with wills and trusts, ensuring all estate documents support the same objectives.

Working alongside estate attorneys can enhance the effectiveness of these notifications, allowing individuals to navigate legal complexities while ensuring their wishes are accurately captured within their estate plans. Regular reviews and updates of bequest intentions ensure that changes in personal circumstances are duly noted, thereby keeping the legacy alive and relevant.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify bequest intention notification form without leaving Google Drive?

Can I sign the bequest intention notification form electronically in Chrome?

How do I fill out bequest intention notification form on an Android device?

What is bequest intention notification form?

Who is required to file bequest intention notification form?

How to fill out bequest intention notification form?

What is the purpose of bequest intention notification form?

What information must be reported on bequest intention notification form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.