Get the free Town Clerk/Tax Collector Office Calendar

Get, Create, Make and Sign town clerktax collector office

Editing town clerktax collector office online

Uncompromising security for your PDF editing and eSignature needs

How to fill out town clerktax collector office

How to fill out town clerktax collector office

Who needs town clerktax collector office?

Understanding the Town Clerk Tax Collector Office Form

Overview of town clerk and tax collector offices

The town clerk and tax collector offices serve essential functions in local government, ensuring streamlined administrative processes and effective communication between the government and its citizens.

The town clerk acts as the official record-keeper for local government, handling vital documents such as meeting minutes, ordinances, and official correspondence. Their responsibilities include managing public records, issuing licenses, and overseeing elections, which are critical for maintaining democracy at the local level.

Conversely, the tax collector's office focuses primarily on the collection of taxes, which is vital for funding local services like schools, public safety, and infrastructure. This office ensures residents understand their tax obligations and provides necessary services to facilitate timely payments.

Understanding town clerk tax collector forms

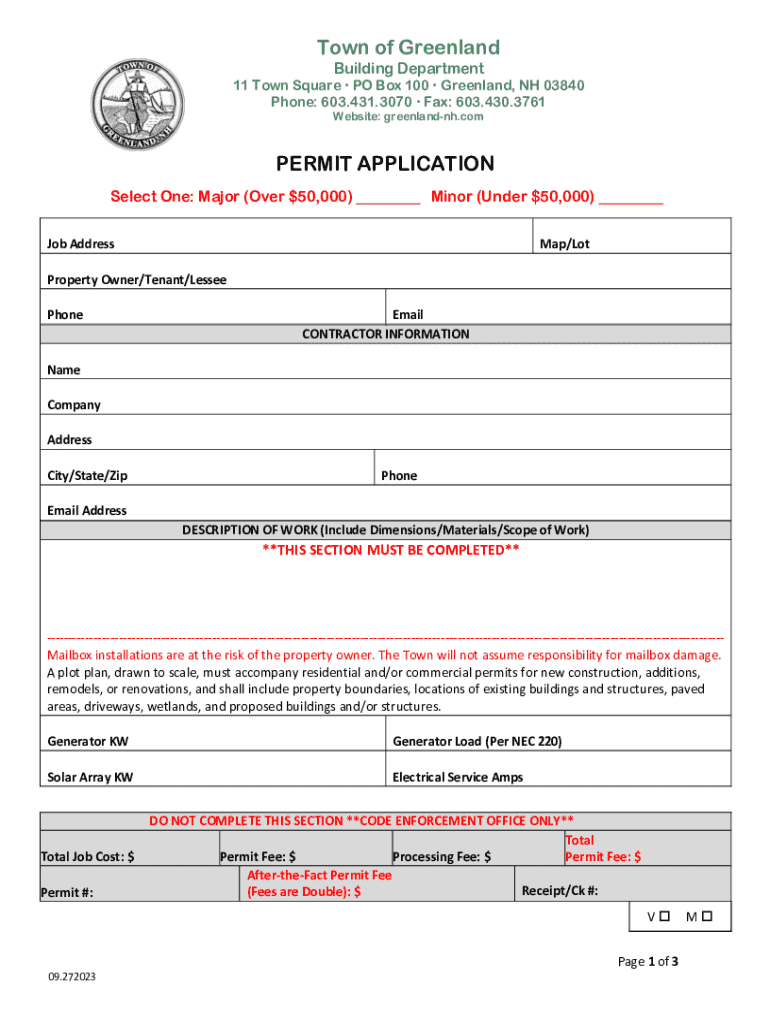

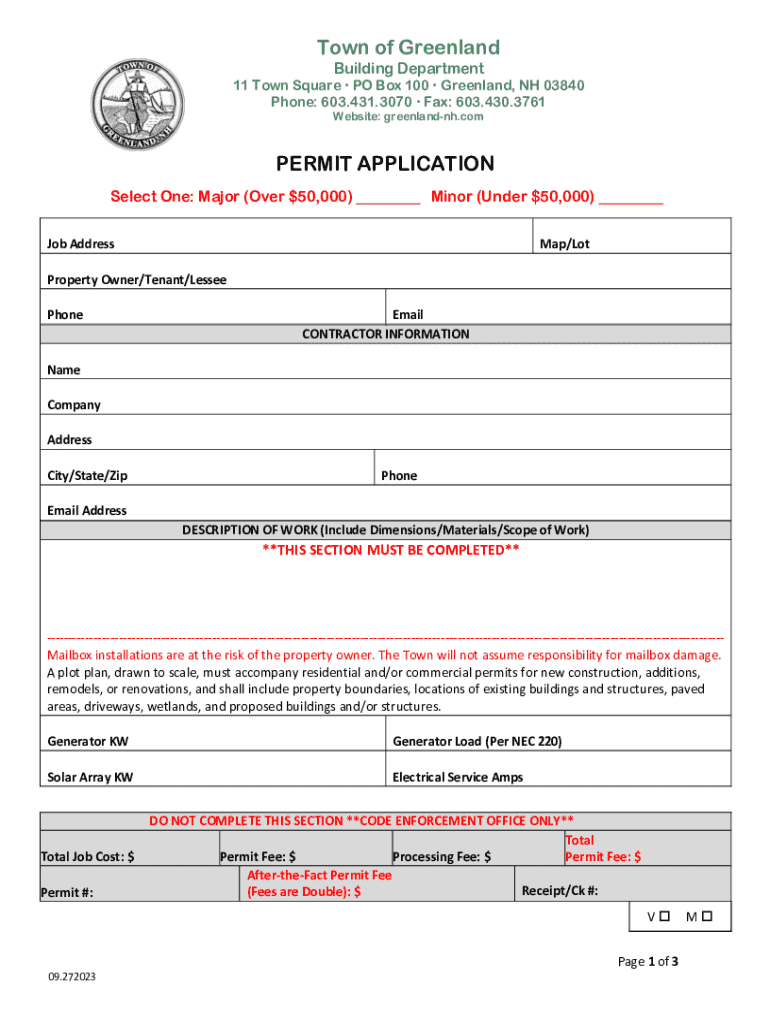

Town clerk tax collector forms are vital documents that residents must understand to engage effectively with their local government. These forms facilitate various interactions, from property tax payments to securing licenses and permits necessary for legal compliance and governance.

Different types of forms are available for residents to utilize, including property tax forms, payment plan applications, and licenses. Each form serves a specific purpose in the tax administration and local governance process.

Navigating the town clerk tax collector office

Navigating the town clerk tax collector office efficiently is key to managing tax responsibilities or acquiring necessary permits. Various resources are available to make this process straightforward.

Quick links they provide can guide residents directly to relevant forms and details. For instance, accessing forms through the official town website can save time. Additionally, understanding contact information is essential if questions arise or further assistance is needed.

Step-by-step guide to filling out forms

Filling out town clerk tax collector forms correctly is crucial for successful processing. Whether you're submitting property tax forms or applying for a payment plan, clarity in instructions can facilitate a smooth submission process.

Begin by reviewing general instructions relevant to all forms, which include required personal information and submission methods. Then, follow the detailed instructions tailored to specific forms for accuracy.

Editing and managing your forms online

In today's fast-paced digital world, editing and managing town clerk tax collector forms online provides convenience and efficiency. Utilizing tools available on pdfFiller enhances this process significantly.

These cloud-based solutions allow you to edit PDFs, e-sign documents, and collaborate with others effortlessly. For residents frequently handling these forms, cloud management becomes a reliable asset.

Frequently asked questions (FAQs)

Residents often have questions regarding town clerk tax collector forms, and it's important to address these to eliminate confusion.

Understanding how to obtain specific forms, the process if a form is denied, and how to track submission status are common inquiries. Utilizing the detailed services offered through platforms like pdfFiller aids in achieving these goals effectively.

Updates and notices

Staying informed with the latest updates from the town clerk's office is essential for local residents. The ongoing communication about changes or new policies impacts how residents manage their forms and responsibilities.

Current news, upcoming events related to tax collectors, and crucial deadlines should be on everyone's radar to ensure compliance with regulations and timely submissions of required documentation.

Related services offered by the town clerk

In addition to tax forms, town clerks frequently provide a variety of services aimed at facilitating the needs of local residents. By recognizing these associated offerings, residents can enhance their engagements with local governance.

Services such as voter registration and notary services play crucial roles within the community, ensuring residents can participate in civic duties and obtain necessary legal confirmations.

Finding additional help

Residents often need additional help beyond initial visits to the town clerk and tax collector offices. Ensuring clear contact information and availability can bridge the gap between uncertainty and direct assistance.

Knowing office hours, available staff for inquiries, and robust online support resources can empower residents when faced with complex forms or regulations.

Useful links and resources

Digitization of town clerk tax collector forms has made finding resources more efficient, especially through dedicated online platforms. These hubs provide residents with rapid access to documents and key information.

Utilizing these resources leads to quicker engagements with local governance, ensuring compliance and responsible citizenship.

Reminders for residents

Being aware of deadlines and changes in tax policy is crucial for residents managing their obligations efficiently. Timeliness in submissions and awareness of new regulations improves compliance and reduces potential penalties.

Keeping track of key dates for tax payments and form submissions will aid in efficient management of duties. Staying informed helps residents navigate changes and adapt to new policies.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send town clerktax collector office to be eSigned by others?

How do I complete town clerktax collector office online?

How do I make edits in town clerktax collector office without leaving Chrome?

What is town clerktax collector office?

Who is required to file town clerktax collector office?

How to fill out town clerktax collector office?

What is the purpose of town clerktax collector office?

What information must be reported on town clerktax collector office?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.