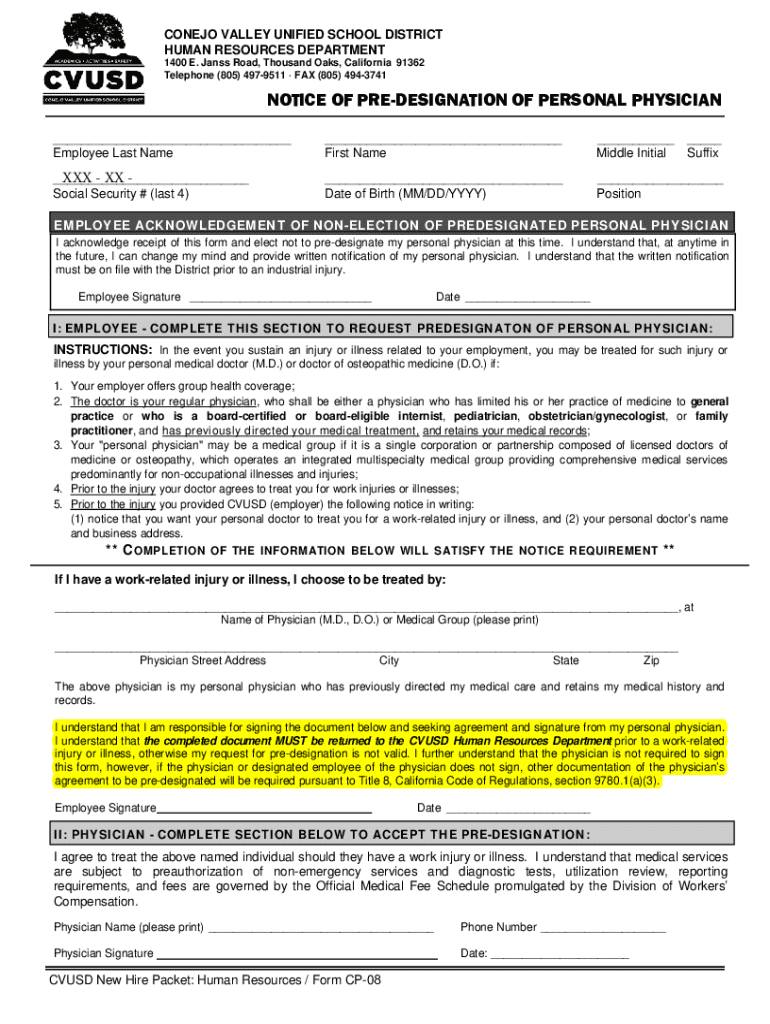

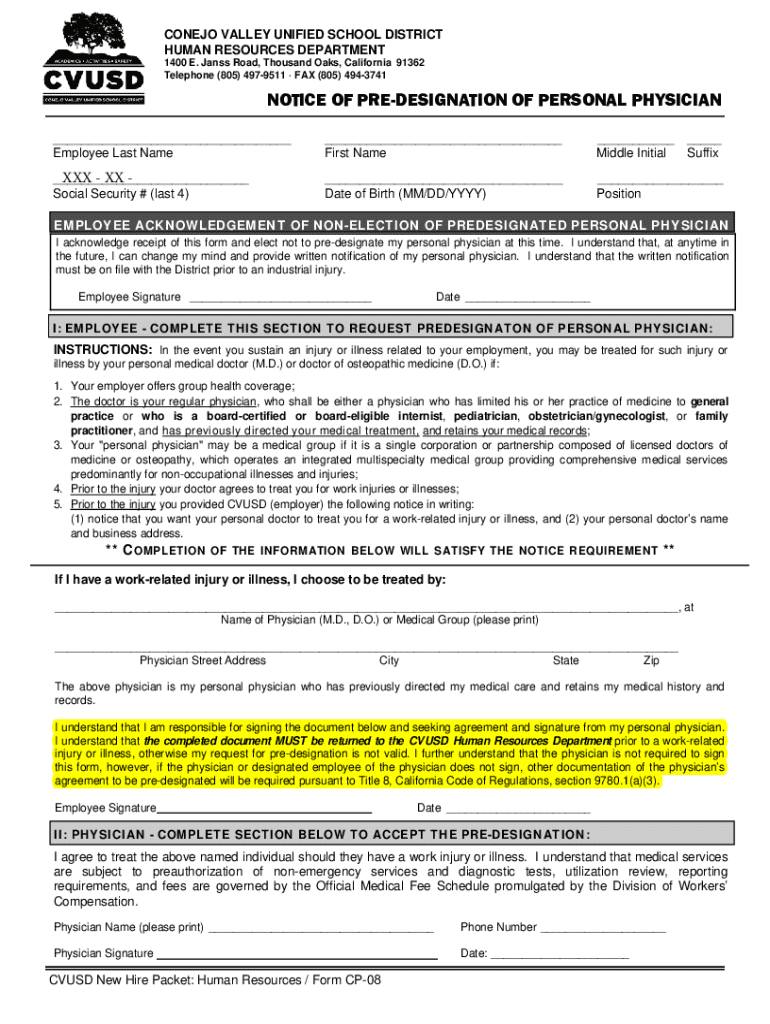

Get the free Social Security # (last 4)

Get, Create, Make and Sign social security last 4

How to edit social security last 4 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out social security last 4

How to fill out social security last 4

Who needs social security last 4?

Understanding the Social Security Last 4 Form: A Comprehensive Guide

Understanding the Social Security Last 4 Form

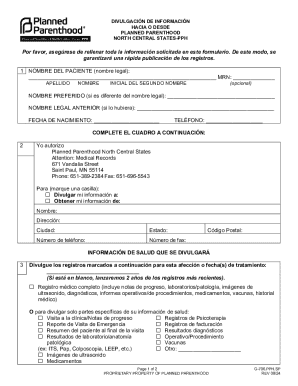

The Social Security Last 4 Form refers to the requirement of providing the last four digits of your Social Security Number (SSN) for various official processes. This form plays a critical role in verifying identity, facilitating transactions, and securing benefits across numerous institutions.

The last four digits of a Social Security number are significant as they are unique to you and help to differentiate you from others with similar names or identifiers. In many cases, you may be required to share just these digits as opposed to your entire SSN, enhancing your privacy and security.

Purpose and use of the Social Security Last 4 Form

The Social Security Last 4 Form is required in several scenarios, primarily revolving around identity verification. Knowing when and why you'll need to provide these digits can facilitate smoother interactions with various agencies.

For instance, many employers and financial institutions may request only the last four digits of your SSN instead of the full number to reduce the risk of fraud. This practice differs among organizations, with some requiring more personal information while others are satisfied with less.

Legally, providing the last four digits doesn’t compromise your security as providing the full SSN could. However, you should be cautious about sharing any part of your SSN to prevent identity theft or fraud.

Step-by-step guide to locate the last 4 digits of your Social Security number

Locating the last four digits of your Social Security number should be a straightforward task if you follow these simple steps. Your Social Security card is the best starting point, where the complete number is clearly printed.

If you do not have your card on hand, you can also find your SSN on various official documents such as tax returns or benefit statements. Income tax returns (Form 1040) typically display your SSN right at the top.

Filling out the Social Security Last 4 Form

Filling out the Social Security Last 4 Form requires precision and care. When instructed to provide your last four digits, ensure that you double-check the numbers to minimize errors. Mistakes can delay applications and lead to unnecessary complications.

Be aware of common mistakes such as transposing numbers or providing an incorrect last digit. Minor inaccuracies can lead to misunderstandings, especially in financial contexts.

Editing and managing the Social Security Last 4 Form with pdfFiller

pdfFiller offers an intuitive platform to edit your Social Security Last 4 Form effortlessly. Users can modify PDFs, fill out forms, and ensure that accuracy is maintained when providing sensitive information.

The platform facilitates seamless electronic signatures and allows collaboration, making document handling a breeze, whether you're working alone or with a team.

Frequently asked questions (FAQs)

When it comes to Social Security, many individuals have similar queries regarding the management of their information. Here are some common questions and answers regarding the Social Security Last 4 Form.

Best practices for safeguarding your Social Security information

Protecting your Social Security information is vital in today’s digital age. Implementing best practices ensures that your personal information remains secure and minimizes the risk of identity theft.

Always treat your Social Security documents with care. Avoid carrying your Social Security card unless absolutely necessary, and store it in a secure place.

Resources for further assistance

For further information and assistance regarding Social Security matters, the following resources can be quite helpful. These links provide direct access to official guidance and support for navigating your Social Security needs.

Collaborating on document management

When it comes to collaborating on document management, pdfFiller stands out as a robust solution. Especially for teams, this platform simplifies form management and facilitates real-time collaboration, making it ideal for any project involving multiple stakeholders.

Cloud-based document solutions like pdfFiller enhance workflow efficiency, freeing users from traditional document handling barriers. Teams can benefit from interactive tools enabling them to streamline processes, manage revisions, and maintain up-to-date records.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit social security last 4 online?

Can I create an electronic signature for signing my social security last 4 in Gmail?

Can I edit social security last 4 on an Android device?

What is social security last 4?

Who is required to file social security last 4?

How to fill out social security last 4?

What is the purpose of social security last 4?

What information must be reported on social security last 4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.