Get the free REFUND & ROLLOVER APPLICATION INFORMATION ...

Get, Create, Make and Sign refund amp rollover application

Editing refund amp rollover application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out refund amp rollover application

How to fill out refund amp rollover application

Who needs refund amp rollover application?

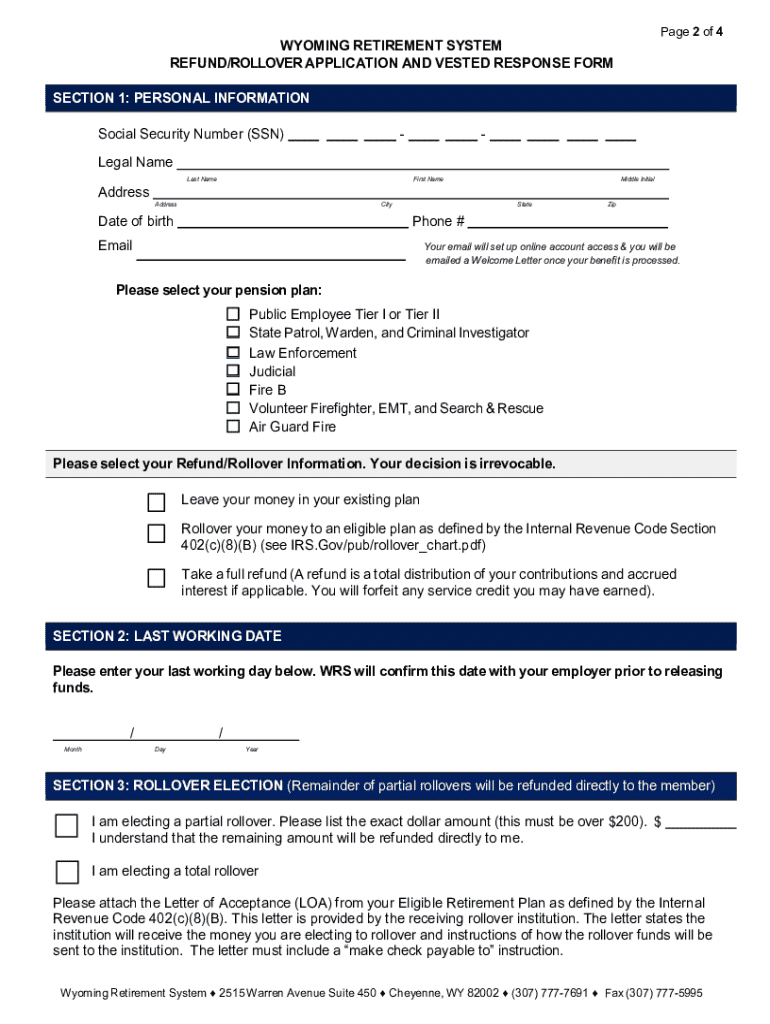

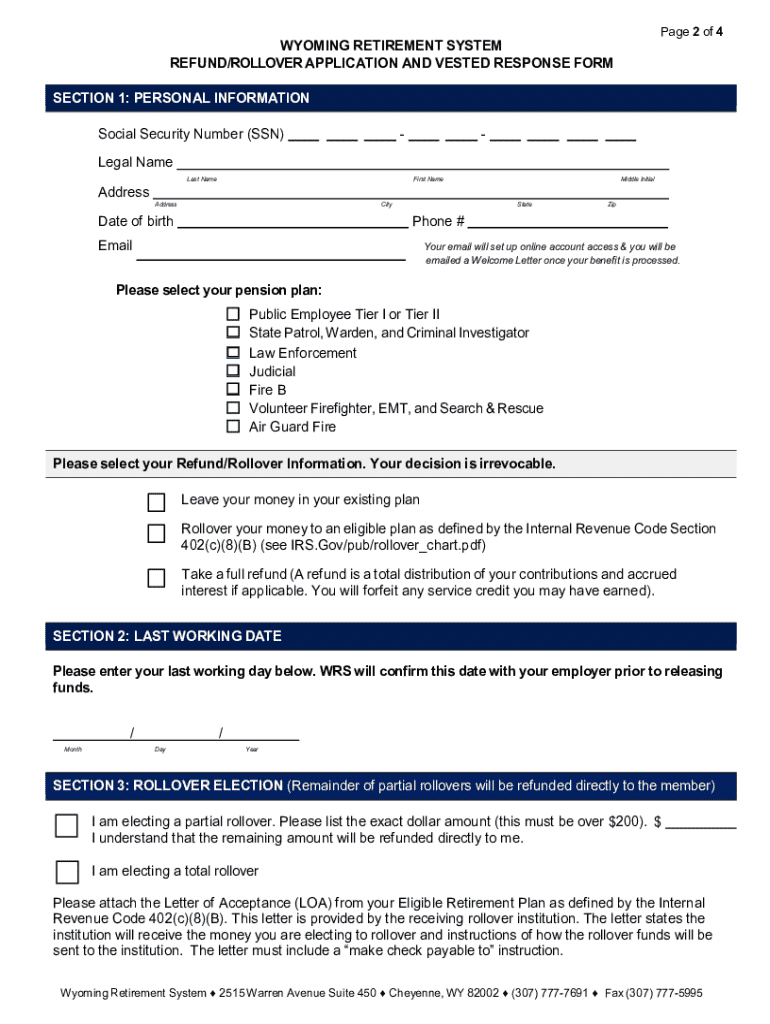

Understanding the Refund and Rollover Application Form

Understanding the refund and rollover application process

In the financial landscape, a refund refers to the return of funds to the original payer, typically due to overpayment, service billing errors, or cancellations. On the other hand, a rollover involves transferring funds from one account to another, often seen in retirement accounts like IRAs or 401(k)s. Both processes require the completion of specific application forms to ensure accurate and timely transactions. Submitting the right application is vital. A well-structured form minimizes processing delays and maximizes the likelihood of a favorable outcome.

Common scenarios that warrant a refund include discrepancies in billing amounts, cancellation of services, or dissatisfaction with purchased goods. In contrast, rollovers are typically initiated when an employee leaves a job, aiming to transfer their retirement savings into an individual retirement account (IRA) or another employer's plan without incurring tax penalties.

Eligibility requirements for refunds and rollovers

Eligibility criteria for refund requests often hinge on the particular service provider's policy. Generally, valid reasons for refunds include incorrect charges, service failures, or outright cancellations. Clients should familiarize themselves with specific timelines for requesting refunds, which can sometimes be as short as 30 days, depending on the provider.

Rollovers, however, have different eligibility requirements. A successful rollover necessitates that the funds be moved without tax liabilities incurred. It's essential to assess if your accounts qualify for such transfers, including checking if they derive from an employer-sponsored retirement plan. Required documentation varies but typically includes proof of the previous account and paperwork confirming the new account.

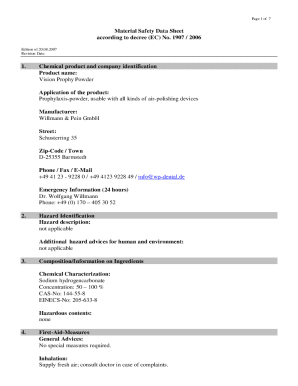

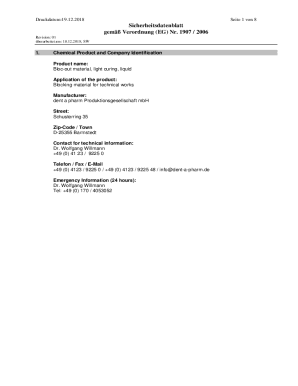

Step-by-step guide to completing the refund application form

Completing the refund application form starts with gathering necessary information. Begin by having your personal identification details and account information handy, such as account numbers and relevant transaction details. Additionally, any financial documentation that supports your request—like receipts or previous correspondence—should also be collected to expedite the process.

Filling out the refund application form

When filling out the refund application form, pay specific attention to each section. Typically, this may involve entering your personal information, specifying the amount you are claiming, providing your reason for the refund, and supporting details justifying your request. Be as thorough as possible, as detailed explanations can facilitate faster processing.

Submitting the refund application

After completing the application, it's time to submit it. Best practices include submitting it through the official channel recommended by your financial institution—this could be online or via mail. If submitting online, ensure your internet connection is stable to avoid interruptions. Common mistakes to avoid include incomplete information and missing documentation, which can lead to processing delays.

Step-by-step guide to completing the rollover application form

To initiate a rollover, first assess your eligibility and requirements. Identify whether your existing accounts qualify for a rollover. Understanding different types of rollovers is crucial; for instance, a direct rollover allows for the transfer of funds between accounts without tax withholding, while an indirect rollover requires the account holder to receive the funds before redepositing them, and comes with stricter timelines.

Filling out the rollover application form

When filling out the rollover application form, ensure to carefully complete specific fields. You will typically need to provide details regarding both the current account and the receiving account. Accuracy and completeness are key—double-check figures and documentation to prevent any setbacks.

Submitting the rollover application

When submitting the rollover application, you can choose among various methods including mail or online platforms. Each method has its timeline for processing; online submissions are often processed faster than those sent via mail. Be sure to follow up on your application to ensure it’s been received and is being processed accordingly.

Tracking your application status

Once submitted, it’s essential to track the status of your refund or rollover application. Most financial institutions offer online portals for this purpose, allowing you to check the progress of your request. In case of delays or if you notice any discrepancies, communication with your financial institution is key. Keeping a record of your application number or correspondence can streamline this process.

Common issues and troubleshooting

If your application is denied, first review the feedback provided by the financial institution. Common reasons for denial include missing information or ineligible requests. Understanding these reasons can help rectify issues and facilitate resubmissions.

Resolving common problems with application processing can often be achieved through direct communication. Don’t hesitate to contact customer support to clarify any uncertainties or seek guidance on how to expedite your application review.

Tools and resources available on pdfFiller

pdfFiller offers interactive features for filling and editing forms, making the refund and rollover application process seamless. The platform's collaborative tools allow teams to work together on submissions, ensuring that all documents are accurate and complete before sending them off.

Additionally, pdfFiller offers eSignature solutions for fast processing, eliminating delays typically associated with waiting for physical signatures, which is particularly beneficial in a time-sensitive financial context.

Frequently asked questions (FAQs)

Refund requests typically involve common questions regarding timelines for processing and allowable reasons for claims. Understanding the most frequently cited reasons for refunds, such as service unavailability or billing errors, can prepare applicants for a successful process.

Similarly, when it comes to rollovers, applicants often inquire about the implications of taxes or penalties. It’s crucial to clarify the policies surrounding your specific rollover type, especially as they can significantly impact your financial status.

Success stories and testimonials

Numerous clients have successfully navigated their refund and rollover processes utilizing pdfFiller's features. Case studies illustrate how users efficiently managed their applications, from initial submission to successful outcomes, underscoring the platform's effectiveness.

Client testimonials highlight the ease of use of pdfFiller, emphasizing how features such as collaborative editing and eSignature functionalities created a streamlined experience for document management. These positive experiences further validate pdfFiller's positioning as a go-to solution for managing financial documents.

Additional tips for managing financial documents

Organizing your financial papers is essential not only for refunds or rollovers but for overall financial health. Utilize pdfFiller to keep track of important documents, ensuring that everything is accessible and in order. Keeping digital copies of your documents is equally important as it provides backup and makes retrieval easy.

Emphasizing the importance of ongoing document management can help prevent confusion in future applications. Regularly review and update your files in pdfFiller to ensure you have current information on hand, aiding in quick resolutions when financial queries arise.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit refund amp rollover application from Google Drive?

How do I fill out the refund amp rollover application form on my smartphone?

Can I edit refund amp rollover application on an Android device?

What is refund amp rollover application?

Who is required to file refund amp rollover application?

How to fill out refund amp rollover application?

What is the purpose of refund amp rollover application?

What information must be reported on refund amp rollover application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.