Get the free Form W-9 - Office of the Controller - University of Notre Dame

Get, Create, Make and Sign form w-9 - office

Editing form w-9 - office online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form w-9 - office

How to fill out form w-9 - office

Who needs form w-9 - office?

Form W-9 - Office Form: A Comprehensive Guide

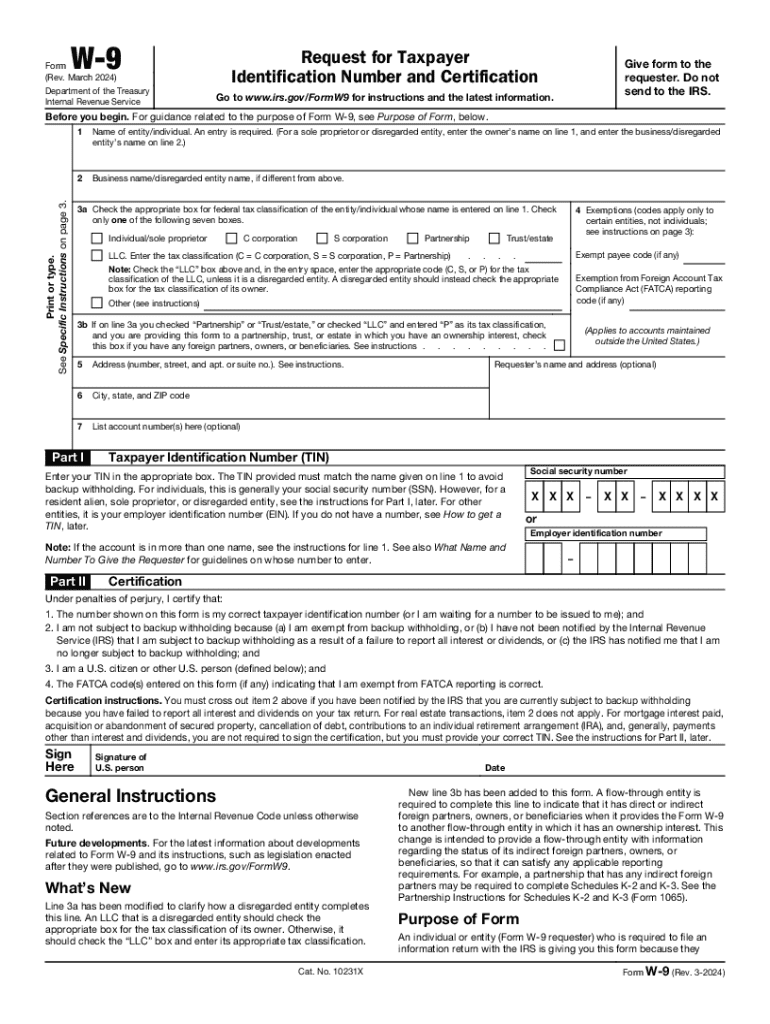

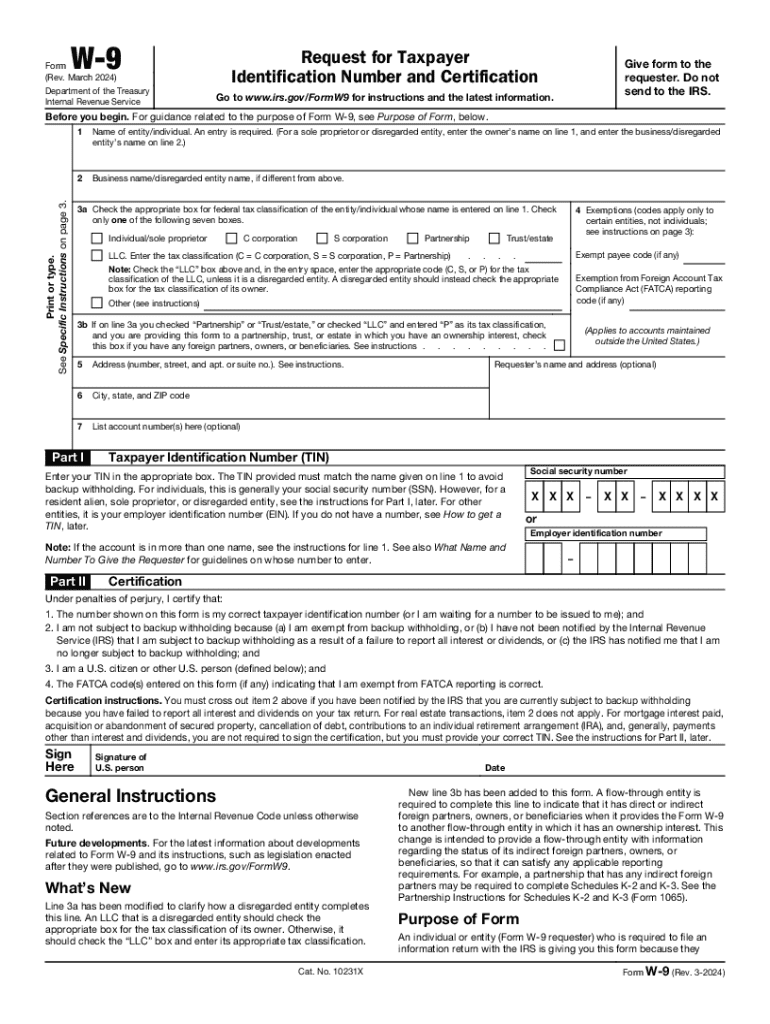

Understanding the W-9 form

The W-9 form is a crucial document for anyone dealing with U.S. tax obligations. Officially known as the 'Request for Taxpayer Identification Number and Certification,' it is primarily used by businesses and individuals to provide their taxpayer identification information for income reporting purposes. This form is essential for freelancers, independent contractors, and vendors working with businesses.

The W-9 collects key information such as the name, business name (if applicable), address, and taxpayer identification number (TIN). Filling this out accurately ensures compliance with tax reporting requirements and helps avoid penalties. Understanding the W-9 form's role is crucial for freelancers and small business owners, as it establishes the legal framework for reportable income.

Why do need to fill out the W-9 form?

Filling out a W-9 form is vital for tax purposes. The Internal Revenue Service (IRS) mandates that payers obtain TINs from taxpayers for accurate income reporting. If you’re a freelancer, contractor, or service provider, you’ll likely need to provide a W-9 before any business transactions occur. This document not only facilitates accurate tax reporting but also helps protect you from potential identity theft.

Failing to submit a W-9 when required can lead to significant consequences, including higher tax withholding by the payer. Without this form, you may also miss out on income summaries reported to the IRS, which can result in tax audits or fines. Therefore, understanding when and why to submit the W-9 is imperative for anyone who engages in contract work or receives business payments.

Detailed breakdown of the W-9 form

The W-9 form has a straightforward structure, but it contains essential sections that require careful attention. Here’s a step-by-step guide on how to correctly fill it out.

1. **Part I – Taxpayer Identification Number (TIN)**: The TIN is either your Social Security Number (SSN) or your Employer Identification Number (EIN). It's used by the IRS to track your income. To find your TIN, check your Social Security card or EIN letter from the IRS. Common mistakes include transposing numbers and using an incorrect format.

2. **Part II – Certification**: This section requires your signature, certifying that the information provided is accurate. Ensure that you also check the boxes acknowledging that you are not subject to backup withholding and that you are a U.S. person. Review your information carefully before signing, as discrepancies can lead to issues with payers.

Common issues and FAQs on the W-9

Many individuals encounter issues when filling out their W-9. Common mistakes include entering an incorrect TIN or failing to sign the form. Both can delay payments and complicate tax reporting. It’s also crucial to understand the type of information required. For instance, if you are using a business name, you must include that in the designated area.

Another frequent question pertains to when to update your W-9. If there's a significant change in your information—like a name change, change of business structure, or changes in TIN—you should submit a new W-9 immediately to all parties that hold your previous form. Regularly reviewing and updating your information can help avoid complications down the line.

After submitting the W-9 form

Once you’ve submitted your W-9, you might wonder what happens next. The recipient of the form uses your TIN to prepare tax documents like 1099s, which report what they’ve paid you. By providing this information, they’ll be able to accurately report to the IRS, reflecting your income. This ensures compliance with tax regulations and prevents the payer from facing penalties for misreporting.

Data security is a major concern when submitting your W-9. Ensure that the recipient is a trusted entity, as your TIN and other personal information are sensitive. Some businesses follow up with verification, such as confirming your TIN through IRS resources. Therefore, always maintain a line of communication to clarify how your information will be used and safeguarded.

Implementation of the W-9 reporting process

Businesses have systems in place to manage W-9 submissions effectively. It’s essential for them to establish a clear process for collecting, reviewing, and securely storing W-9 forms. This may include integrating document management solutions that enable easy access and retrieval of these forms as needed.

Best practices for maintaining W-9 records include secure storage, either physically or digitally, and ensuring that only authorized personnel have access to this sensitive information. Regular reviews can also help keep records up-to-date and relevant, preventing any discrepancies in tax reporting.

Digital management of the W-9 form

In today’s fast-paced world, managing W-9 forms digitally offers numerous advantages. Platforms like pdfFiller allow users to complete and sign W-9 forms online, enhancing accessibility and convenience. This feature is particularly beneficial for those who require forms on the go or need to facilitate remote work settings.

Utilizing an online platform means you can securely store your W-9s, reducing the risk of loss or data breaches. Digital signatures also streamline the submission process, protecting the integrity of the document while complying with legal requirements. Managing your paperwork digitally ultimately saves time and boosts efficiency.

How to edit and collaborate on a W-9 form

Editing a W-9 form through platforms like pdfFiller is straightforward. Users can easily adjust fields, update information, and insert electronic signatures. This approach allows individuals and businesses to maintain accurate records without the hassle of printing and rescanning forms.

Moreover, collaboration features built into many digital document solutions promote teamwork, allowing multiple stakeholders to review and edit the form simultaneously. This ensures that everyone involved in the process stays informed and reduces the chance of errors.

W-9 usage insights

Understanding who typically requests a W-9 is vital for smooth business operations. Common requesters include businesses engaging freelancers, independent contractors, and companies offering financial services. Whenever you start a new contract, it’s likely that the company will ask you to complete a W-9 to formalize the working relationship.

Additionally, it’s important to know how often you should obtain a new W-9 from contractors. Generally, a new form is required if there are changes to the individual’s information, like a change in business structure or TIN. Keeping track of this helps ensure that the records remain accurate and compliant.

Helpful tools and interactive resources

When managing your W-9 forms, utilizing digital tools can enhance your efficiency. pdfFiller, for instance, offers various resources for filling out and submitting W-9s, including templates and interactive guides. These tools are designed to simplify the process and ensure accuracy for all users.

Additionally, links to tutorials and customer support can provide further assistance as needed. Access to these resources allows you to navigate the W-9 submission process with confidence and clarity.

About pdfFiller

pdfFiller is dedicated to providing comprehensive document management solutions tailored to the needs of individuals and teams. Our platform empowers users to seamlessly edit, eSign, and collaborate on various forms from a single, cloud-based interface, enhancing both productivity and document security.

From managing your W-9 submissions to collaborating on business contracts, pdfFiller’s tools are designed to further simplify your document management experiences. With a focus on user-friendly services, we aim to help you tackle paperwork efficiently.

Contact information for support

For assistance with your W-9 form or any other queries, users can access pdfFiller’s robust customer support. Options include live chat for immediate help, email support for detailed questions, and a comprehensive FAQ section for self-service inquiries. Our support team is committed to ensuring user satisfaction and providing solutions to any document management challenges.

Site footer content

For more information about privacy policies, terms of service, and community engagement, visit our website. pdfFiller connects you to valuable resources and keeps you informed on the latest updates in document management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my form w-9 - office directly from Gmail?

Where do I find form w-9 - office?

How do I complete form w-9 - office on an iOS device?

What is form w-9 - office?

Who is required to file form w-9 - office?

How to fill out form w-9 - office?

What is the purpose of form w-9 - office?

What information must be reported on form w-9 - office?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.