Get the free IRS - Department of the Treasury Internal Revenue Service

Get, Create, Make and Sign irs - department of

How to edit irs - department of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out irs - department of

How to fill out irs - department of

Who needs irs - department of?

IRS - Department of Form: A Comprehensive How-to Guide

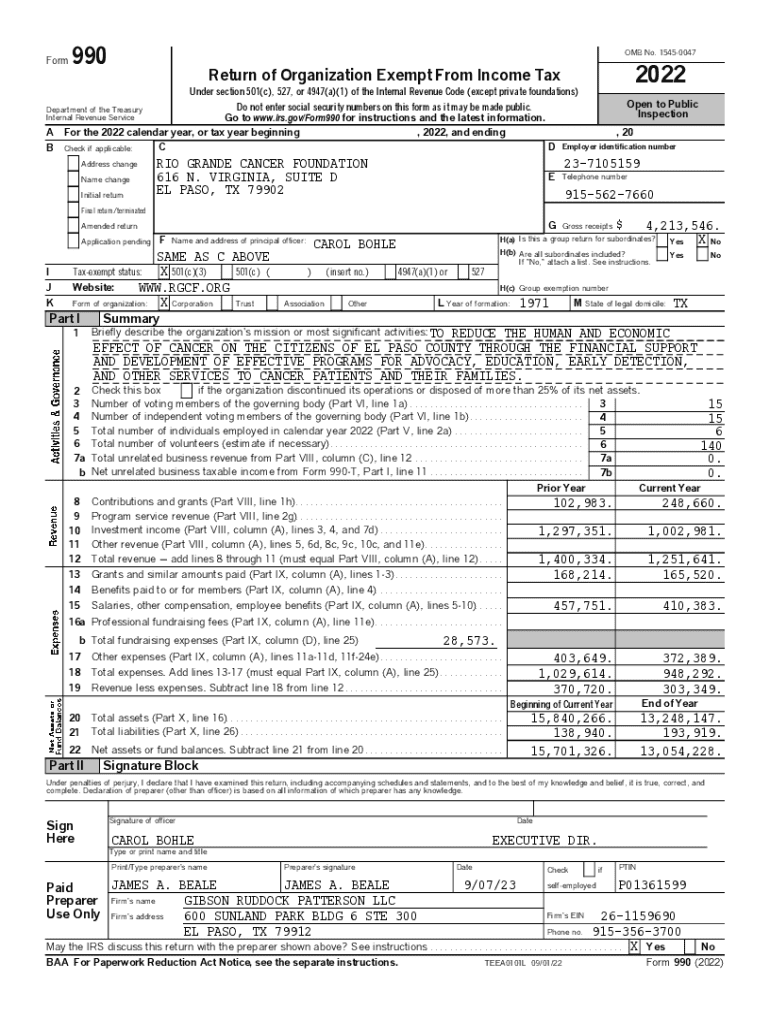

Overview of IRS forms

IRS forms are official documents utilized by the Internal Revenue Service (IRS) to collect necessary information from taxpayers. They are crucial for reporting income, calculating tax liabilities, and claiming deductions or credits. Understanding these forms is vital for both individuals and businesses to maintain compliance with tax laws, avoid penalties, and ensure accurate tax reporting.

Understanding your tax obligations

Tax obligations for individuals and businesses can vary greatly depending on income levels, business structure, and jurisdiction. Individuals are generally required to file annual tax returns and report all sources of income, while businesses need to comply with different regulations based on their size and type. IRS forms play a critical role in this process, facilitating accurate reporting and ensuring compliance.

Common mistakes in tax filing can lead to delays and additional penalties. For individuals, incorrect reporting of income or failure to claim eligible deductions can result in overpayment of taxes. Businesses often struggle with misclassifying employees or misreporting taxable income, which can attract penalties. Understanding the requirements of each IRS form is essential to avoid these pitfalls and ensure accurate submissions.

The role of the IRS department of forms

The IRS Department of Forms is responsible for the creation, maintenance, and distribution of all forms that taxpayers need to comply with federal tax laws. This department ensures that forms are up-to-date with the latest regulations and are user-friendly for taxpayers. Effective communication between the IRS and taxpayers is essential, and the Department of Forms plays a key role in this.

The department supports taxpayers by providing clear instructions on how to complete forms and offering updates on any regulatory changes. It also actively solicits feedback to improve the usability of forms, ensuring they meet the evolving needs of taxpayers. Services include online resources, form tutorials, and personalized assistance for complex tax situations.

Introduction to specific IRS forms

Familiarity with specific IRS forms is crucial for proper tax compliance. Popular forms such as Form 1040, the primary income tax return for individuals, and Form W-2, which reports employee wages, are foundational to understanding tax obligations.

How to access and obtain IRS forms

Accessing IRS forms has become easier with advancements in technology. The most efficient way to obtain forms is through the IRS website, which offers downloadable versions of all current forms. Taxpayers can simply navigate to the forms section, locate their required document, and print it out at home.

Step-by-step instructions for filling out IRS forms

Properly filling out IRS forms is crucial to avoid delays in processing and potential errors in your tax submission. Each form has specific requirements, but there are general guidelines to follow. For instance, all mandatory information must be accurately stated, and it’s important to double-check for any math errors before submission.

Editing and managing your IRS forms

In a digital age, editing IRS forms has become more streamlined. Utilizing tools such as pdfFiller allows users to edit PDFs easily and securely. Users can upload forms, make necessary changes, and save them without hassle.

eSigning IRS forms

With the emergence of digital solutions, eSigning documents has become a legal and compliant way to sign IRS forms. Electronic signatures are widely accepted, making the filing process more efficient.

Troubleshooting common issues with IRS forms

Filing errors can occur at any stage of the tax process, and knowing how to address these issues can save taxpayers time and stress. If a mistake is identified in submitted forms, it’s crucial to take corrective action promptly. Moreover, understanding the common types of errors can help prevent them in the first place.

Recent updates and changes in IRS form regulations

Compliance with new IRS form regulations is essential for accurate tax reporting. The IRS frequently updates forms and guidelines based on changing laws or economic conditions. Staying informed about these changes is paramount to avoid compliance issues.

FAQs related to IRS forms

Common queries regarding IRS forms often stem from confusion about which forms to use or how to submit them. Addressing these FAQs can help demystify the process for many taxpayers.

Tools and resources within pdfFiller for IRS forms

pdfFiller provides an all-in-one solution for users looking to create, edit, and manage IRS forms effectively. With features designed to ensure compliance and streamline workflows, pdfFiller empowers users to navigate their tax obligations with confidence.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete irs - department of online?

Can I create an electronic signature for signing my irs - department of in Gmail?

How can I edit irs - department of on a smartphone?

What is irs - department of?

Who is required to file irs - department of?

How to fill out irs - department of?

What is the purpose of irs - department of?

What information must be reported on irs - department of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.