Get the free FG 0015 11-30-09FG 0015 505.qxd.qxd

Get, Create, Make and Sign fg 0015 11-30-09fg 0015

How to edit fg 0015 11-30-09fg 0015 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out fg 0015 11-30-09fg 0015

How to fill out fg 0015 11-30-09fg 0015

Who needs fg 0015 11-30-09fg 0015?

The fg 0015 11-30-09fg 0015 Form: A Comprehensive Guide

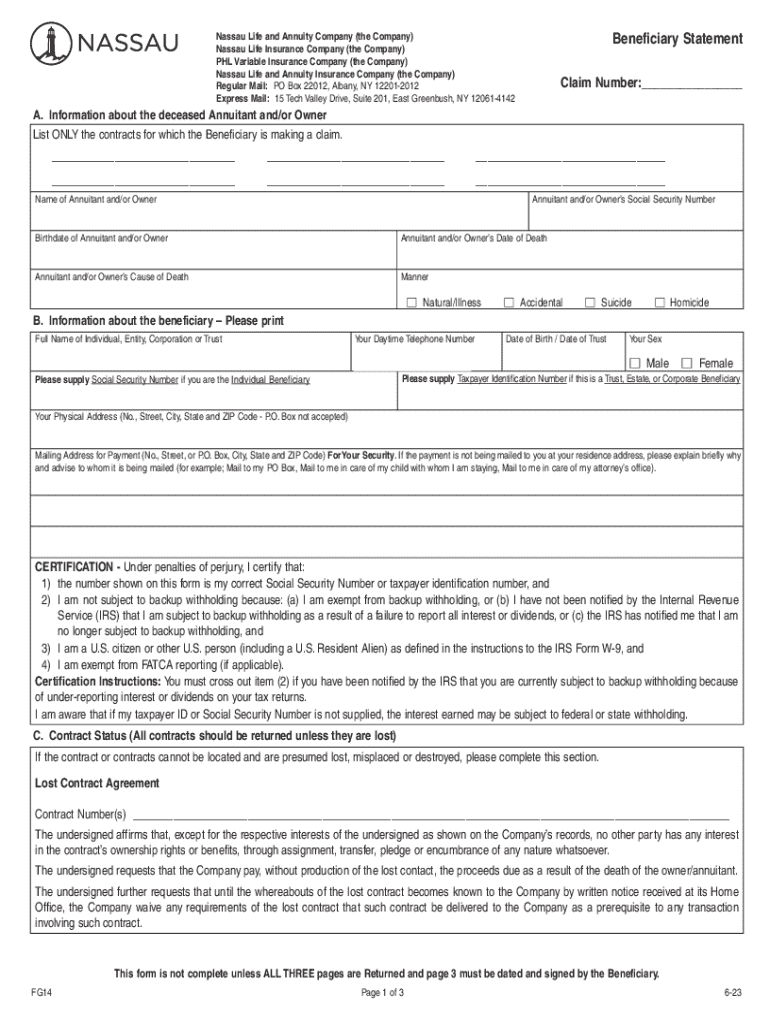

Overview of fg 0015 11-30-09fg 0015 form

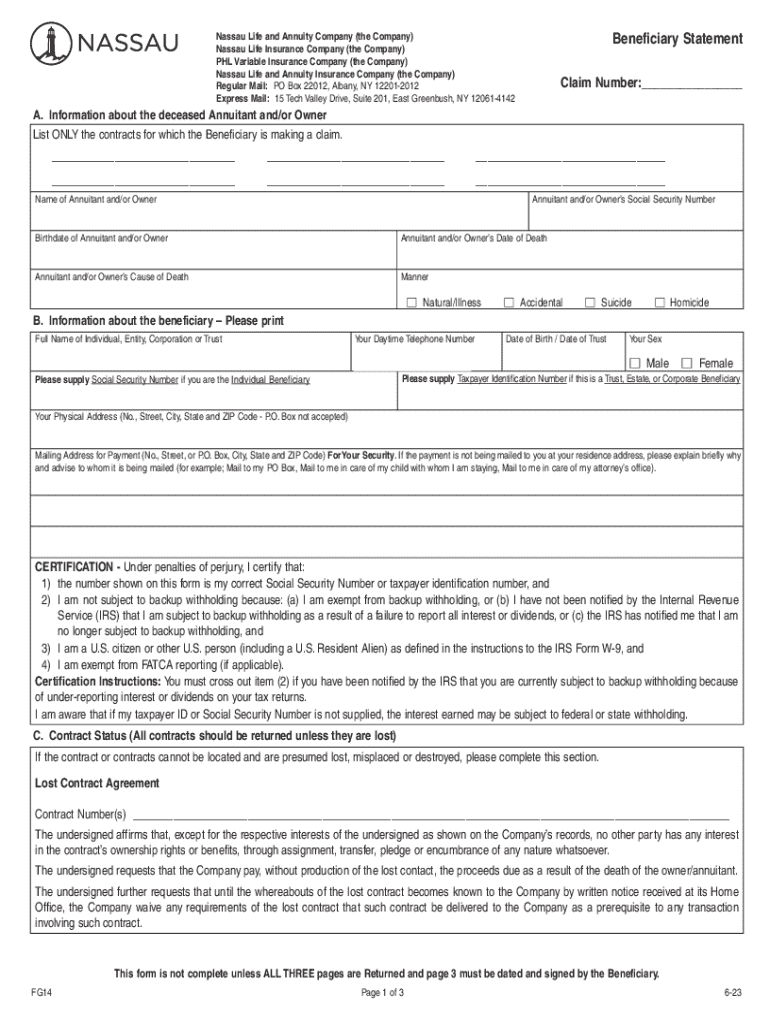

The fg 0015 form, dated 11-30-09, is an essential document used in various administrative processes. This form serves different purposes across multiple sectors, including tax filings, corporate compliance, and individual applications. Its importance lies in its role as a standardized method for submitting necessary information, ensuring that all relevant data is collected consistently and efficiently.

In any organization, the accuracy and proper use of the fg 0015 form can significantly impact operations. Due to its standardized nature, it allows both individuals and teams to streamline their documentation processes, ultimately improving productivity and efficiency.

Key features of pdfFiller and its relevance to fg 0015 form

pdfFiller offers a suite of cloud-based tools for managing documents, making it particularly advantageous when working with the fg 0015 form. This platform enables users to create, edit, and manage their forms from anywhere with an internet connection, thus enhancing accessibility for both individual and team-based workflows.

One of the standout features of pdfFiller is its eSignature capability, which holds legal standing. This feature allows users to sign documents electronically, simplifying the signing process of the fg 0015 form without the need for printing and scanning. Additionally, real-time collaboration tools foster teamwork, permitting multiple users to work on the same document seamlessly.

Step-by-step instructions for filling out the fg 0015 form

Filling out the fg 0015 form requires careful attention to detail. The following steps will guide you through the process, ensuring that all necessary information is correctly provided.

3.1. Gathering required information

Before starting, it’s essential to gather all necessary documents and information. Make sure you have the following:

3.2. Accessing the fg 0015 form via pdfFiller

To access the fg 0015 form on pdfFiller, start by visiting their website and using the search functionality to locate the specific form. Once you find it, simply click on the form to open the editing interface.

pdfFiller provides interactive tools that make it easy to edit the form to fit your specific needs effortlessly.

3.3. Editing the fg 0015 form

Editing the fg 0015 form involves several steps, such as inputting text or adding images. Follow these detailed instructions to ensure you fill it out correctly:

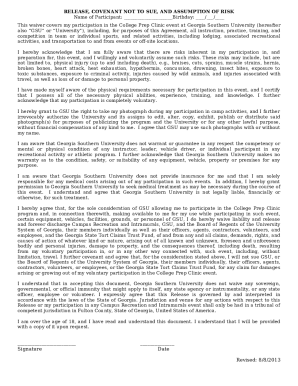

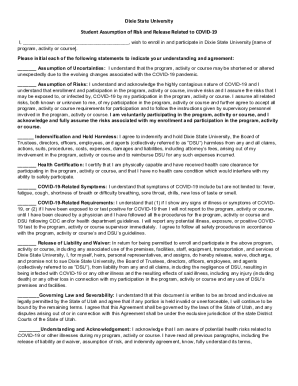

3.4. Adding eSignatures

Signing the fg 0015 form electronically is straightforward. Here’s how to insert eSignatures effectively:

3.5. Saving and managing your fg 0015 form

After completing the form, you have several options for saving it. You can download the completed form as a PDF, print it directly, or share it via email. Proper organization of your forms is key, and pdfFiller allows you to categorize and manage all your documents within your account easily.

Common mistakes to avoid when filling out the fg 0015 form

Many individuals encounter pitfalls when completing the fg 0015 form. Here are some common mistakes to avoid:

To ensure compliance and accuracy, use checklists and review each section of the form carefully before submission.

Frequently asked questions (FAQs)

1. What is the primary purpose of the fg 0015 form? The fg 0015 form is commonly used for tax filings and other official documentation.

2. Can I electronically sign the fg 0015 form? Yes, pdfFiller supports eSignature functionality for legal document signing.

3. What should I do if I encounter issues while filling out the form? Refer to customer support on pdfFiller for assistance or use their help resources.

Advanced tips for using pdfFiller with the fg 0015 form

To get the most out of your experience with the fg 0015 form on pdfFiller, consider leveraging some of their advanced functions:

User testimonials and case studies

Many users have reported increased efficiency while using the fg 0015 form via pdfFiller. For instance, a small business owner shared how transitioning to a digital form resulted in a 40% reduction in processing time for applications. Another team highlighted the effectiveness of real-time collaboration tools that allowed them to finalize documents with fewer delays.

Other related forms available on pdfFiller

In addition to the fg 0015 form, pdfFiller offers various similar forms that users may find beneficial, including:

Conclusion of fg 0015 form insights on pdfFiller

In summary, the fg 0015 form is a critical document that plays an impactful role across various applications. Utilizing pdfFiller to manage this form offers numerous advantages, including enhanced accessibility, efficient editing, and secure eSignature functionalities.

Embracing a cloud-based document management solution like pdfFiller not only simplifies the form-filling process but also promotes organizational effectiveness and compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete fg 0015 11-30-09fg 0015 online?

How can I edit fg 0015 11-30-09fg 0015 on a smartphone?

How do I edit fg 0015 11-30-09fg 0015 on an iOS device?

What is fg 0015 11-30-09fg 0015?

Who is required to file fg 0015 11-30-09fg 0015?

How to fill out fg 0015 11-30-09fg 0015?

What is the purpose of fg 0015 11-30-09fg 0015?

What information must be reported on fg 0015 11-30-09fg 0015?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.