Get the free Coverdell Education Savings Account (ESA) Application & ...

Get, Create, Make and Sign coverdell education savings account

Editing coverdell education savings account online

Uncompromising security for your PDF editing and eSignature needs

How to fill out coverdell education savings account

How to fill out coverdell education savings account

Who needs coverdell education savings account?

Coverdell Education Savings Account Form - How-to Guide Long-Read

Understanding the Coverdell Education Savings Account (ESA)

The Coverdell Education Savings Account, commonly known as the Coverdell ESA, is a tax-advantaged savings vehicle designed to help families save for educational expenses. Unlike 529 plans, which are primarily used for college savings, the Coverdell ESA allows contributions for both K-12 and higher education expenses. This flexibility makes it an appealing option for parents who want to lighten the financial burdens associated with education for their children.

The primary purpose of a Coverdell ESA is to enable tax-free growth of funds when used for qualified educational expenses. These expenses include tuition, fees, books, and even room and board for eligible institutions. This account is designed to benefit those looking for an efficient way to fund education while enjoying certain tax benefits.

Key benefits of opening a Coverdell ESA

Opening a Coverdell ESA carries several key benefits that make it an attractive option for education savings:

Eligibility requirements for contributors

To contribute to a Coverdell ESA, certain eligibility requirements must be met. Primarily, contributors must be individuals, not entities, and their modified adjusted gross income (MAGI) should not exceed specified limits. As of the latest updates, the income phase-out begins at $190,000 for joint filers and $95,000 for single filers. Additionally, the maximum age for the beneficiary is 18, although contributions can continue until the beneficiary reaches age 30 under certain conditions.

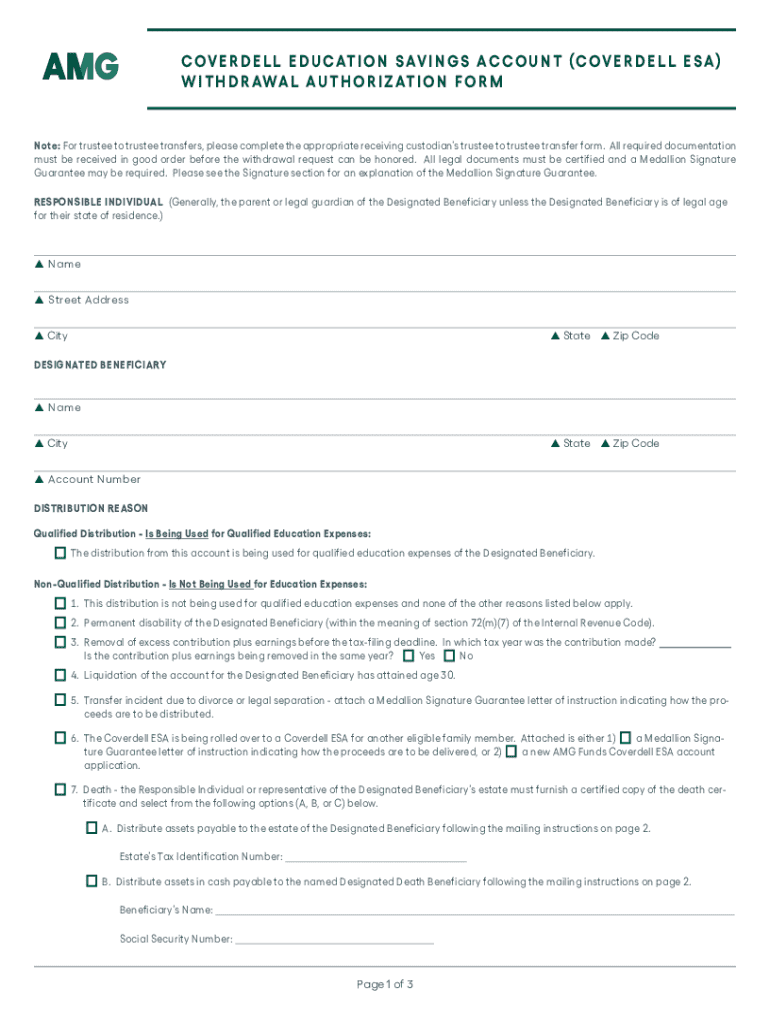

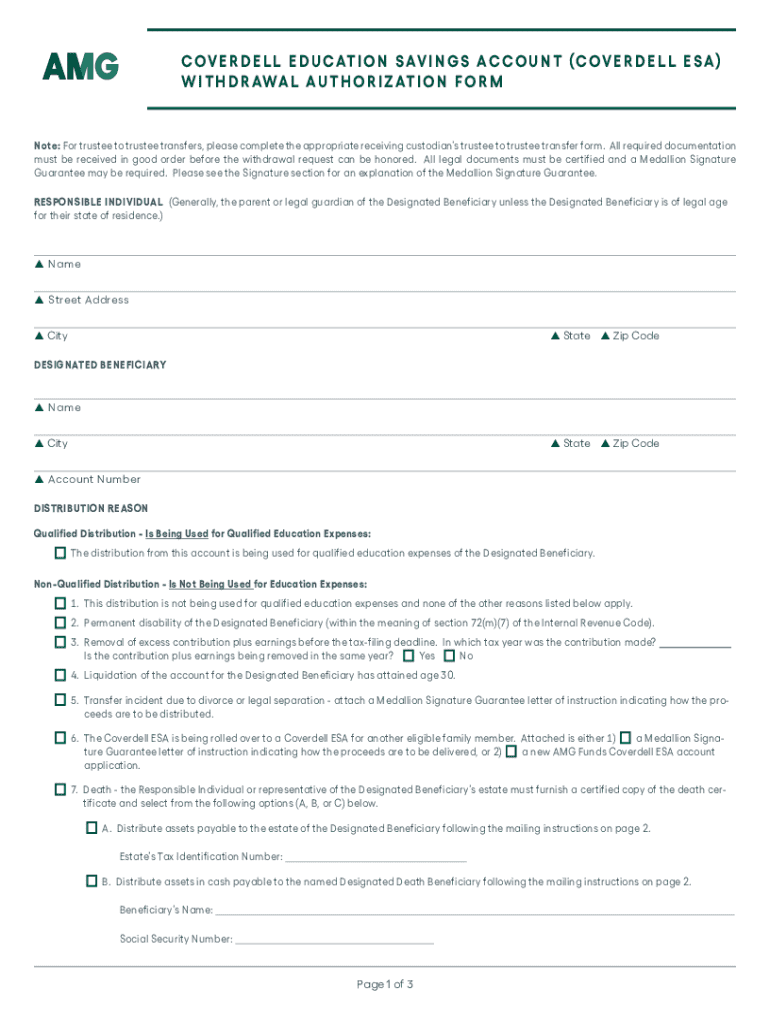

Overview of the Coverdell ESA form

The Coverdell ESA form is essential for initiating and managing your account. Understanding its purpose is crucial for both new and existing account holders. This form serves as a means to apply for the account, update beneficiary information, and manage contributions and withdrawals effectively.

Purpose of the Coverdell ESA form

The Coverdell ESA form plays a significant role in setting up the account and managing essential changes throughout its lifecycle. It ensures that accurate information is collected and recorded, fostering a smooth administrative process for the account holder and the financial institution handling the account.

Types of Coverdell ESA forms

There are various types of Coverdell ESA forms tailored for specific actions, including:

Step-by-step guide to filling out the Coverdell ESA form

Filling out a Coverdell ESA form can seem daunting, but a systematic approach will simplify the process. Follow these steps to ensure a successful submission.

Preparing to complete the form

Before tackling the form, gather all necessary documents and information. This includes personal identification, Social Security numbers, and details regarding the beneficiary, including their date of birth and educational plans.

Detailed instructions for each section of the form

Once you have your documents ready, start filling out the form. Pay close attention to the following sections:

Common mistakes to avoid when filling out the form

To ensure a smooth process, avoid these common pitfalls:

Editing and customizing the Coverdell ESA form

Once you've filled out the form, you might want to customize or edit it before the final submission. pdfFiller offers intuitive tools for this purpose.

Utilizing pdfFiller's tools for editing PDF forms

With pdfFiller, editing your Coverdell ESA form is a breeze. Utilize features such as highlighting important sections, adding annotations, or filling in blanks. This can enhance clarity for both you and the reviewer.

Adding eSignatures and collaborating on the form

If collaboration is needed, pdfFiller allows users to add eSignatures easily. Participants can sign the form electronically, and features like sharing options facilitate the collaboration process among teams.

Submitting the Coverdell ESA form

Submitting your completed Coverdell ESA form is straightforward. You need to decide between online submission or physical mailing based on your preference and the institution's requirements.

Where to submit your completed form

If your financial institution provides an electronic submission option, this is often the quickest route. Alternatively, if physical mailing is necessary, ensure that you use certified mail for confirmation.

Tracking your submission status

After submitting your Coverdell ESA form, keep an eye out for a confirmation from your financial institution. It’s important to track your submission to address any issues promptly, maintaining clear communication lines.

Managing your Coverdell ESA after submission

Managing your Coverdell ESA effectively after submission is critical for maximizing its benefits. Regular monitoring and understanding of the associated tax implications are essential.

How to monitor contributions and withdrawals

To ensure your Coverdell ESA is growing as expected, track your contributions and withdrawals regularly. Most financial institutions provide online access to your account, making this process simpler.

Strategies for growing your Coverdell ESA

Consider diversifying your investment choices based on market conditions and your risk tolerance. Regularly rebalancing your portfolio will help you stay aligned with your financial goals.

Understanding the tax implications of withdrawals

Familiarize yourself with IRS guidelines regarding withdrawals. Non-qualified withdrawals may incur taxes and penalties, so it’s vital to ensure that funds are used appropriately for educational expenses.

Frequently asked questions about Coverdell ESAs

As you navigate through the world of Coverdell ESAs, you may have questions. Here are some commonly asked queries with answers that provide clarity.

General FAQs

Individuals often seek clarifications on eligibility and contribution limits. Remember that specific income thresholds determine your ability to contribute, and beneficiary age plays a crucial role in account management.

Specific queries on the form and submission process

Many users face common issues while filling out the Coverdell ESA form. Contacting customer support through pdfFiller ensures that you receive timely assistance to overcome these challenges.

Additional tools and resources available on pdfFiller

pdfFiller offers an array of tools and resources to empower users better in managing their Coverdell ESA forms.

Interactive tools for managing your Coverdell ESA

For users looking for practical guidance, pdfFiller provides how-to video tutorials that guide you through filling out and submitting your Coverdell ESA form.

Community insights and expert support

Engage with community insights and access expert support for any form-related inquiries. pdfFiller's community forums allow users to share their experiences and solutions, fostering a collaborative environment.

Conclusion

Navigating the Coverdell Education Savings Account form does not need to be overwhelming. By utilizing the comprehensive tools provided by pdfFiller and following the outlined steps, you can efficiently manage this important financial resource. The Coverdell ESA can provide significant long-term benefits for educational funding, making informed contributions and proper management essential for success.

Footer navigation

For more financial tools and assistance, navigate through the resources available on pdfFiller. Contact information is available for any further inquiries or support needed in managing your Coverdell ESA or other forms.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit coverdell education savings account from Google Drive?

How do I edit coverdell education savings account straight from my smartphone?

How can I fill out coverdell education savings account on an iOS device?

What is coverdell education savings account?

Who is required to file coverdell education savings account?

How to fill out coverdell education savings account?

What is the purpose of coverdell education savings account?

What information must be reported on coverdell education savings account?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.