Get the free Beneficiary Designation Form - Lockton Employee Connects

Get, Create, Make and Sign beneficiary designation form

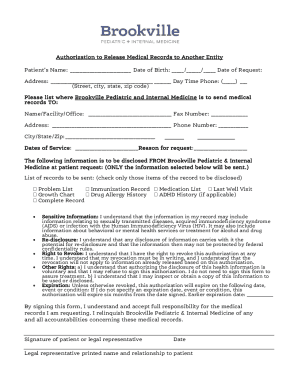

Editing beneficiary designation form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out beneficiary designation form

How to fill out beneficiary designation form

Who needs beneficiary designation form?

Beneficiary designation form: A comprehensive how-to guide

Understanding beneficiary designation

A beneficiary designation form is a crucial tool in estate planning, determining how your assets will be distributed upon your passing. Understanding the components of beneficiary designation is essential for everyone managing financial assets. In simple terms, a beneficiary is an individual or entity that inherits assets from financial accounts, life insurance policies, or will provisions. The person who designates these beneficiaries is known as the designator.

Beneficiary designations can be either revocable or irrevocable. While revocable designations allow you to change beneficiaries at any time, irrevocable ones are binding and require consent from the beneficiary for any changes. Properly designating beneficiaries ensures that your assets are transferred according to your wishes, thereby avoiding potential disputes among heirs.

Why a beneficiary designation form is essential

Utilizing a beneficiary designation form guarantees that your assets are distributed as per your intentions. This is fundamentally important, especially when considering complex family dynamics or substantial assets. By clearly specifying beneficiaries, you minimize ambiguity and lessen the chances of disputes after your passing.

Furthermore, beneficiary designations play a significant role in avoiding probate. When assets are specifically designated to a beneficiary, they do not go through the probate process, allowing for much quicker access to funds for your heirs. Avoiding probate not only saves time; it can also result in significant cost savings.

Types of beneficiary designation forms

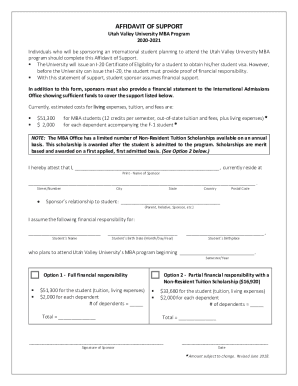

Different assets carry specific forms for beneficiary designation. The most common types include those used for life insurance policies, retirement accounts such as 401(k) and IRAs, and bank accounts. Each of these asset types requires a unique approach to designating beneficiaries, ensuring that your wishes are honored effectively.

It's critical to select the right form tailored to your specific needs. Consider factors like the type of asset and the nature of your beneficiaries, whether they are individuals, trusts, or charities. Additionally, be mindful of state-specific requirements, as laws regarding beneficiary designations can vary significantly.

Step-by-step guide to filling out a beneficiary designation form

Preparing to fill out your beneficiary designation form involves gathering essential personal information. Collect necessary documents that include your name, address, and social security number, as well as the details of your potential beneficiaries, including their relationships to you and their contact information.

Understanding the impact of your choices is vital. Each beneficiary can be classified as either a primary or contingent beneficiary. Primary beneficiaries will receive assets first, while contingent beneficiaries are next in line if the primary beneficiaries cannot inherit.

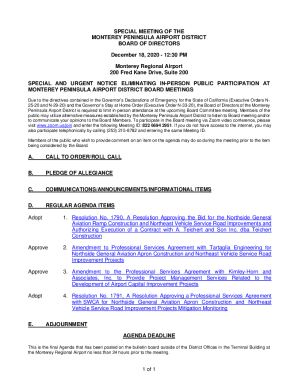

Editing and updating your designation

Life is dynamic, and your beneficiary designation form may require updates due to major life events such as marriage, divorce, births, or deaths. Establishing a routine review timeline—ideally annually or when significant changes occur—will help ensure your designations are current and reflective of your wishes.

Editing a beneficiary designation form can be streamlined using tools like pdfFiller. These tools allow you to digitally update forms easily, save changes, and maintain essential records. After updating, it's crucial to communicate these changes to relevant financial institutions to ensure they have the latest information.

Common pitfalls to avoid

Miscommunication with financial institutions is a common pitfall when dealing with beneficiary designations. Submitting forms incorrectly or not following up can lead to severe complications. Always confirm that your beneficiary forms have been received and processed to avoid any misallocation of assets.

Additionally, understanding the legal considerations is crucial. Each state may have differing laws regarding beneficiary designations, and overlooking these could lead to unintended distributions. Familiarize yourself with tax implications and potential liabilities that affect your beneficiaries to ensure a smooth transfer of assets.

Managing your beneficiary designation form long-term

Securing and accessing your documents is fundamental for long-term management of your beneficiary designation form. Utilizing cloud-based storage solutions like those offered by pdfFiller ensures that your documents are accessible from anywhere while implementing privacy and security measures.

Collaborating with legal advisors or family members becomes easier when using collaborative features available on platforms like pdfFiller. This allows for shared access to documents for review, ensuring all parties involved stay informed and aligned on designated beneficiaries.

FAQs about beneficiary designation forms

Understanding answers to common questions regarding beneficiary designations can offer clarity. For instance, if you don’t name a beneficiary, your assets may potentially go through probate, leading to delays and possible disputes among heirs.

If you’re considering naming a minor as a beneficiary, take special note. In most jurisdictions, a court-appointed guardian is typically required to manage assets until the minor reaches adulthood.

Interactive tools and resources

Utilizing interactive form filling tools, such as those provided by pdfFiller, allows for a streamlined experience when completing beneficiary designation forms. Features that enhance user experience include the ability to fill, edit, and electronically sign forms with ease.

Additionally, accessing templates available on pdfFiller can simplify the process of creating accurate and compliant beneficiary designation forms, making it easier to ensure you have the correct and effective documentation.

Conclusion: Streamlined document management with pdfFiller

Efficiently managing your beneficiary designation form is key to ensuring your wishes are honored after your passing. By understanding the various aspects of beneficiary designations and utilizing tools like pdfFiller, you can simplify the process of creating, updating, and managing your documents.

Empower yourself to take control of your estate planning needs confidently, ensuring that your assets are protected and allocated to those you care about. Start the process today, leveraging pdfFiller’s features to safeguard your legacy.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit beneficiary designation form from Google Drive?

Where do I find beneficiary designation form?

Can I edit beneficiary designation form on an iOS device?

What is beneficiary designation form?

Who is required to file beneficiary designation form?

How to fill out beneficiary designation form?

What is the purpose of beneficiary designation form?

What information must be reported on beneficiary designation form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.