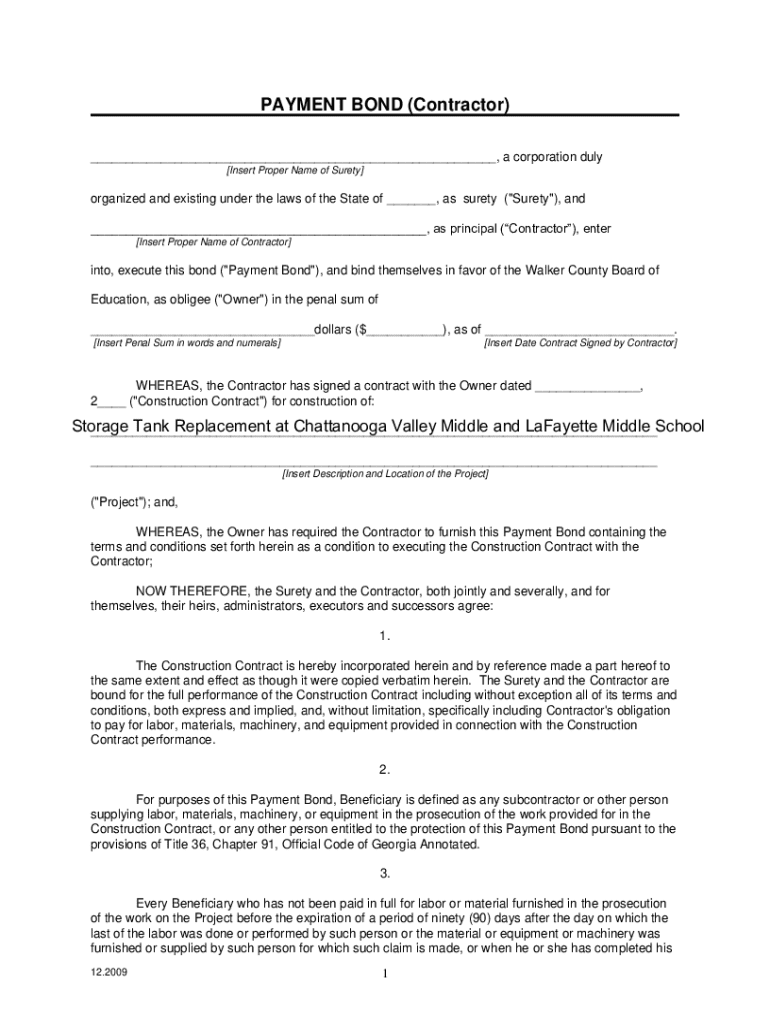

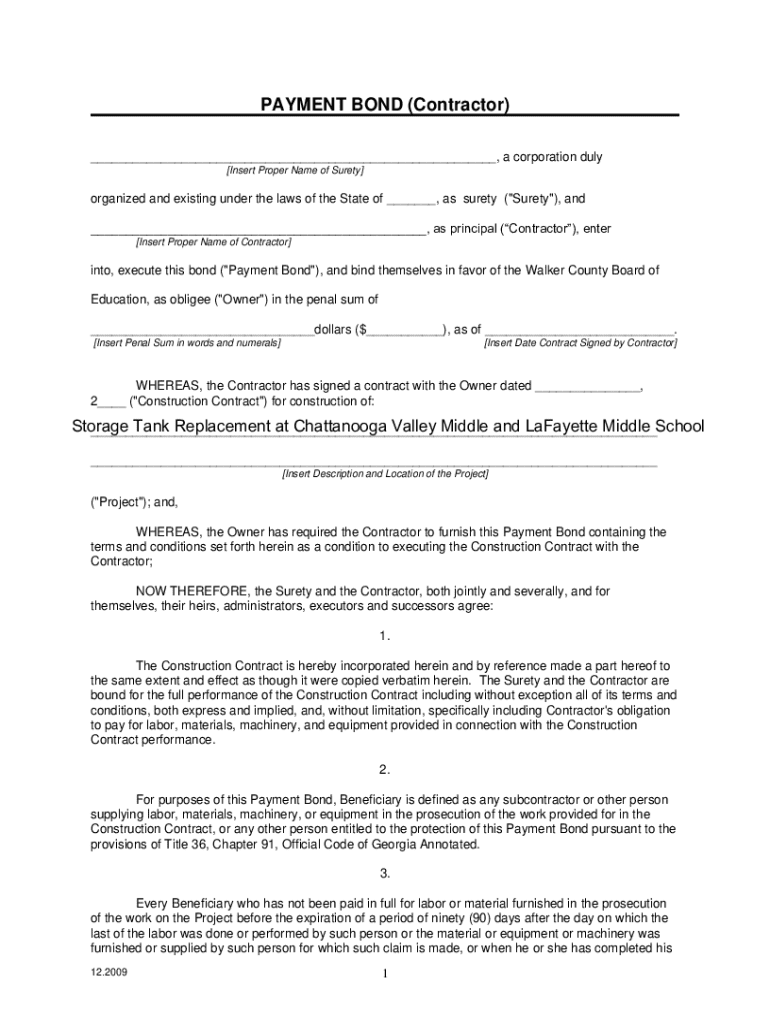

Get the free PAYMENT BOND (Contractor)

Get, Create, Make and Sign payment bond contractor

Editing payment bond contractor online

Uncompromising security for your PDF editing and eSignature needs

How to fill out payment bond contractor

How to fill out payment bond contractor

Who needs payment bond contractor?

A Comprehensive Guide to the Payment Bond Contractor Form

Understanding payment bonds

Payment bonds are essential financial documents that guarantee the contractor will pay subcontractors and suppliers for their work on a project. These bonds protect project owners from the risk of contractor default and ensure that payments are made. Without a payment bond, contractors may struggle to prove their financial reliability, making it imperative in most construction agreements.

The importance of payment bonds cannot be understated. They foster trust between project owners and contractors, with owners requiring them as a standard practice. This safeguard is particularly crucial in public construction projects, where taxpayers seek assurance that funds are used appropriately.

Types of payment bonds

Payment bonds typically come in various forms, including bid bonds and performance bonds. Bid bonds assure project owners that the contractor will accept the contract if awarded, while performance bonds ensure that the contractor will complete the project according to the terms agreed upon. Together, these bonds create a financial safety net throughout the project lifecycle.

Overview of the payment bond contractor form

The payment bond contractor form serves multiple purposes, primarily ensuring that a clear agreement exists between the contractor, project owner, and surety company. This form details the obligations that the contractor must fulfill for payment to subcontractors and suppliers. Additionally, by formalizing the agreement, it reinforces accountability, which is essential in project management.

Legal requirements surrounding the payment bond form can vary significantly by state. For instance, some states may mandate specific bond amounts based on project size or type, impacting both the contractor and surety. Understanding these regulations is crucial for compliance and can help prevent costly legal disputes down the line.

Essential components of the payment bond contractor form

Every payment bond contractor form contains critical components that must be filled out accurately. Essential basic information includes the contractor's name, address, and contact details along with specific project information such as its location and scope of work. This ensures all parties involved are correctly identified.

Financial details are also central to the form. This includes the bond amount, which is often a percentage of the total project cost, reflecting the financial risk incurred by the project owner. Additionally, a clear methodology for calculating the bond value must be documented, ensuring transparency in how costs are determined.

In terms of signatory requirements, the form must disclose the authorized signatory's information. Often, this means that an officer of the company must sign the bond, ensuring that the contractor is legally binding themselves to the obligations outlined.

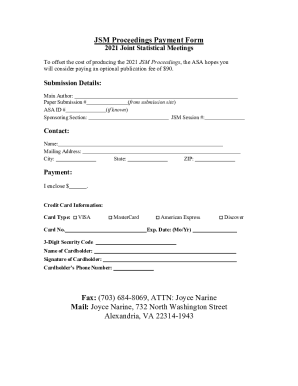

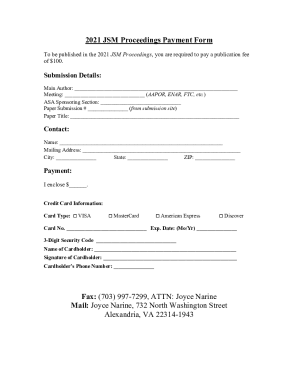

Step-by-step guide to completing the payment bond contractor form

Completing the payment bond contractor form can seem daunting, but breaking it down into manageable steps simplifies the process.

Managing your payment bond documents

Once the payment bond is secured, managing documentation becomes paramount. One effective strategy is to track the payment bond status over time, which can typically be done through organizational tools. This helps ensure that renewals are addressed with ample time before they lapse.

Utilizing a platform like pdfFiller can enhance document management. By providing cloud storage, this tool allows contractors to access and manage their bonds from various locations easily. The ability to collaborate with teams and share documents in real time helps streamline workflows.

Interactive tools and features

pdfFiller offers interactive features designed to simplify the completion of payment bond forms. With tools for eSignature, editing, and file organization, contractors can efficiently complete their paperwork and ensure compliance accurately.

Collaboration is also key within projects. Teams can work together in real-time within pdfFiller, ensuring that all necessary stakeholders can contribute without delays. This shared approach not only saves time but also minimizes the risk of miscommunication.

Tips for success in the bond process

Navigating the bond process effectively requires understanding common questions and concerns. Frequently asked questions about payment bonds range from their necessity to concerns about costs and required documentation. Addressing these issues early can significantly reduce stress for contractors.

It is beneficial for contractors to adopt best practices in bond management. This includes maintaining open dialogues with surety companies, keeping all documents organized, and setting reminders for renewal dates. Such strategies significantly enhance efficiency and compliance throughout the project lifecycle.

Preparing for different project scenarios

Understanding when to seek professional help is crucial, especially in complex project scenarios. Contractors should recognize situations that might require legal advice, such as policy disputes or disagreements on bond execution.

Case studies highlighting successful payment bond applications provide valuable insights. For example, a contractor in New York faced challenges with a municipal project but successfully secured a bond that covered larger subcontractor payment risks, ensuring successful project completion. Learning from such scenarios can aid in future applications.

Additional forms related to payment bonds

Several forms accompany the payment bond process and may be required for comprehensive compliance. Certificates of insurance provide proof of coverage, while performance bond forms assure project completion according to terms.

Subcontractor payment bond forms also exist to ensure payments within the subcontracting chain, safeguarding all parties involved in the broader project. Familiarizing oneself with these forms is paramount for smooth project execution.

Payment bond FAQ section

Understanding key terms is critical in navigating the payment bond landscape. A glossary of important terminologies can aid in demystifying the bond process. Ensuring familiarity with terms like 'surety', 'obligee', and 'principal' can enhance communication with stakeholders and create a more seamless bond experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send payment bond contractor to be eSigned by others?

How do I complete payment bond contractor online?

Can I create an eSignature for the payment bond contractor in Gmail?

What is payment bond contractor?

Who is required to file payment bond contractor?

How to fill out payment bond contractor?

What is the purpose of payment bond contractor?

What information must be reported on payment bond contractor?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.