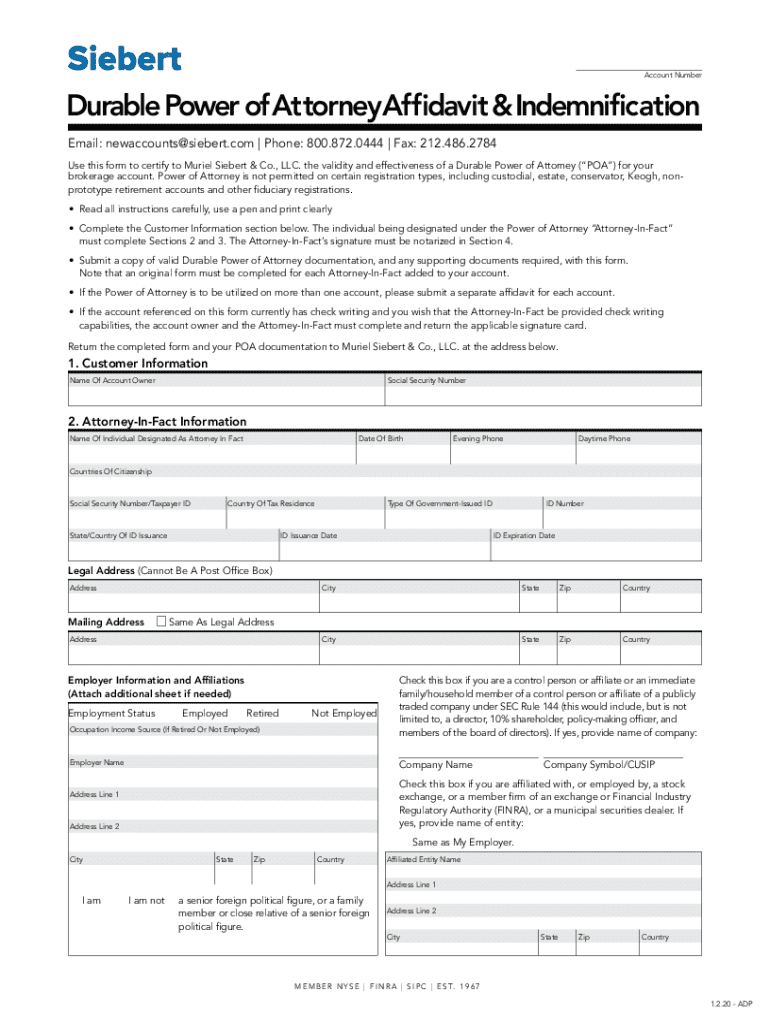

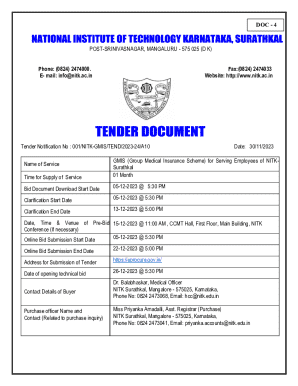

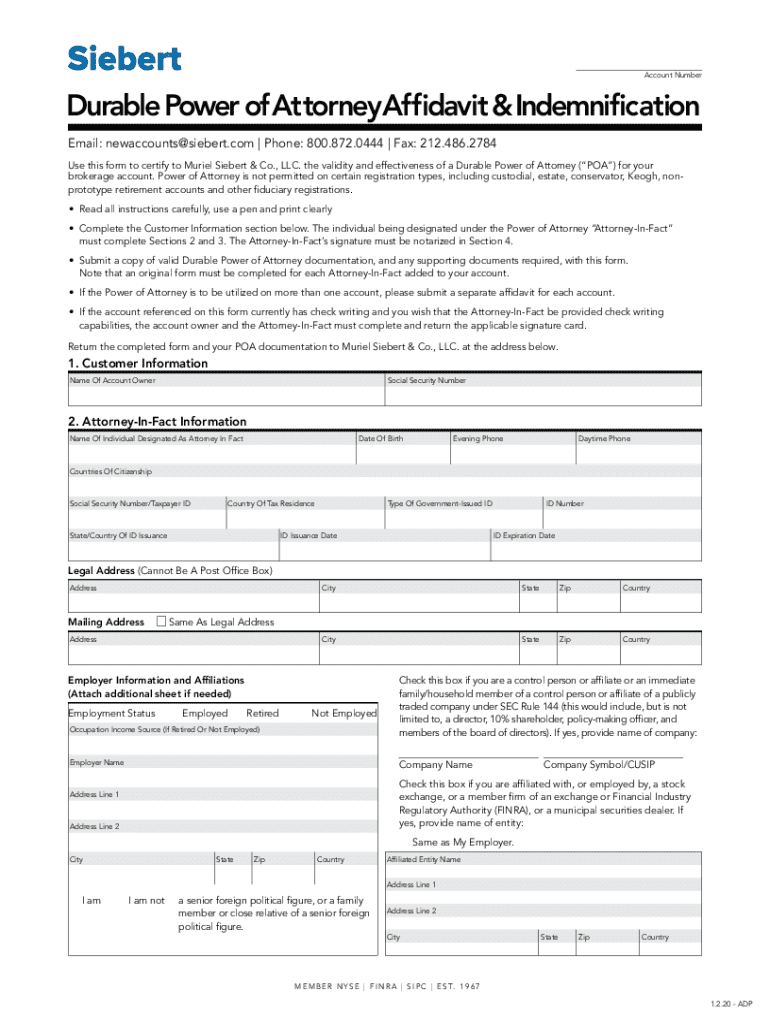

Get the free Durable Power of Attorney Affidavit & Indemnification

Get, Create, Make and Sign durable power of attorney

Editing durable power of attorney online

Uncompromising security for your PDF editing and eSignature needs

How to fill out durable power of attorney

How to fill out durable power of attorney

Who needs durable power of attorney?

Understanding Durable Power of Attorney Forms

Understanding durable power of attorney

A Durable Power of Attorney (DPOA) is a legal document that allows you to appoint someone else to make decisions on your behalf, even if you become incapacitated. This trusted individual, referred to as your agent or attorney-in-fact, can manage various aspects of your life, including financial, legal, and even medical decisions, depending on the scope defined in the document.

Having a DPOA is crucial, especially as you age or face health uncertainties. It ensures that someone you trust can make vital decisions if you are unable, protecting your financial interests and ensuring your medical or personal preferences are honored. Without a DPOA, decisions may be made by the court or family members who might not fully understand your wishes.

Types of durable power of attorney

There are various types of Durable Power of Attorney, primarily categorized into two groups: Statutory Durable Power of Attorney and Limited or General Power of Attorney. Each serves specific purposes and carries unique legal implications.

Statutory durable power of attorney

A Statutory Durable Power of Attorney is a DPOA that adheres to state laws and regulations. It is standardized, meaning it typically complies with specific requirements set by the state, making it a reliable option for many. This type of DPOA allows your agent to handle a wide range of financial decisions, such as managing bank accounts, selling real estate, or handling investments.

Limited vs. general power of attorney

The distinction between Limited and General Power of Attorney is fundamental. A Limited Power of Attorney grants your agent authority over specific tasks or decisions, defined clearly in the document. This is ideal for situations where you might be unavailable, such as selling a property when you’re out of state. In contrast, a General Power of Attorney provides broad powers, allowing the agent to act on your behalf in virtually all matters. Understanding these differences is key in choosing the right DPOA for your own circumstances.

Key components of a durable power of attorney form

A properly executed Durable Power of Attorney form must include essential components that define its purpose and scope. Typically, the following elements are critical:

In addition to these components, your DPOA must often be signed in the presence of a notary and/or witnesses. Each state has its own requirements for these formalities, which is why it's essential to be familiar with local laws.

Instructions for filling out the durable power of attorney form

Filling out a Durable Power of Attorney form requires diligence to ensure legality and clarity. Here’s a step-by-step guide to assist you:

To maintain clarity and legality, avoid common mistakes such as vague language or failing to customize the form to your specific needs. It can also be advantageous to consult a legal professional to review your document.

Customizing your durable power of attorney

Selecting the right agent is perhaps the most critical decision you’ll make when creating a Durable Power of Attorney. Look for someone who is trustworthy, responsible, and possesses the necessary knowledge about financial and healthcare matters. This individual should understand your values and preferences deeply, ensuring they can act in your best interest.

In addition to your primary agent, it’s wise to designate successor agents. These are backup individuals who can step in if your primary agent is unable or unwilling to serve. Having a robust plan covering all possibilities can provide peace of mind as you age or face health uncertainties.

Financial powers and responsibilities

When creating a Durable Power of Attorney, it’s important to outline the financial powers you wish your agent to have. Common powers granted typically include managing bank accounts, paying bills, handling investments, and over real estate transactions. These functions are essential for ensuring your financial affairs can be managed effectively in your absence.

However, limitations should be considered. Imposing restrictions on an agent's authority might be necessary to prevent potential misuse of power. For instance, you may want to specify that your agent cannot sell your home without your explicit consent. Establishing these boundaries upfront can help protect your interests.

Medical decisions and durable power of attorney

It’s crucial to differentiate between a financial Durable Power of Attorney and a medical Durable Power of Attorney. While a financial DPOA allows the agent to manage your finances, a medical DPOA enables them to make healthcare decisions on your behalf. This distinction is vital, especially as needs may vary due to health conditions.

Combining these documents is common. Many choose to create both a Durable Power of Attorney and healthcare directives, which detail specific medical preferences such as end-of-life care, organ donation, and other critical healthcare choices. This holistic approach ensures your agent can make informed decisions that align with your wishes.

Frequently asked questions (faqs)

Potential questions about DPOAs often arise. Here are some common queries:

Checklist for executing a durable power of attorney

Once your Durable Power of Attorney form is complete, executing it properly is crucial. Here’s a helpful checklist to ensure everything is in order:

Legal considerations and compliance

Local laws regarding Durable Power of Attorney can vary significantly. It's essential to familiarize yourself with your state’s specific regulations to ensure compliance and validity. States may have different requirements about the signing, witnessing, and notarizing process, which directly affects the legality of your DPOA.

Additionally, safeguarding your DPOA against fraud is paramount. Store your DPOA in a secure location, and limit access to it. Some opt to register their DPOA with local authorities for added protection and verification.

Resources for durable power of attorney forms

To create a DPOA, accessing quality resources is a great starting point. You can obtain downloadable DPOA templates from various platforms, including pdfFiller, where you can find user-friendly forms customized for your state.

Additionally, if you prefer personalized assistance, consider consulting a legal professional. Many firms offer reviews of your DPOA to ensure it meets all legal standards, providing peace of mind and ensuring the document serves its intended purpose.

Managing your durable power of attorney

Creating a Durable Power of Attorney is not a one-time task. As your circumstances change, so should your DPOA. Periodically reviewing the document ensures it remains a true reflection of your wishes. Major life events such as marriage, divorce, or a significant change in financial status may prompt necessary updates.

In today’s digital world, safely storing and managing your DPOA online can boost accessibility and security. Platforms like pdfFiller offer secure, cloud-based storage options that allow you to access your documents from anywhere, collaborate with trusted individuals, and ensure your DPOA is always up-to-date.

Related documents

As you consider creating a Durable Power of Attorney, it’s wise to explore related legal documents that can complement your DPOA. These may include:

User experience features

Utilizing a platform like pdfFiller enhances your experience when creating and managing a Durable Power of Attorney form. The site features interactive tools that aid in the personalized creation of your DPOA, ensuring all necessary elements are included and correct.

Moreover, pdfFiller provides seamless editing and eSigning capabilities, allowing for swift updates or modifications. Collaboration features enable you to work with legal professionals or family members on your document, ensuring everyone involved understands the contents and implications.

Legal sources and further insights

Staying informed about relevant laws in your state is essential for ensuring your Durable Power of Attorney is valid. Each state has its own regulations governing DPOAs, and knowing these can safeguard your interests. Additionally, considering complementary documents and their implications can lead to better overall planning regarding your affairs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify durable power of attorney without leaving Google Drive?

How do I edit durable power of attorney online?

Can I create an electronic signature for signing my durable power of attorney in Gmail?

What is durable power of attorney?

Who is required to file durable power of attorney?

How to fill out durable power of attorney?

What is the purpose of durable power of attorney?

What information must be reported on durable power of attorney?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.